This version of the form is not currently in use and is provided for reference only. Download this version of

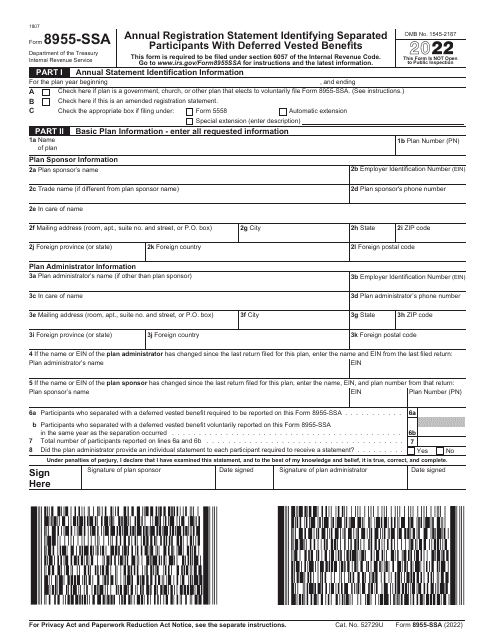

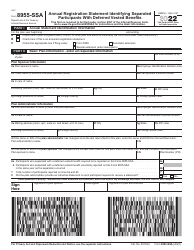

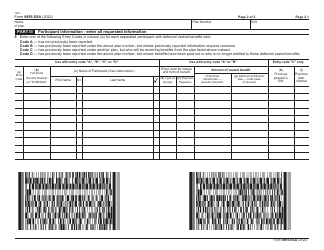

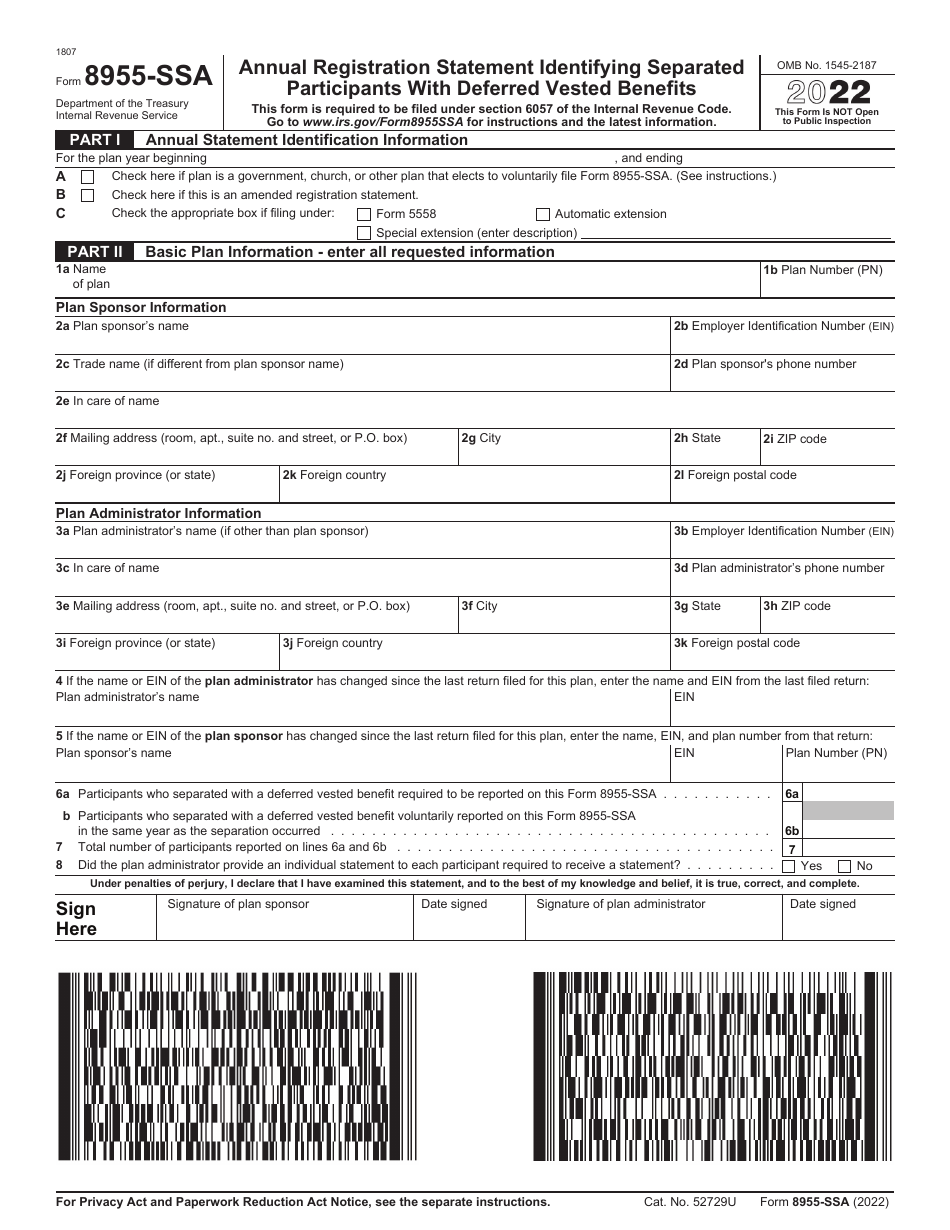

IRS Form 8955-SSA

for the current year.

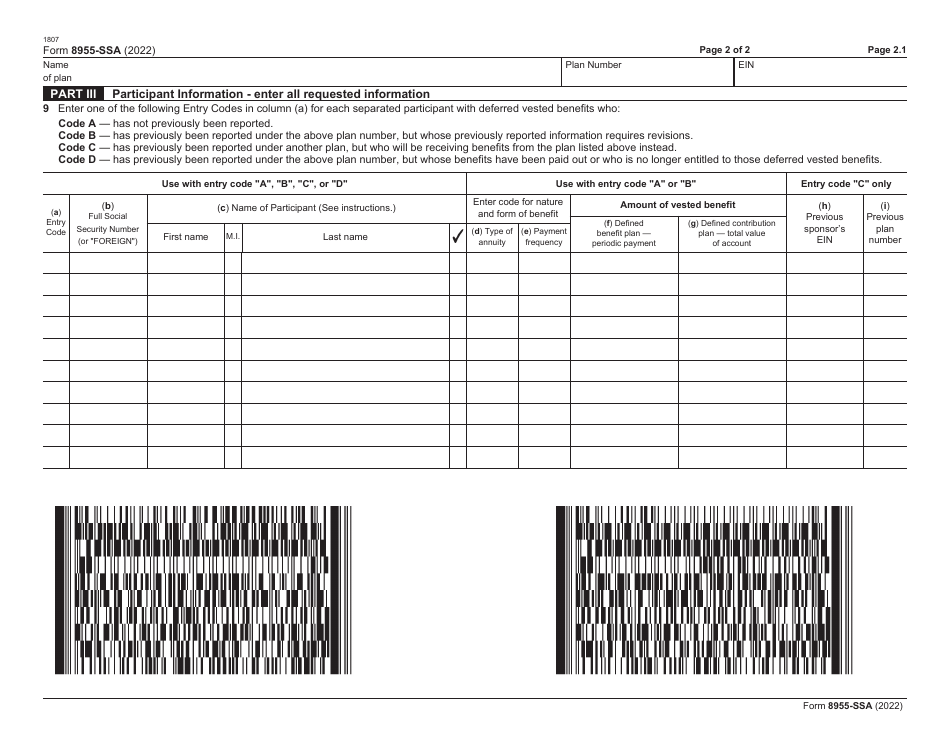

IRS Form 8955-SSA Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits

What Is IRS Form 8955-SSA?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8955-SSA?

A: IRS Form 8955-SSA is an annual registration statement that identifies separated participants with deferred vested benefits.

Q: Who needs to file IRS Form 8955-SSA?

A: Plan administrators of qualified retirement plans, such as pension plans, need to file IRS Form 8955-SSA.

Q: What is the purpose of filing IRS Form 8955-SSA?

A: The purpose of filing IRS Form 8955-SSA is to provide the IRS with information about participants who have separated from the plan but still have vested benefits.

Q: When is the deadline for filing IRS Form 8955-SSA?

A: The deadline for filing IRS Form 8955-SSA is the last day of the seventh month following the end of the plan year.

Q: What happens if I fail to file IRS Form 8955-SSA?

A: Failure to file IRS Form 8955-SSA may result in penalties imposed by the IRS.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8955-SSA through the link below or browse more documents in our library of IRS Forms.