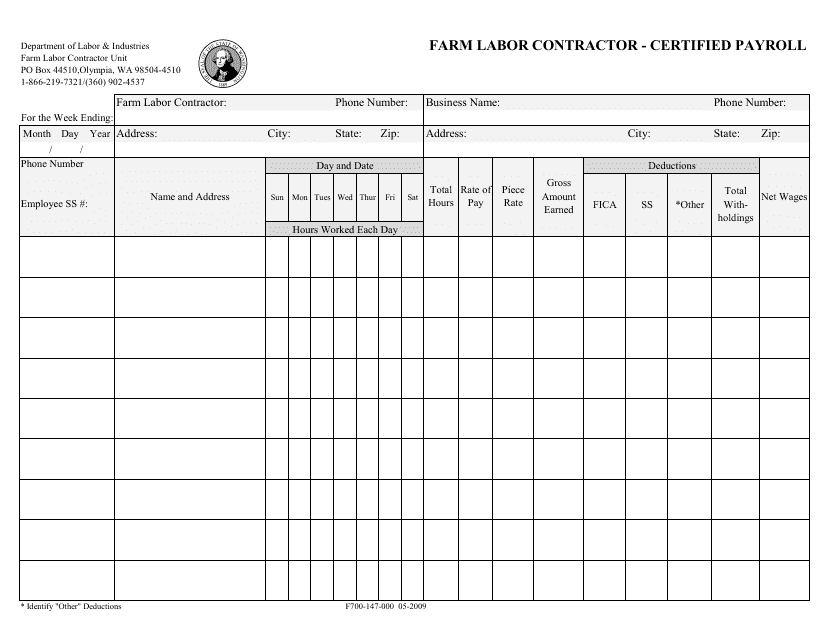

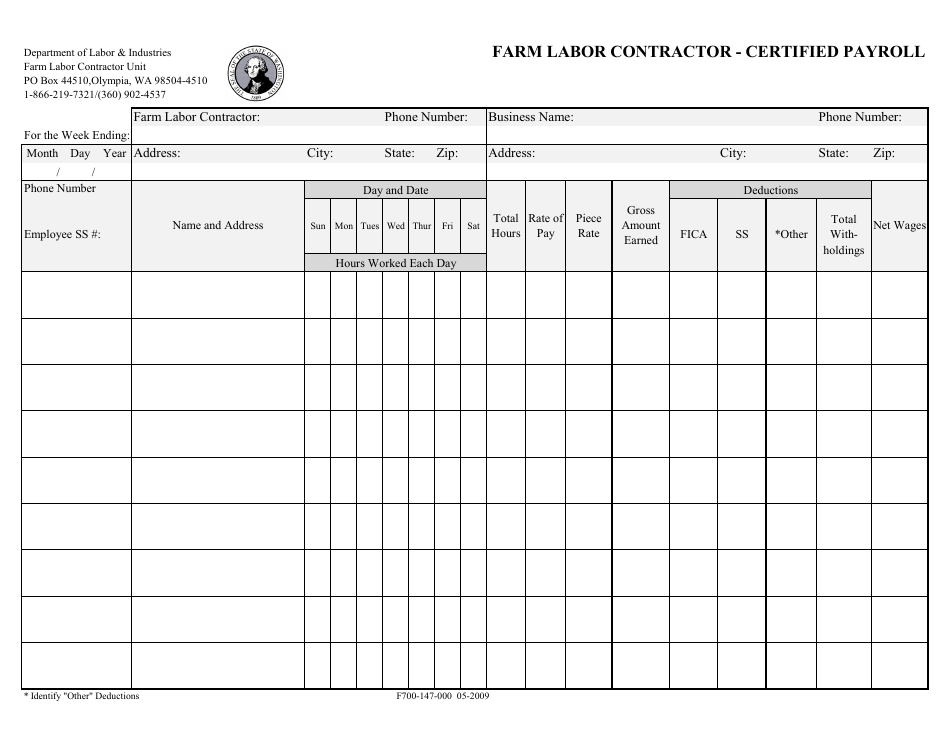

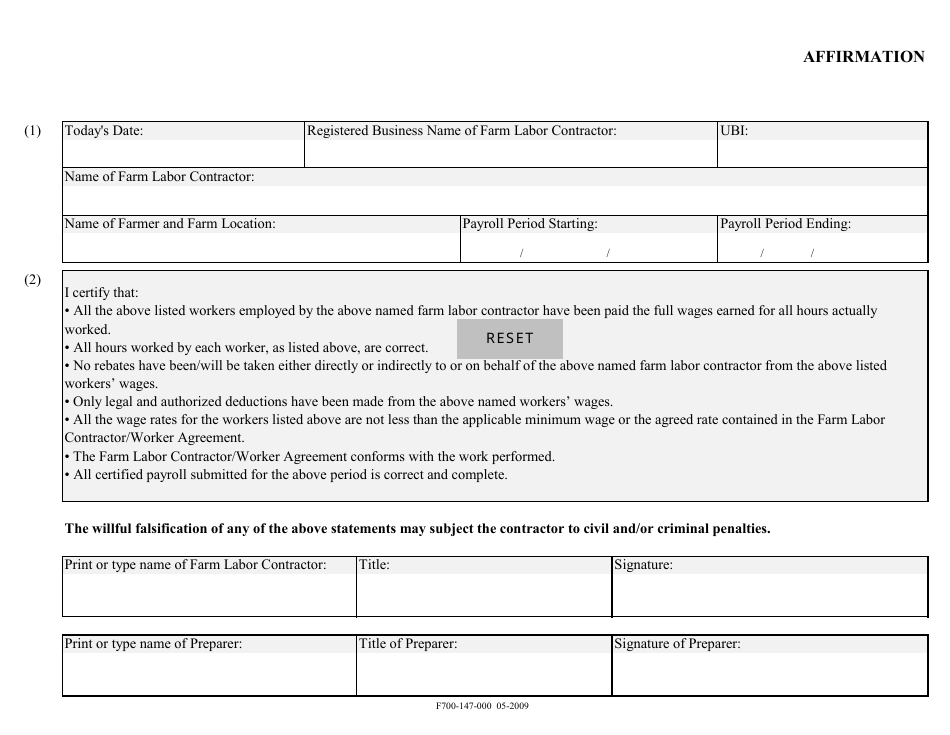

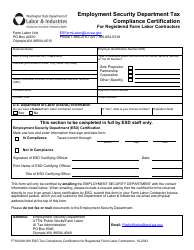

Form F700-147-000 Farm Labor Contractor - Certified Payroll - Washington

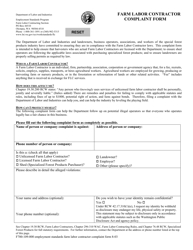

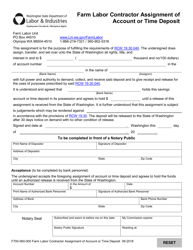

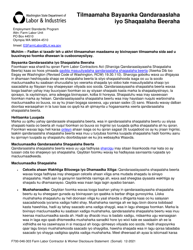

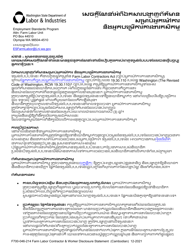

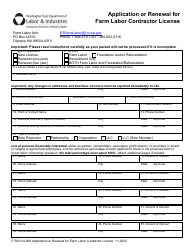

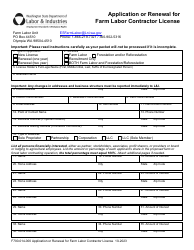

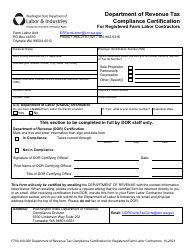

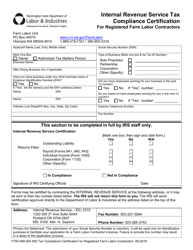

What Is Form F700-147-000?

This is a legal form that was released by the Washington State Department of Labor and Industries - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F700-147-000?

A: Form F700-147-000 is a document used for certified payroll by farm labor contractors in Washington state.

Q: Who needs to file Form F700-147-000?

A: Farm labor contractors in Washington state need to file Form F700-147-000.

Q: What is the purpose of Form F700-147-000?

A: The purpose of Form F700-147-000 is to report certified payroll for farm labor contractors in Washington state.

Q: Is filing Form F700-147-000 mandatory?

A: Yes, farm labor contractors in Washington state are required to file Form F700-147-000.

Q: Are there any deadlines for filing Form F700-147-000?

A: Yes, Form F700-147-000 must be filed on a weekly basis.

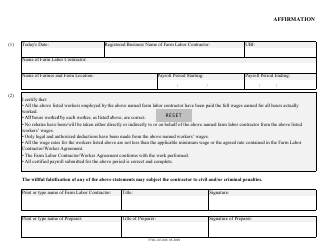

Q: What information is required on Form F700-147-000?

A: Form F700-147-000 requires information such as employee names, hours worked, wages, and withholdings.

Q: Can Form F700-147-000 be filed electronically?

A: Yes, farm labor contractors have the option to file Form F700-147-000 electronically.

Q: What happens if Form F700-147-000 is not filed?

A: Failure to file Form F700-147-000 can result in penalties and legal consequences for farm labor contractors.

Q: Is Form F700-147-000 specific to Washington state?

A: Yes, Form F700-147-000 is specific to farm labor contractors in Washington state.

Form Details:

- Released on May 1, 2009;

- The latest edition provided by the Washington State Department of Labor and Industries;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F700-147-000 by clicking the link below or browse more documents and templates provided by the Washington State Department of Labor and Industries.