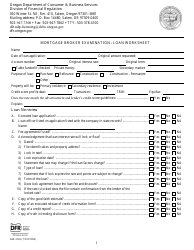

This version of the form is not currently in use and is provided for reference only. Download this version of

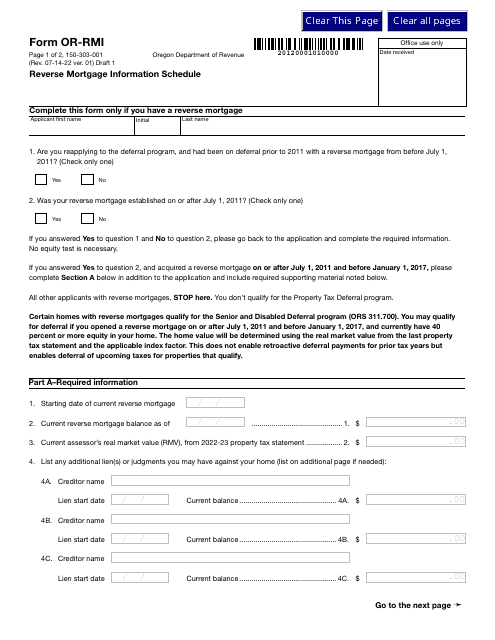

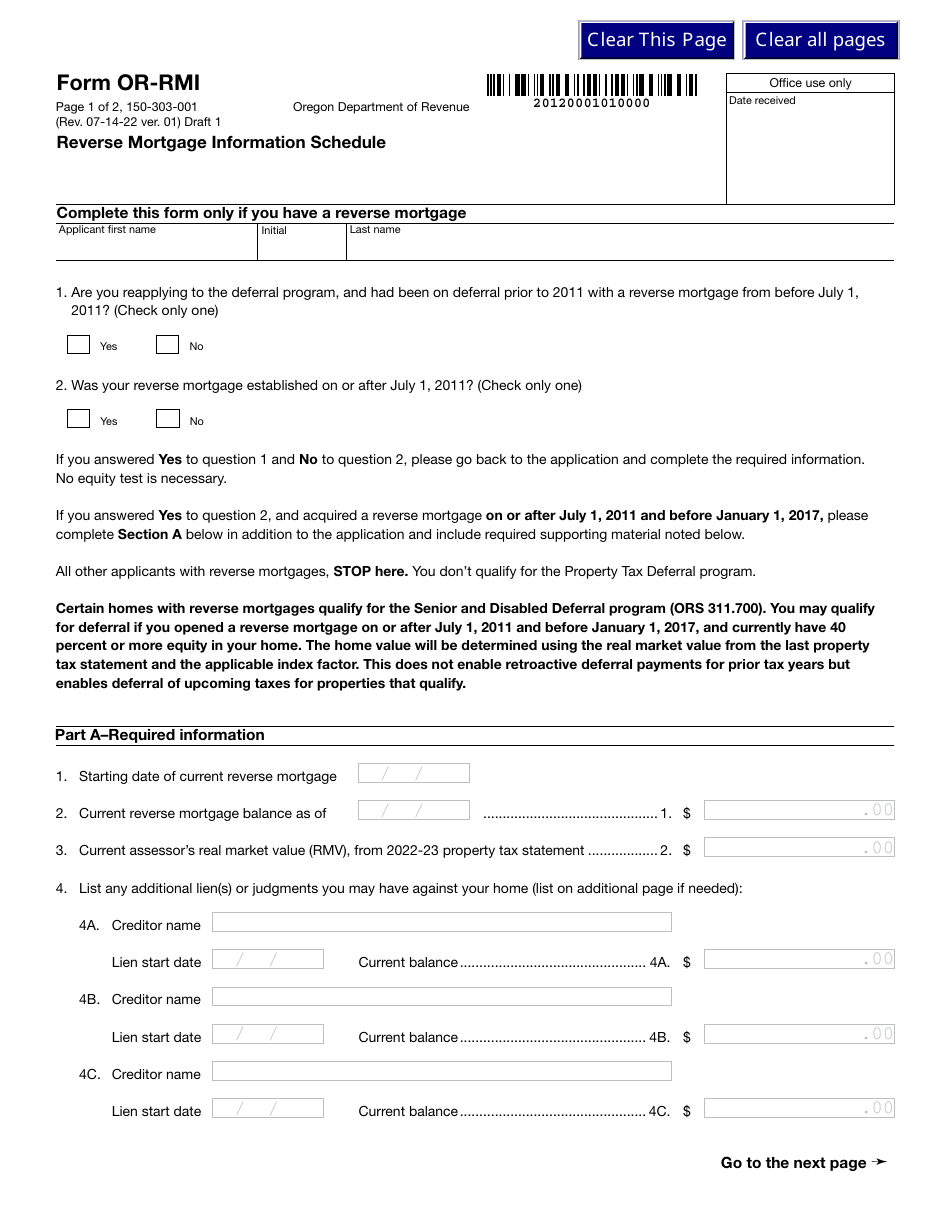

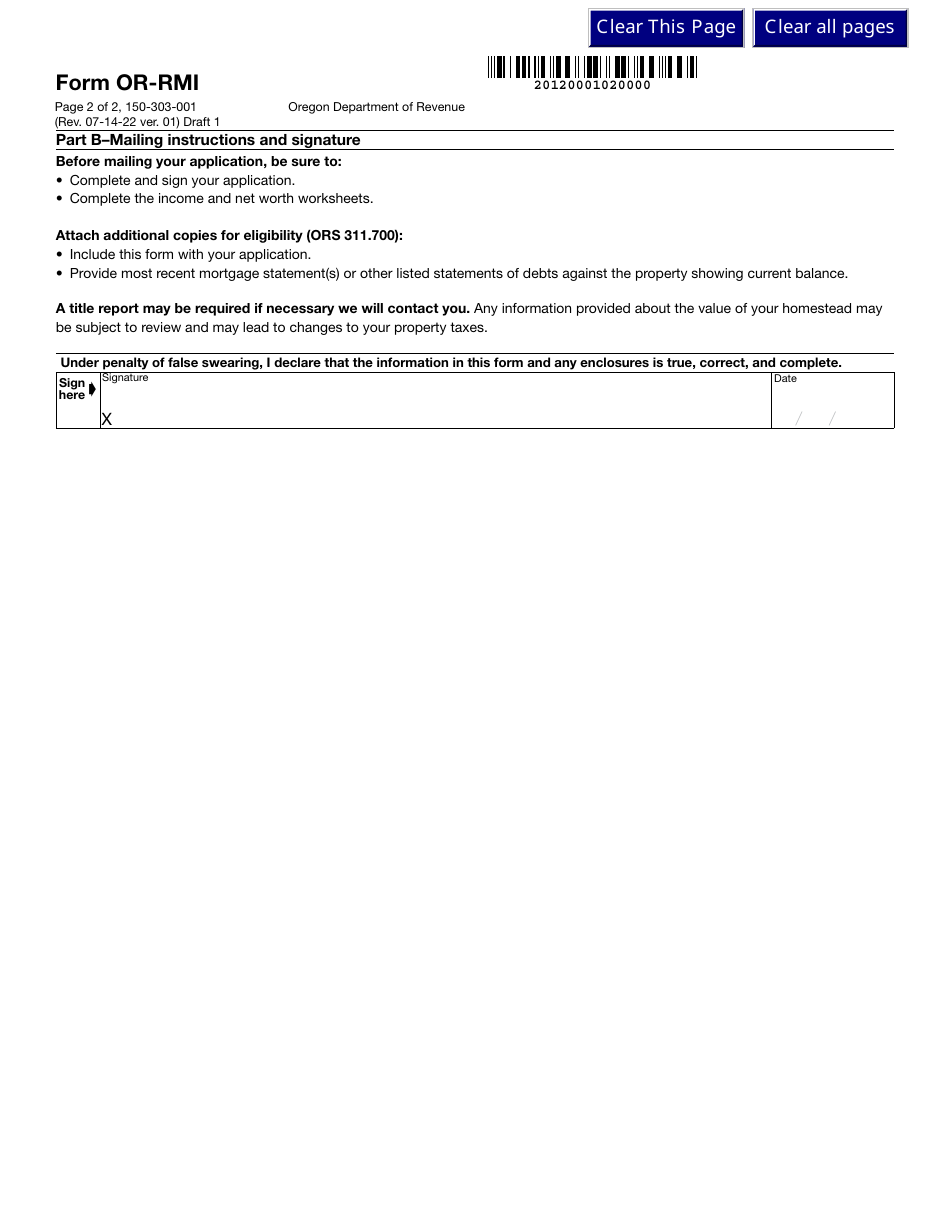

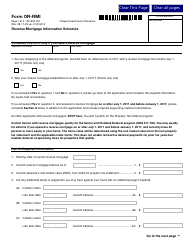

Form OR-RMI (150-303-001)

for the current year.

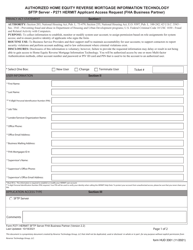

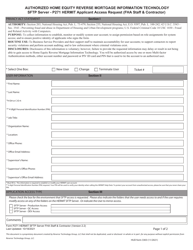

Form OR-RMI (150-303-001) Reverse Mortgage Information Schedule - Oregon

What Is Form OR-RMI (150-303-001)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OR-RMI (150-303-001)?

A: OR-RMI (150-303-001) is a Reverse Mortgage Information Schedule specific to Oregon.

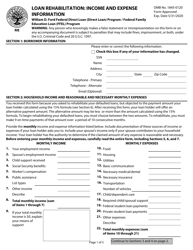

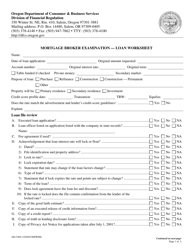

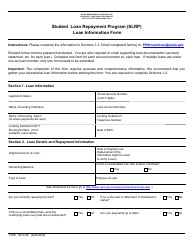

Q: What is a reverse mortgage?

A: A reverse mortgage is a loan program that allows homeowners to convert a portion of their home equity into cash.

Q: How does a reverse mortgage work?

A: With a reverse mortgage, borrowers do not make monthly mortgage payments. Instead, the loan is repaid when the homeowner sells the property, moves out of the home, or passes away.

Q: Who is eligible for a reverse mortgage?

A: To be eligible for a reverse mortgage, you must be at least 62 years old, own a home, and have sufficient equity in the property.

Q: What is the purpose of OR-RMI (150-303-001)?

A: OR-RMI (150-303-001) serves as a schedule to provide specific reverse mortgage information for residents of Oregon.

Q: Are reverse mortgages available in Canada?

A: Yes, reverse mortgages are available in Canada.

Q: Is a reverse mortgage taxable?

A: The proceeds from a reverse mortgage are typically not taxable, as they are considered as loan advances rather than income.

Q: Are there any risks associated with reverse mortgages?

A: Yes, there are risks associated with reverse mortgages. It is important to carefully consider the potential impact on your finances and consult with a financial advisor.

Q: Can I lose my home with a reverse mortgage?

A: Yes, if you fail to meet the obligations of the reverse mortgage, such as keeping up with property taxes and homeowners insurance, you could potentially lose your home.

Form Details:

- Released on July 14, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-RMI (150-303-001) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.