This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

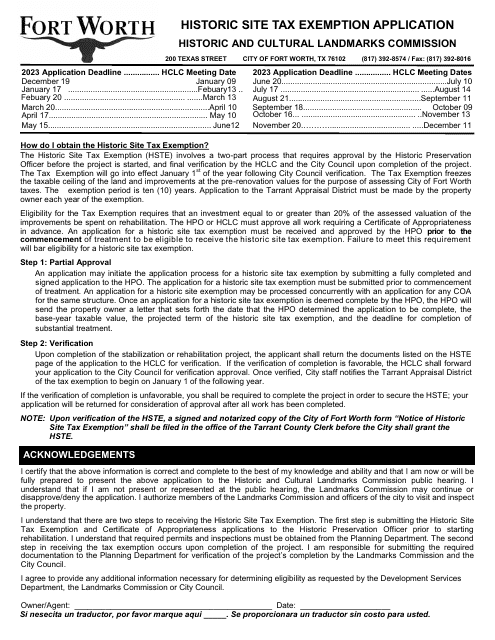

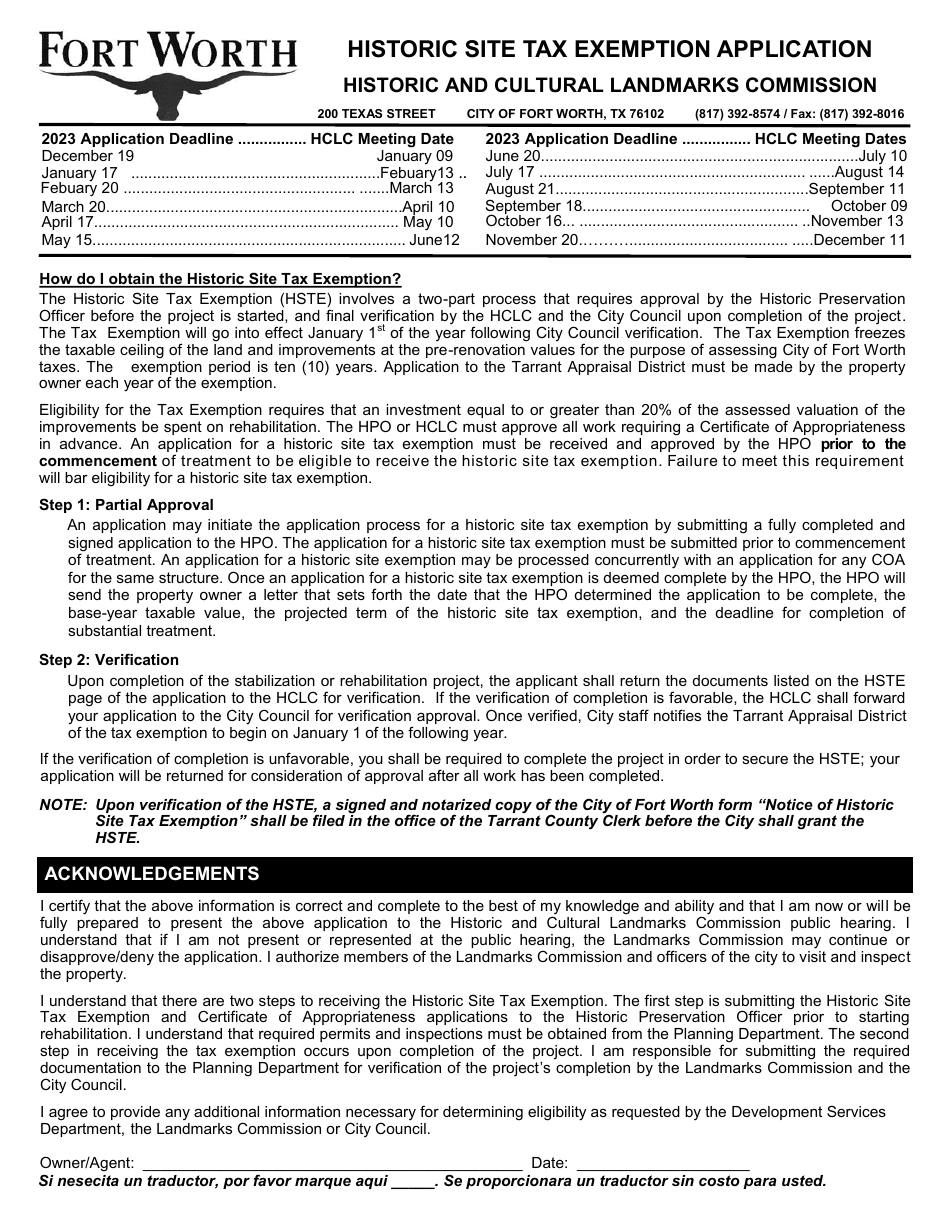

Historic Site Tax Exemption Application - City of Fort Worth, Texas

Historic Site Tax Exemption Application is a legal document that was released by the Planning and Development Department - City of Fort Worth, Texas - a government authority operating within Texas. The form may be used strictly within City of Fort Worth.

FAQ

Q: What is the Historic Site Tax Exemption Application?

A: The Historic Site Tax Exemption Application is a form used in the City of Fort Worth, Texas to apply for tax exemption for a historic site.

Q: Who can apply for the Historic Site Tax Exemption?

A: Property owners who have a historic site in the City of Fort Worth, Texas can apply for the Historic Site Tax Exemption.

Q: What is the purpose of the tax exemption?

A: The tax exemption is aimed at providing financial relief to property owners for the preservation and maintenance of historic sites.

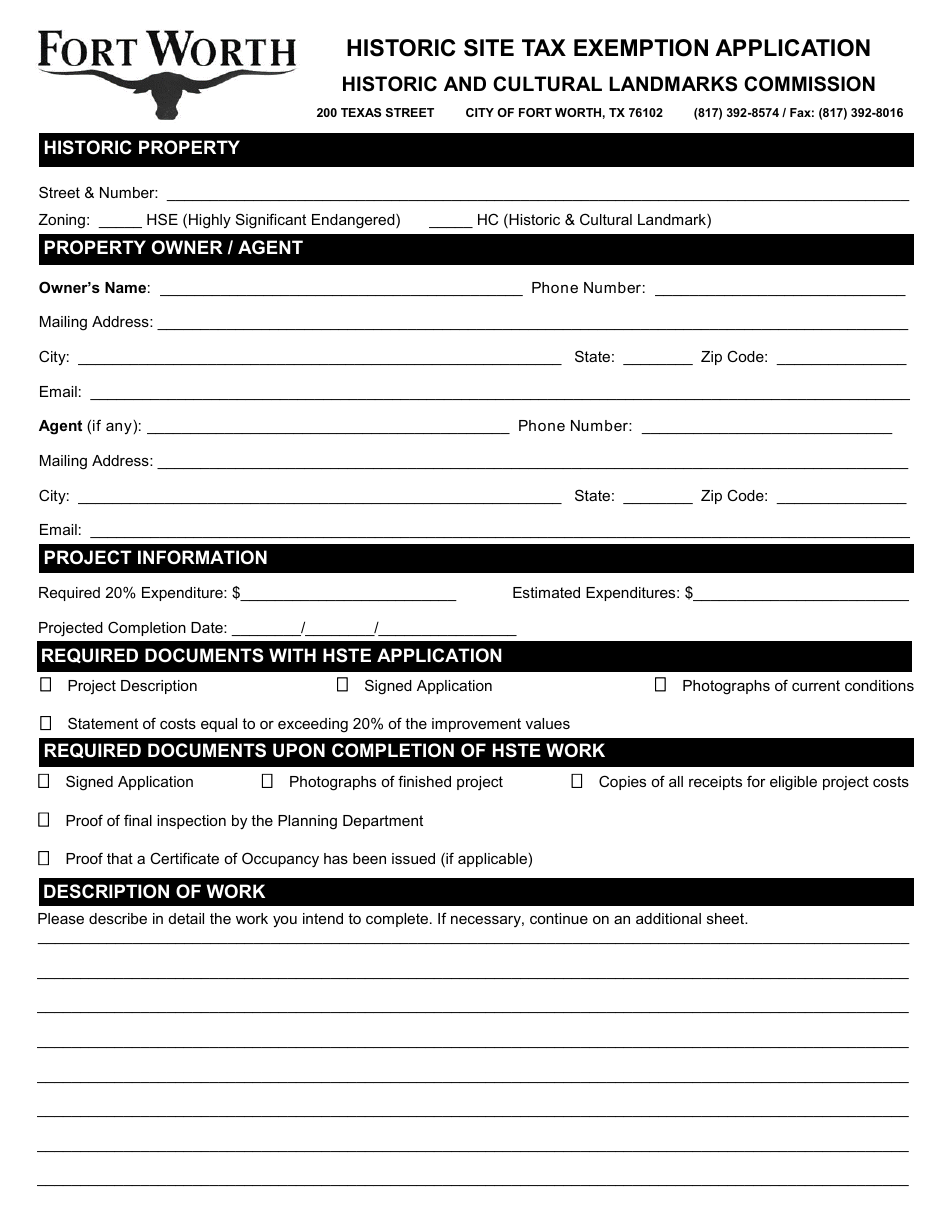

Q: What documents are required for the application?

A: The application generally requires documentation such as property information, historical significance, and evidence of ongoing preservation efforts.

Q: Is the tax exemption guaranteed after submitting the application?

A: The approval of the tax exemption is subject to review by the appropriate city officials and preservation boards.

Q: Are there any fees associated with the application?

A: There may be administrative fees associated with the Historic Site Tax Exemption Application, which can vary depending on the specific requirements of the city.

Form Details:

- The latest edition currently provided by the Planning and Development Department - City of Fort Worth, Texas;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Planning and Development Department - City of Fort Worth, Texas.