This version of the form is not currently in use and is provided for reference only. Download this version of

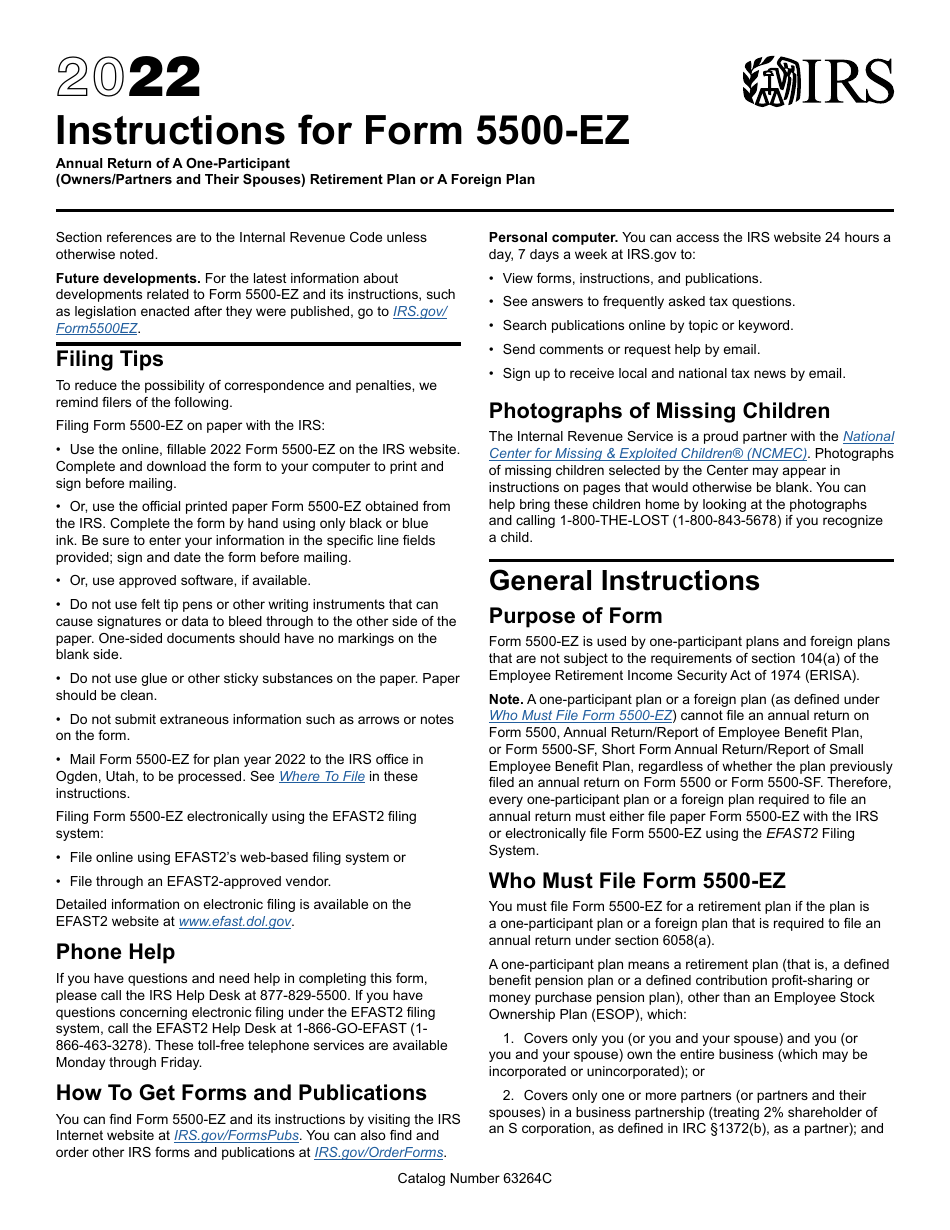

Instructions for IRS Form 5500-EZ

for the current year.

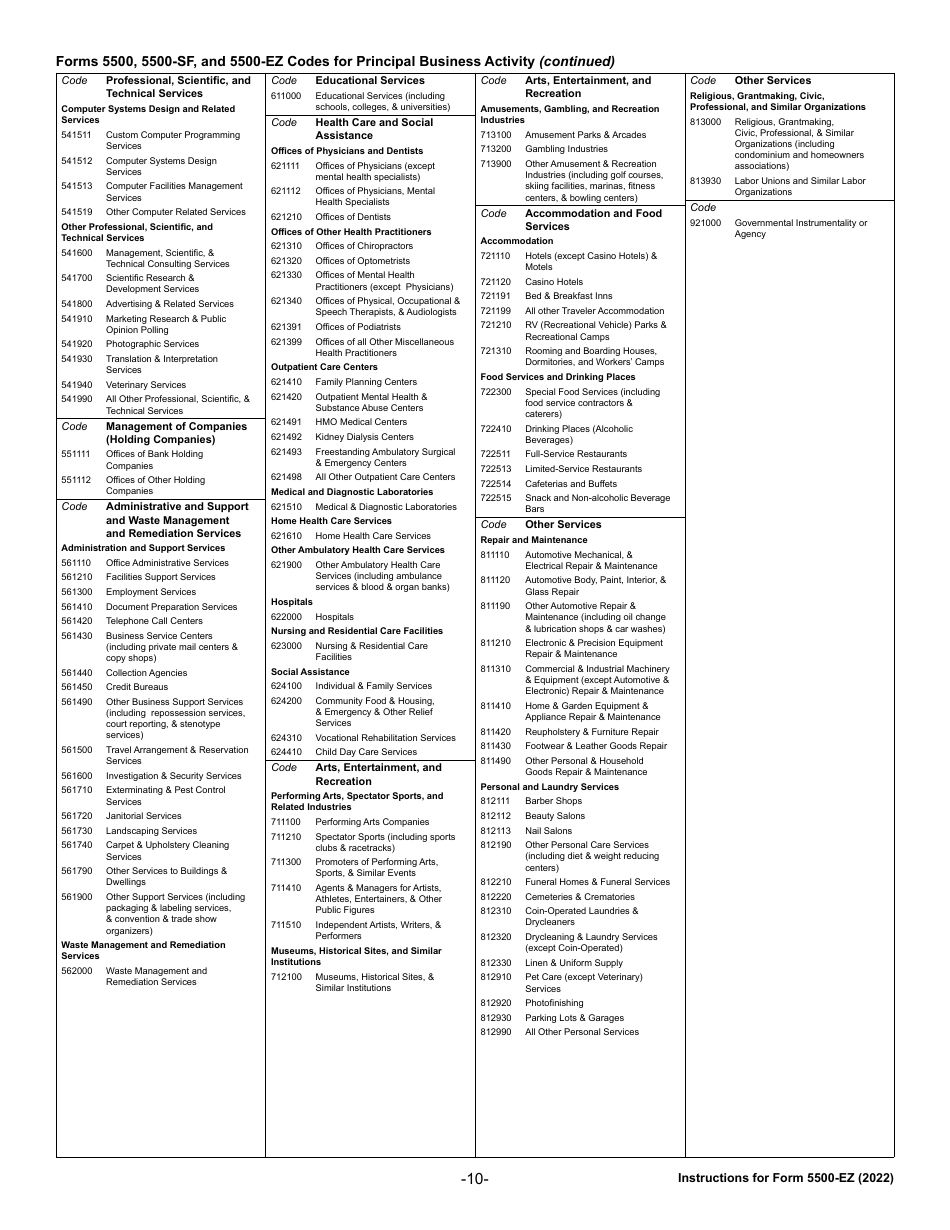

Instructions for IRS Form 5500-EZ Annual Return of a One Participant (Owners / Partners and Their Spouses) Retirement Plan or a Foreign Plan

This document contains official instructions for IRS Form 5500-EZ , Annual Return of a One Participant (Owners/Partners and Their Spouses) Retirement Plan or a Foreign Plan - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 5500-EZ is available for download through this link.

FAQ

Q: 1. Who needs to file IRS Form 5500-EZ?

A: Employers or plan administrators of one-participant retirement plans or foreign plans.

Q: 2. What is IRS Form 5500-EZ used for?

A: It is used to report information about the plan's financial condition, investments, annual contributions, and other details.

Q: 3. What are one-participant retirement plans?

A: These are retirement plans that cover only the owner(s), partner(s), or their spouses.

Q: 4. What is a foreign plan?

A: It is a retirement plan established or maintained outside the United States.

Q: 5. When is the deadline for filing Form 5500-EZ?

A: The deadline is the last day of the seventh month after the plan year ends, usually July 31st for calendar year plans.

Q: 6. Are there any penalties for late or incorrect filings?

A: Yes, penalties may apply for late or incorrect filings. It's important to submit the form on time and ensure accuracy.

Q: 7. Can Form 5500-EZ be filed electronically?

A: Yes, the form can be filed electronically using the Department of Labor's EFAST2 system.

Instruction Details:

- This 10-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.