This version of the form is not currently in use and is provided for reference only. Download this version of

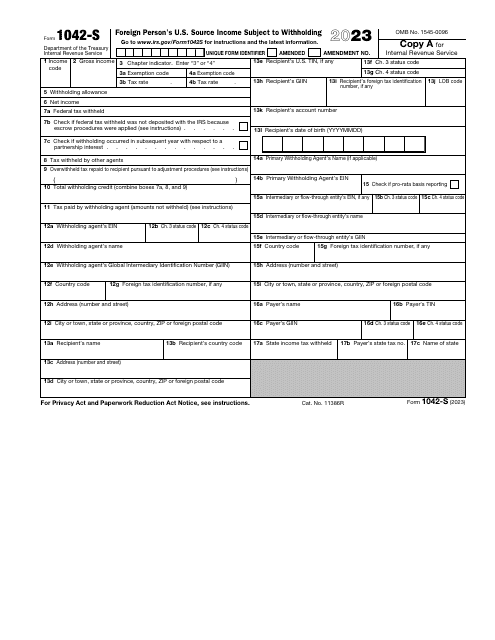

IRS Form 1042-S

for the current year.

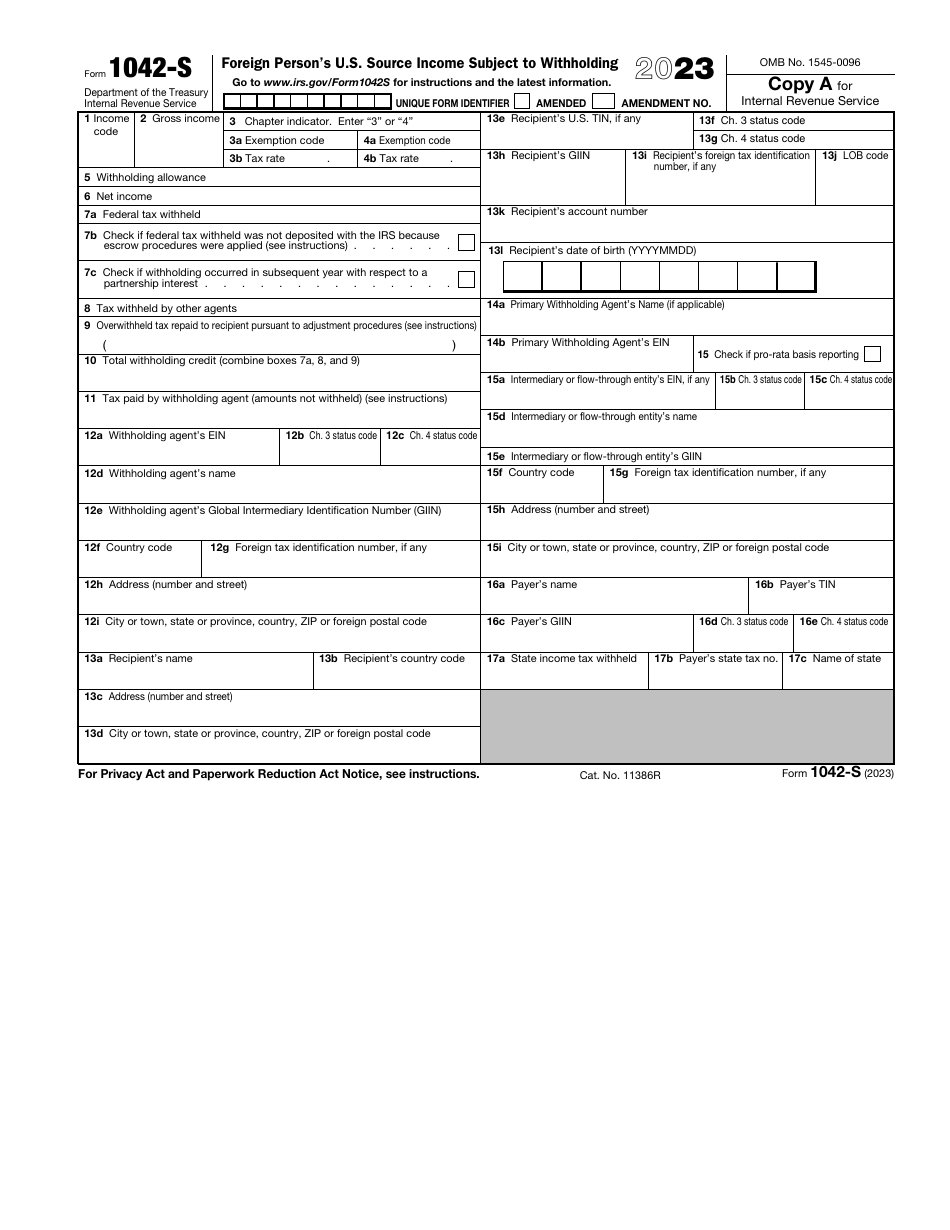

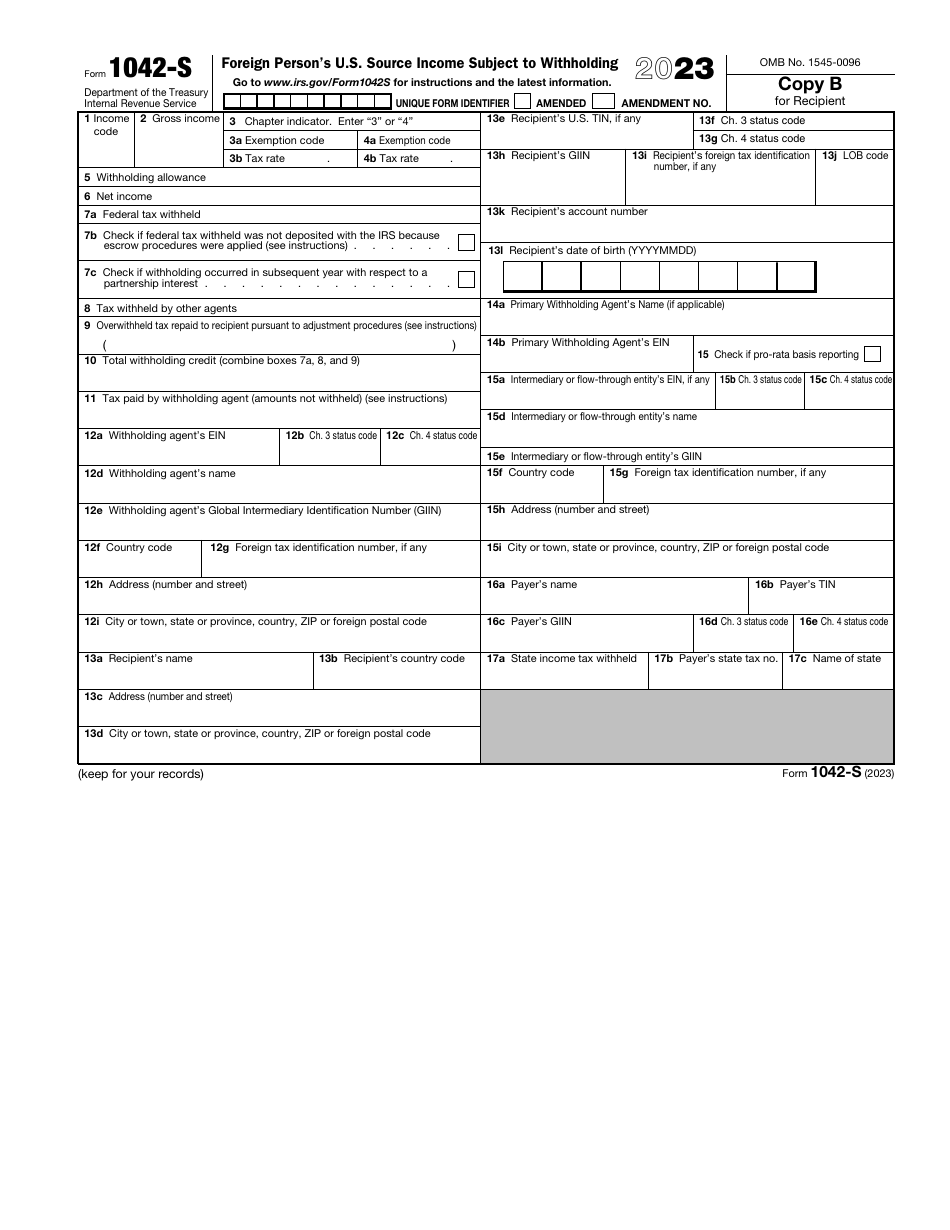

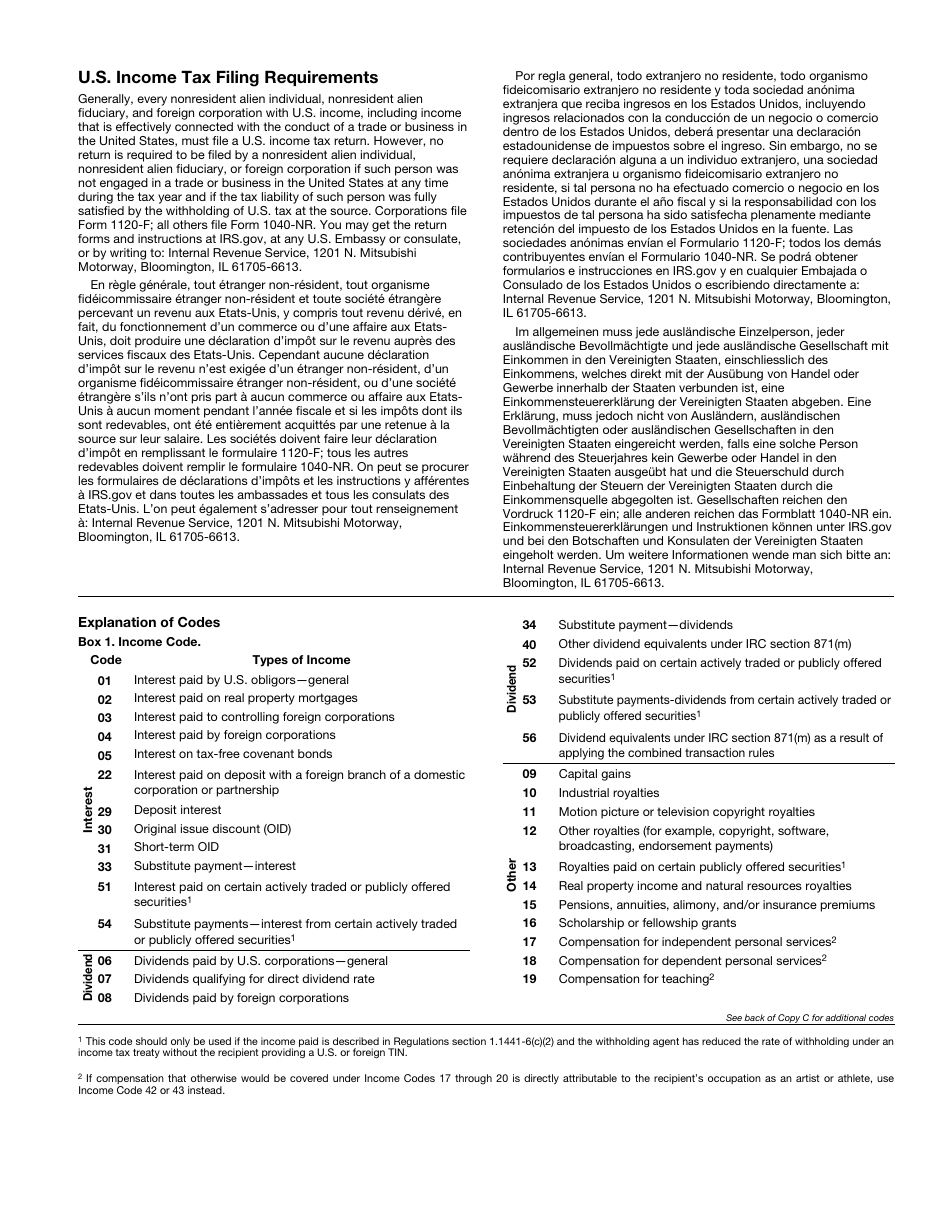

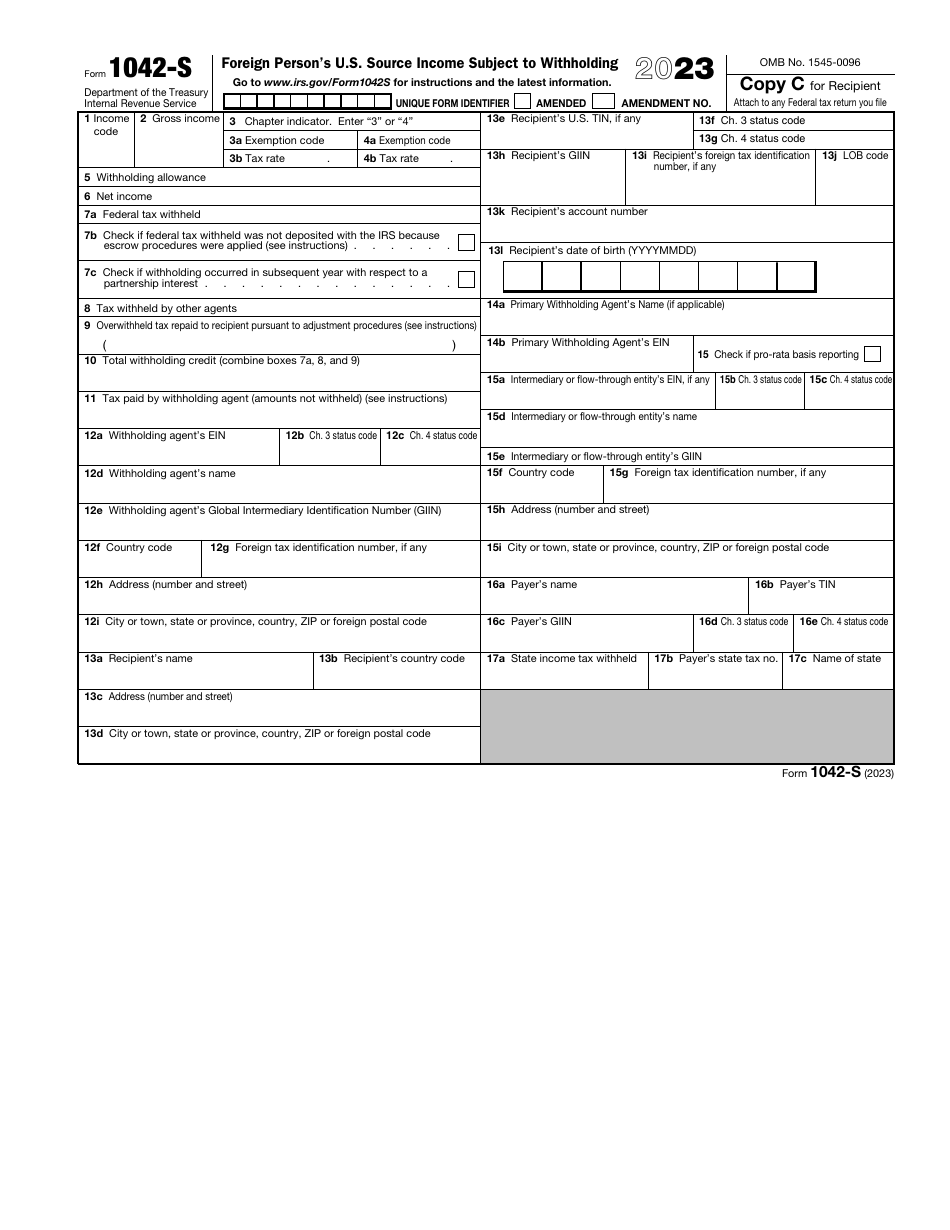

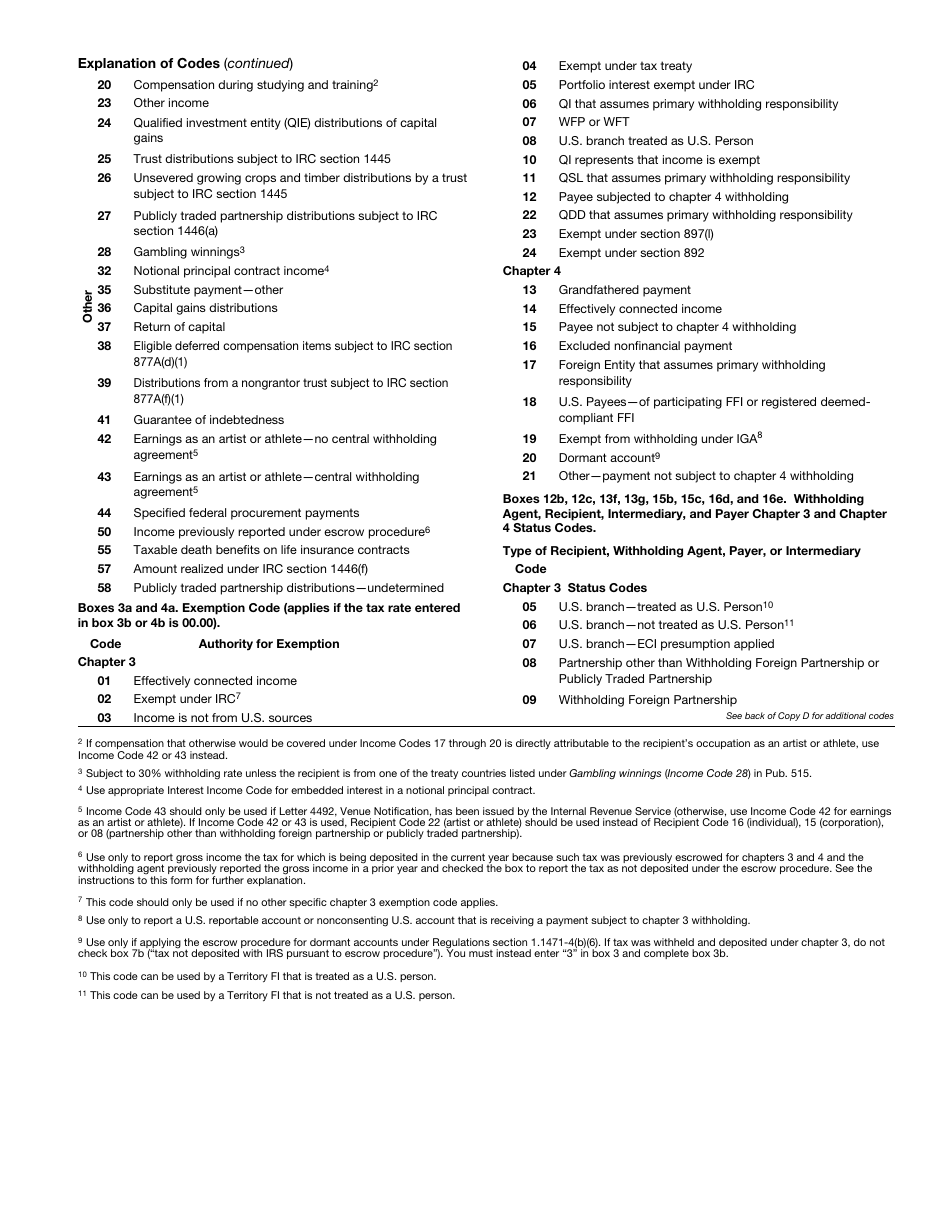

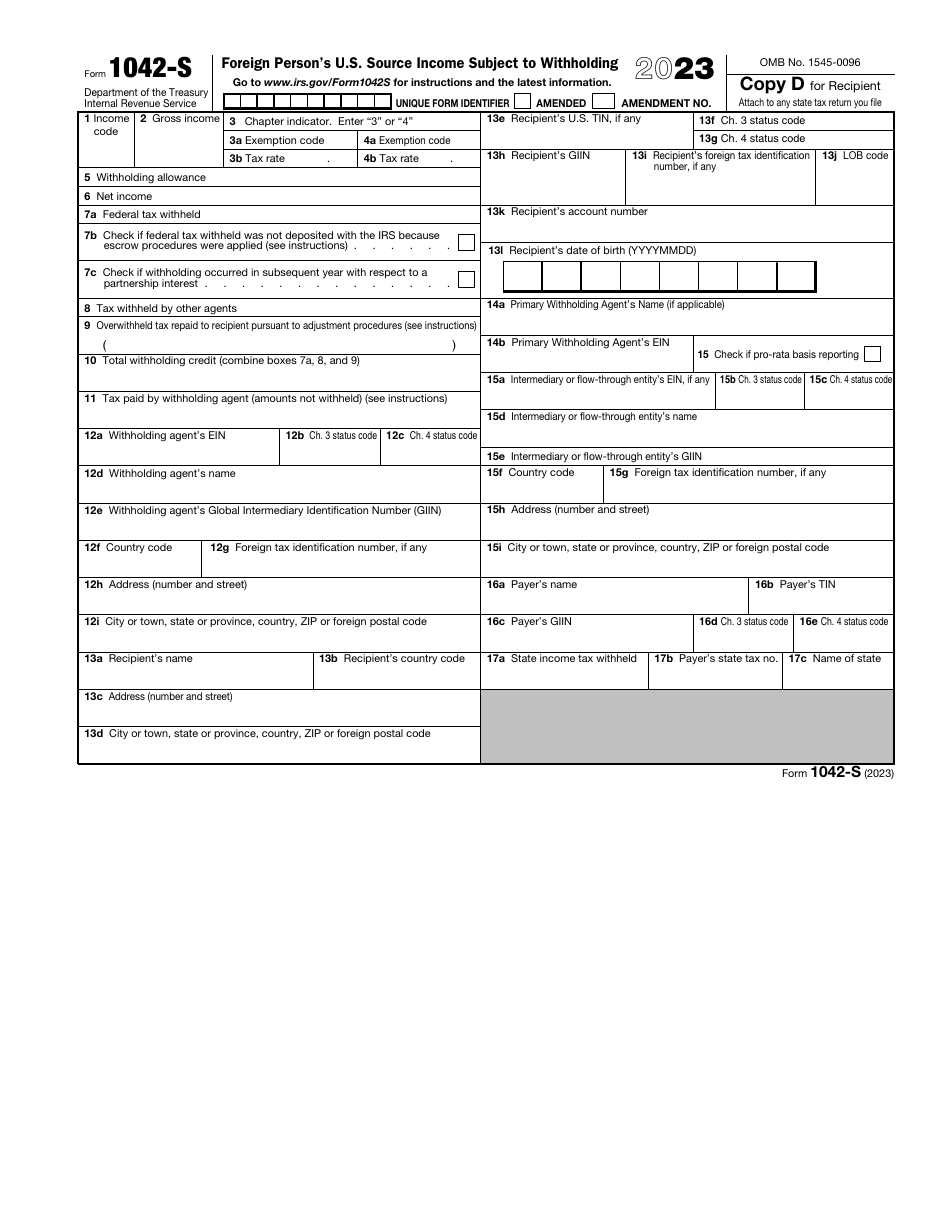

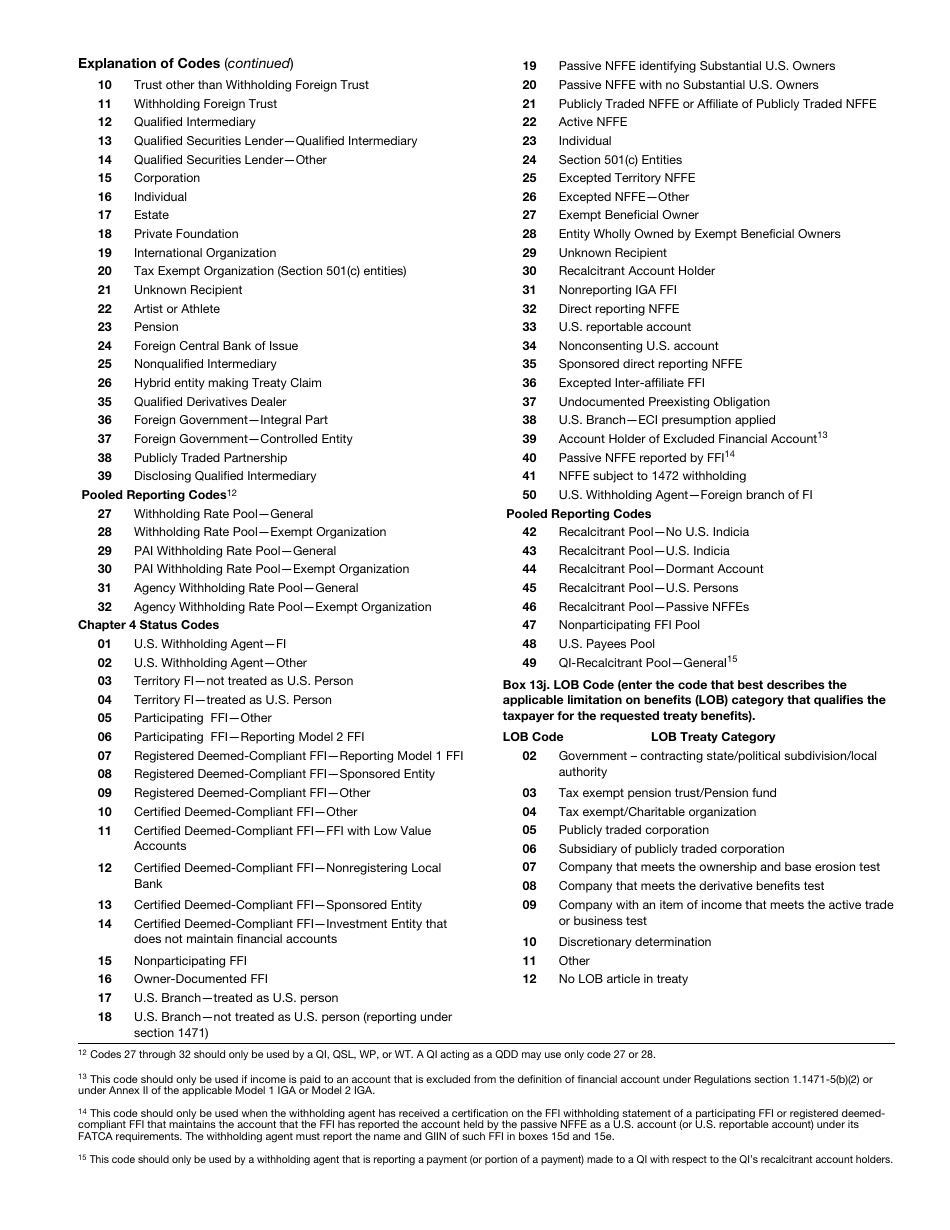

IRS Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding

What Is IRS Form 1042-S?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1042-S?

A: IRS Form 1042-S is a form used to report income paid to non-U.S. residents, including both individuals and foreign entities, that is subject to withholding.

Q: Who needs to file IRS Form 1042-S?

A: U.S. withholding agents, such as businesses and organizations, are required to file IRS Form 1042-S when they have made payments of U.S. source income to foreign persons that are subject to withholding.

Q: What is considered U.S. source income?

A: U.S. source income generally includes income derived from U.S. sources, such as wages, salaries, dividends, rental income, and royalties.

Q: What is withholding?

A: Withholding is the process of deducting taxes from certain types of income at the time it is paid.

Q: What are the key sections of IRS Form 1042-S?

A: The key sections of IRS Form 1042-S include: recipient information, income codes, tax withheld, treaty benefits, and special rates and conditions.

Q: Is it necessary for foreign persons to file IRS Form 1042-S?

A: No, foreign persons themselves do not file IRS Form 1042-S. It is the responsibility of the U.S. withholding agent to file the form on their behalf.

Q: When is the deadline to file IRS Form 1042-S?

A: The deadline to file IRS Form 1042-S is generally March 15th of the year following the calendar year in which the income was paid.

Q: Are there any exceptions to the deadline for filing IRS Form 1042-S?

A: Yes, there are certain exceptions to the deadline for filing IRS Form 1042-S. For example, if the U.S. withholding agent is filing electronically, the deadline is extended to March 31st.

Q: What are the consequences of not filing IRS Form 1042-S?

A: Failure to file IRS Form 1042-S or filing it late can result in penalties and interest being assessed by the IRS.

Form Details:

- A 8-page form available for download in PDF;

- This form will be used to file next year's taxes. Choose a previous version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1042-S through the link below or browse more documents in our library of IRS Forms.