This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 4797

for the current year.

Instructions for IRS Form 4797 Sales of Business Property

This document contains official instructions for IRS Form 4797 , Sales of Business Property - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 4797 is available for download through this link.

FAQ

Q: What is IRS Form 4797?

A: IRS Form 4797 is used to report the sales of business property.

Q: When do I need to file Form 4797?

A: You need to file Form 4797 if you have sold business property during the year.

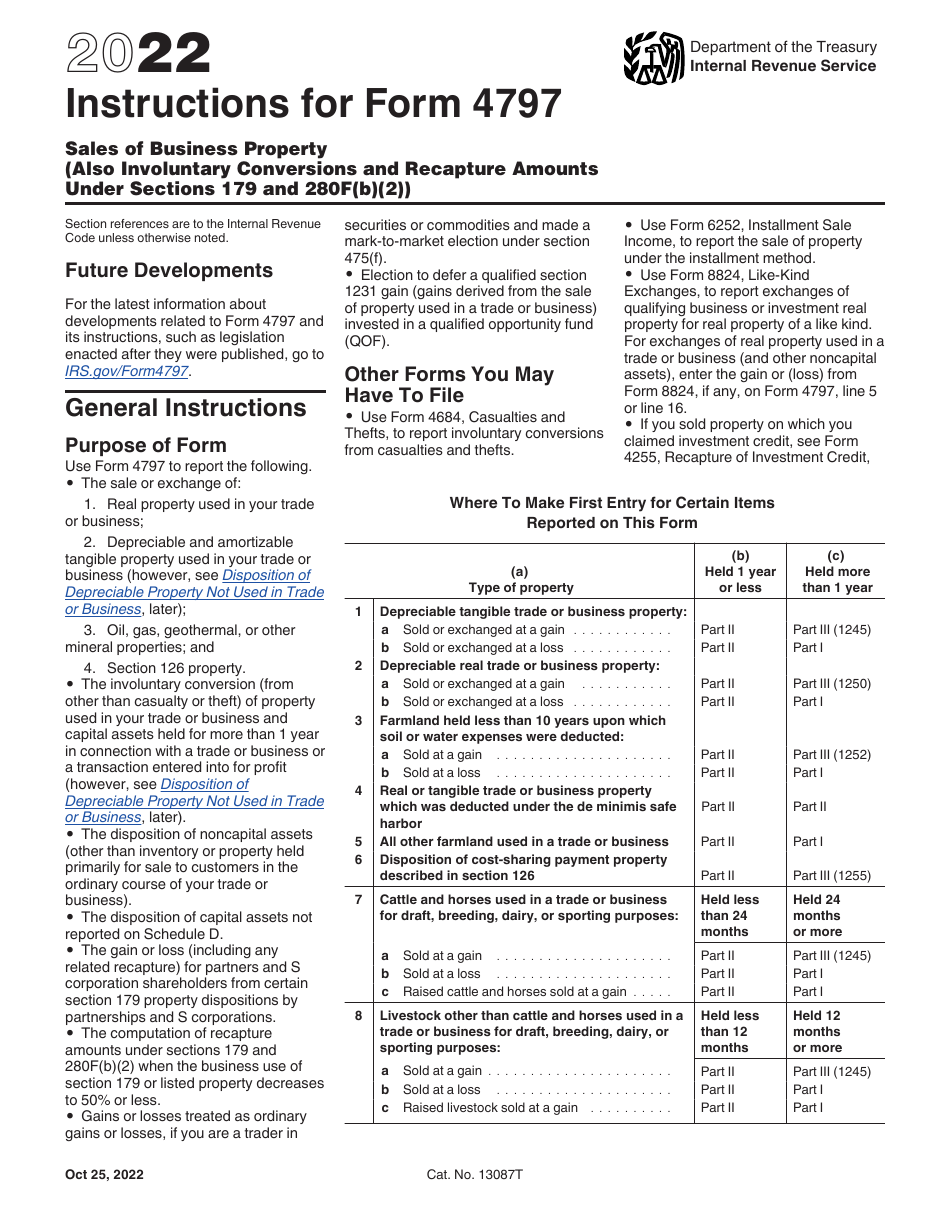

Q: What types of property are reported on Form 4797?

A: Form 4797 is used to report the sale of assets such as buildings, land, and equipment used for business purposes.

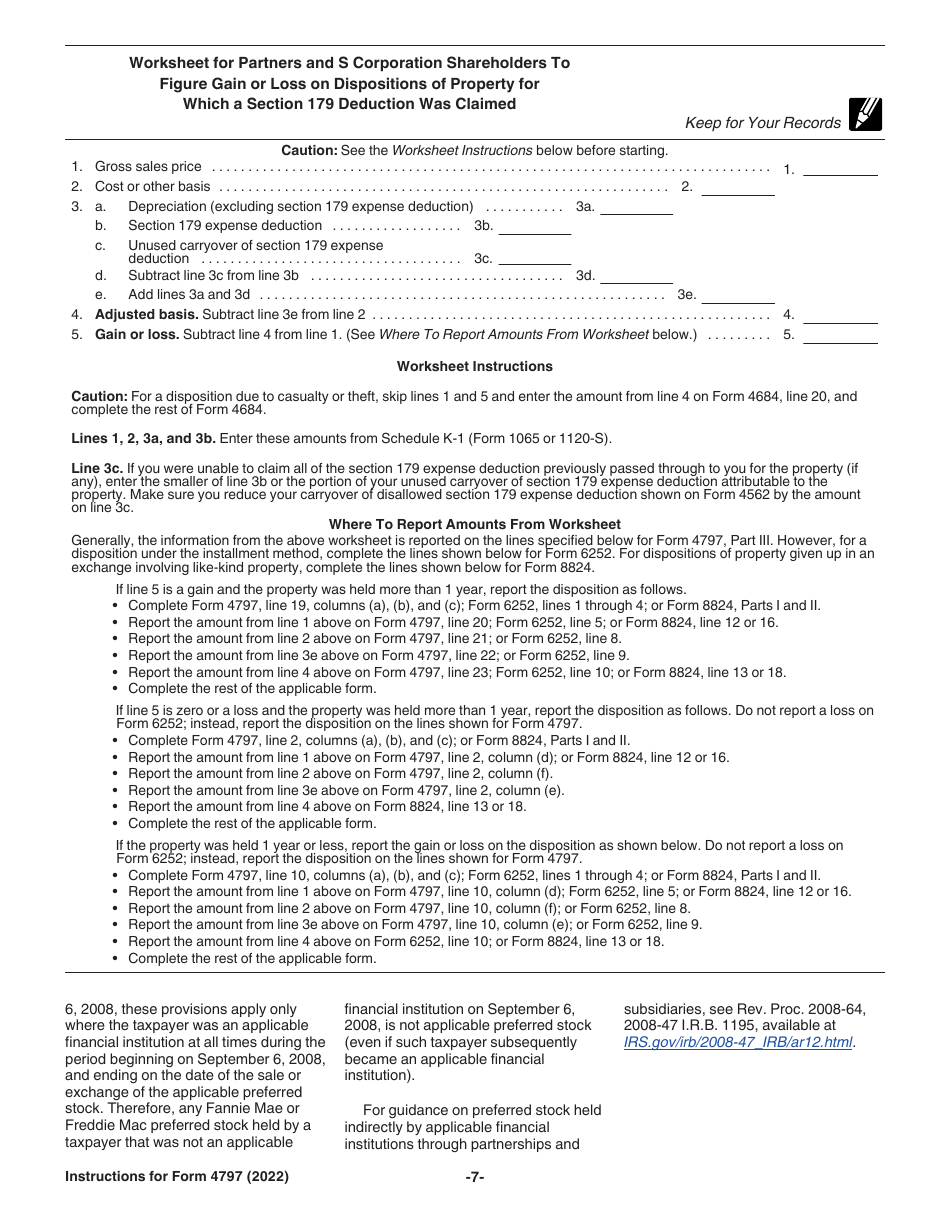

Q: What information do I need to provide on Form 4797?

A: You will need to provide details about the property being sold, the purchase price, the sales price, and the dates of acquisition and sale.

Q: How do I calculate the gain or loss on the sale of business property?

A: The gain or loss is calculated by subtracting the purchase price from the sales price.

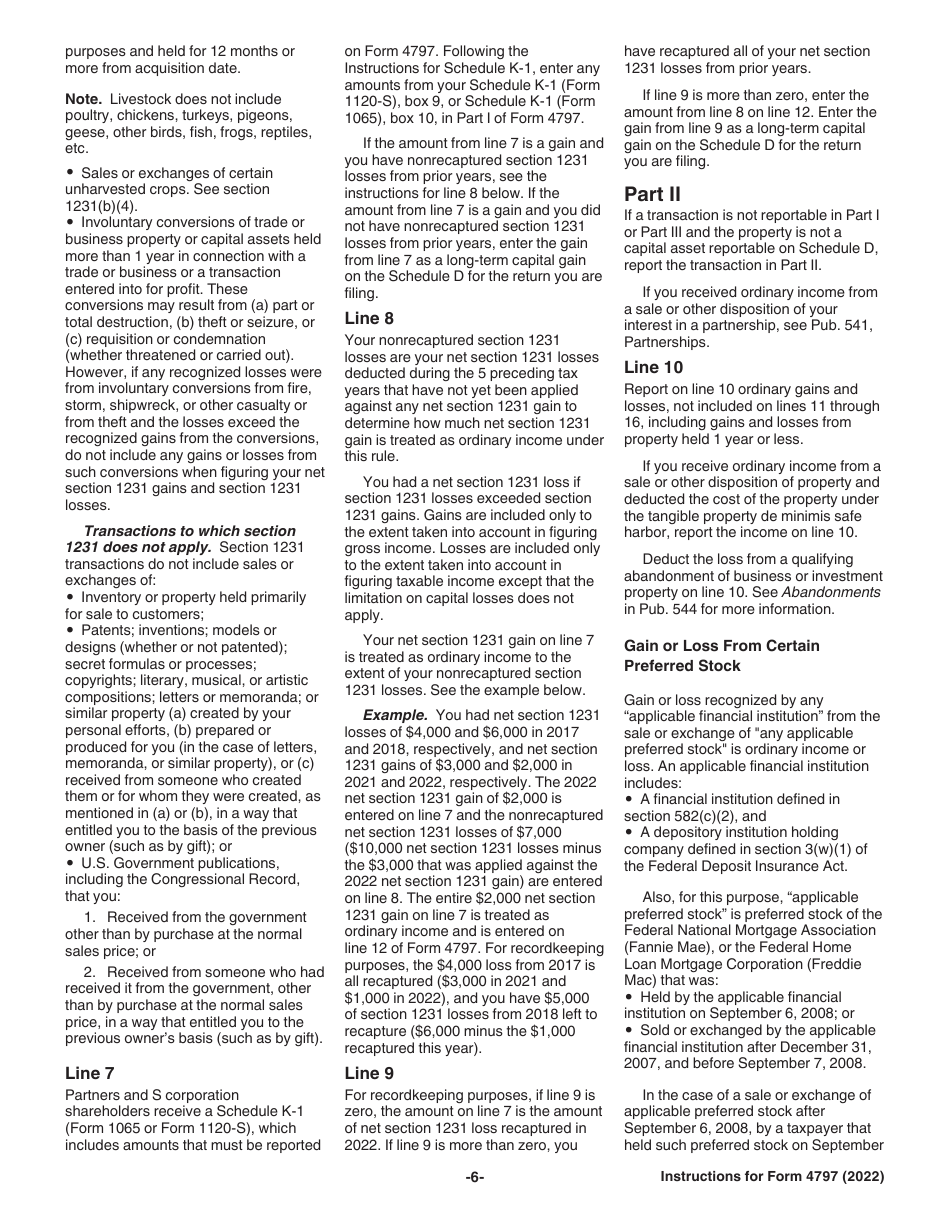

Q: Are there any special rules for reporting Section 1231 gains and losses?

A: Yes, if you have both gains and losses from the sale of Section 1231 property, there are specific rules for reporting and netting the amounts.

Instruction Details:

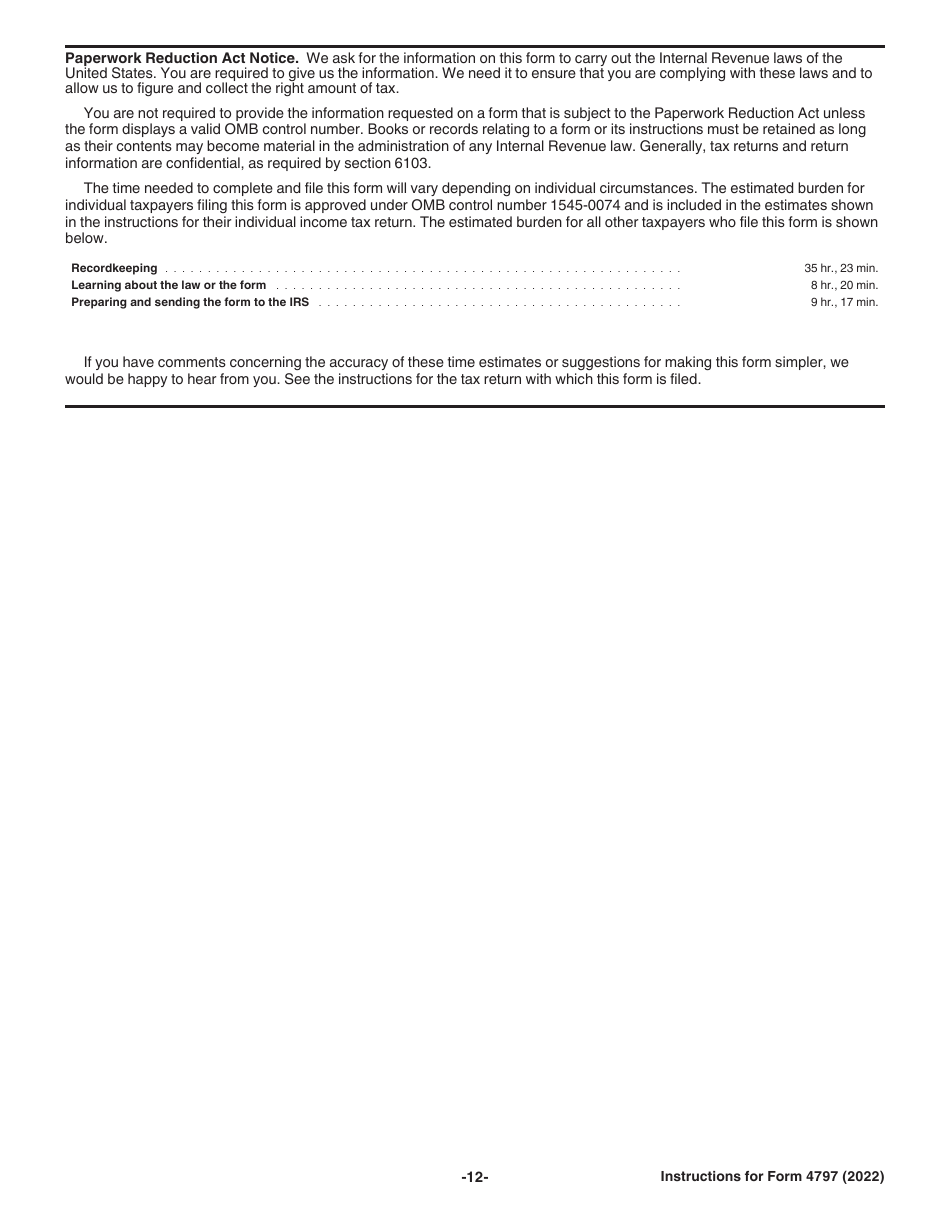

- This 12-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.