This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8960

for the current year.

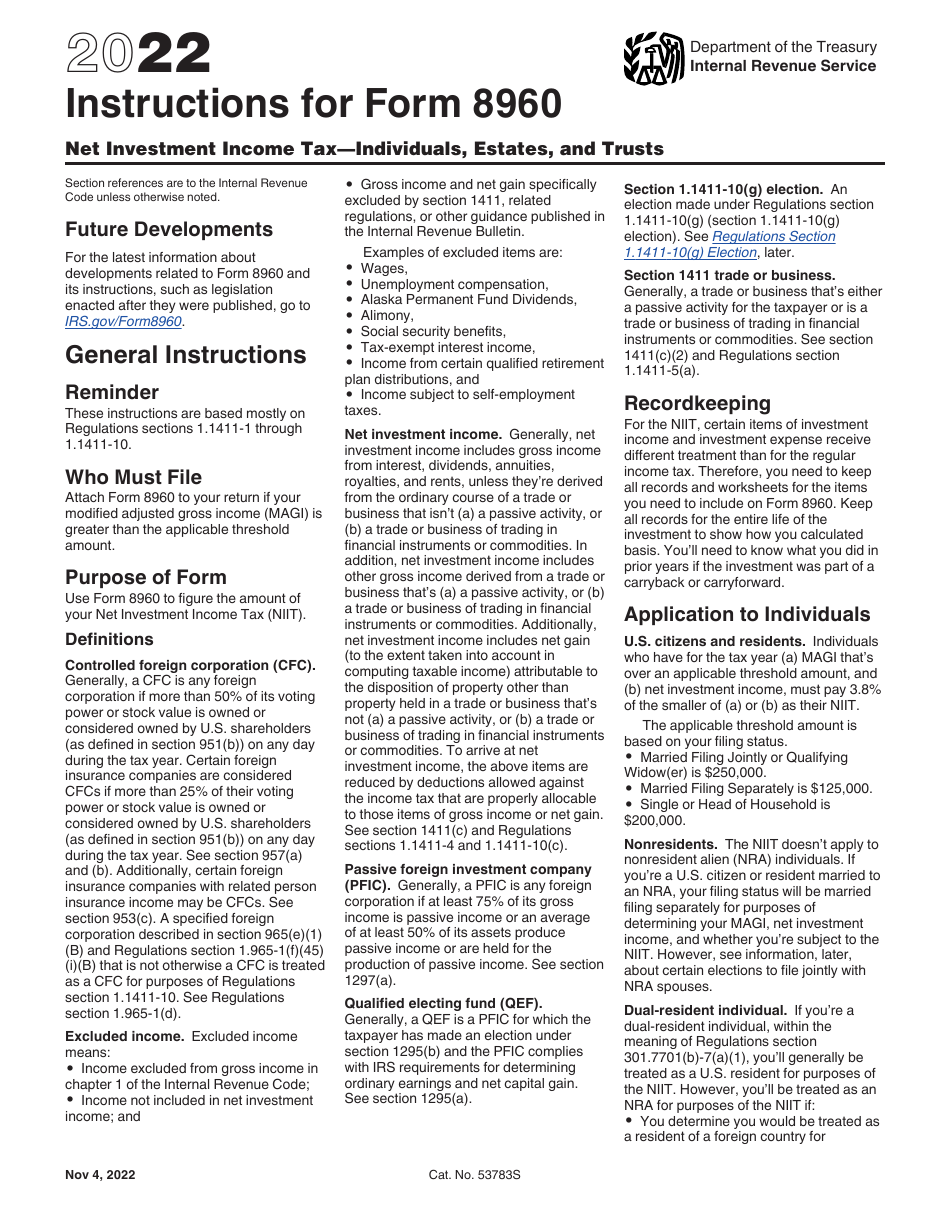

Instructions for IRS Form 8960 Net Investment Income Tax - Individuals, Estates, and Trusts

This document contains official instructions for IRS Form 8960 , Net Investment Income Tax - Individuals, Estates, and Trusts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8960 is available for download through this link.

FAQ

Q: What is IRS Form 8960?

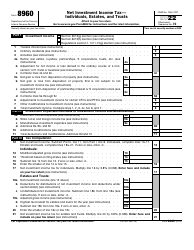

A: IRS Form 8960 is used to calculate and report the Net Investment Income Tax (NIIT) for individuals, estates, and trusts.

Q: Who needs to file IRS Form 8960?

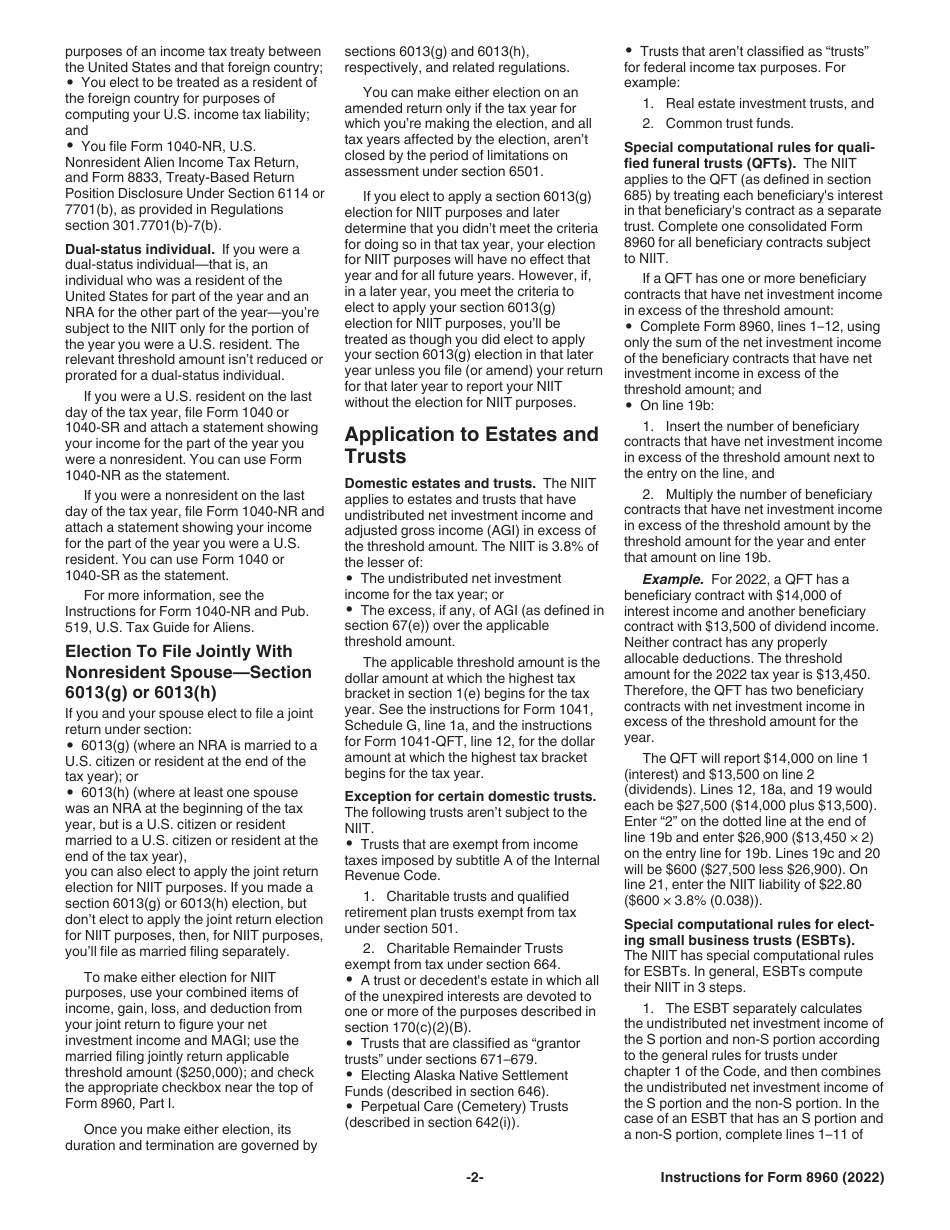

A: Individuals, estates, and trusts that have net investment income and meet certain income thresholds may need to file Form 8960.

Q: What is the Net Investment Income Tax (NIIT)?

A: The Net Investment Income Tax (NIIT) is a 3.8% tax on certain types of investment income for higher-income individuals, estates, and trusts.

Q: What types of income are subject to the Net Investment Income Tax?

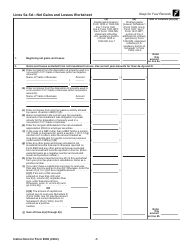

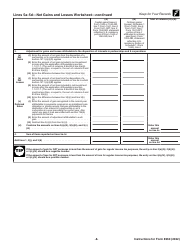

A: Income from sources such as interest, dividends, capital gains, rental income, and passive business activities may be subject to the Net Investment Income Tax.

Q: How do I calculate the Net Investment Income Tax?

A: To calculate the Net Investment Income Tax, you'll need to determine your net investment income and compare it to the applicable income thresholds. Form 8960 provides the necessary calculations.

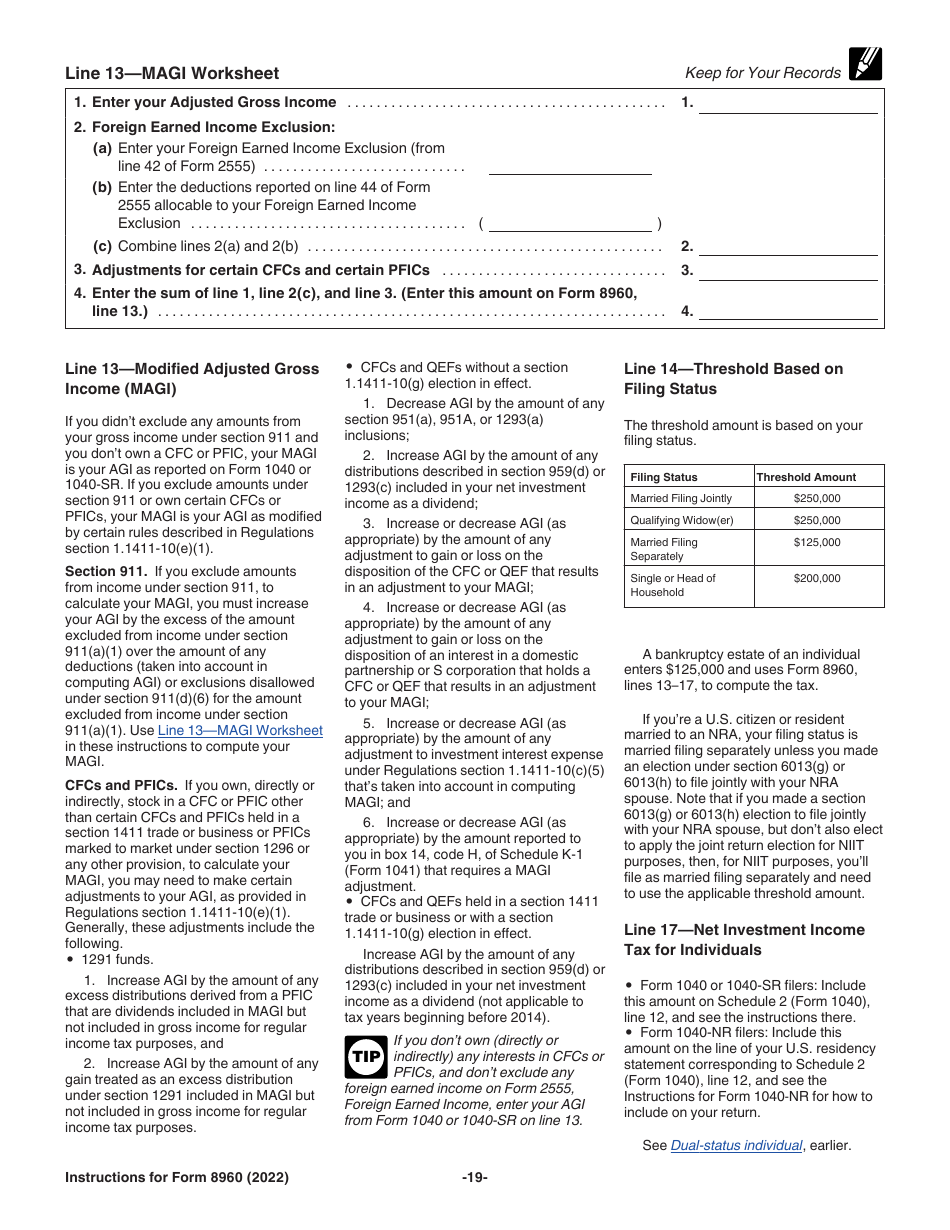

Q: What are the income thresholds for the Net Investment Income Tax?

A: For individuals, the threshold is $200,000 for single filers and $250,000 for married couples filing jointly. Estates and trusts have different thresholds.

Q: When is the deadline to file IRS Form 8960?

A: The deadline to file IRS Form 8960 generally coincides with the individual income tax return deadline, which is April 15th.

Q: Do I need to attach IRS Form 8960 to my tax return?

A: Yes, if you are required to file Form 8960, you will need to attach it to your individual or estate/trust tax return.

Instruction Details:

- This 21-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.