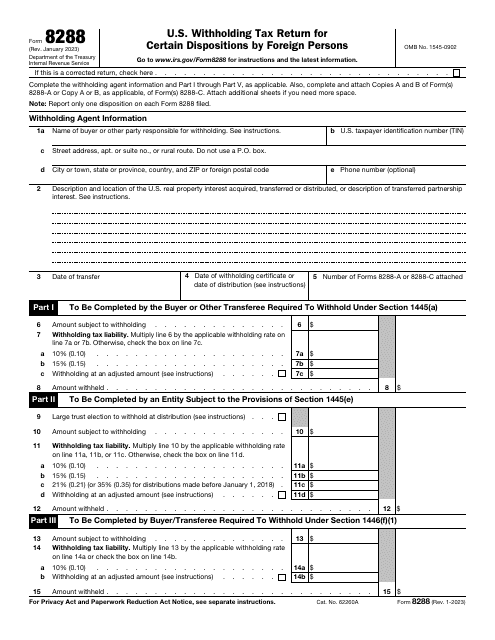

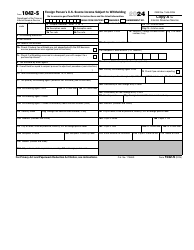

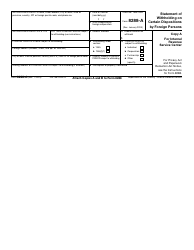

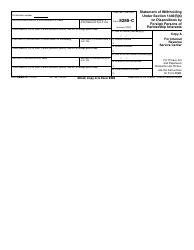

IRS Form 8288 U.S. Withholding Tax Return for Certain Dispositions by Foreign Persons

What Is IRS Form 8288?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2023. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8288?

A: IRS Form 8288 is the U.S. Withholding Tax Return for Certain Dispositions by Foreign Persons.

Q: Who is required to file IRS Form 8288?

A: Foreign persons who dispose of U.S. real property interests are required to file IRS Form 8288.

Q: What is the purpose of IRS Form 8288?

A: The purpose of IRS Form 8288 is to report and pay withholding taxes on the amount realized from the disposition of U.S. real property interests by foreign persons.

Q: When is the due date for filing IRS Form 8288?

A: IRS Form 8288 must be filed within 20 days after the date of the disposition.

Q: Are there any penalties for not filing IRS Form 8288?

A: Yes, failure to file IRS Form 8288 may result in penalties and interest.

Q: What supporting documents are required to be attached to IRS Form 8288?

A: Supporting documents such as a copy of the deed or other instrument of transfer should be attached to IRS Form 8288.

Q: Can IRS Form 8288 be filed electronically?

A: No, IRS Form 8288 cannot be filed electronically. It must be filed by mail.

Q: Is there an extension available for filing IRS Form 8288?

A: No, there is no extension available for filing IRS Form 8288. It must be filed within 20 days after the date of the disposition.

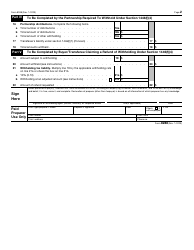

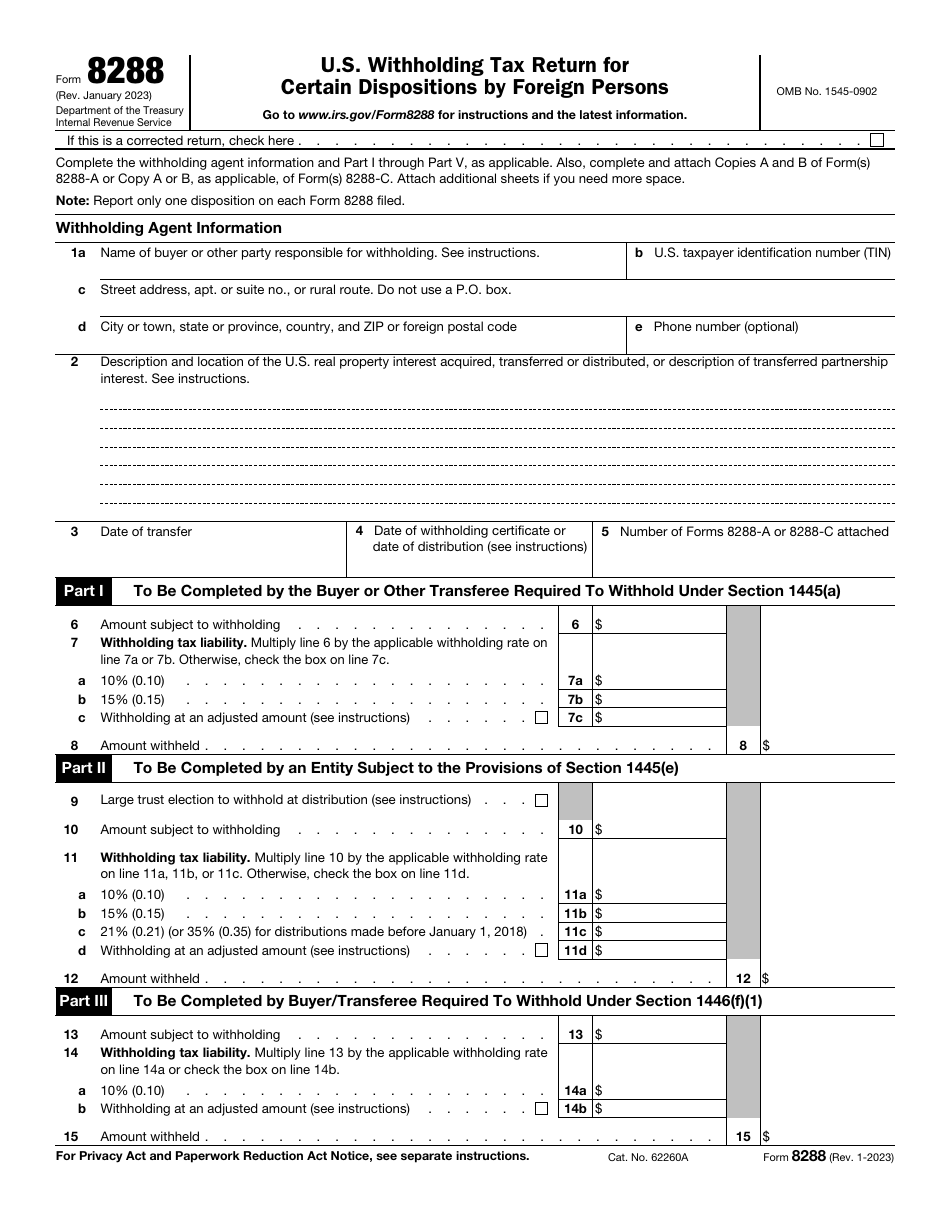

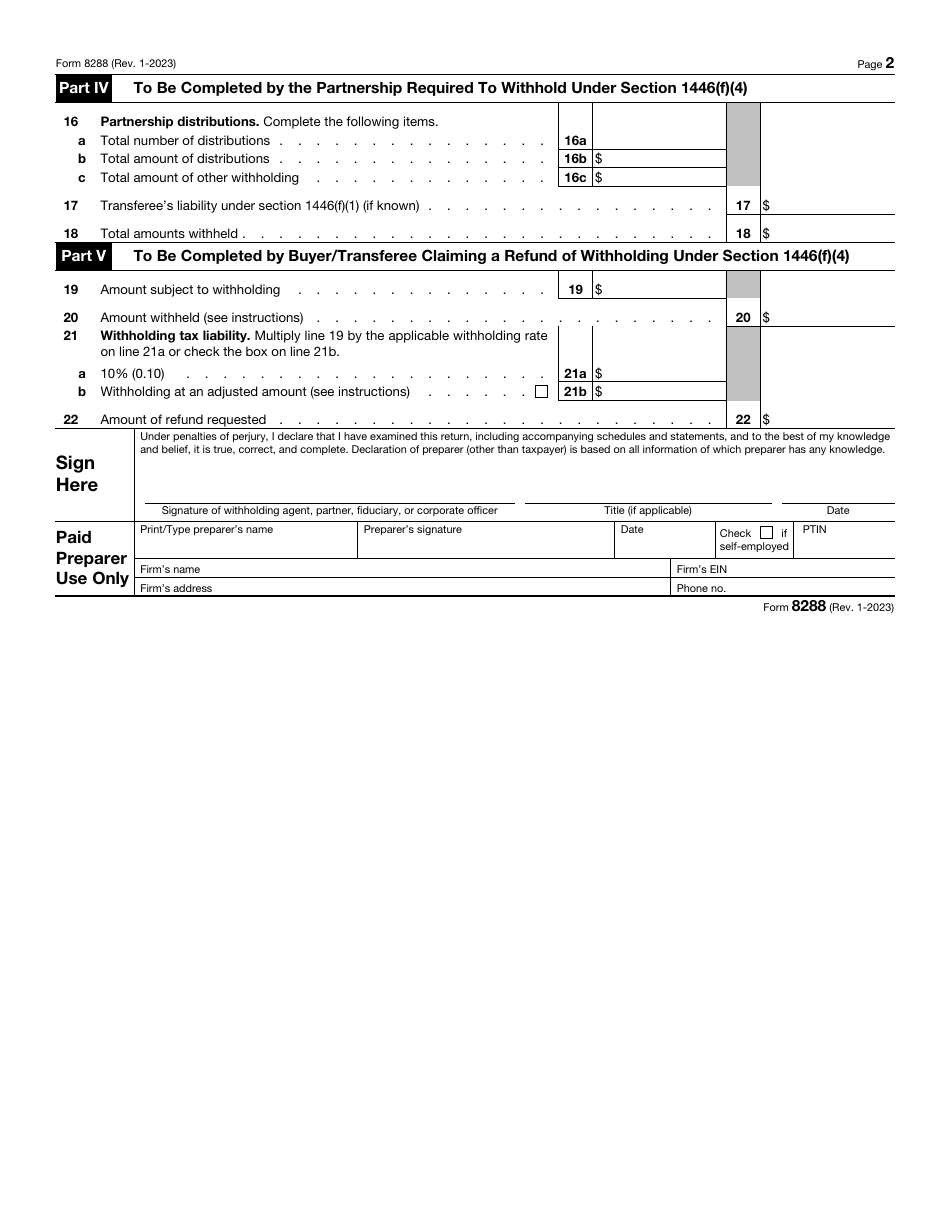

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8288 through the link below or browse more documents in our library of IRS Forms.