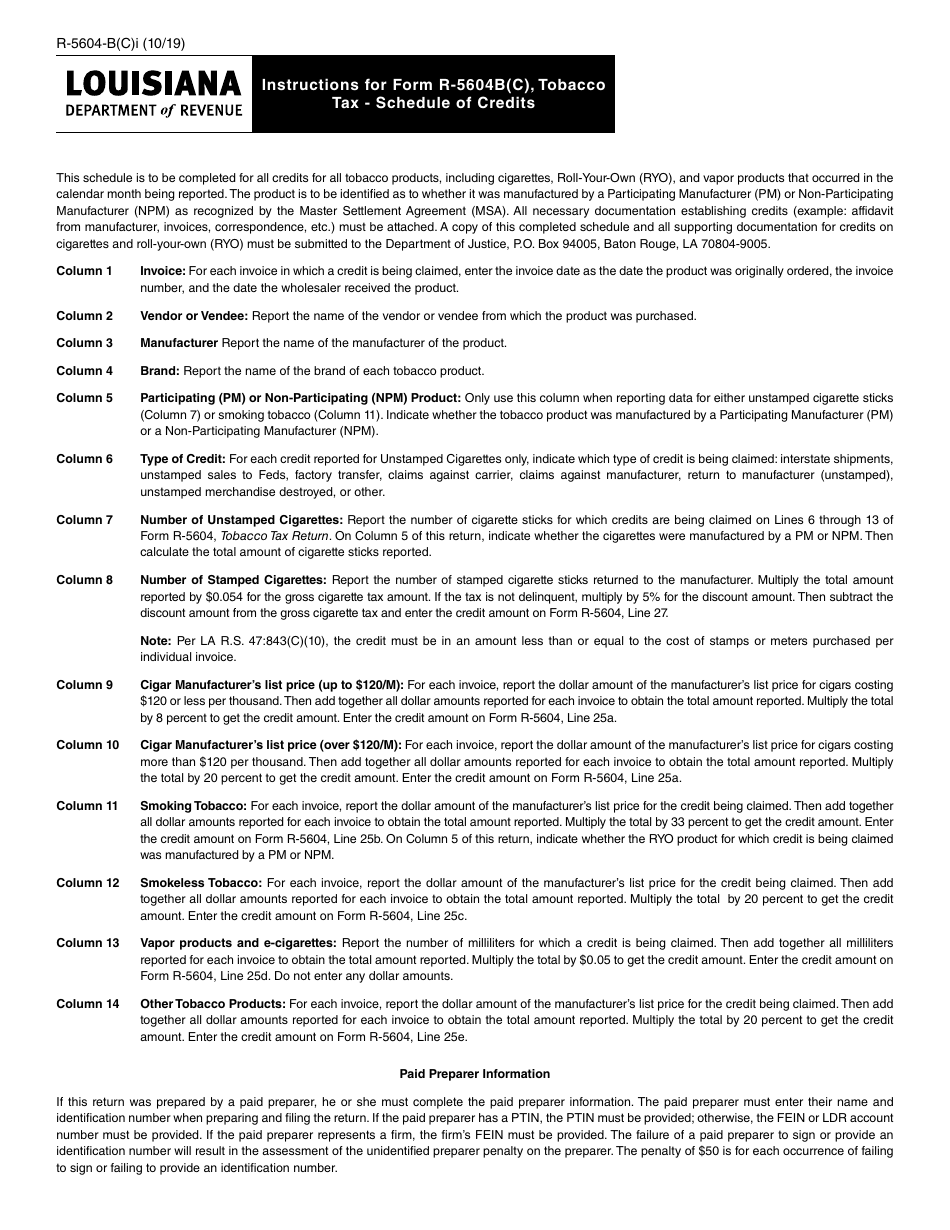

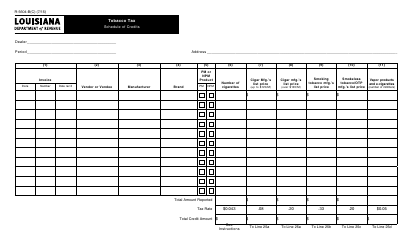

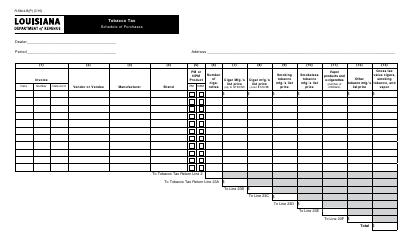

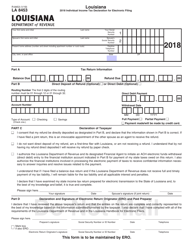

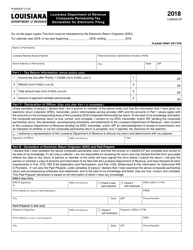

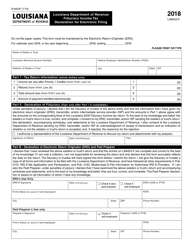

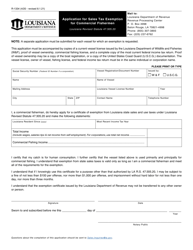

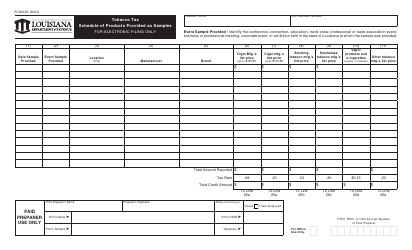

Instructions for Form R-5604B(C) Tobacco Tax - Schedule of Credits - Louisiana

This document contains official instructions for Form R-5604B(C) , Tobacco Tax - Schedule of Credits - a form released and collected by the Louisiana Department of Revenue.

FAQ

Q: What is Form R-5604B(C)?

A: Form R-5604B(C) is a tax form used in Louisiana to claim credits for tobacco taxes.

Q: Who should fill out Form R-5604B(C)?

A: Form R-5604B(C) should be filled out by individuals or businesses who want to claim credits for tobacco taxes.

Q: What are the credits available on Form R-5604B(C)?

A: Form R-5604B(C) allows you to claim credits for various types of tobacco taxes, including cigarette, snuff, and cigar taxes.

Q: When is the deadline for filing Form R-5604B(C)?

A: The deadline for filing Form R-5604B(C) is the same as the deadline for filing your annual tobacco tax return, which is usually the last day of the month following the end of your reporting period.

Q: Are there any penalties for late filing of Form R-5604B(C)?

A: Yes, there may be penalties for late filing of Form R-5604B(C), including interest and potential loss of credits.

Q: What supporting documentation should I include with Form R-5604B(C)?

A: You should include copies of the invoices or receipts for the tobacco purchases that are being claimed for the credits on Form R-5604B(C).

Q: Who should I contact for help with Form R-5604B(C)?

A: For assistance with Form R-5604B(C), you can contact the Louisiana Department of Revenue's taxpayer services hotline or visit their office in person.

Q: Is Form R-5604B(C) only for individuals, or can businesses also use it?

A: Form R-5604B(C) can be used by both individuals and businesses to claim credits for tobacco taxes in Louisiana.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Louisiana Department of Revenue.