This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-R, 5498

for the current year.

Instructions for IRS Form 1099-R, 5498

This document contains official instructions for IRS Form 1099-R , and IRS Form 5498 . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-R is available for download through this link. The latest available IRS Form 5498 can be downloaded through this link.

FAQ

Q: What is IRS Form 1099-R?

A: IRS Form 1099-R is a tax form used to report distributions from pensions, annuities, retirement plans, and insurance contracts.

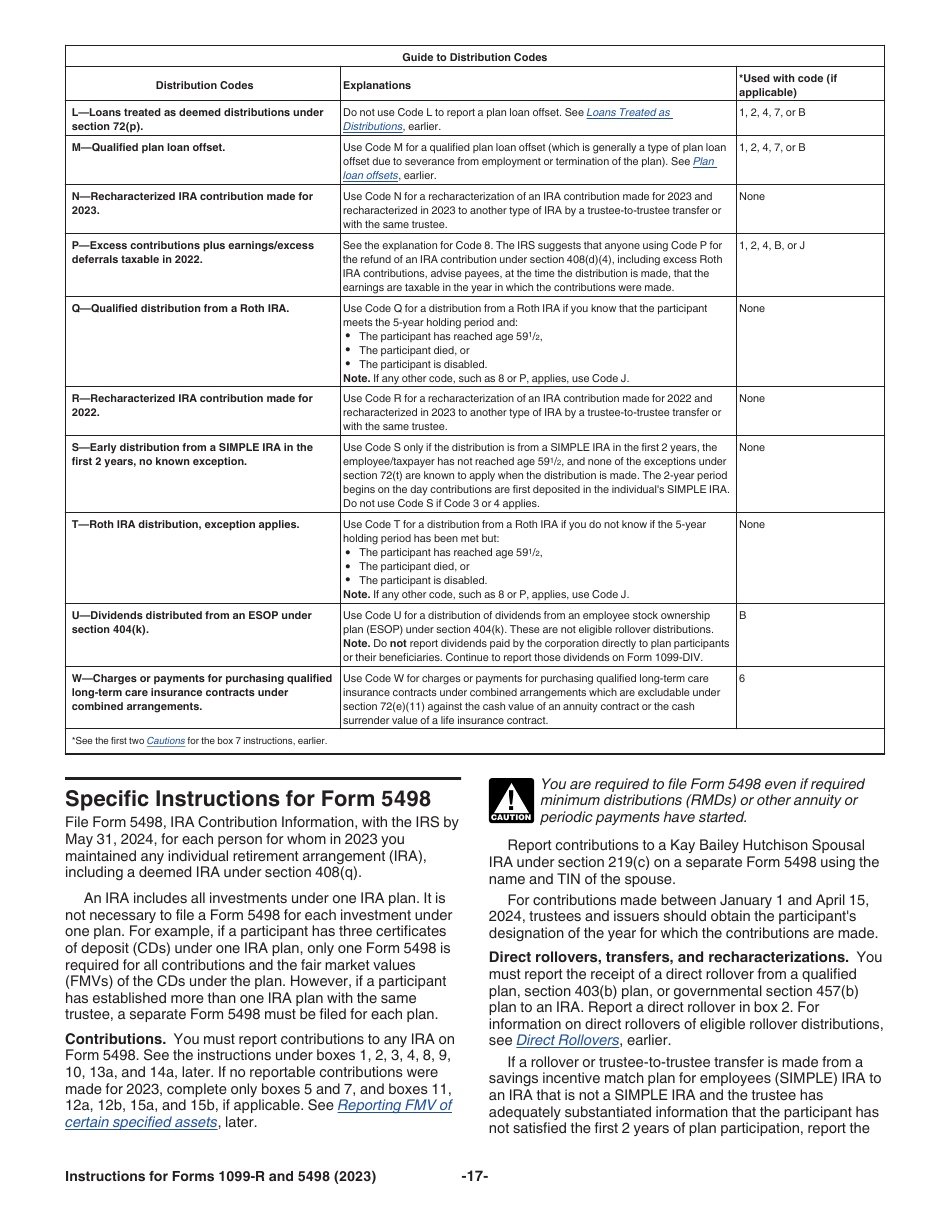

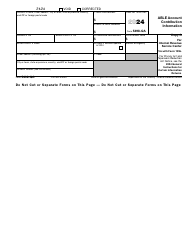

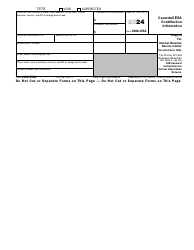

Q: What is IRS Form 5498?

A: IRS Form 5498 is a tax form used to report contributions made to individual retirement accounts (IRAs), including traditional IRAs, Roth IRAs, and SEP IRAs.

Q: Who needs to file IRS Form 1099-R?

A: Financial institutions and other organizations that made distributions of $10 or more from pensions, annuities, retirement plans, or insurance contracts need to file IRS Form 1099-R.

Q: Who needs to file IRS Form 5498?

A: Financial institutions and other organizations that manage individual retirement accounts (IRAs) need to file IRS Form 5498 to report contributions made to IRAs.

Q: When is the deadline to file IRS Form 1099-R?

A: The deadline to file IRS Form 1099-R is January 31st of the year following the calendar year in which the distributions were made.

Q: When is the deadline to file IRS Form 5498?

A: The deadline to file IRS Form 5498 is May 31st of the year following the calendar year in which the contributions were made.

Q: Can I file IRS Forms 1099-R and 5498 electronically?

A: Yes, you can file IRS Forms 1099-R and 5498 electronically through the IRS FIRE (Filing Information Returns Electronically) system.

Q: What information is needed to complete IRS Form 1099-R?

A: To complete IRS Form 1099-R, you will need the recipient's name, address, taxpayer identification number (TIN), distribution amount, and distribution code.

Q: What information is needed to complete IRS Form 5498?

A: To complete IRS Form 5498, you will need the account holder's name, address, taxpayer identification number (TIN), contribution amount, and contribution type.

Q: What should I do if there is an error on my IRS Form 1099-R or 5498?

A: If there is an error on your IRS Form 1099-R or 5498, you should contact the issuer of the form to request a corrected version.

Q: Do I need to include copies of IRS Forms 1099-R and 5498 with my tax return?

A: No, you do not need to include copies of IRS Forms 1099-R and 5498 with your tax return. However, you should keep them for your records.

Q: Is there a penalty for failing to file IRS Forms 1099-R and 5498?

A: Yes, there can be penalties for failing to file IRS Forms 1099-R and 5498. The amount of the penalty depends on how late the forms are filed and other factors.

Q: Can I request an extension to file IRS Forms 1099-R and 5498?

A: Yes, you can request an extension to file IRS Forms 1099-R and 5498 by filing Form 8809, Application for Extension of Time to File Information Returns.

Instruction Details:

- This 23-page document is available for download in PDF;

- These instructions will be used to file next year's taxes. Choose a previous version to file for the current tax year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.