This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990-EZ

for the current year.

Instructions for IRS Form 990-EZ Short Form Return of Organization Exempt From Income Tax

This document contains official instructions for IRS Form 990-EZ , Short Form Return of Organization Exempt From Income Tax - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990-EZ is available for download through this link.

FAQ

Q: What is IRS Form 990-EZ?

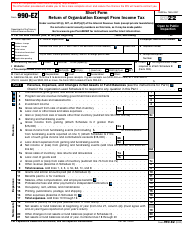

A: IRS Form 990-EZ is a short form return for organizations that are exempt from income tax.

Q: Who is eligible to use Form 990-EZ?

A: Certain organizations that have gross receipts less than $200,000 and total assets less than $500,000 can use Form 990-EZ.

Q: What is the purpose of Form 990-EZ?

A: Form 990-EZ is used to provide information about the organization's activities, governance, and financial status to the IRS.

Q: Do all tax-exempt organizations have to file Form 990-EZ?

A: No, only organizations that meet the eligibility criteria mentioned earlier are required to file Form 990-EZ.

Q: What information is required to complete Form 990-EZ?

A: Some of the information required includes details about the organization's income, expenses, assets, and program services.

Q: When is the deadline to file Form 990-EZ?

A: Form 990-EZ must be filed by the 15th day of the 5th month after the organization's fiscal year ends.

Q: Are there any penalties for late or incorrect filing of Form 990-EZ?

A: Yes, there are penalties for late or incorrect filing, including potential loss of tax-exempt status.

Q: Can I e-file Form 990-EZ?

A: Yes, certain organizations are eligible to electronically file Form 990-EZ.

Q: Do I need to attach any additional documents with Form 990-EZ?

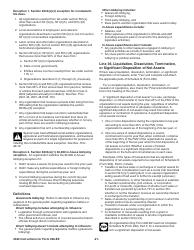

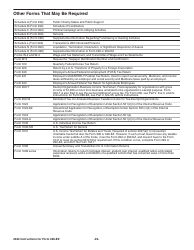

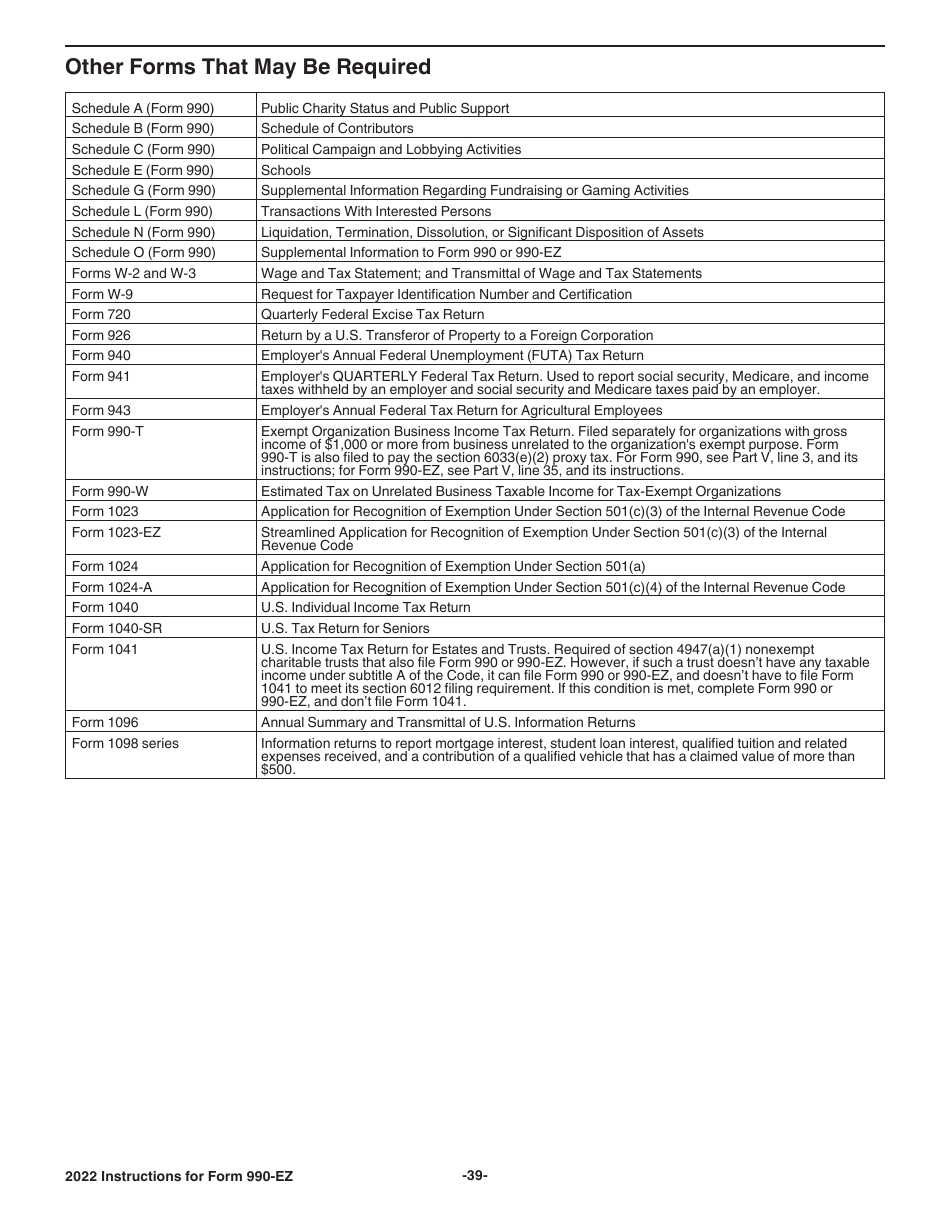

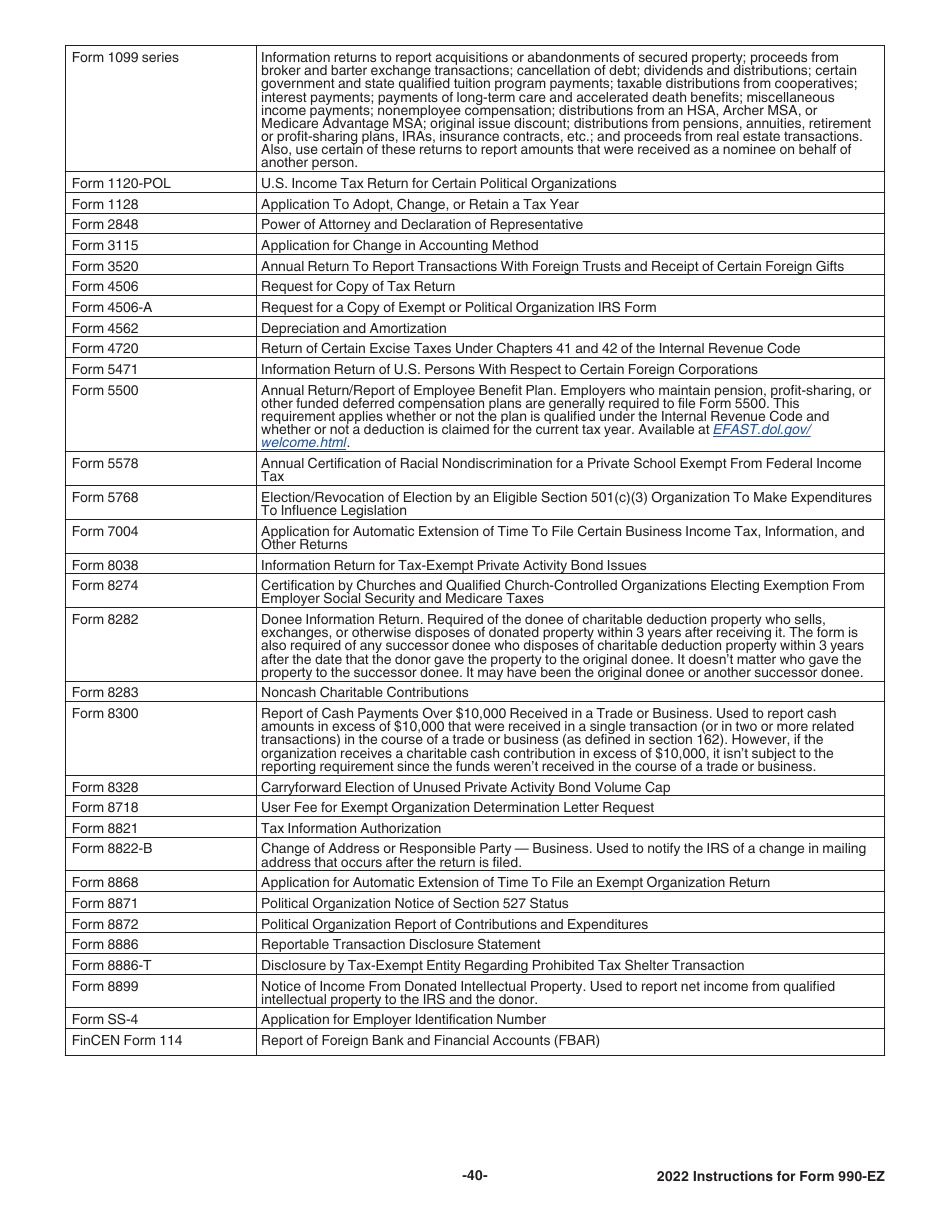

A: Depending on the organization's activities, certain schedules and attachments may be required to be included with Form 990-EZ.

Instruction Details:

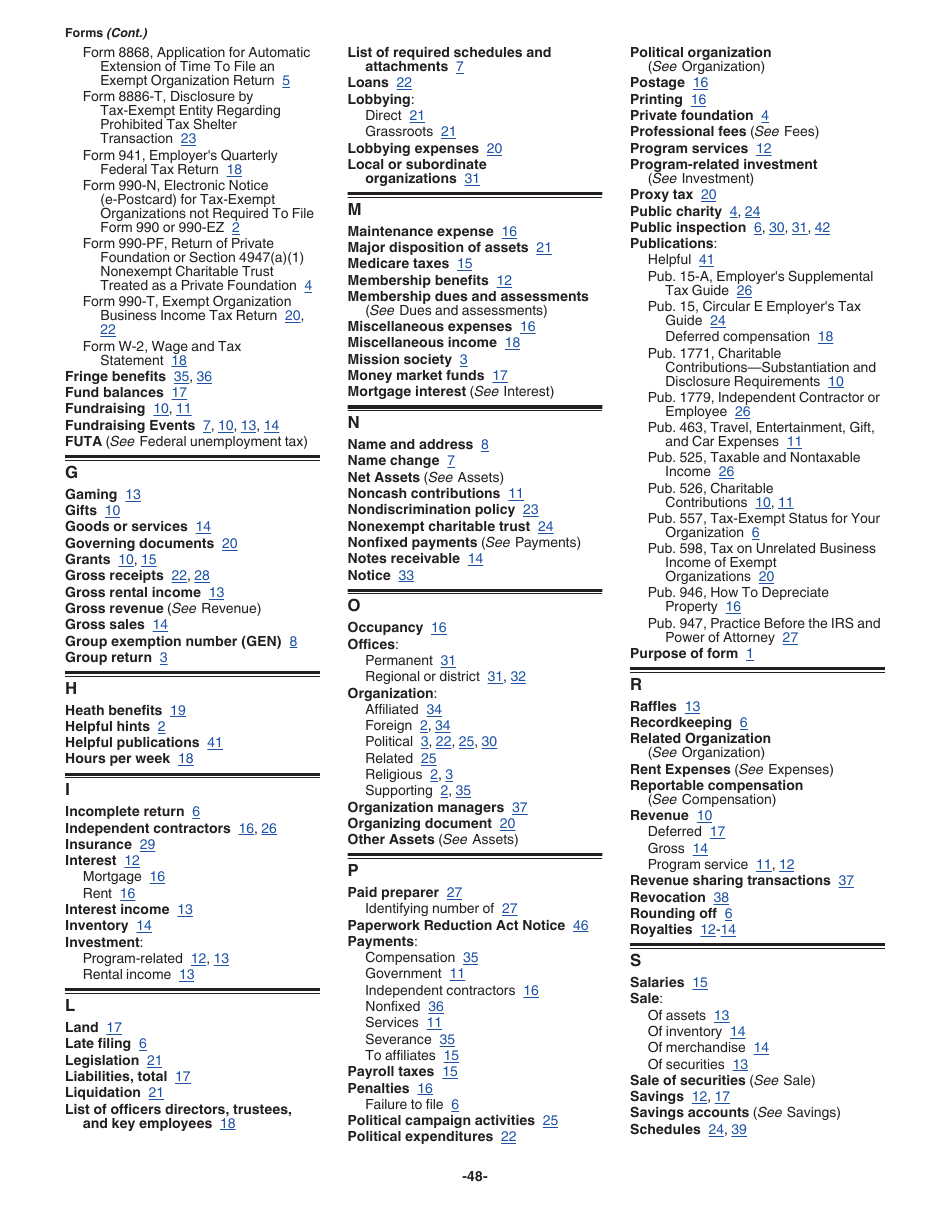

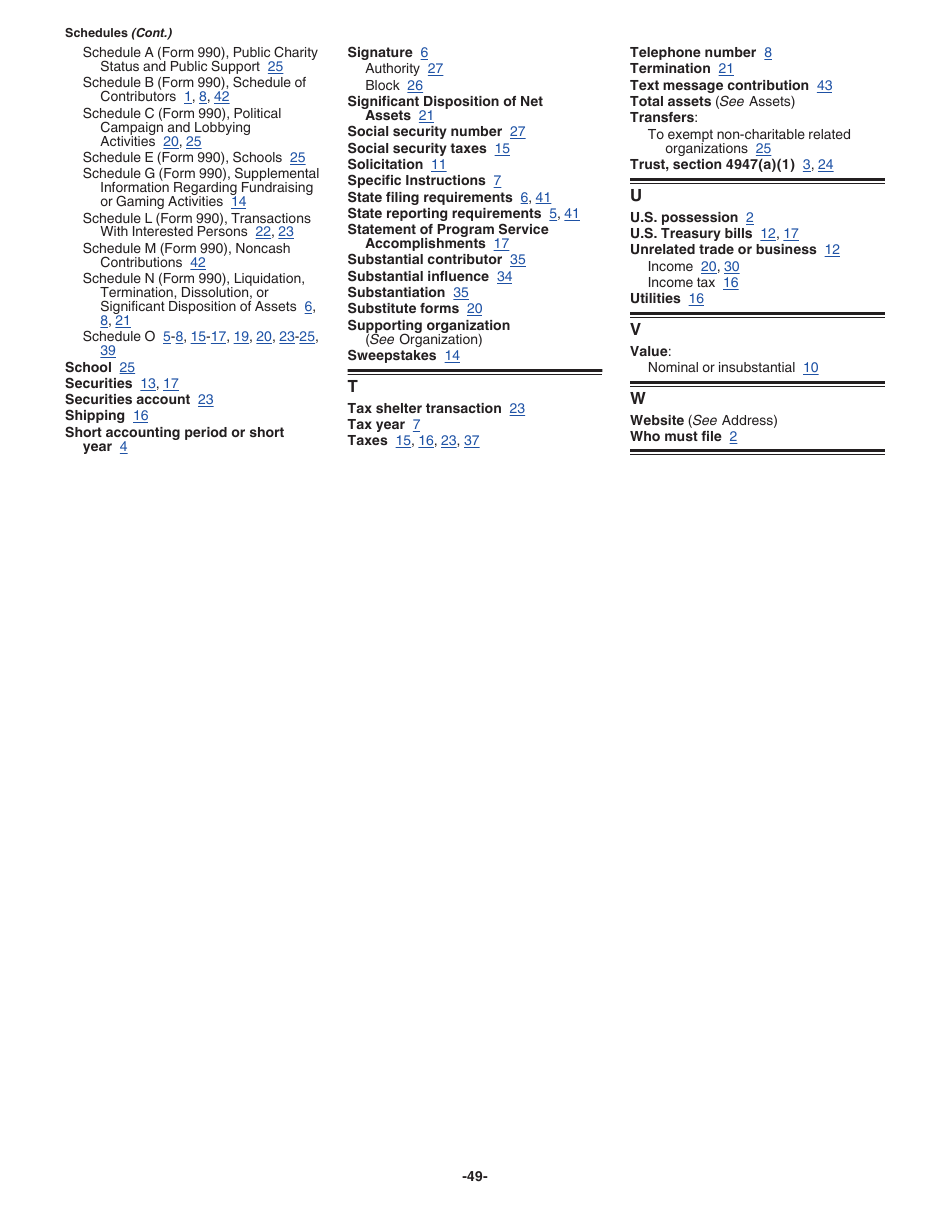

- This 49-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.