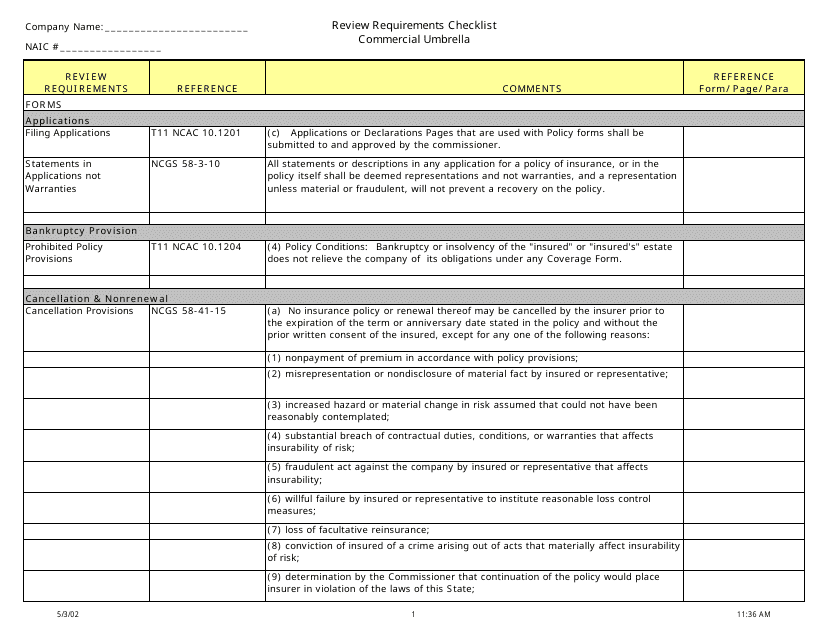

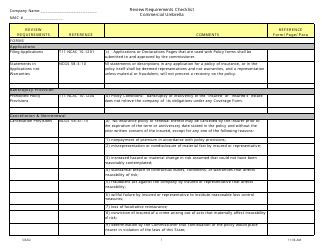

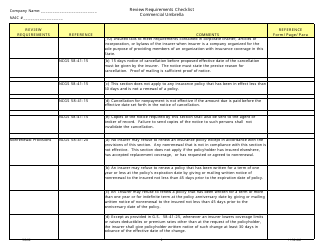

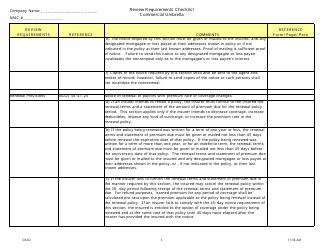

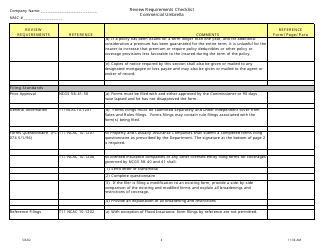

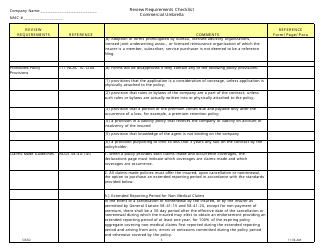

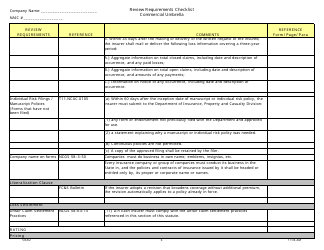

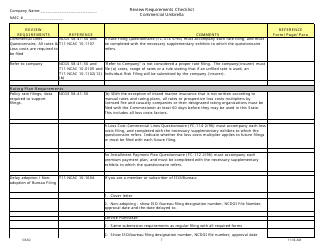

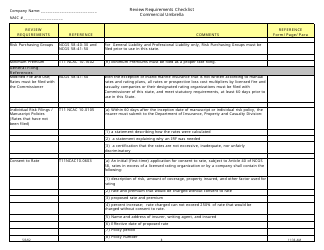

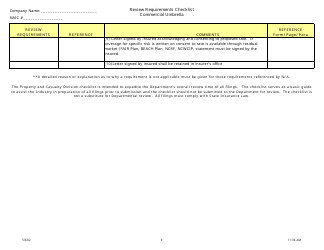

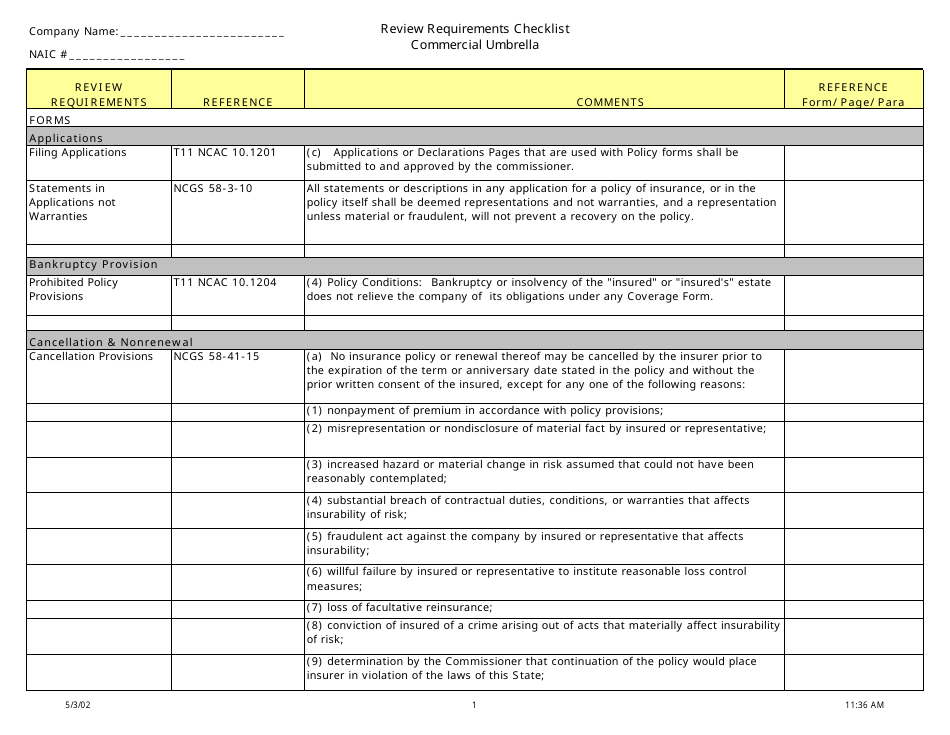

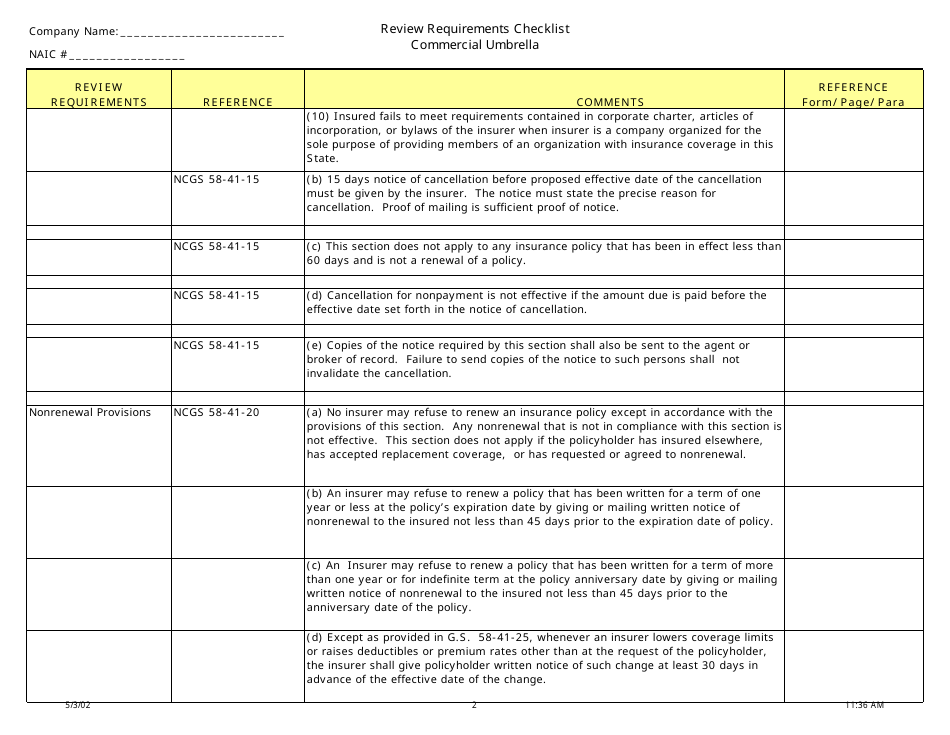

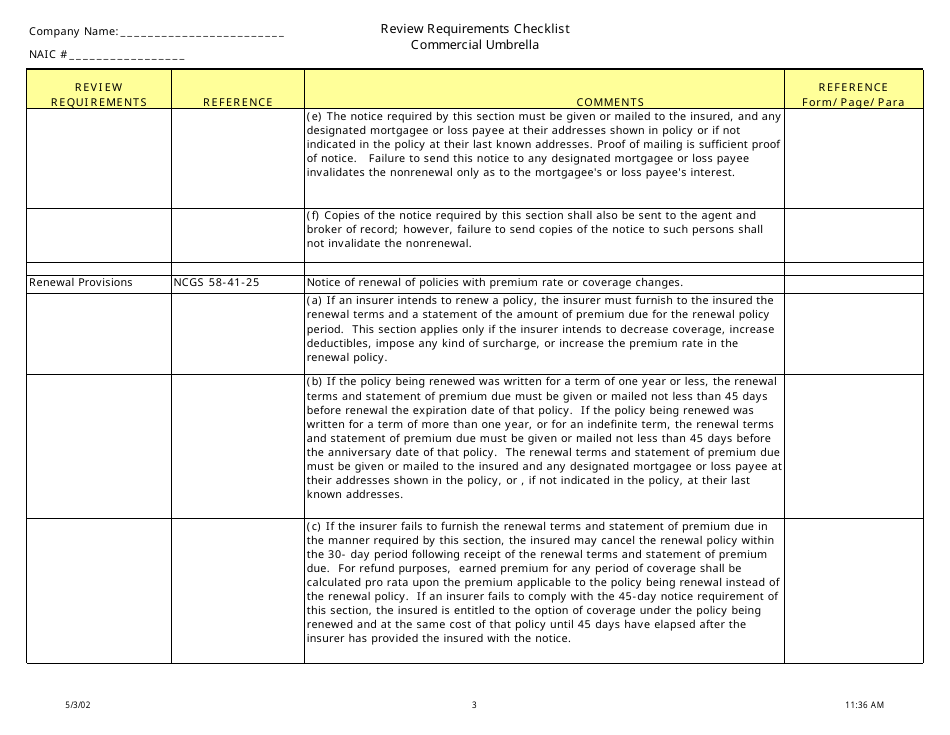

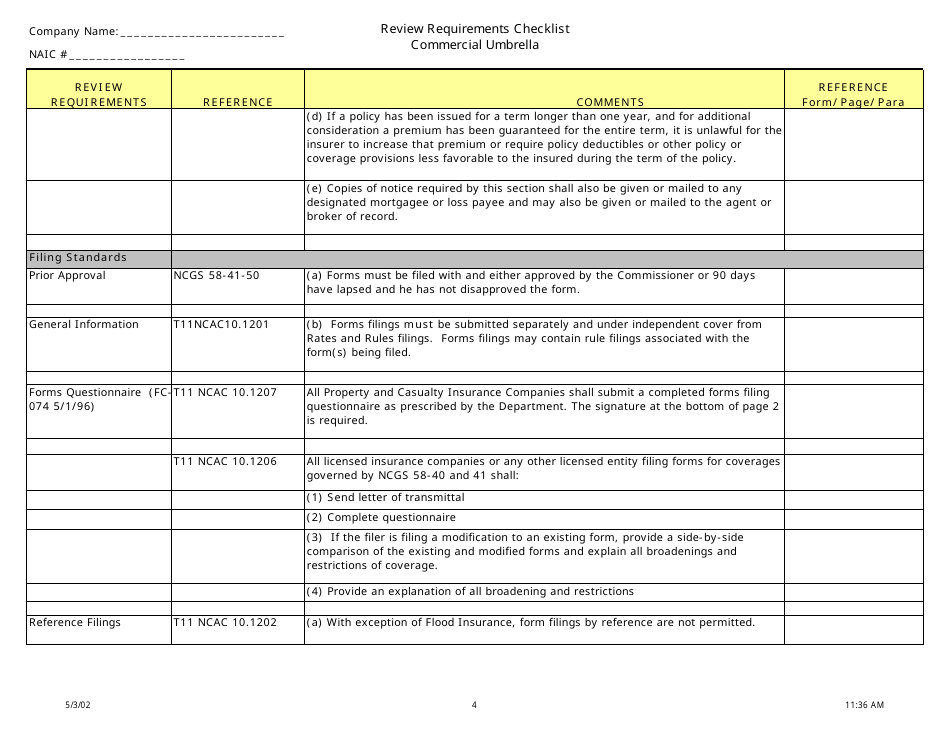

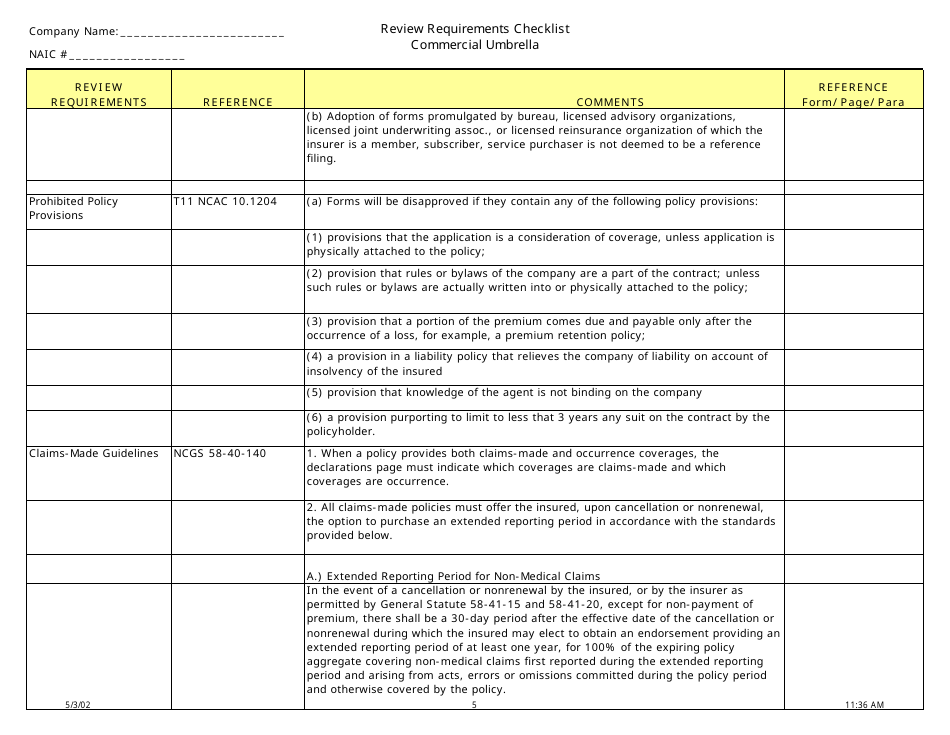

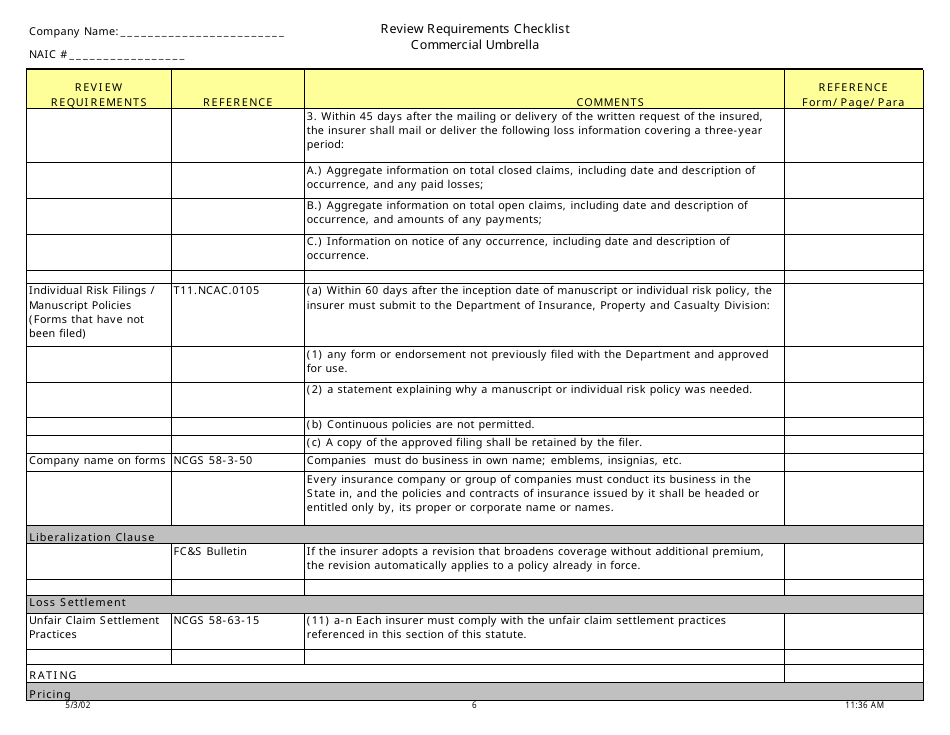

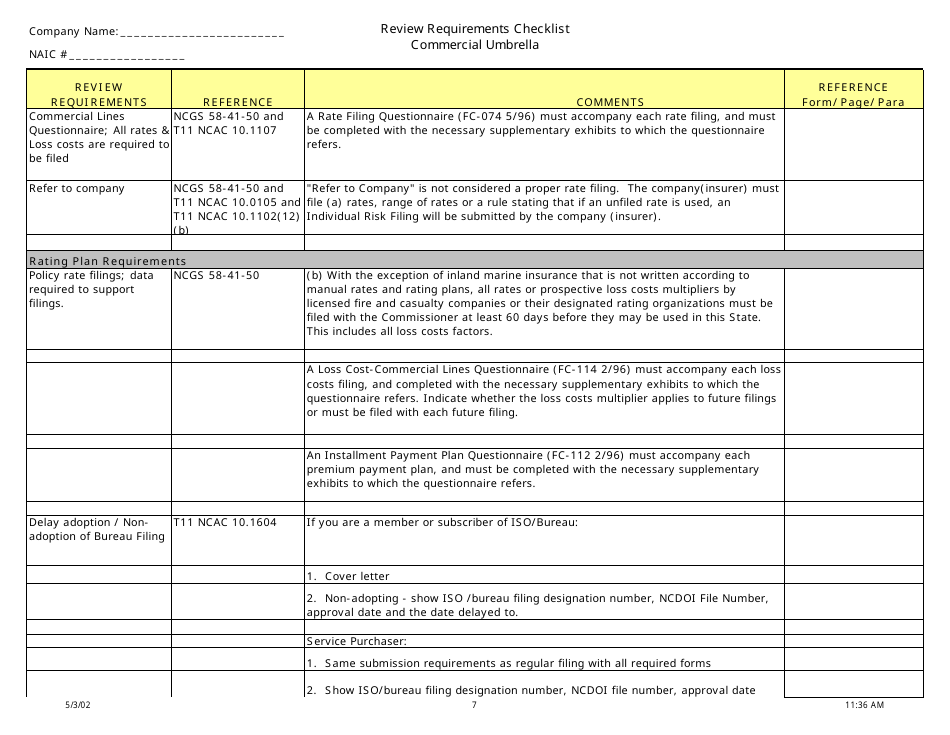

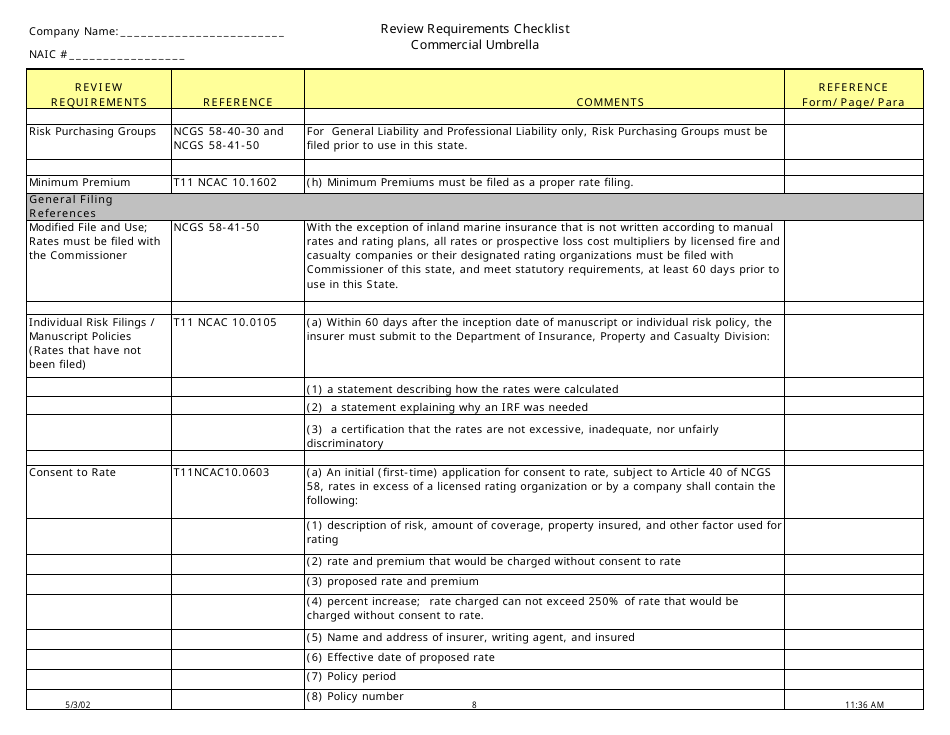

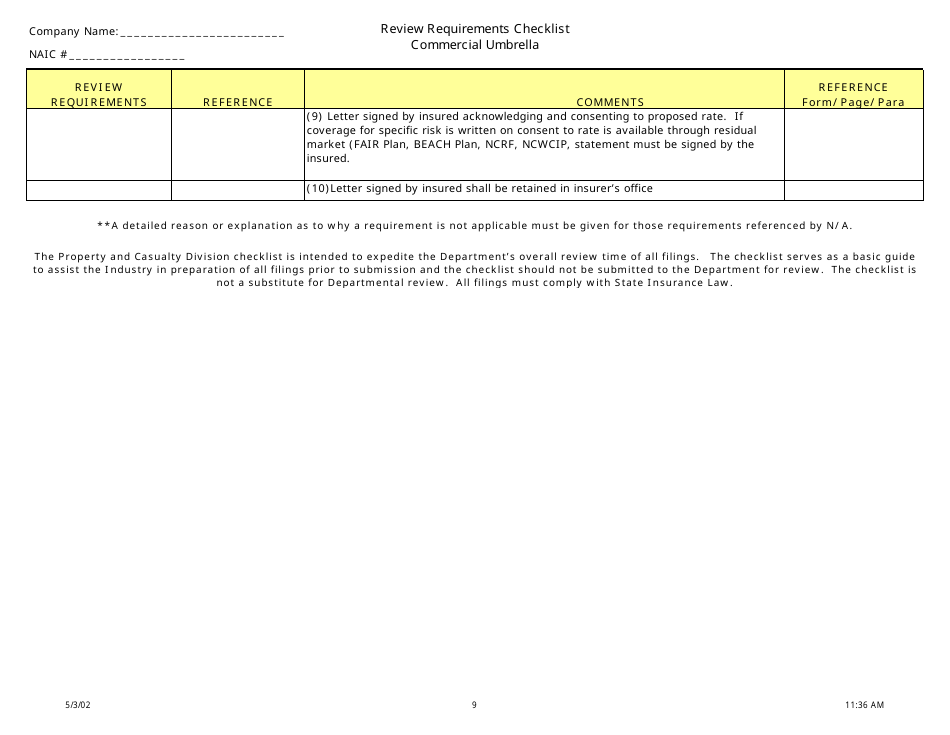

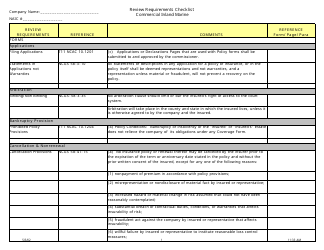

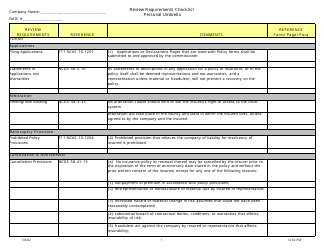

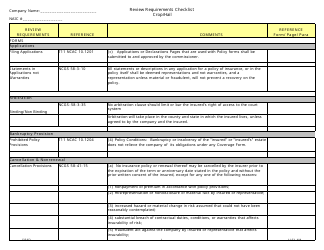

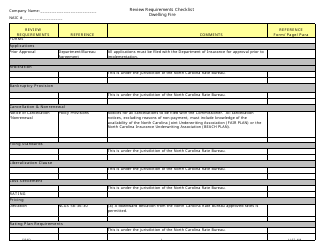

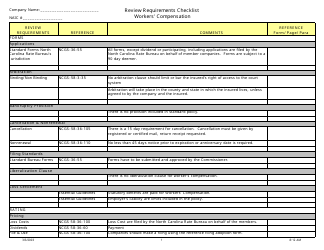

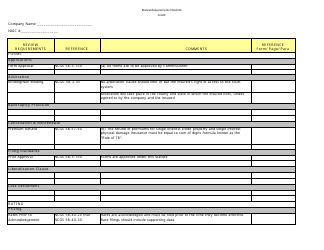

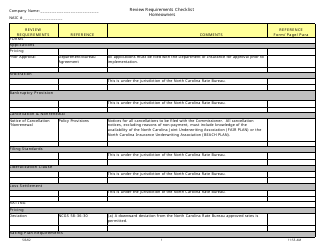

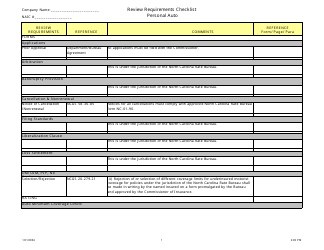

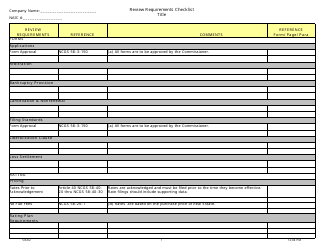

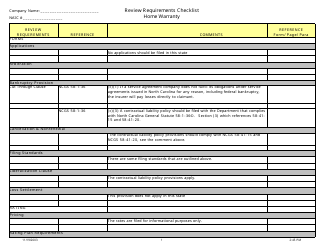

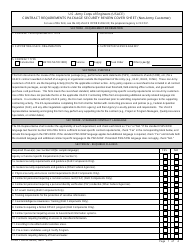

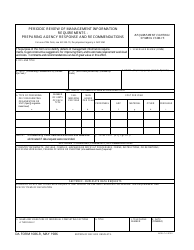

Review Requirements Checklist - Commercial Umbrella - North Carolina

Review Requirements Checklist - Commercial Umbrella is a legal document that was released by the North Carolina Department of Insurance - a government authority operating within North Carolina.

FAQ

Q: What is a Commercial Umbrella policy?

A: A Commercial Umbrella policy provides additional liability coverage beyond the limits of your primary business insurance policies.

Q: Why would I need a Commercial Umbrella policy?

A: A Commercial Umbrella policy is valuable because it helps protect your business from large liability claims that exceed the limits of your other insurance policies.

Q: Is a Commercial Umbrella policy mandatory in North Carolina?

A: No, a Commercial Umbrella policy is not mandatory in North Carolina.

Q: How much coverage does a Commercial Umbrella policy provide?

A: The coverage amount of a Commercial Umbrella policy varies, but it typically starts at $1 million and can go up to $10 million or more.

Q: What types of claims does a Commercial Umbrella policy cover?

A: A Commercial Umbrella policy covers claims such as bodily injury, property damage, libel, slander, and false advertising that exceed the limits of your primary insurance policies.

Form Details:

- Released on May 3, 2002;

- The latest edition currently provided by the North Carolina Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Insurance.