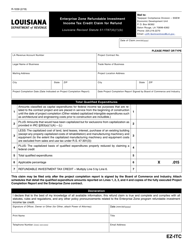

This version of the form is not currently in use and is provided for reference only. Download this version of

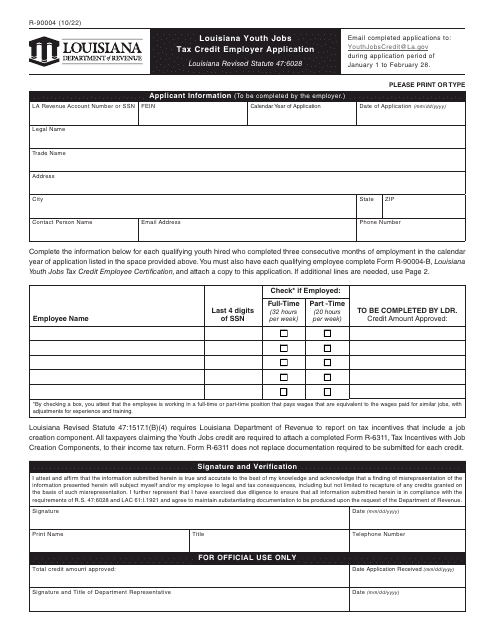

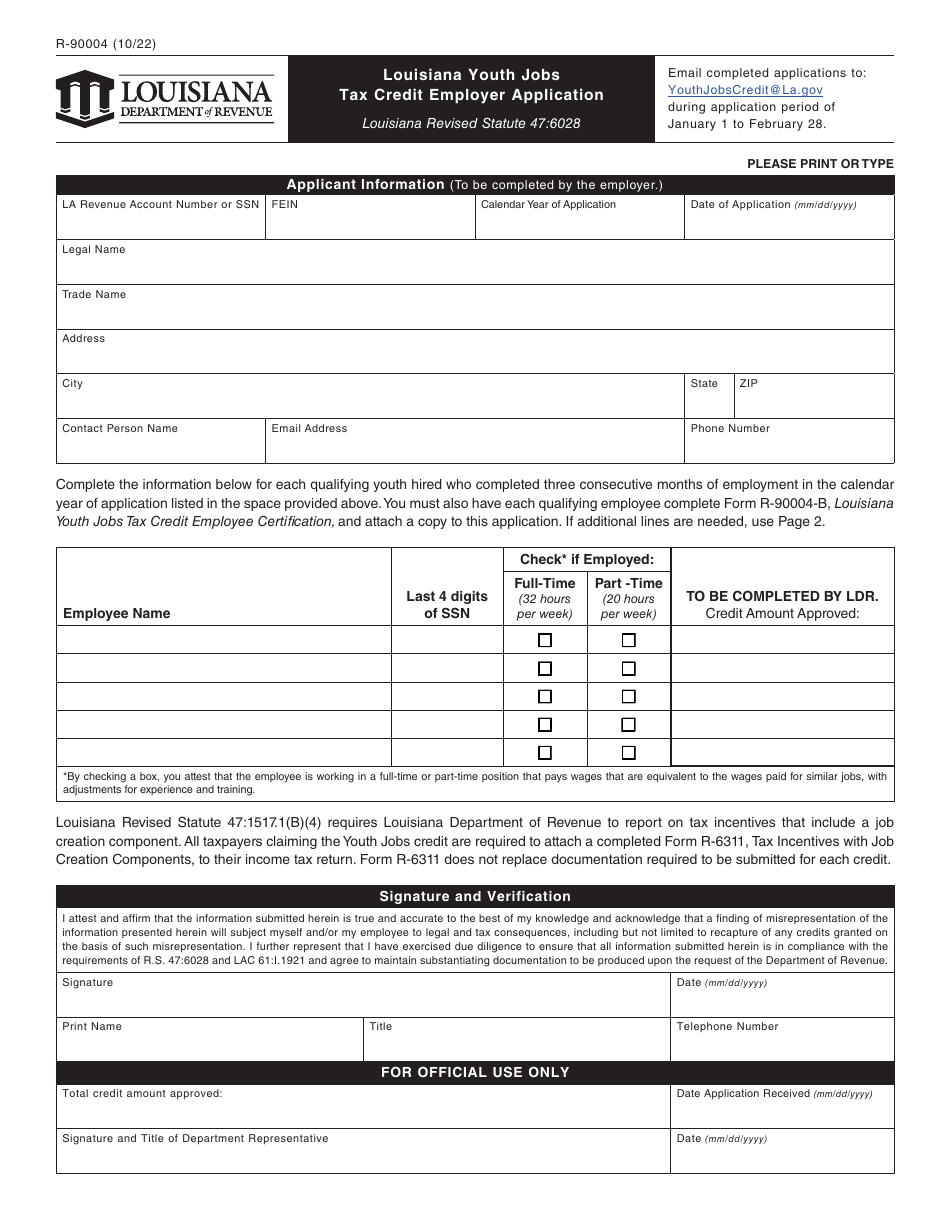

Form R-90004

for the current year.

Form R-90004 Louisiana Youth Jobs Tax Credit Employer Application - Louisiana

What Is Form R-90004?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-90004?

A: Form R-90004 is the Louisiana Youth Jobs Tax Credit Employer Application.

Q: What is the purpose of Form R-90004?

A: The purpose of Form R-90004 is to apply for the Louisiana Youth Jobs Tax Credit.

Q: Who needs to fill out Form R-90004?

A: Employers in Louisiana who want to apply for the Youth Jobs Tax Credit need to fill out Form R-90004.

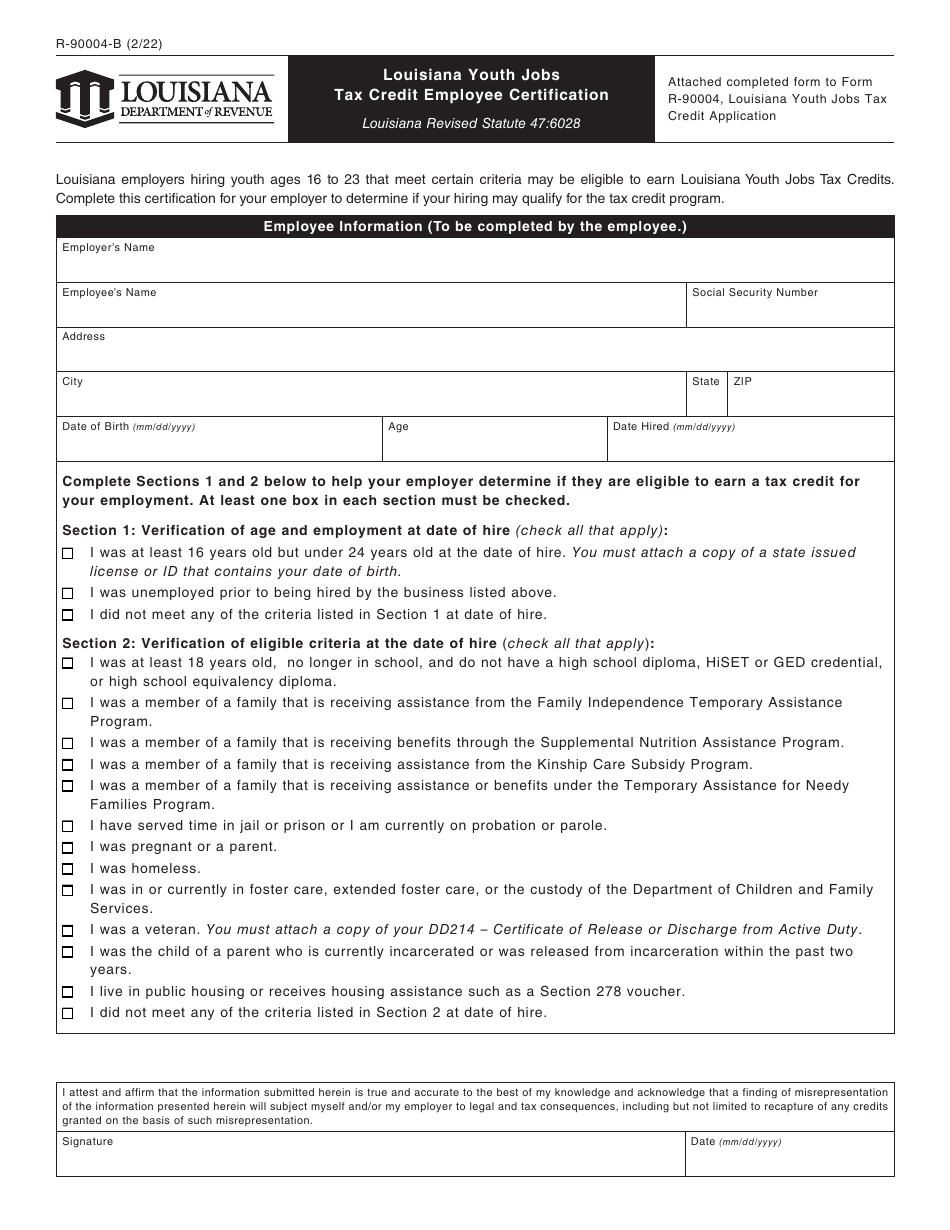

Q: What is the Louisiana Youth Jobs Tax Credit?

A: The Louisiana Youth Jobs Tax Credit is a tax credit aimed at encouraging employers to hire and train young individuals.

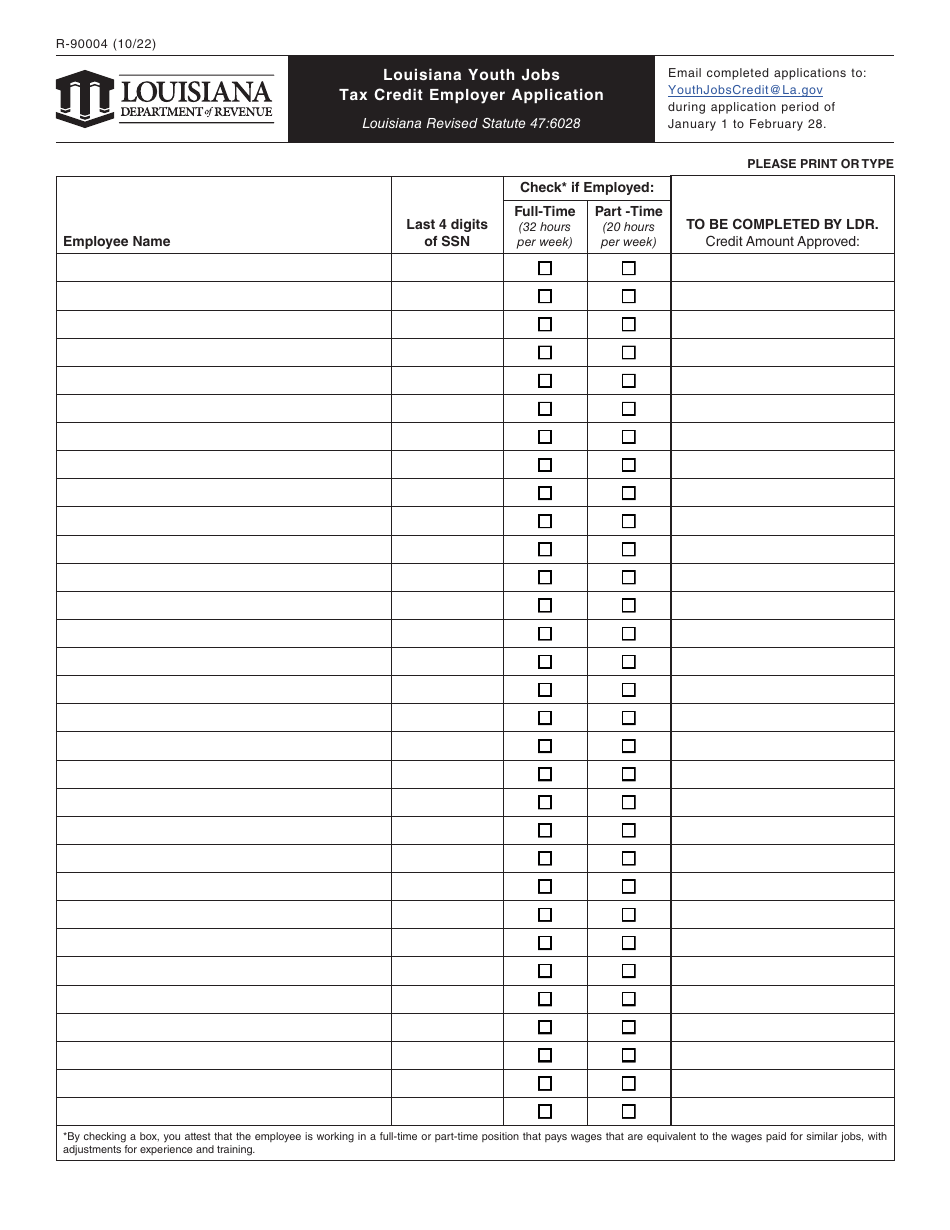

Q: What information is required on Form R-90004?

A: Form R-90004 requires information about the employer, the eligible employee, and the wages paid to the employee.

Q: When is the deadline to submit Form R-90004?

A: The deadline to submit Form R-90004 is determined by the Louisiana Department of Revenue and can vary.

Q: Is there a fee to file Form R-90004?

A: No, there is no fee to file Form R-90004.

Q: What are the benefits of the Louisiana Youth Jobs Tax Credit?

A: The Louisiana Youth Jobs Tax Credit provides a tax credit of up to $1,000 per eligible employee per tax year.

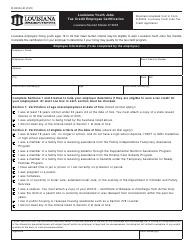

Q: Are there any limitations or eligibility requirements for the Louisiana Youth Jobs Tax Credit?

A: Yes, there are limitations and eligibility requirements for the Louisiana Youth Jobs Tax Credit. It is best to refer to the instructions provided with Form R-90004 for more details.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-90004 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.