This version of the form is not currently in use and is provided for reference only. Download this version of

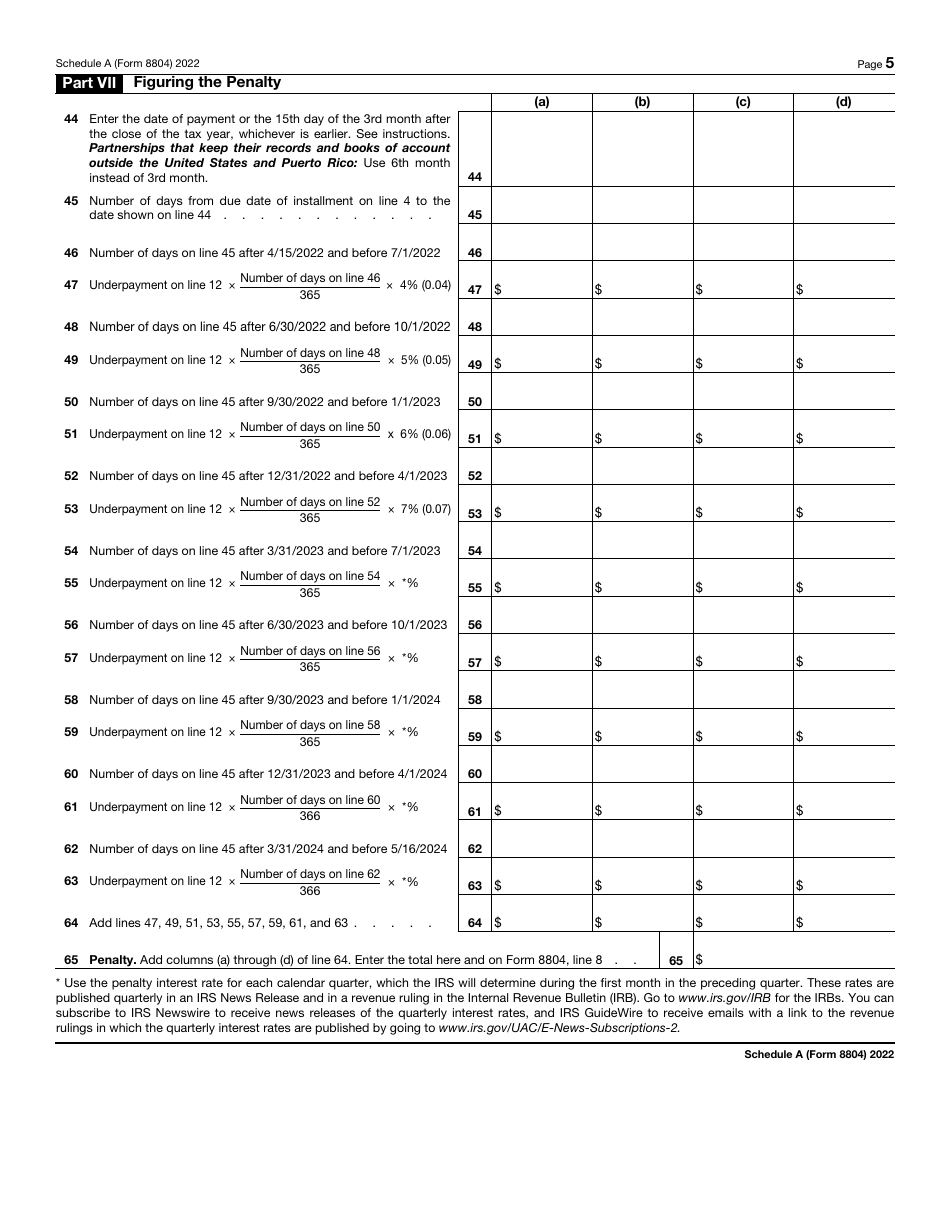

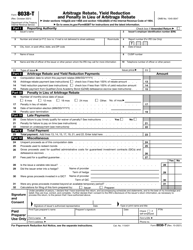

IRS Form 8804 Schedule A

for the current year.

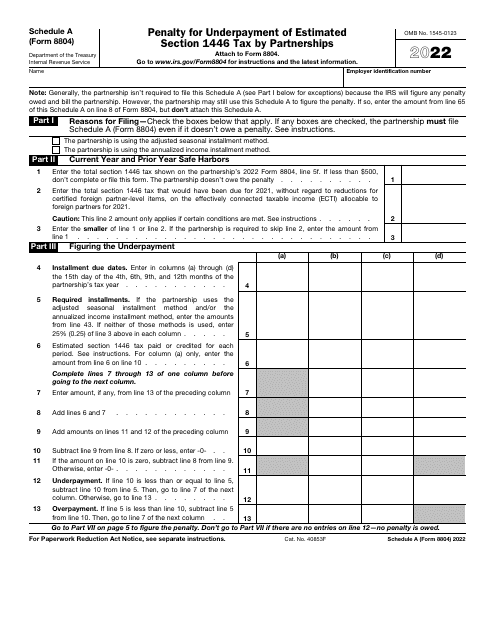

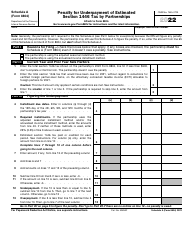

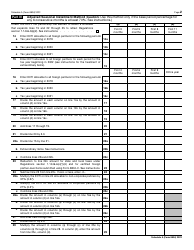

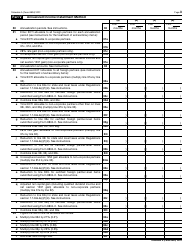

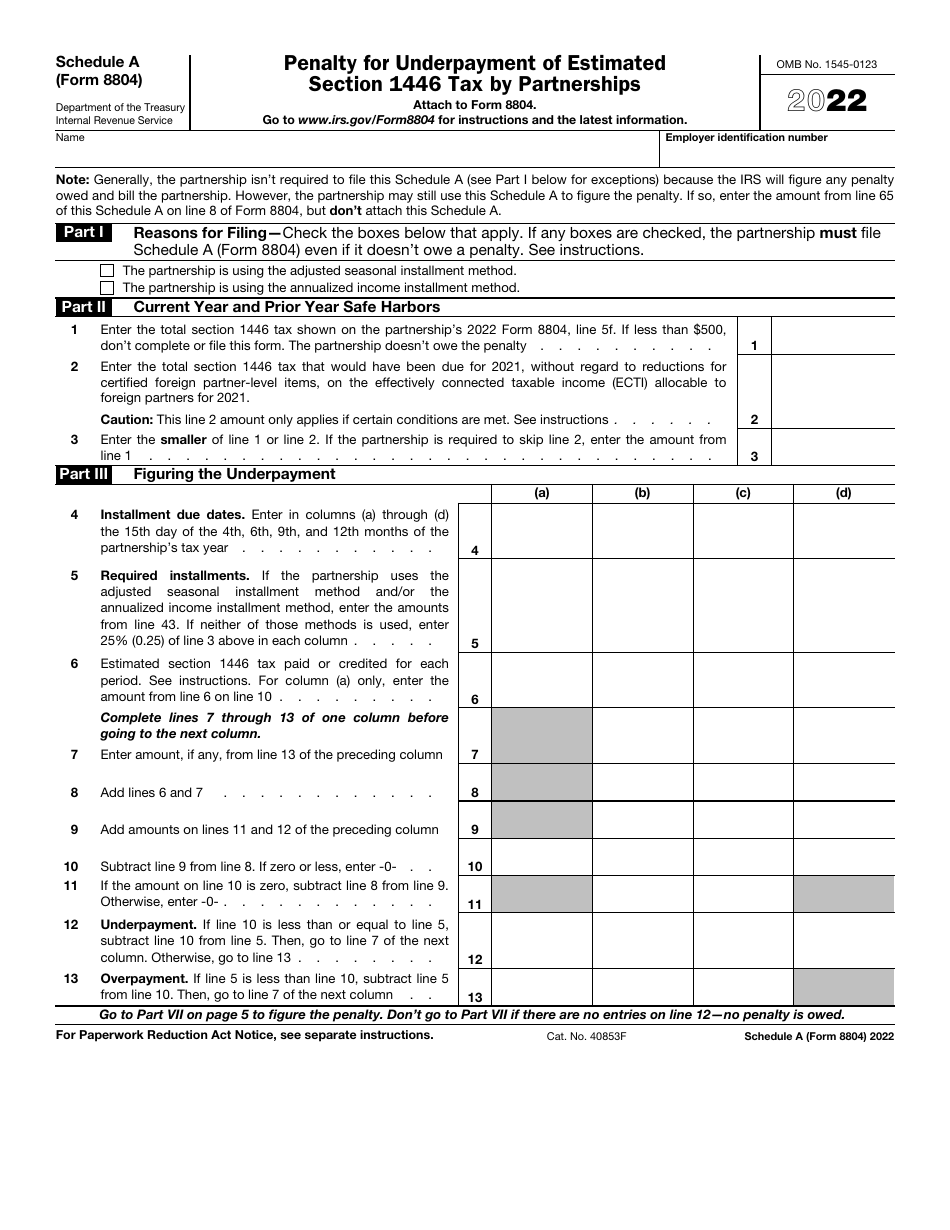

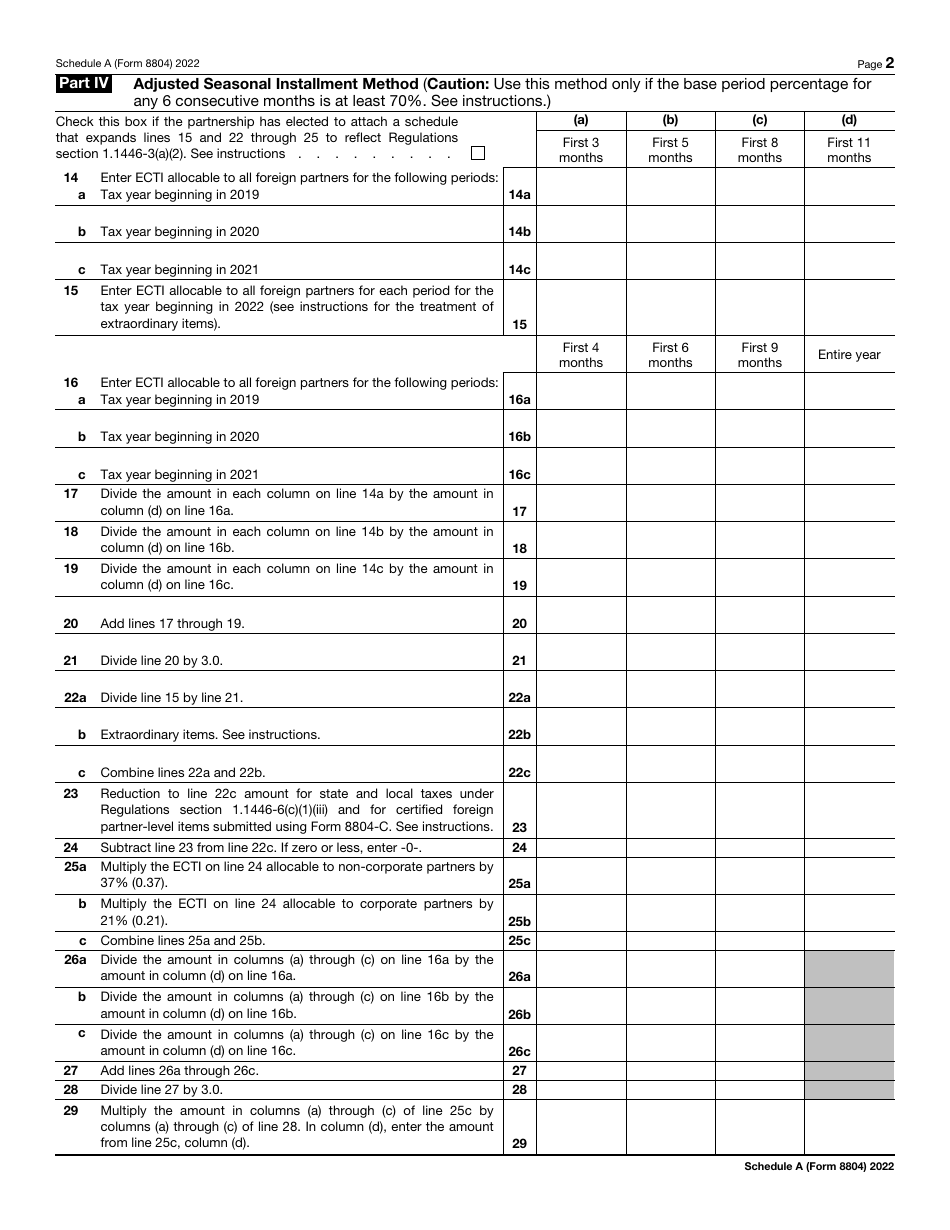

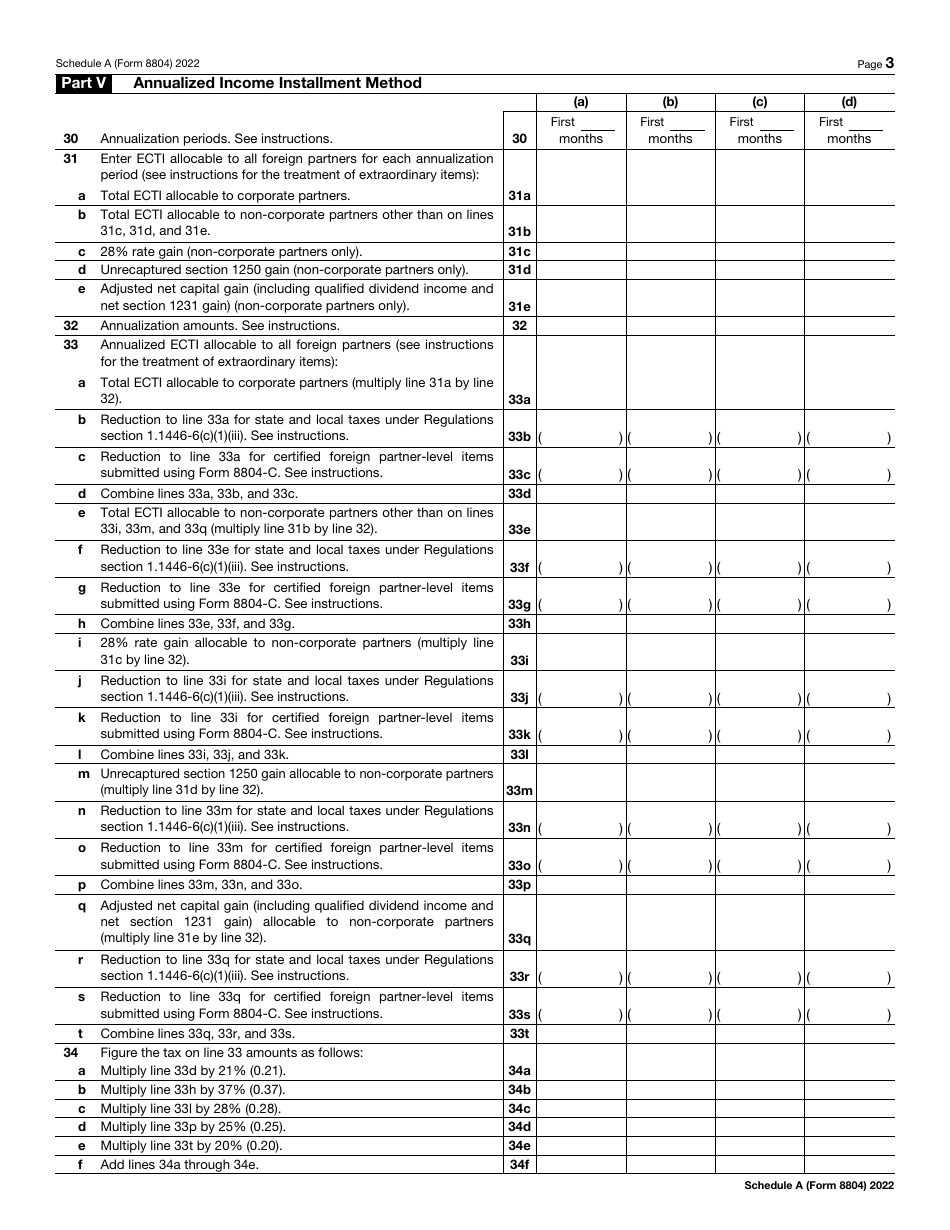

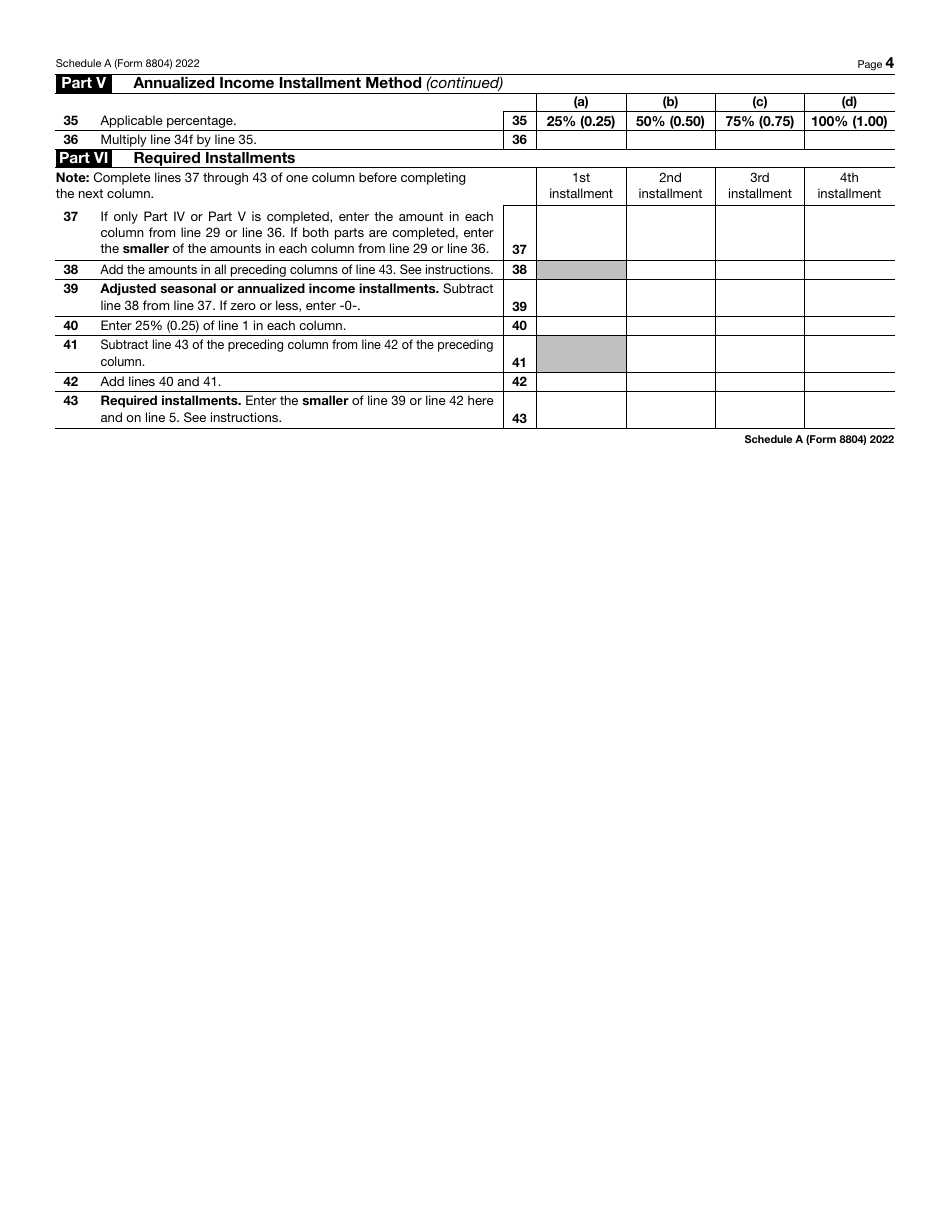

IRS Form 8804 Schedule A Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships

What Is IRS Form 8804 Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8804 Schedule A?

A: IRS Form 8804 Schedule A is a form used by partnerships to report penalties for underpayment of estimated Section 1446 tax.

Q: What is the penalty for underpayment of estimated Section 1446 tax by partnerships?

A: The penalty for underpayment of estimated Section 1446 tax by partnerships is reported on IRS Form 8804 Schedule A.

Q: Who uses IRS Form 8804 Schedule A?

A: Partnerships use IRS Form 8804 Schedule A to report penalties for underpayment of estimated Section 1446 tax.

Q: What is Section 1446 tax?

A: Section 1446 tax is a withholding tax on foreign partners' share of effectively connected income from a partnership.

Q: When is IRS Form 8804 Schedule A filed?

A: IRS Form 8804 Schedule A is filed with the partnership's tax return, usually along with Form 8804.

Q: What happens if a partnership underpays estimated Section 1446 tax?

A: If a partnership underpays estimated Section 1446 tax, it may be subject to penalties that are reported on IRS Form 8804 Schedule A.

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8804 Schedule A through the link below or browse more documents in our library of IRS Forms.