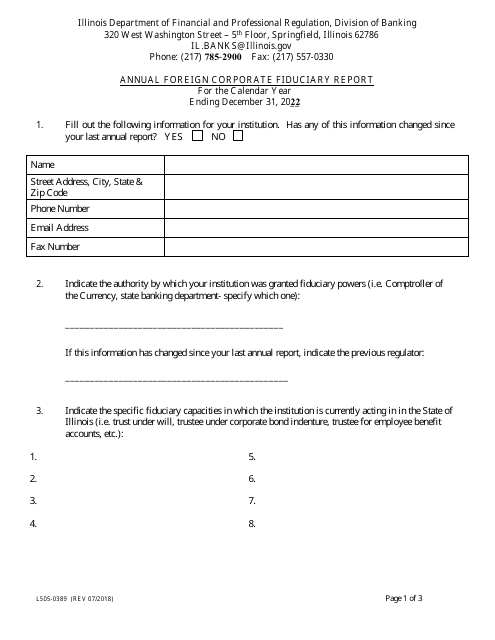

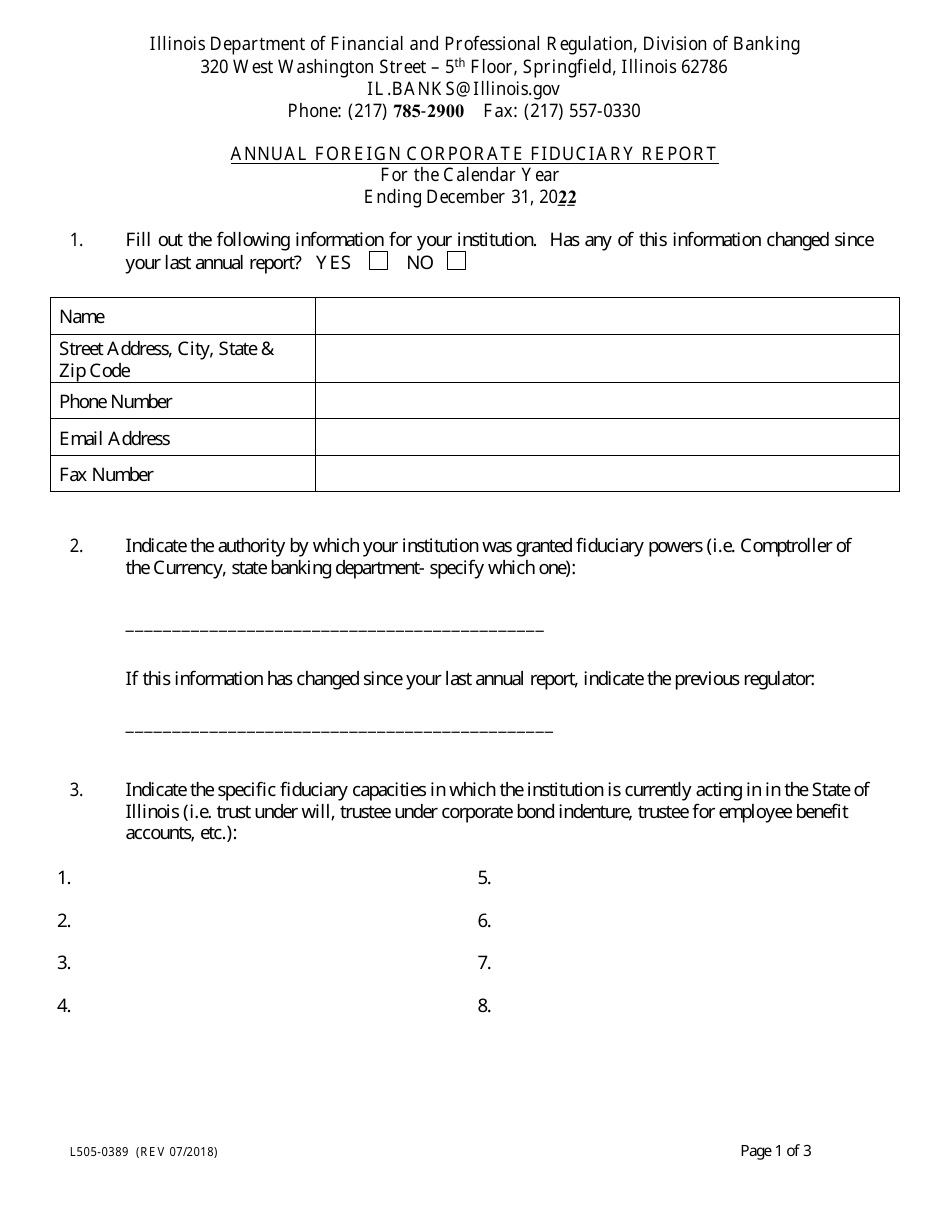

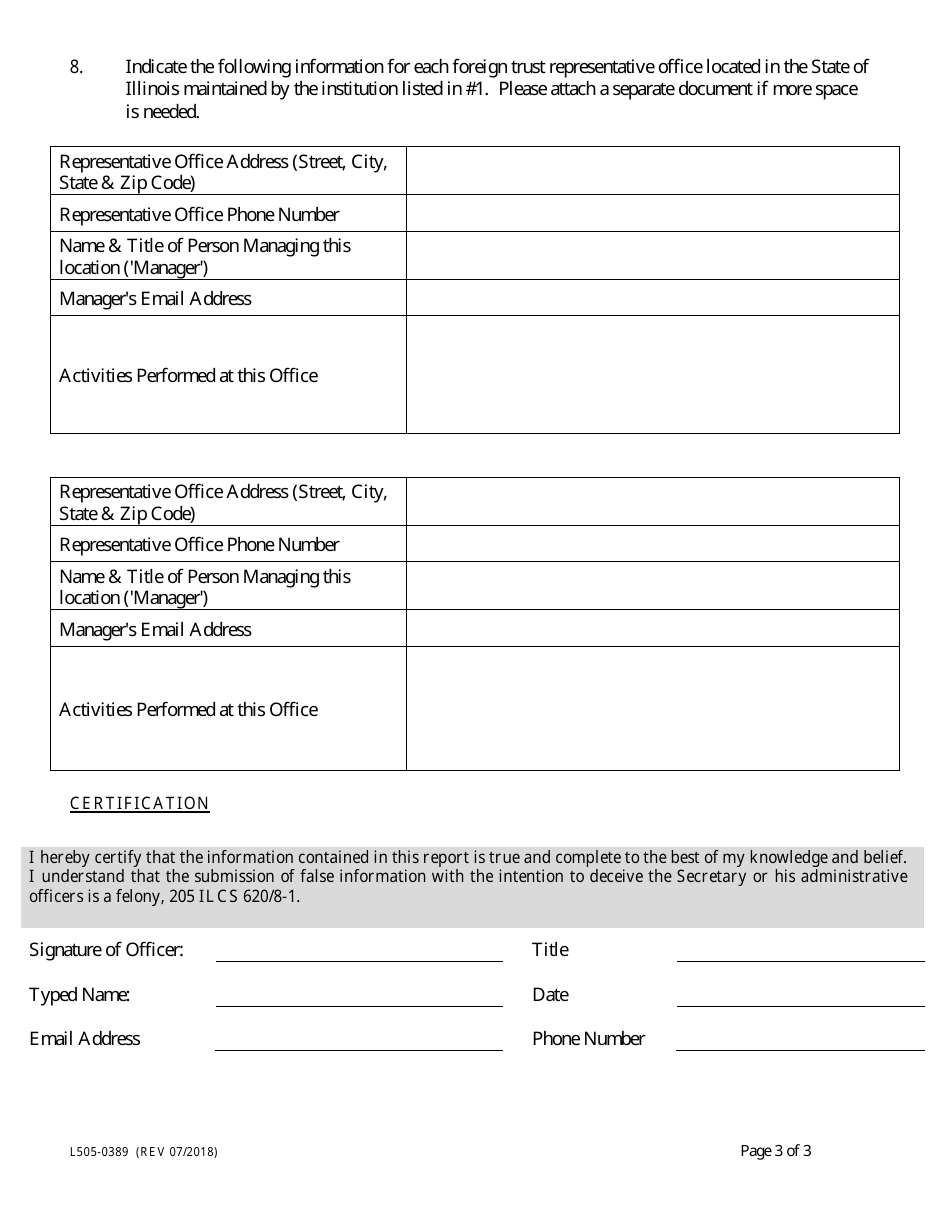

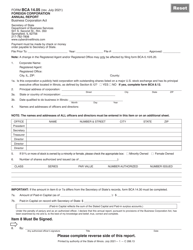

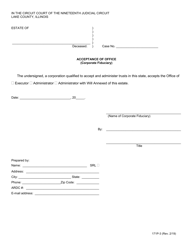

Form L505-0389 Annual Foreign Corporate Fiduciary Report - Illinois

What Is Form L505-0389?

This is a legal form that was released by the Illinois Department of Financial and Professional Regulation - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L505-0389?

A: Form L505-0389 is the Annual Foreign CorporateFiduciary Report for Illinois.

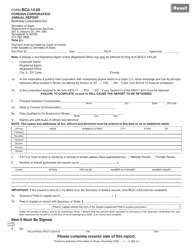

Q: Who needs to file Form L505-0389?

A: Foreign corporations acting as fiduciaries in Illinois are required to file Form L505-0389.

Q: When is Form L505-0389 due?

A: Form L505-0389 is due on the 15th day of the 3rd month after the close of the corporation's fiscal year.

Q: Are there any fees associated with filing Form L505-0389?

A: Yes, there is a filing fee of $250 for filing Form L505-0389.

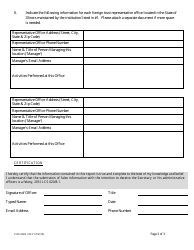

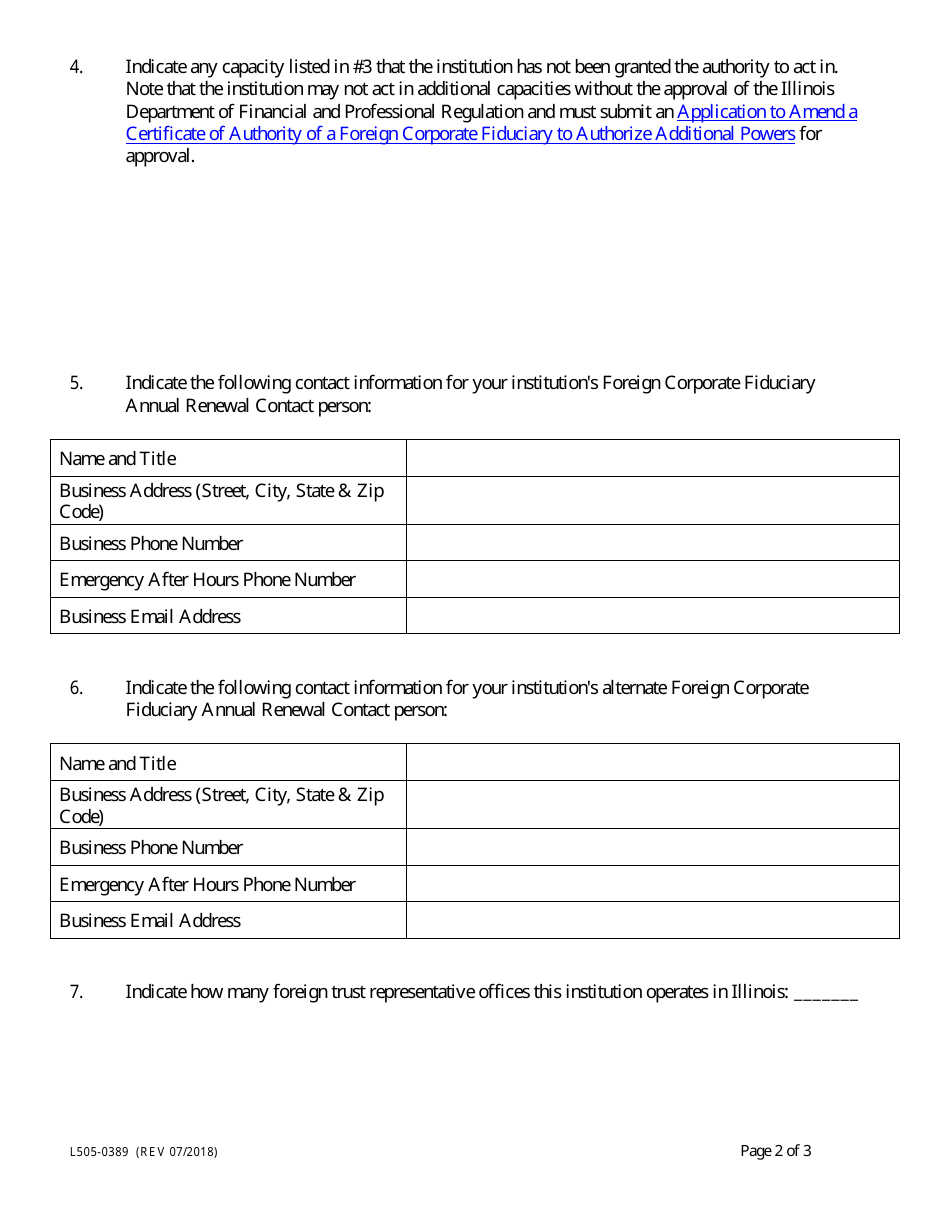

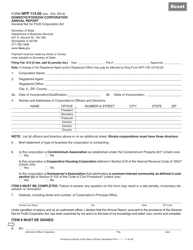

Q: What information is required on Form L505-0389?

A: Form L505-0389 requires information about the corporation's name, address, fiscal year, and details of the fiduciary activities in Illinois.

Q: Is there a penalty for filing Form L505-0389 late?

A: Yes, there is a penalty of $100 for each month or part of a month that the report is late, up to a maximum of $1,000.

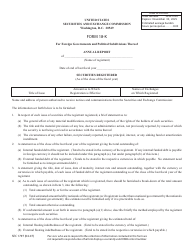

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Illinois Department of Financial and Professional Regulation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L505-0389 by clicking the link below or browse more documents and templates provided by the Illinois Department of Financial and Professional Regulation.