This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule H

for the current year.

Instructions for IRS Form 990 Schedule H Hospitals

This document contains official instructions for IRS Form 990 Schedule H, Hospitals - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule H is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule H?

A: IRS Form 990 Schedule H is a form used by hospitals to report certain information to the Internal Revenue Service (IRS).

Q: Who is required to file IRS Form 990 Schedule H?

A: Nonprofit hospitals that meet certain criteria are required to file IRS Form 990 Schedule H.

Q: What information is reported on IRS Form 990 Schedule H?

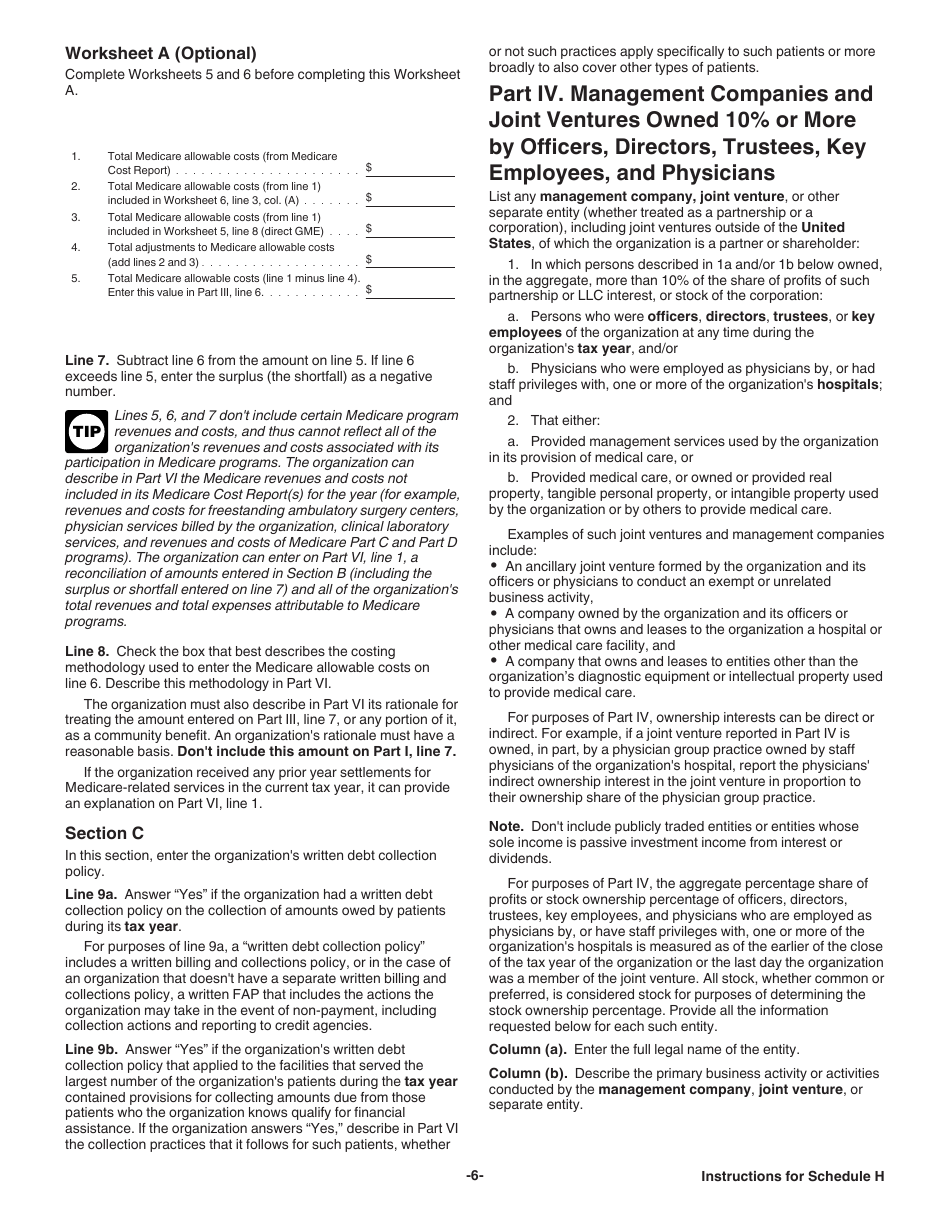

A: IRS Form 990 Schedule H reports information related to a hospital's community benefit activities, financial assistance policies, and other aspects of its operations.

Q: What is the deadline for filing IRS Form 990 Schedule H?

A: The deadline for filing IRS Form 990 Schedule H is typically the same as the deadline for filing Form 990, which is the 15th day of the fifth month after the end of the hospital's tax year.

Instruction Details:

- This 24-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.