This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8933

for the current year.

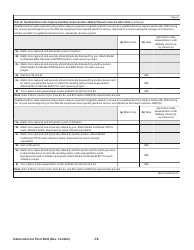

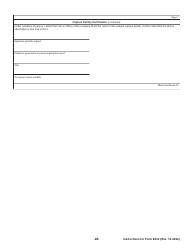

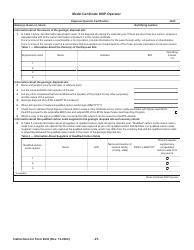

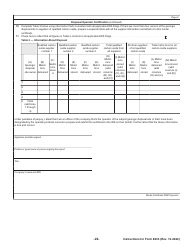

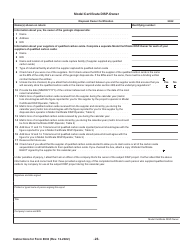

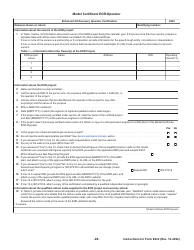

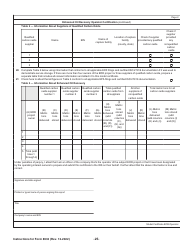

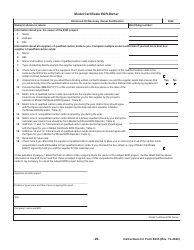

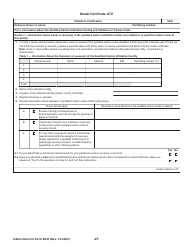

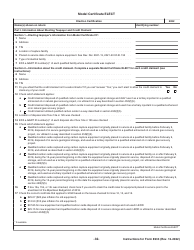

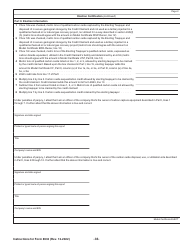

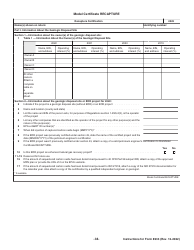

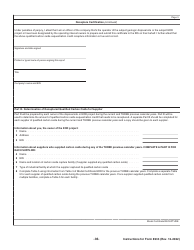

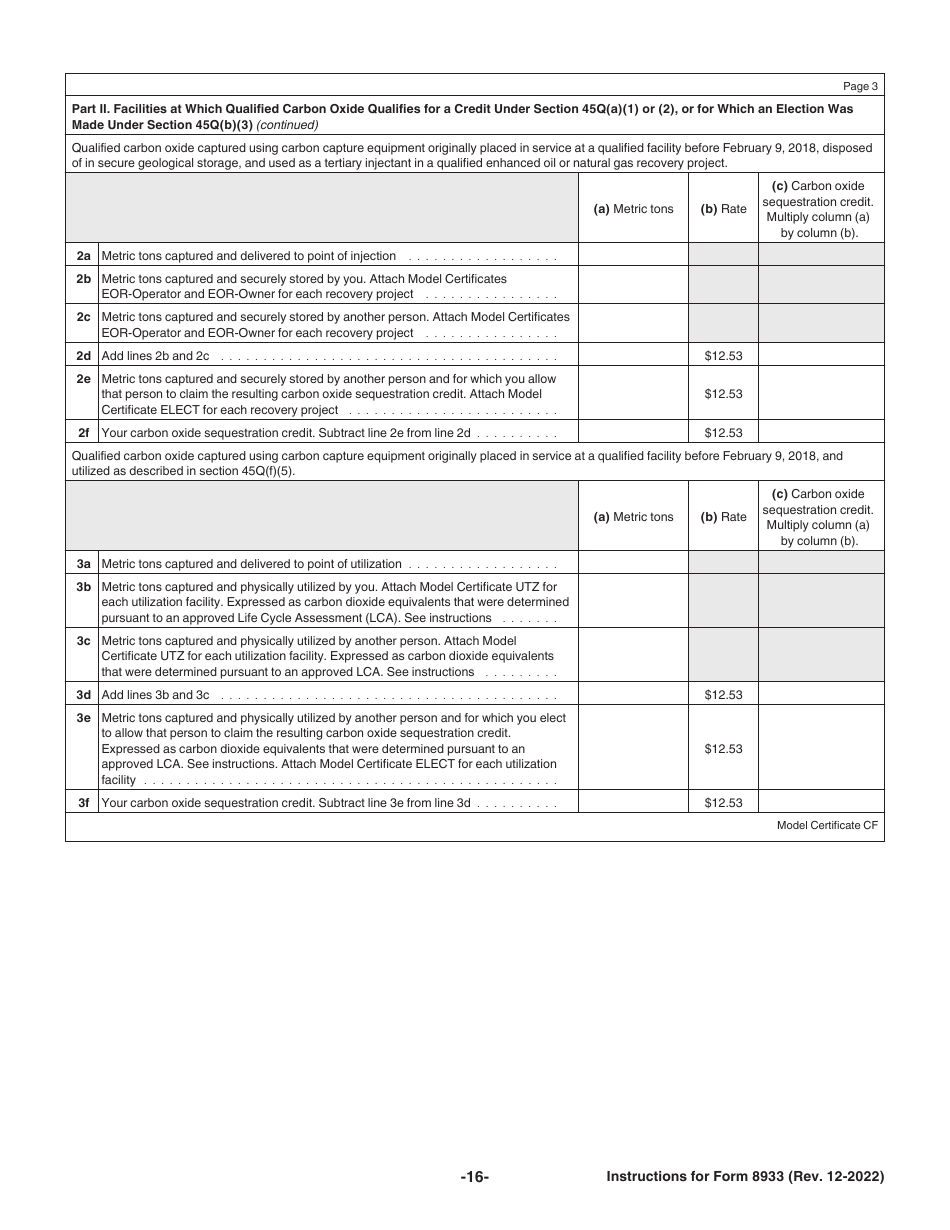

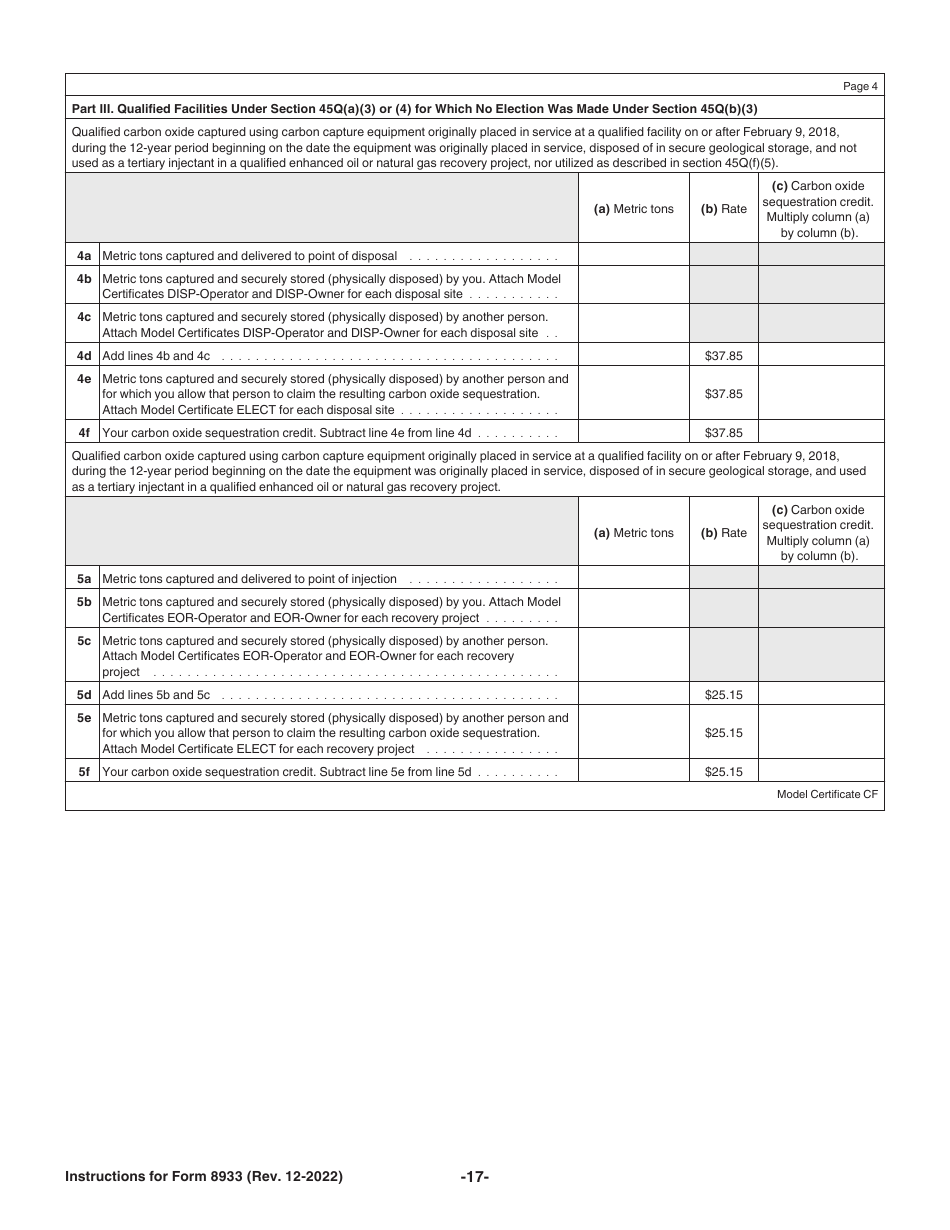

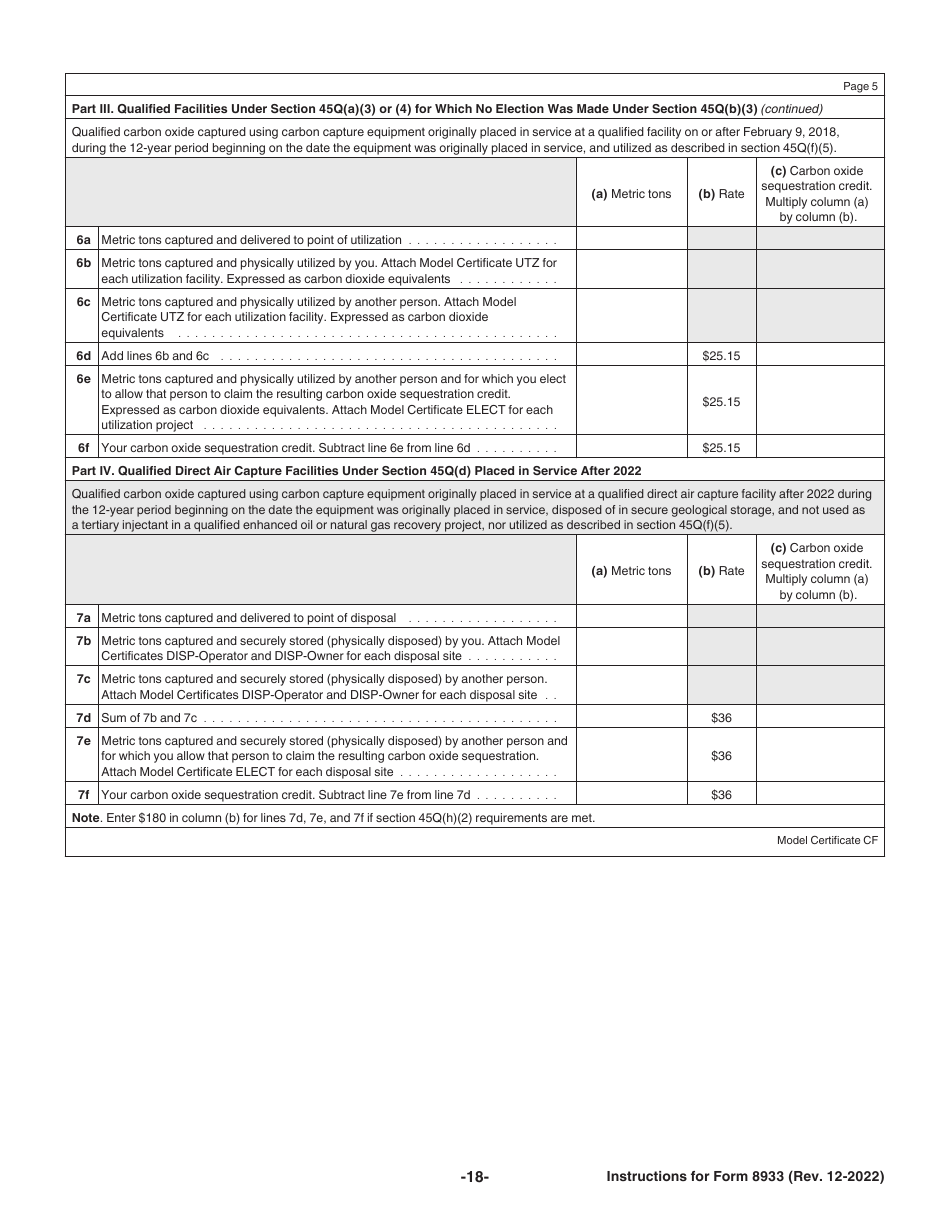

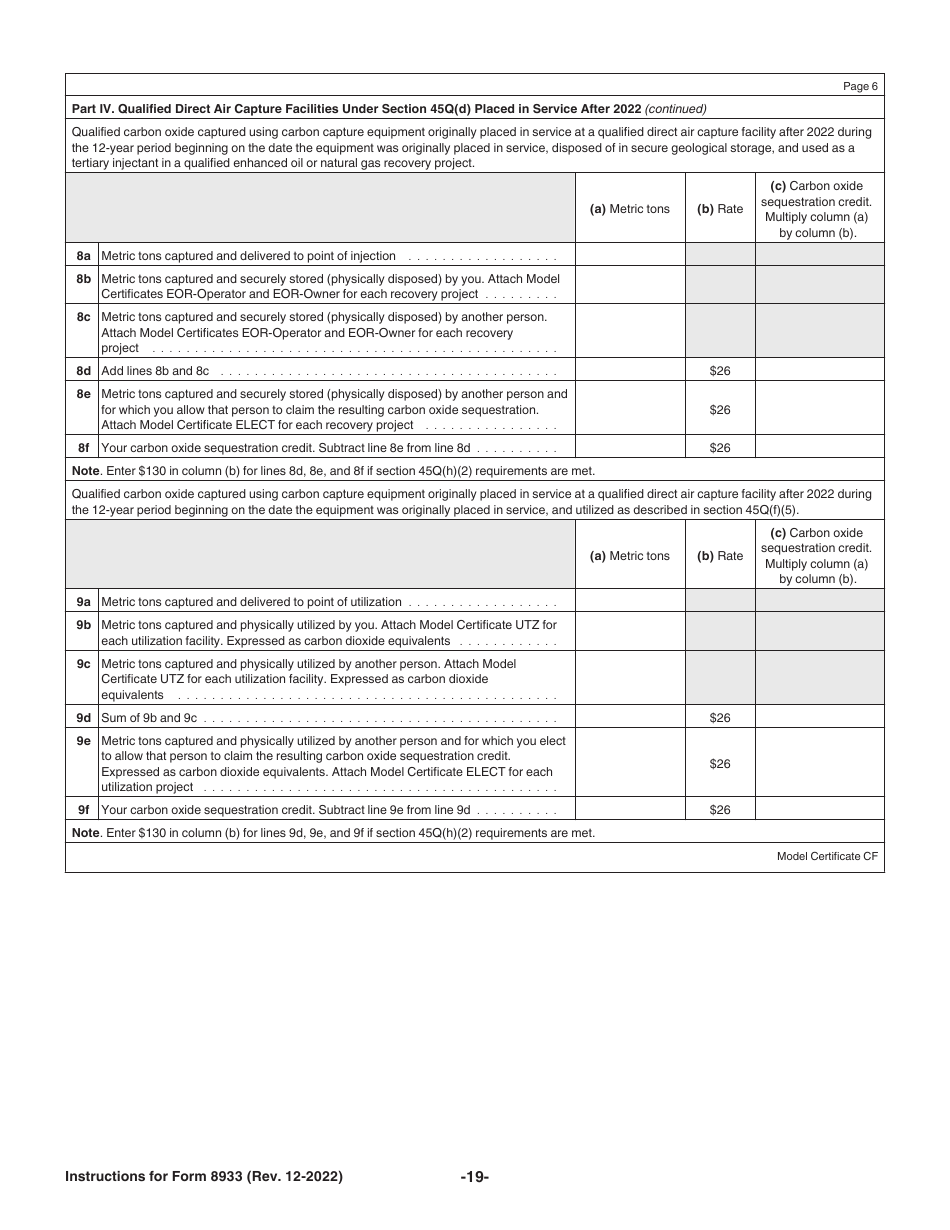

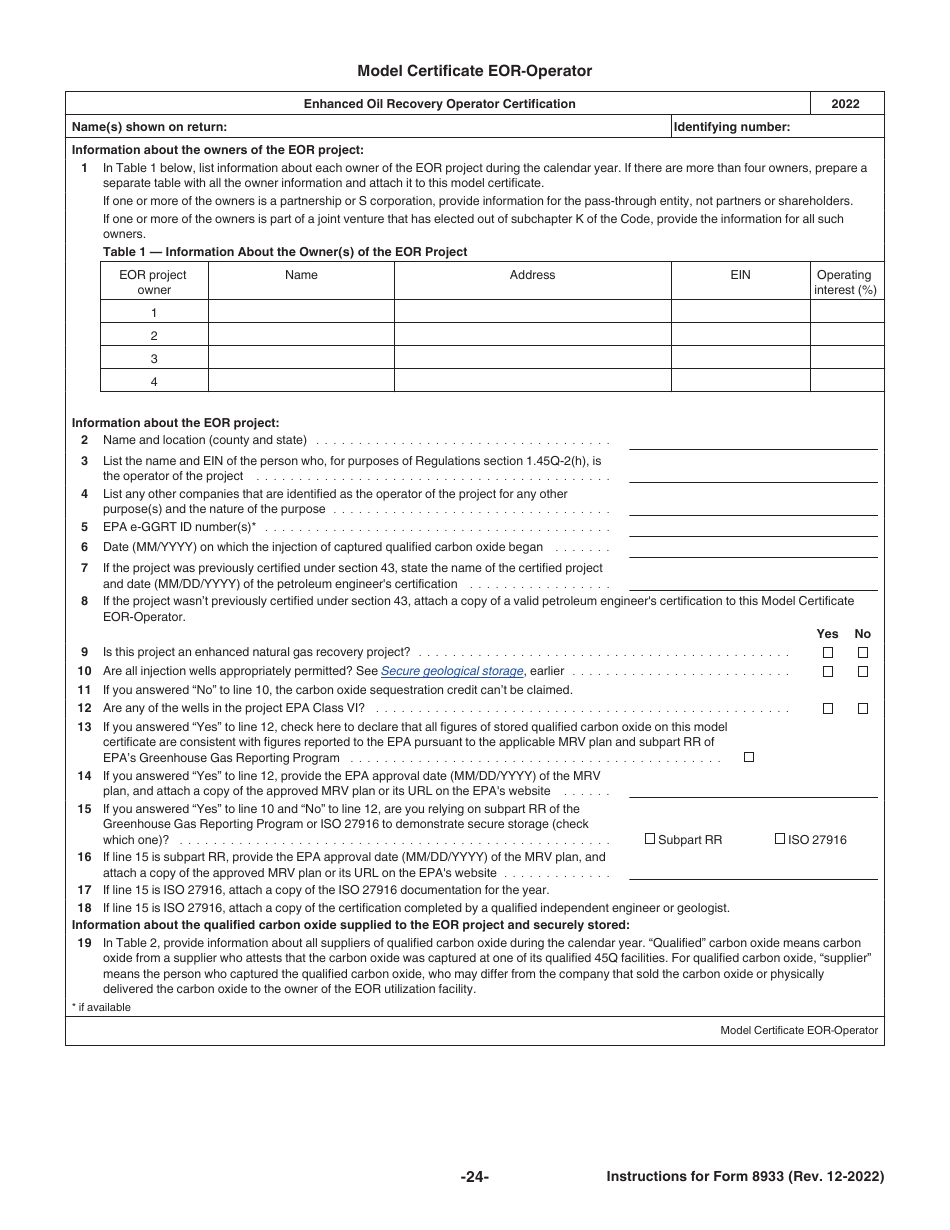

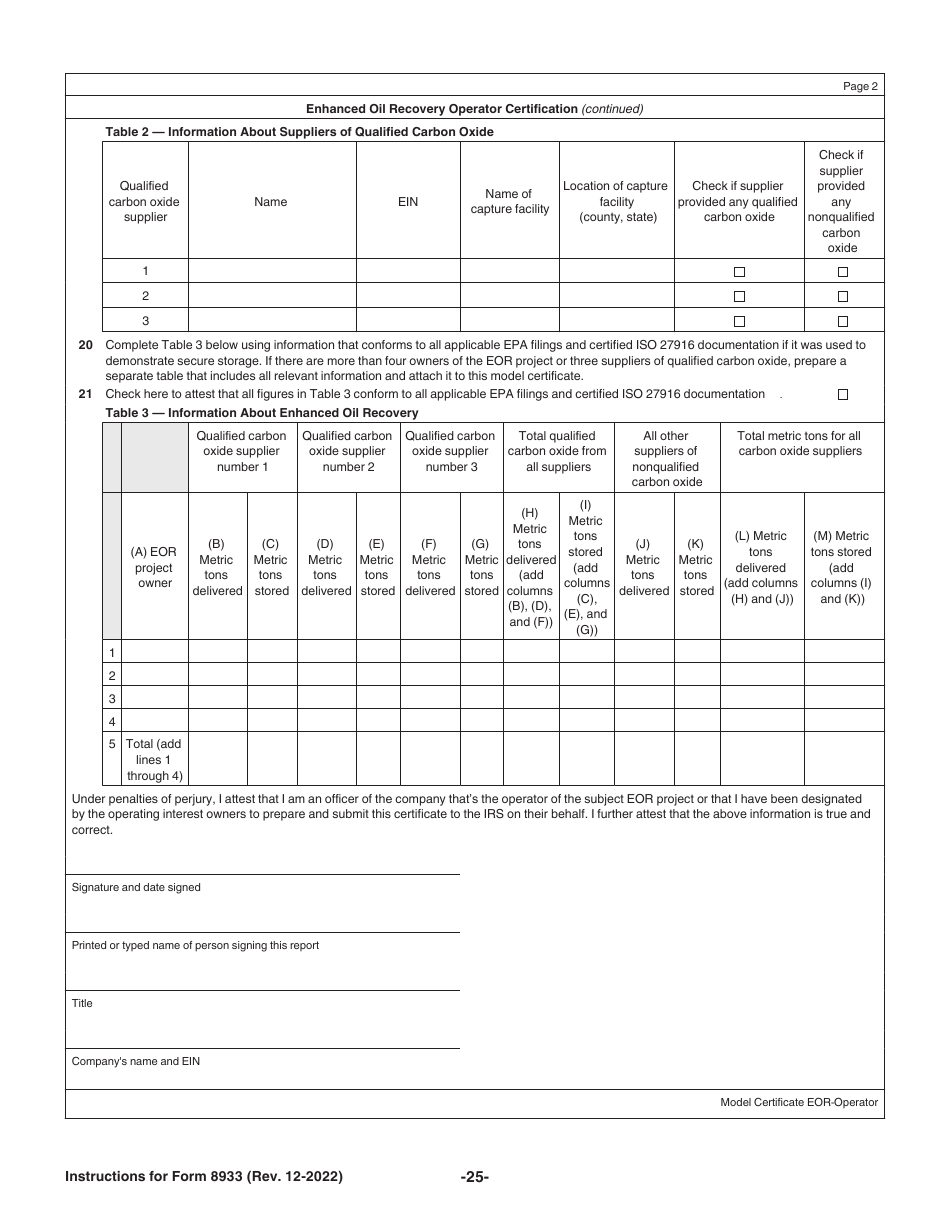

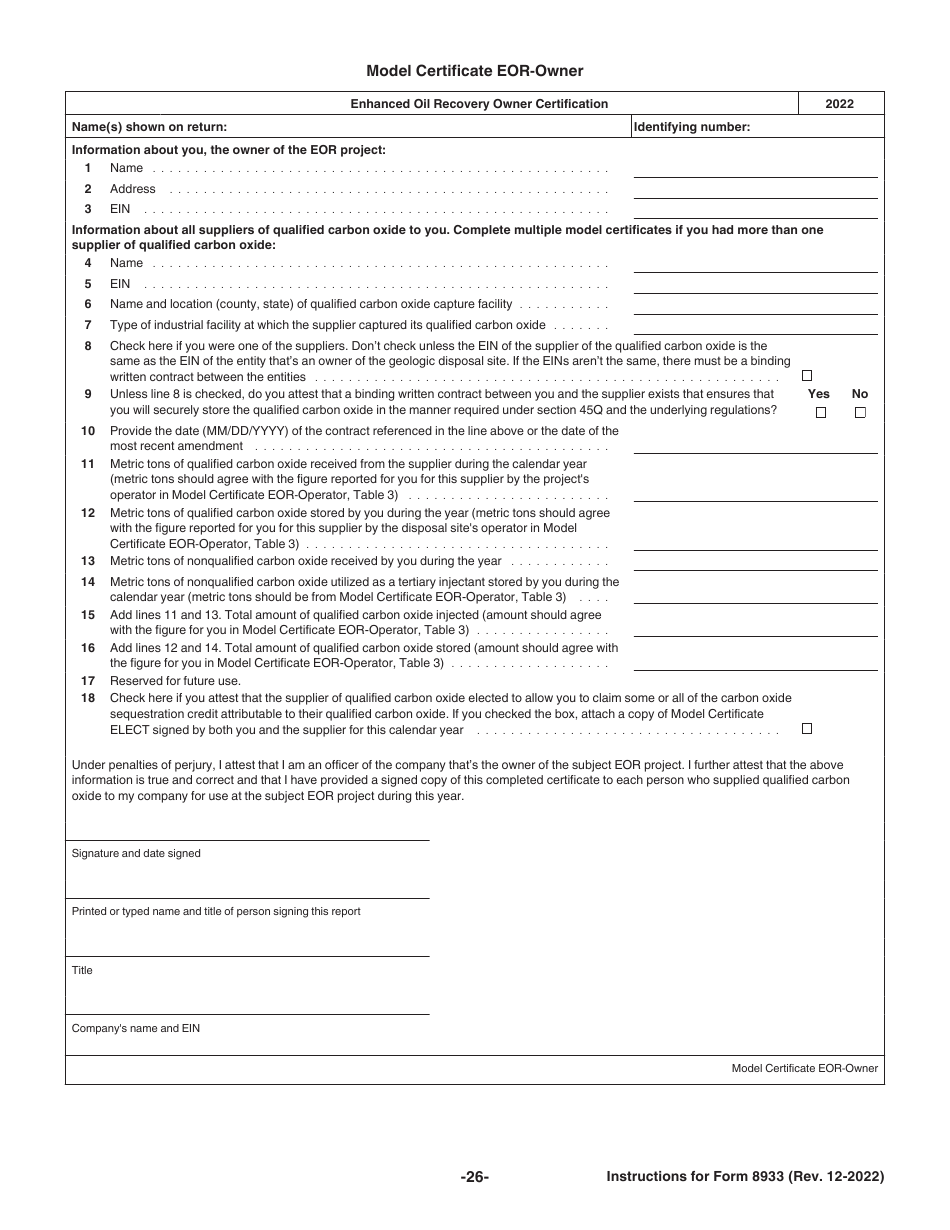

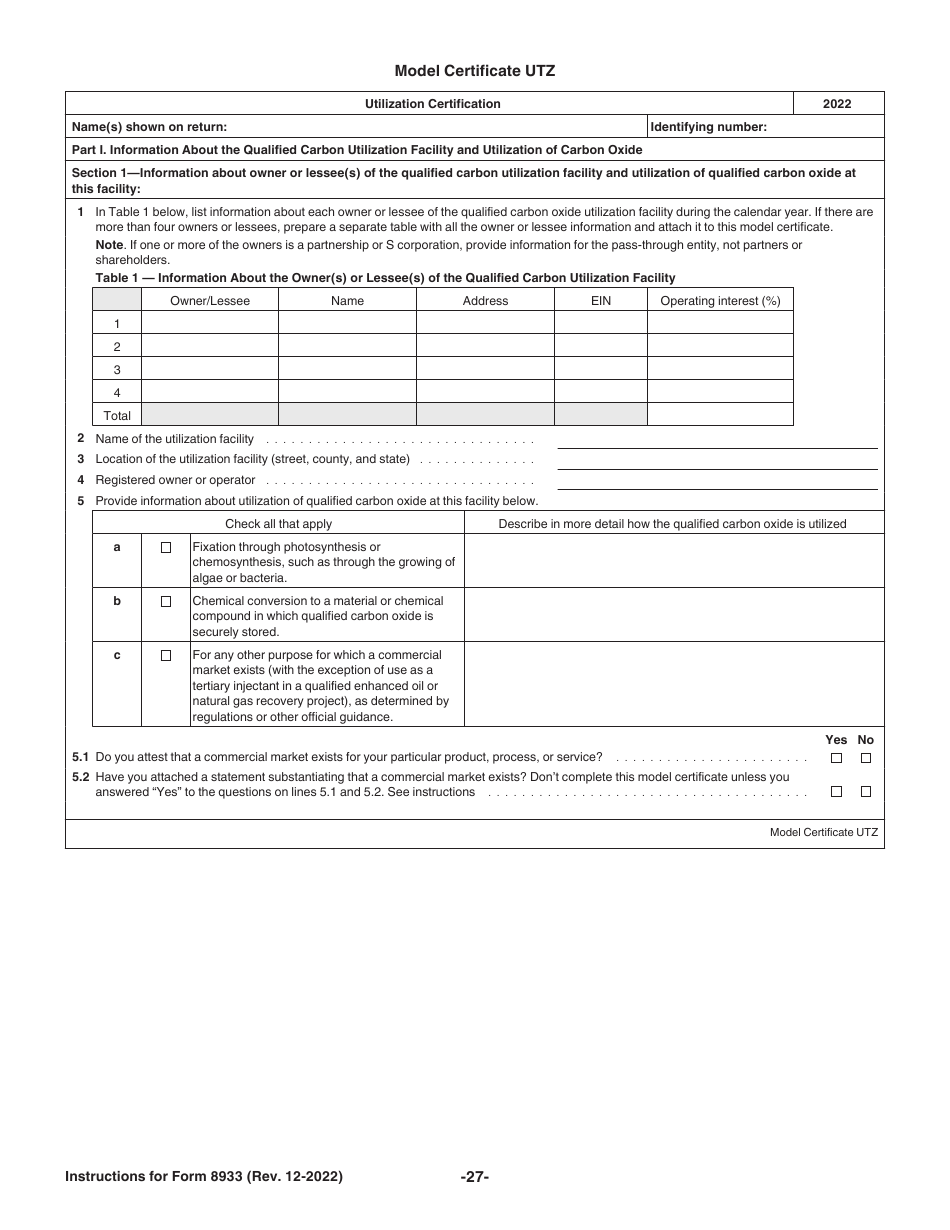

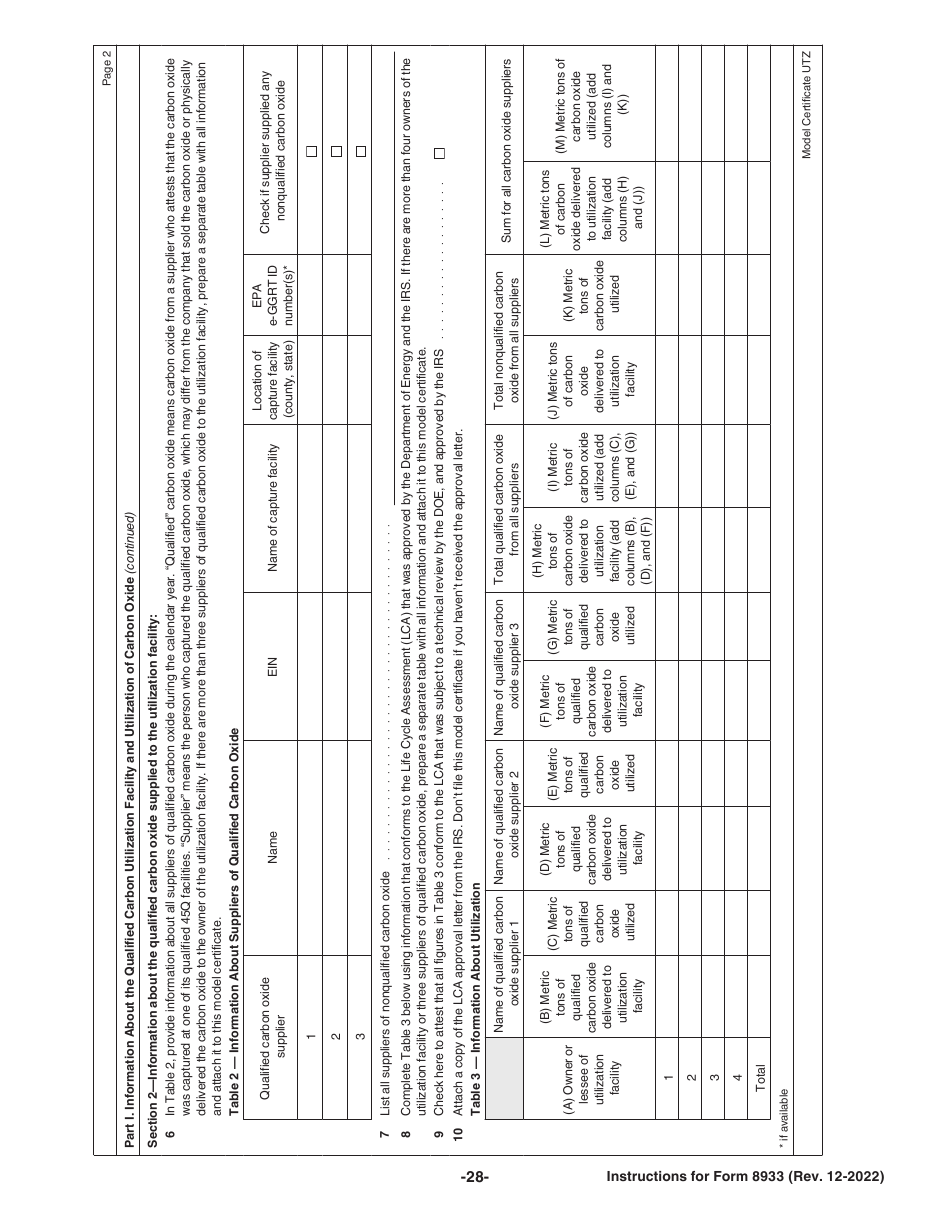

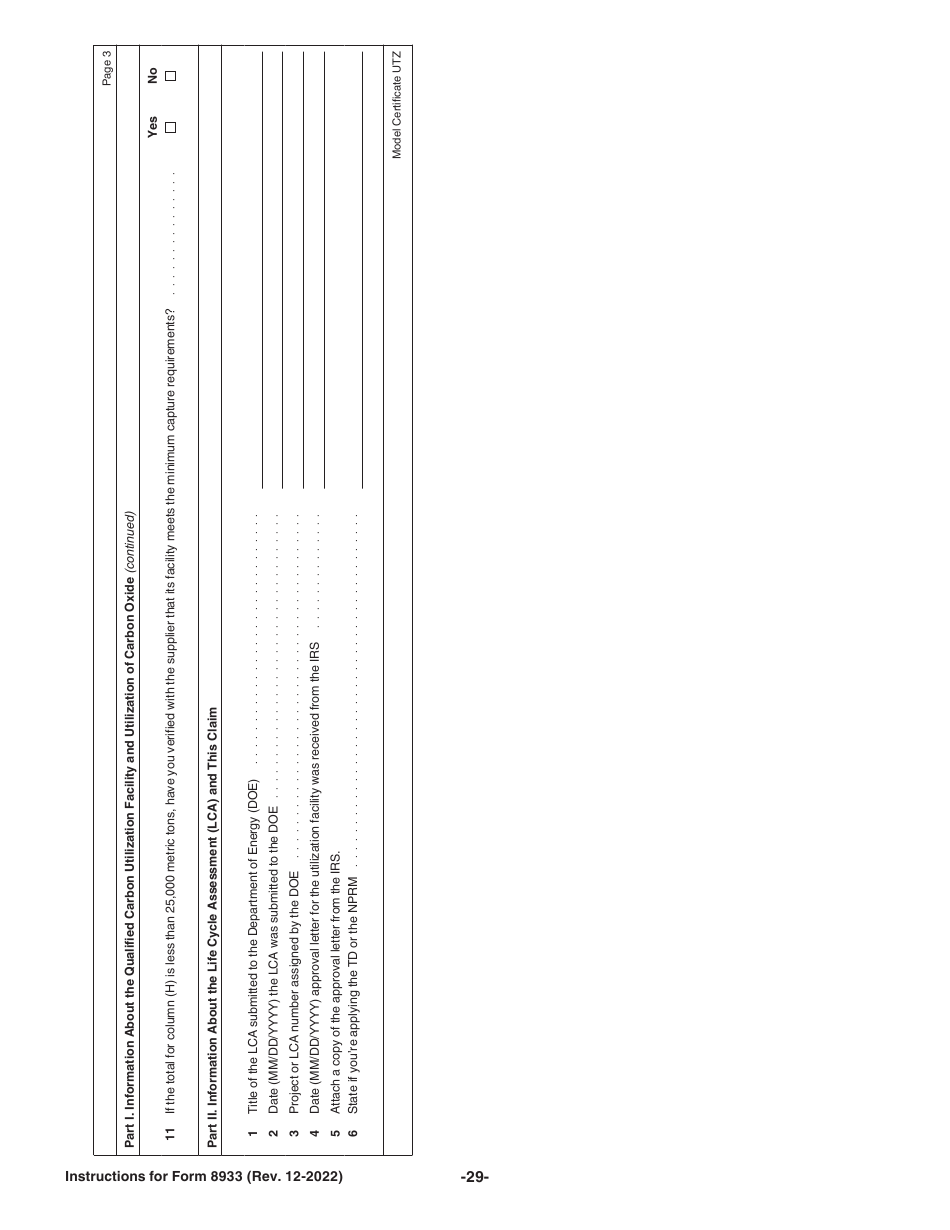

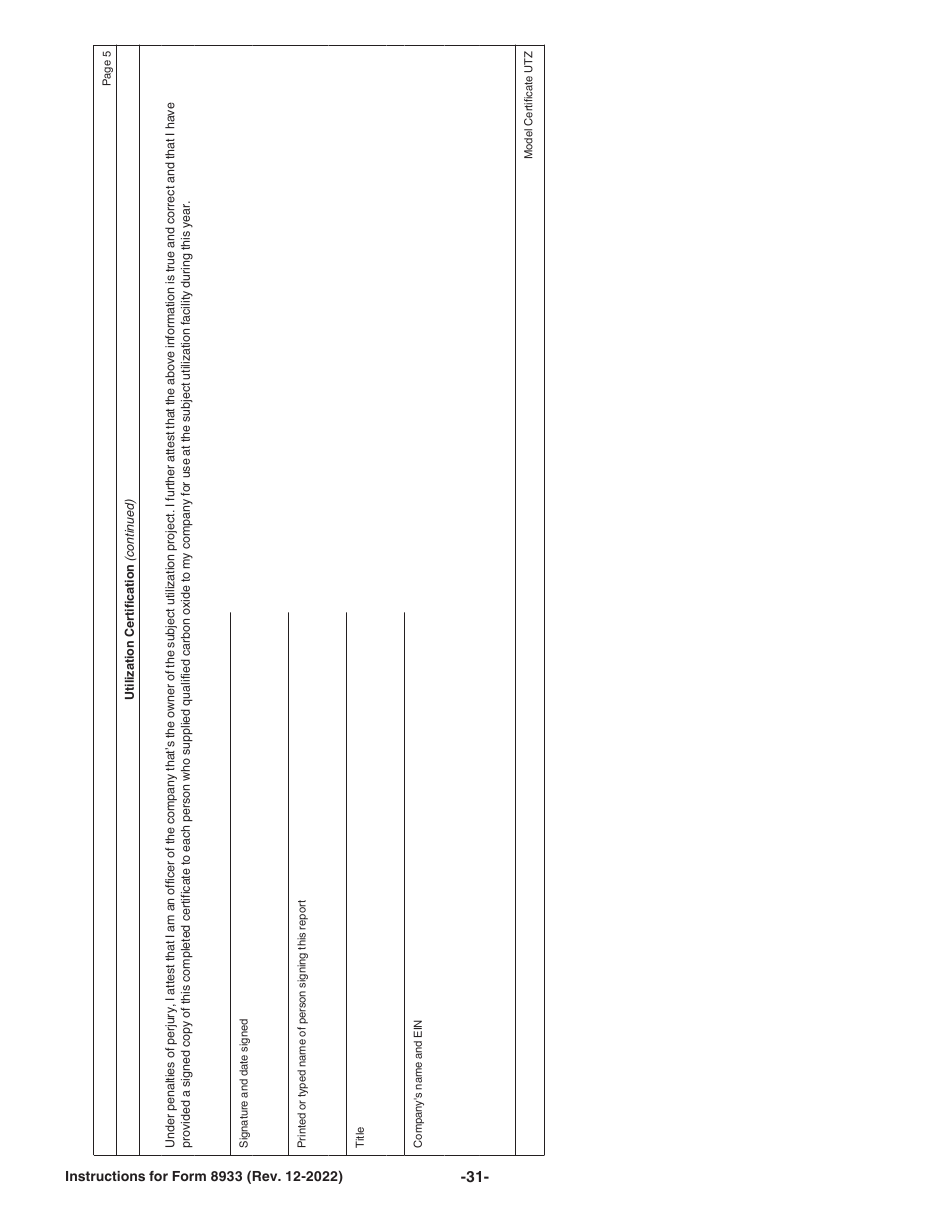

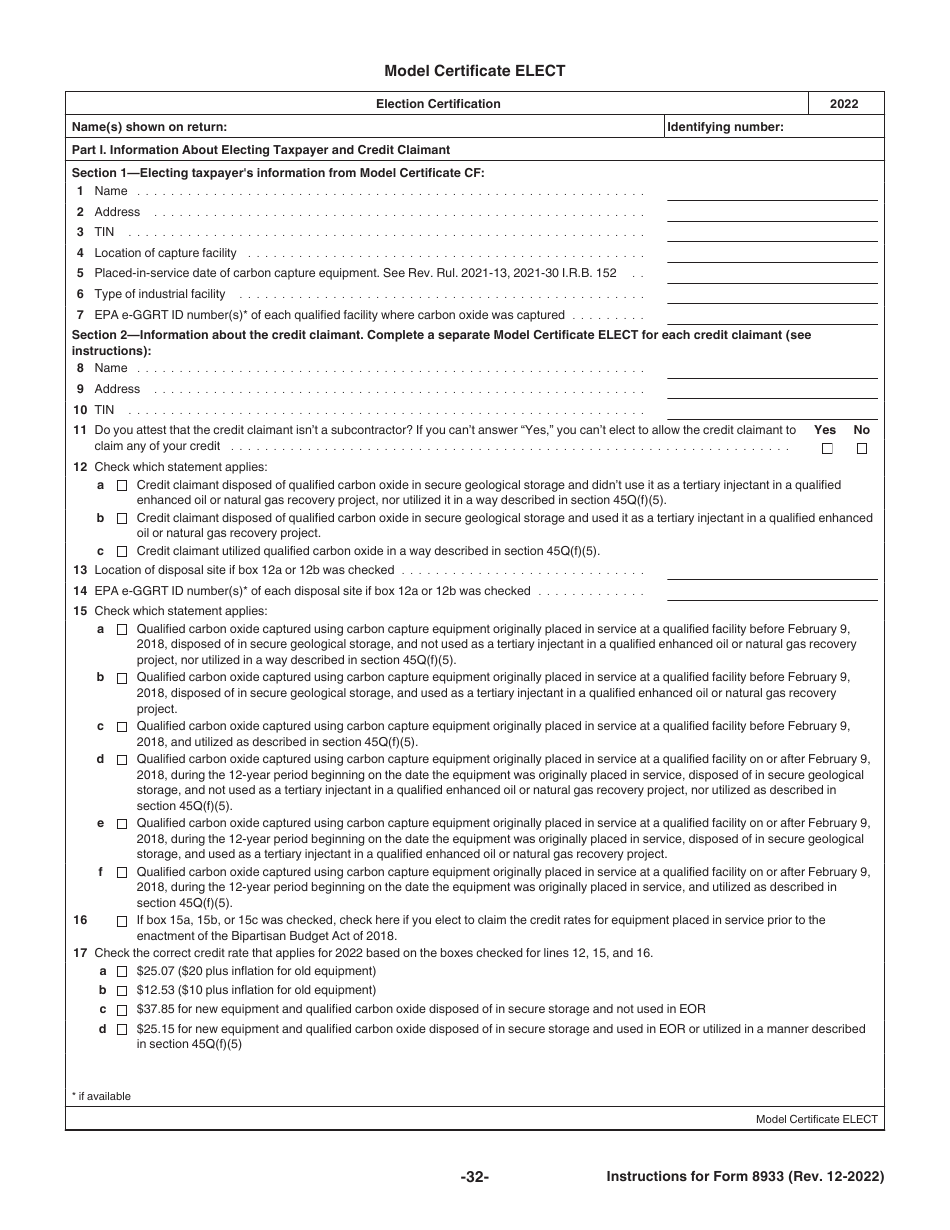

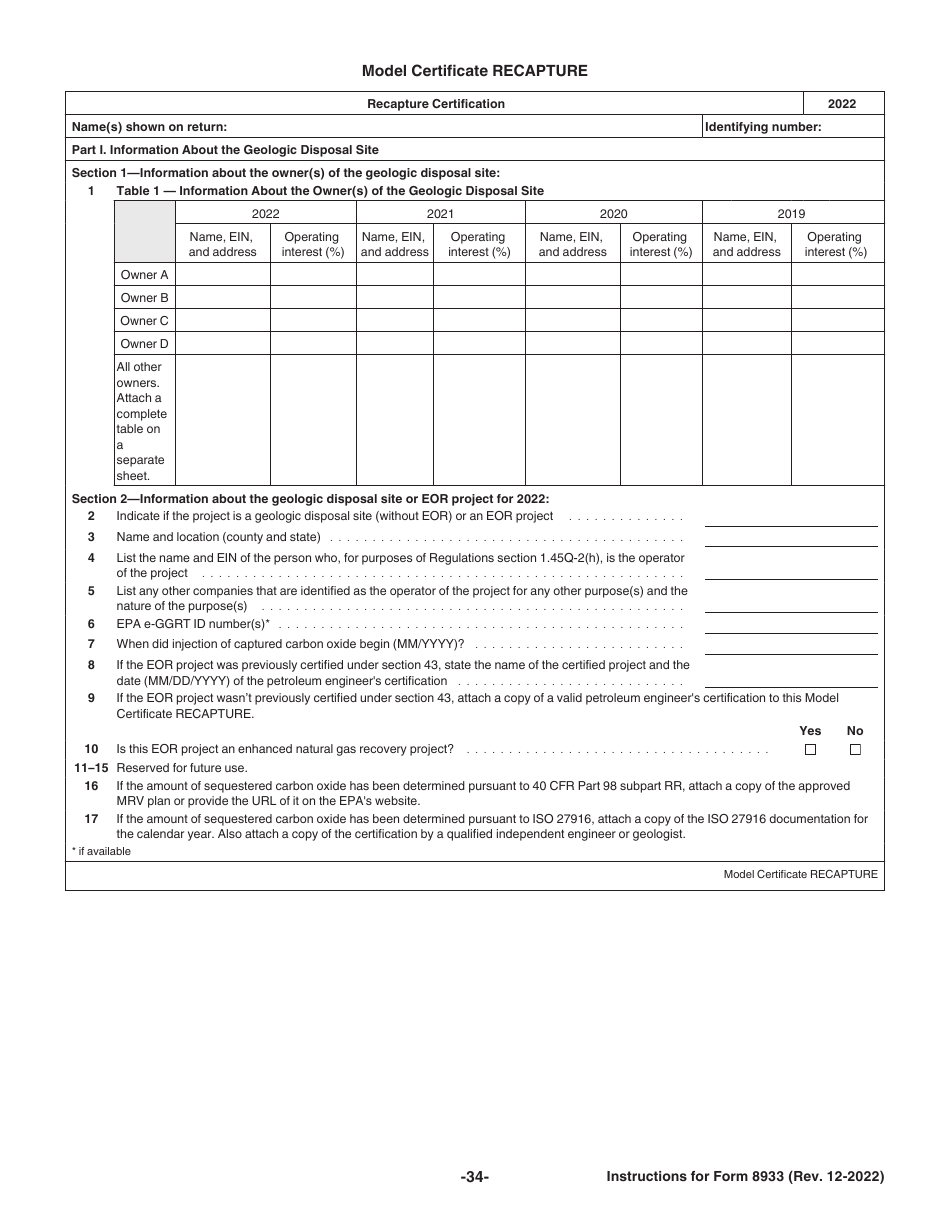

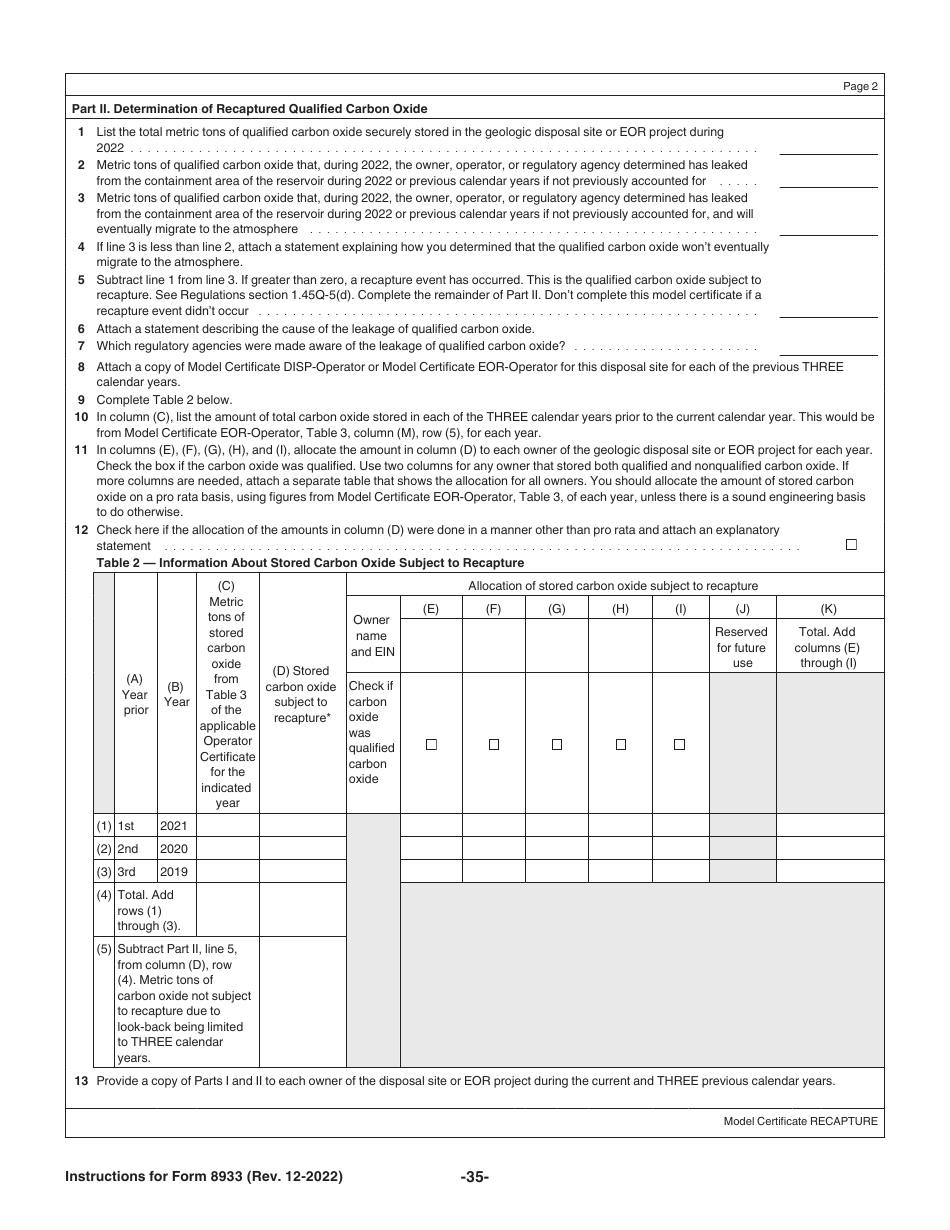

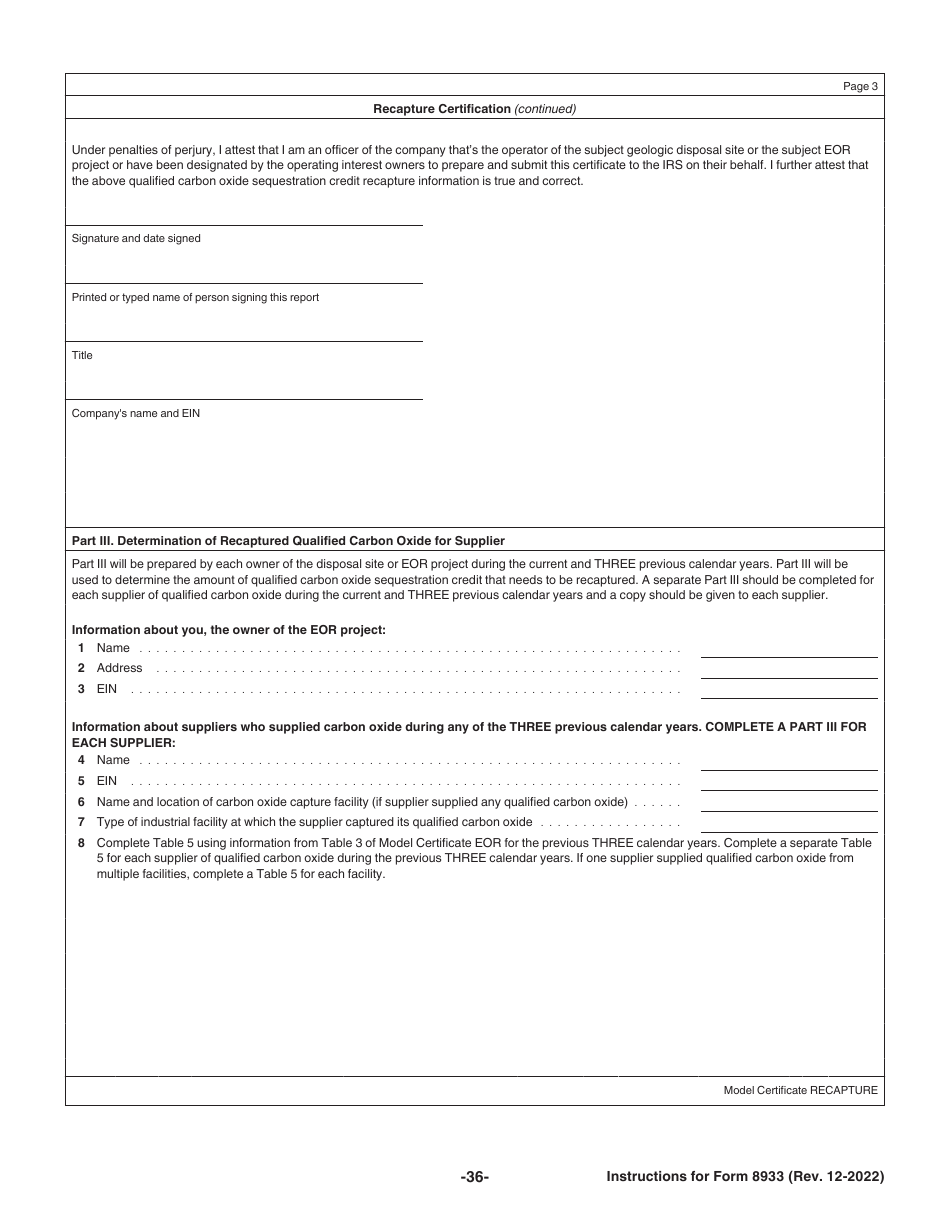

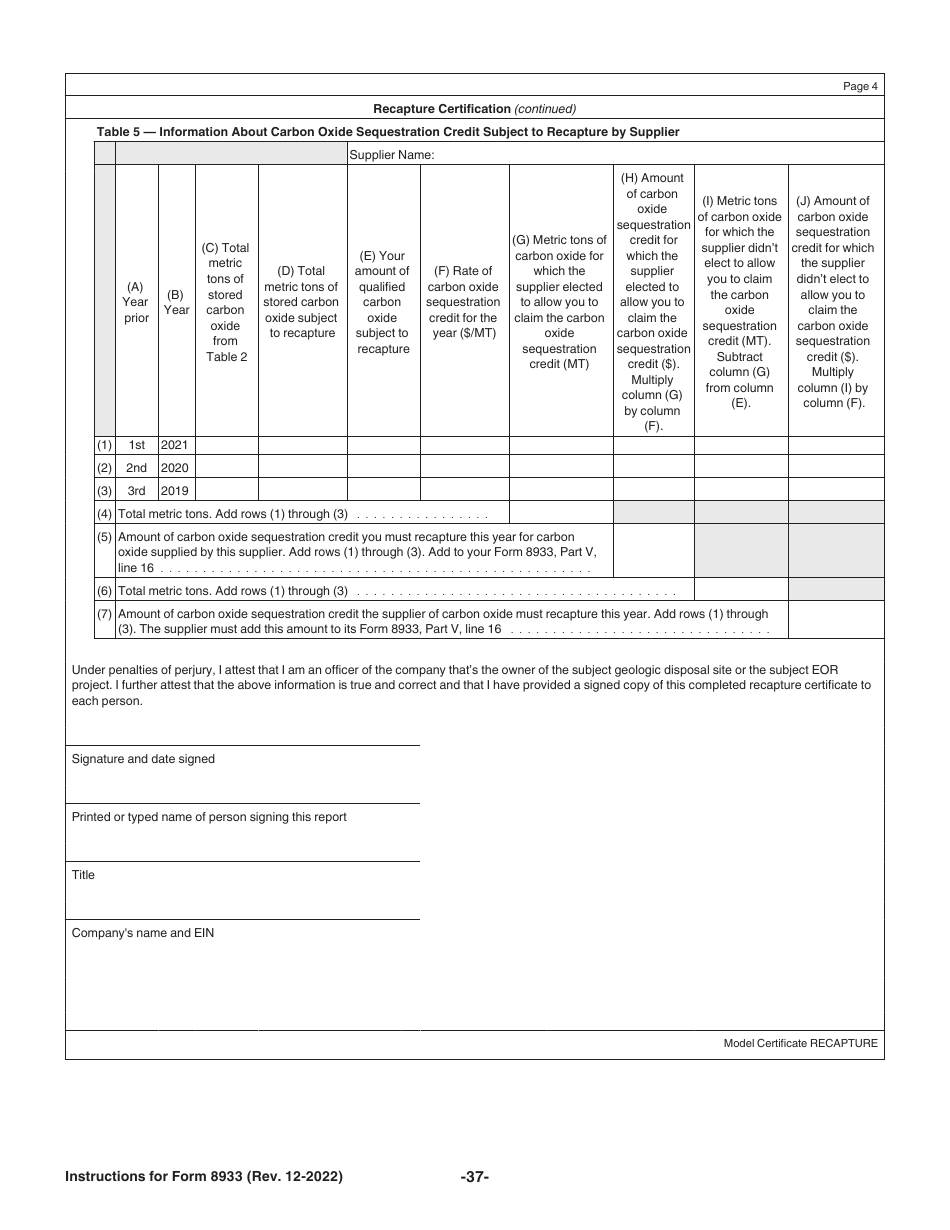

Instructions for IRS Form 8933 Carbon Oxide Sequestration Credit

This document contains official instructions for IRS Form 8933 , Carbon Oxide Sequestration Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8933 is available for download through this link.

FAQ

Q: What is IRS Form 8933?

A: IRS Form 8933 is a tax form used to claim the Carbon Oxide Sequestration Credit.

Q: What is the Carbon Oxide Sequestration Credit?

A: The Carbon Oxide Sequestration Credit is a tax credit available for certain projects that capture and store carbon dioxide.

Q: Who can claim the Carbon Oxide Sequestration Credit?

A: Taxpayers who engage in carbon capture and storage projects may be eligible to claim this credit.

Q: What expenses can be claimed under this credit?

A: Expenses related to the purchase, installation, and operation of carbon capture equipment and facilities can be claimed.

Q: How much is the Carbon Oxide Sequestration Credit?

A: The credit amount depends on the amount of carbon dioxide captured and stored, and is subject to certain limitations.

Q: When is the deadline to file Form 8933?

A: The deadline for filing Form 8933 is the same as the deadline for filing your annual tax return.

Q: Can I claim this credit for previous years?

A: Yes, you can file an amended return to claim this credit for prior years if you meet the eligibility requirements.

Instruction Details:

- This 38-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.