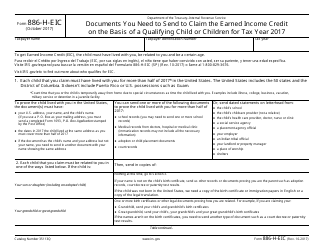

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2441

for the current year.

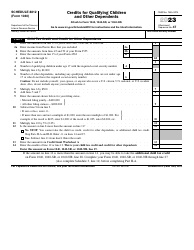

Instructions for IRS Form 2441 Child and Dependent Care Expenses

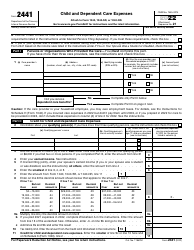

This document contains official instructions for IRS Form 2441 , Child and Dependent Care Expenses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2441 is available for download through this link.

FAQ

Q: What is IRS Form 2441?

A: IRS Form 2441 is a tax form used to claim the child and dependent care expenses deduction.

Q: Who can use Form 2441?

A: Parents who paid for child or dependent care so they could work can use Form 2441.

Q: What expenses can be claimed on Form 2441?

A: Expenses for the care of qualifying children under the age of 13 and certain expenses for disabled dependents.

Q: What information is needed to complete Form 2441?

A: You will need the name, address, and taxpayer identification number of the care provider, as well as the total amount paid for care.

Q: What is the purpose of Form 2441?

A: The purpose of Form 2441 is to calculate the amount of the child and dependent care expenses deduction you can claim on your taxes.

Q: Are there any income limitations to claim the deduction?

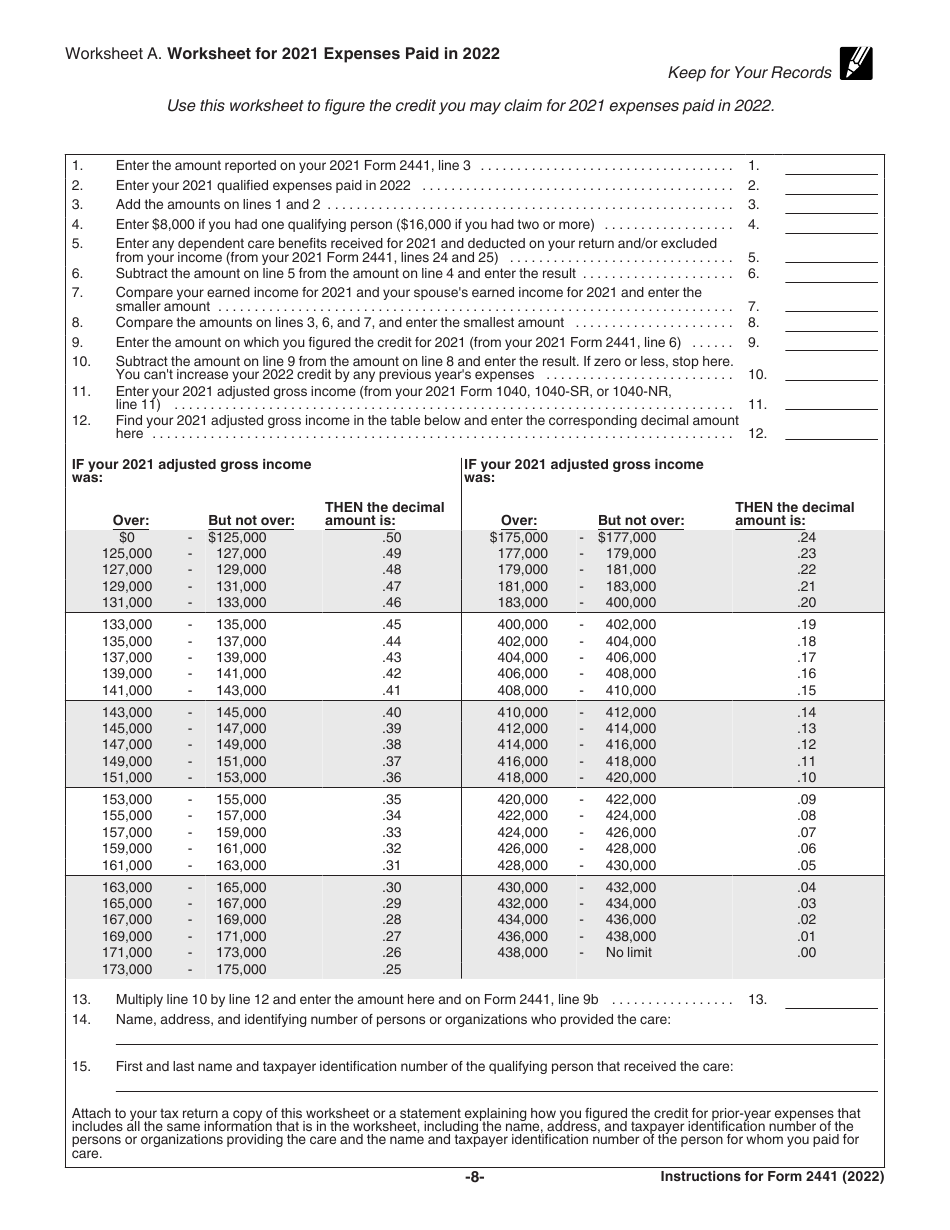

A: Yes, there are income limitations. The amount of the deduction may be reduced if your income exceeds certain thresholds.

Q: When is the deadline to file Form 2441?

A: Form 2441 is typically filed along with your annual tax return, which has a deadline of April 15th (or the following business day if April 15th falls on a weekend or holiday).

Q: Can I claim expenses for care provided by a family member?

A: In most cases, you cannot claim expenses for care provided by a family member who is under the age of 19 or whom you can claim as a dependent.

Q: What documentation should I keep to support my claim?

A: You should keep receipts, invoices, or other proof of payment for child or dependent care expenses in case you are audited by the IRS.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.