This version of the form is not currently in use and is provided for reference only. Download this version of

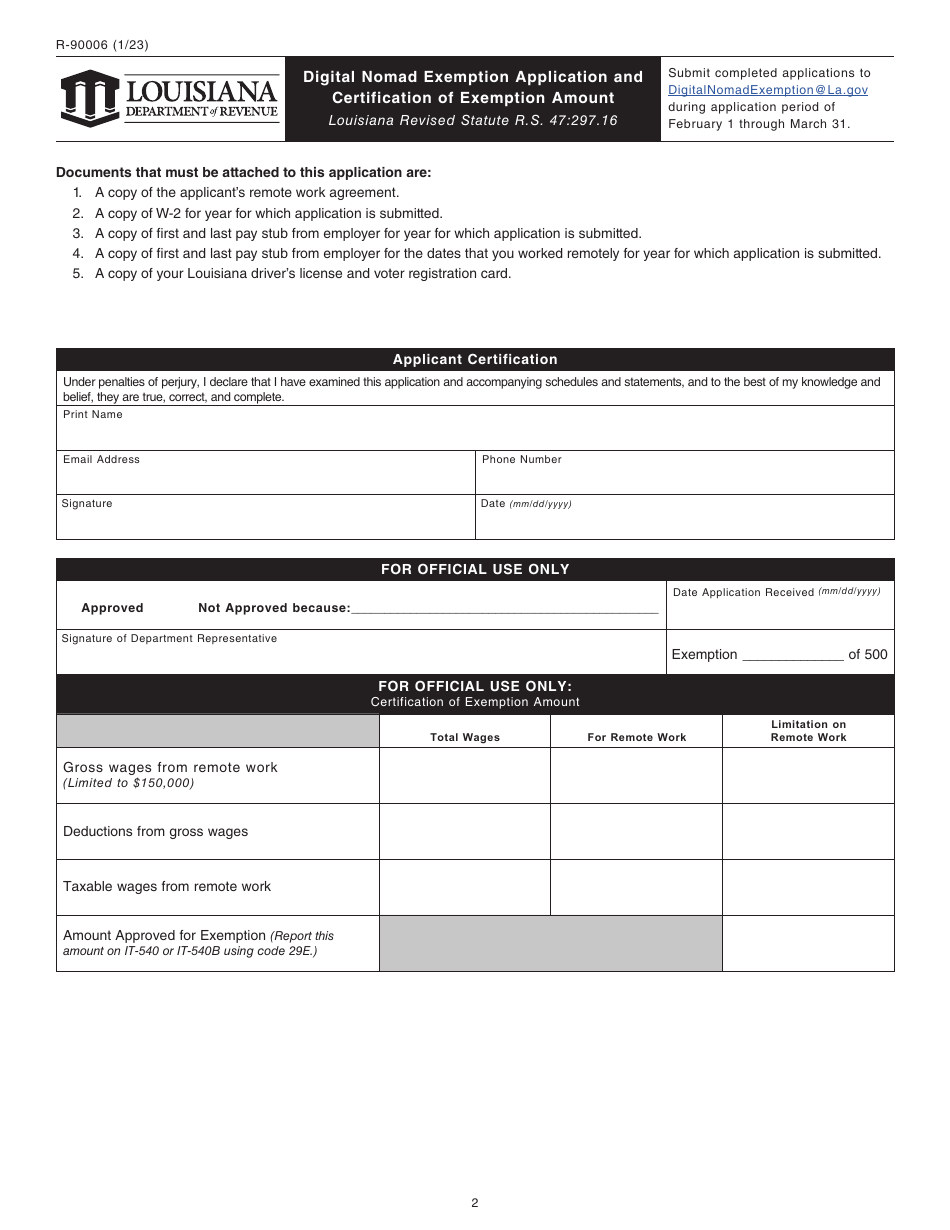

Form R-90006

for the current year.

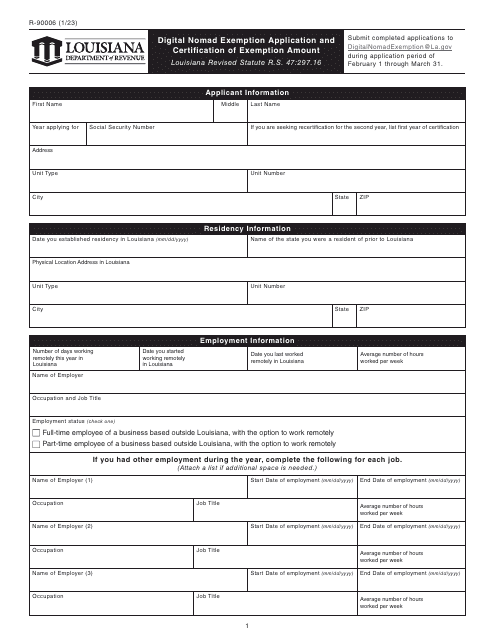

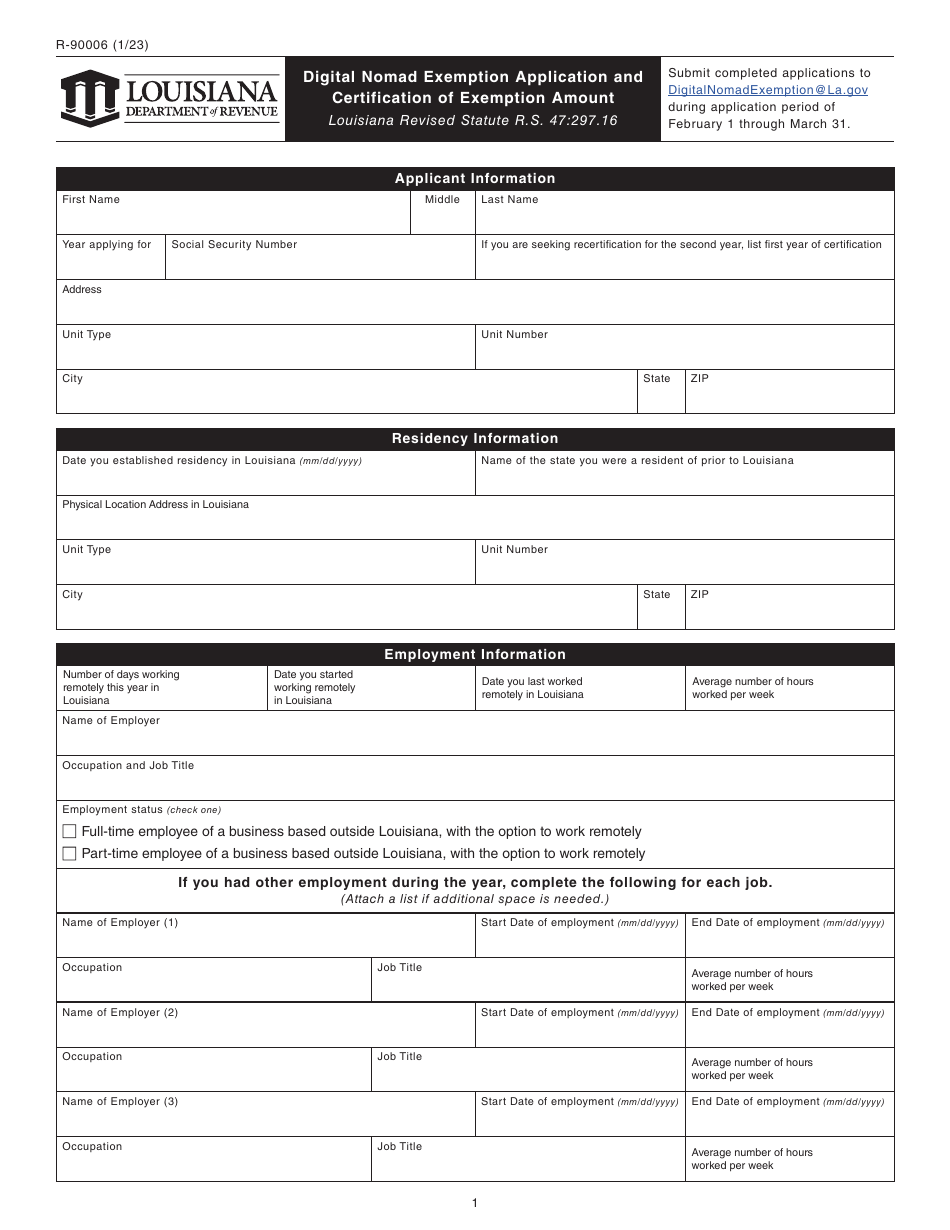

Form R-90006 Digital Nomad Exemption Application and Certification of Exemption Amount - Louisiana

What Is Form R-90006?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-90006?

A: Form R-90006 is the Digital Nomad Exemption Application and Certification of Exemption Amount in Louisiana.

Q: Who needs to file Form R-90006?

A: Digital nomads who qualify for the exemption in Louisiana need to file Form R-90006.

Q: What is the purpose of Form R-90006?

A: The purpose of Form R-90006 is to apply for the digital nomad exemption and certify the exemption amount in Louisiana.

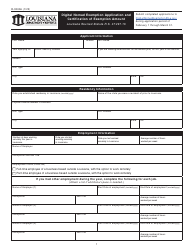

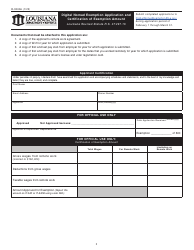

Q: What information is required on Form R-90006?

A: Form R-90006 requires information such as personal details, income details, certification of digital nomad status, and exemption amount.

Q: When should I file Form R-90006?

A: Form R-90006 should be filed by the due date of your Louisiana state tax return.

Q: Is there a fee for filing Form R-90006?

A: No, there is no fee for filing Form R-90006.

Q: What happens after filing Form R-90006?

A: After filing Form R-90006, the Louisiana Department of Revenue will review your application and determine the eligibility for the digital nomad exemption.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-90006 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.