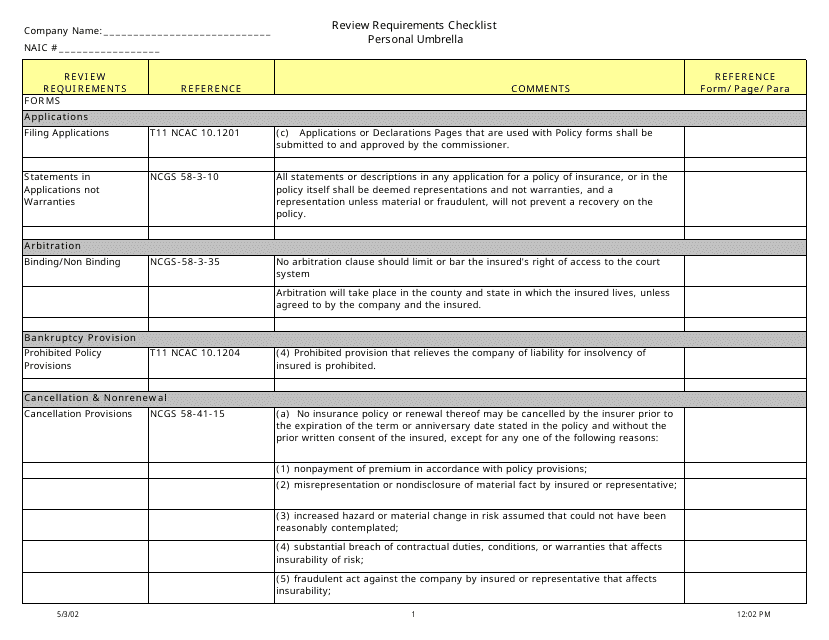

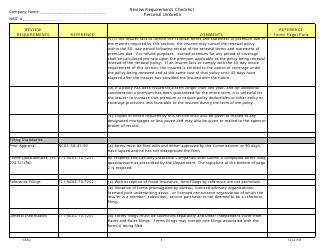

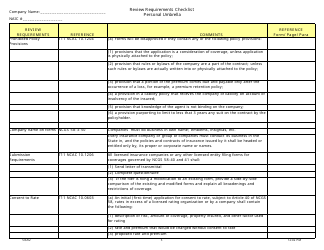

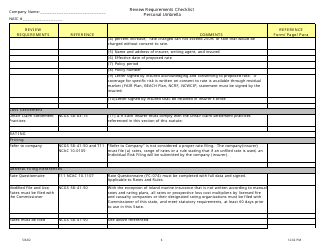

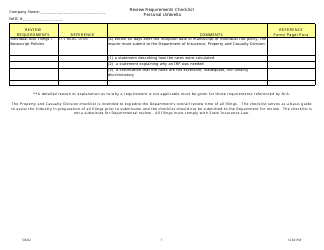

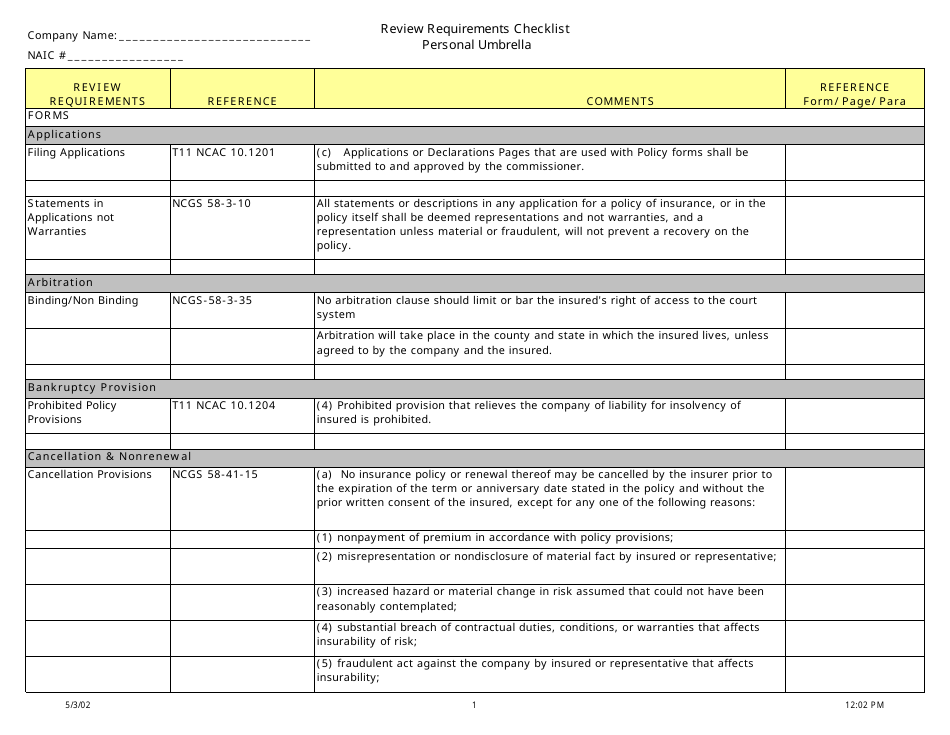

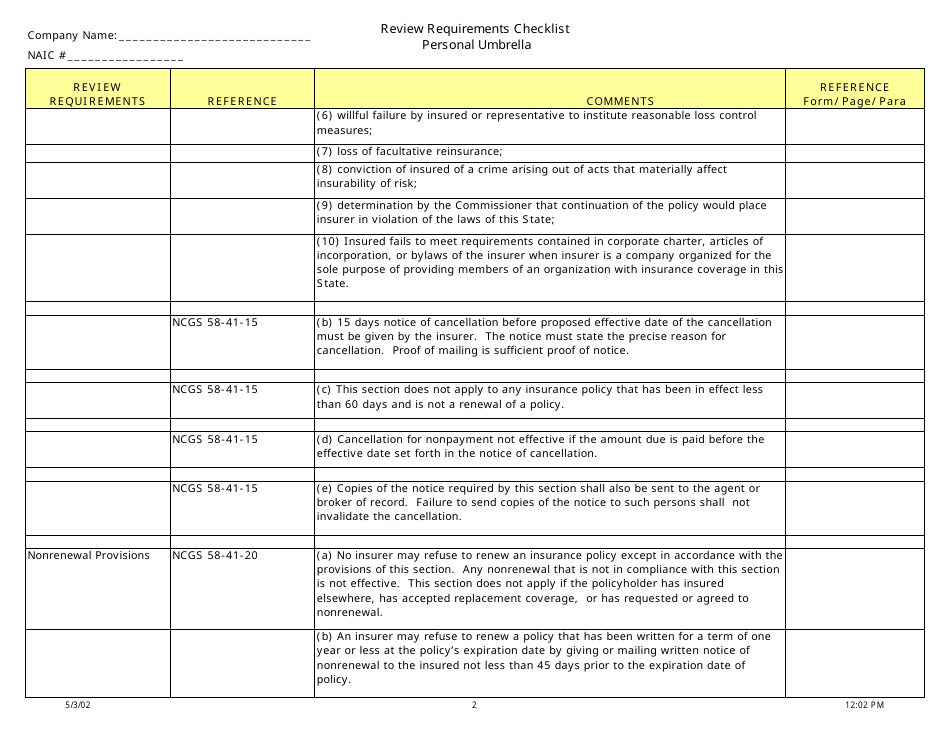

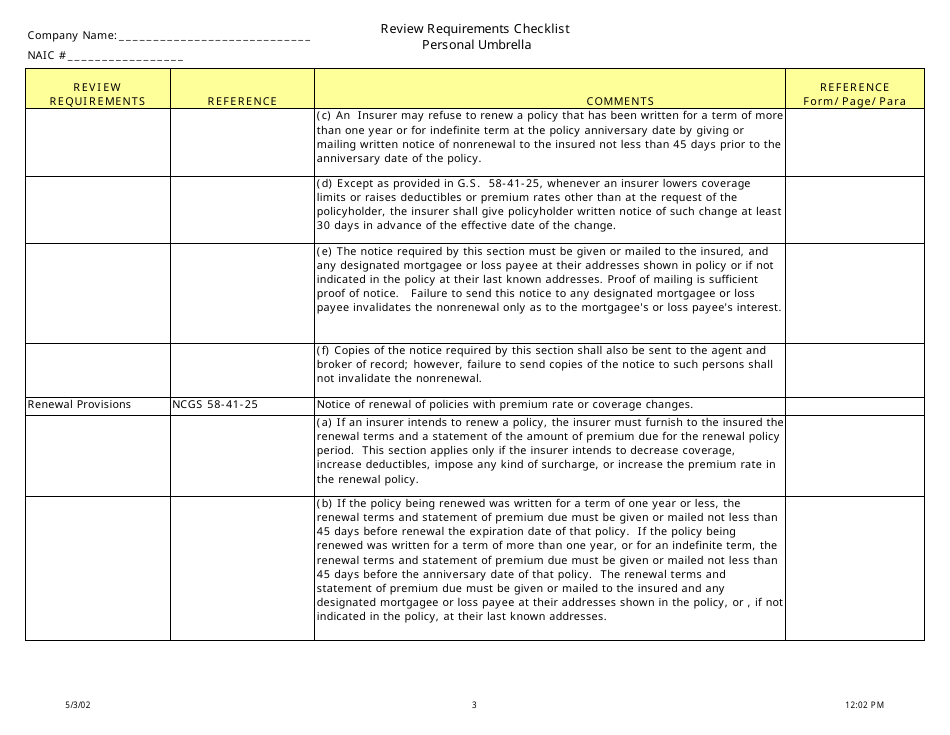

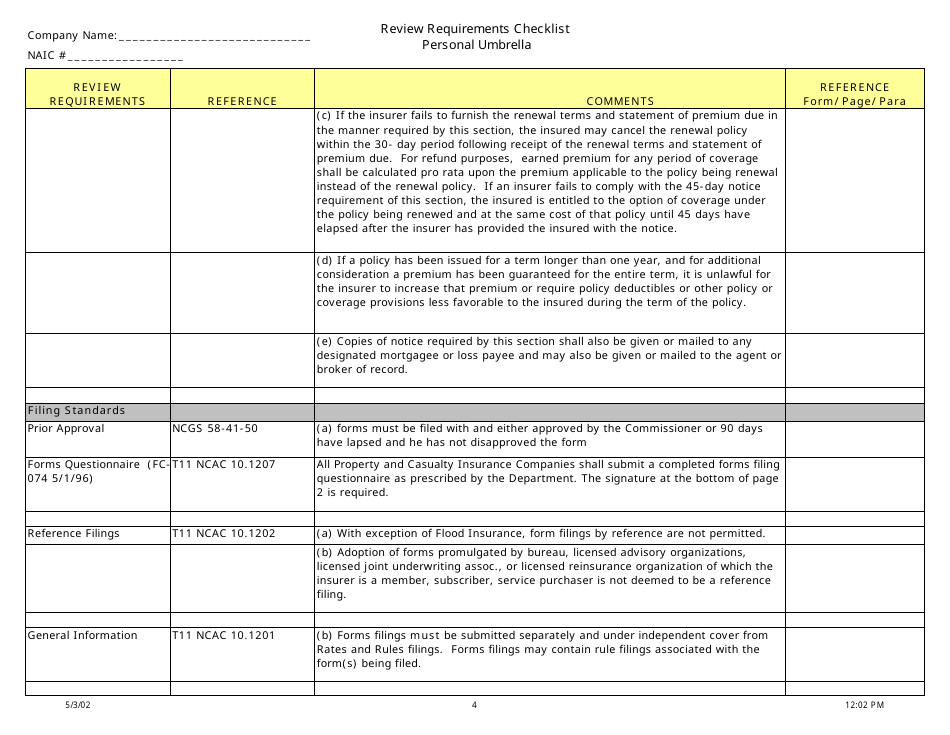

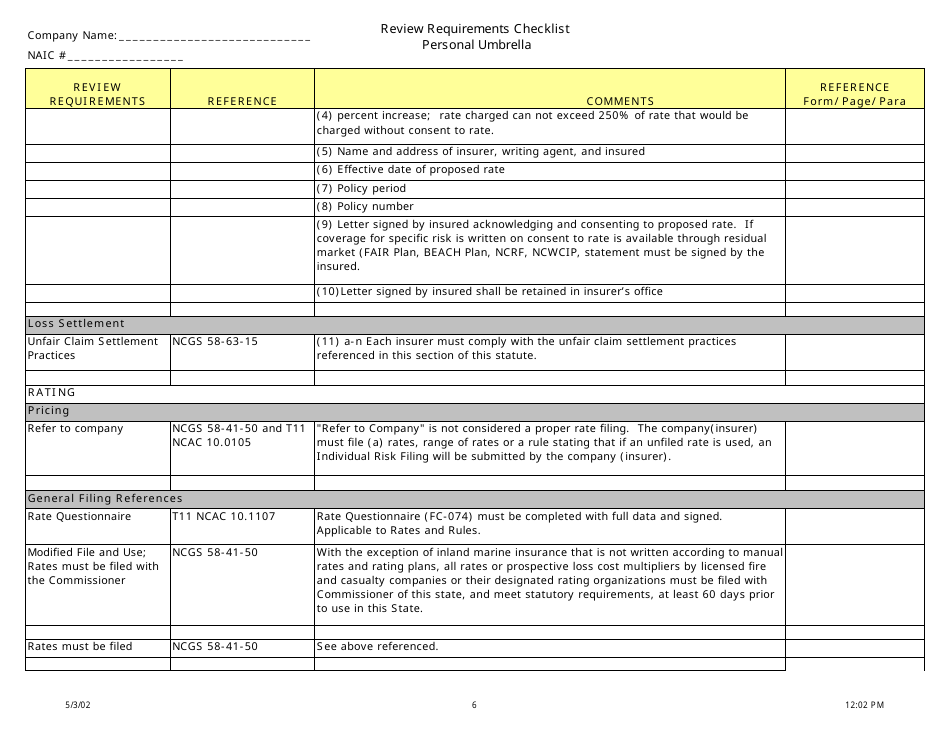

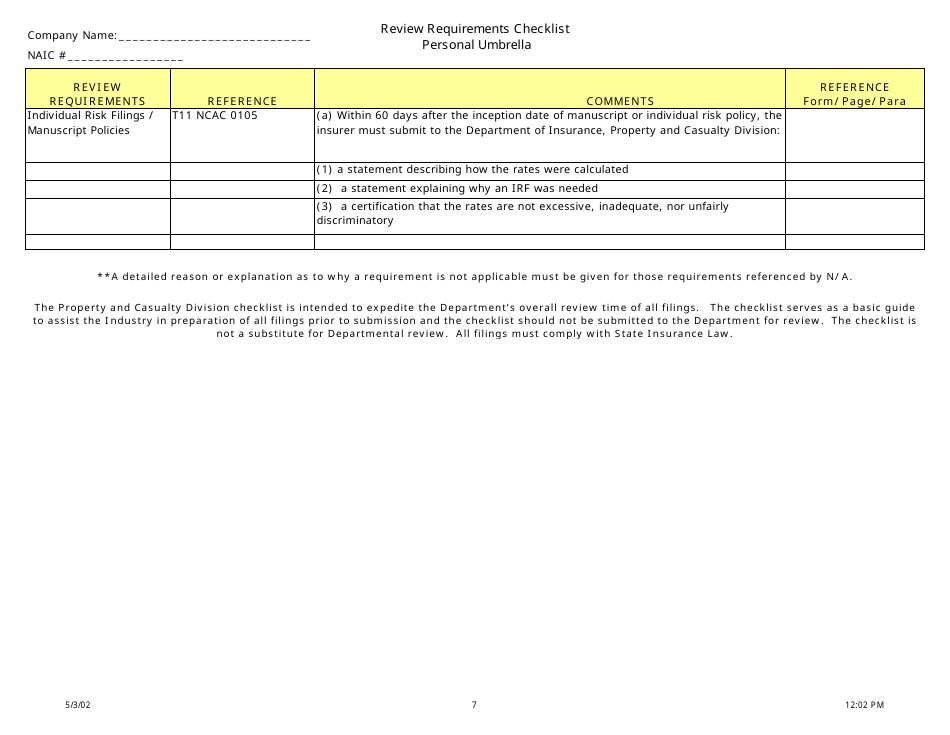

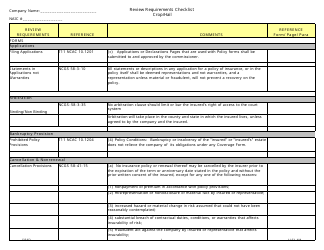

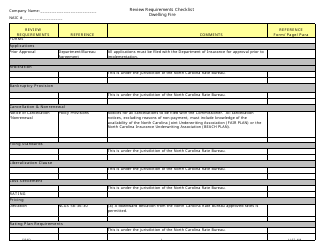

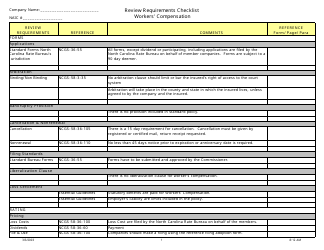

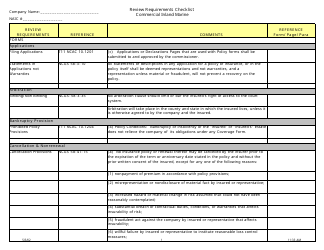

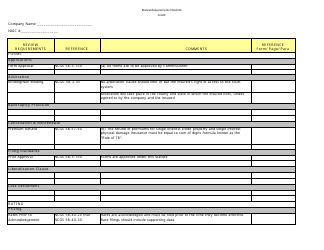

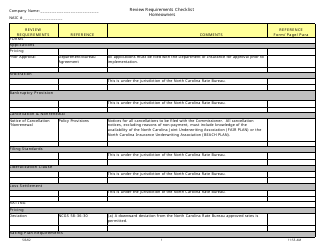

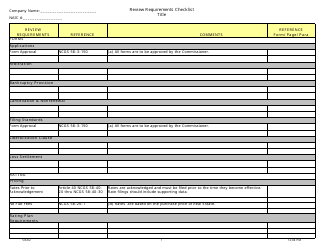

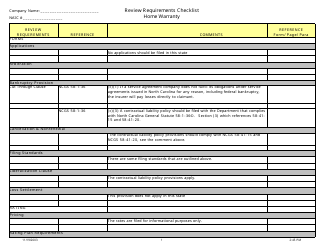

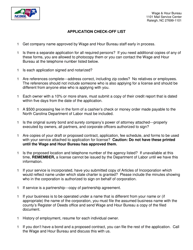

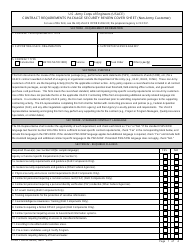

Review Requirements Checklist - Personal Umbrella - North Carolina

Review Requirements Checklist - Personal Umbrella is a legal document that was released by the North Carolina Department of Insurance - a government authority operating within North Carolina.

FAQ

Q: What is a personal umbrella policy?

A: A personal umbrella policy is an extra layer of liability insurance that provides additional coverage beyond the limits of your existing policies.

Q: Why do I need a personal umbrella policy?

A: You may need a personal umbrella policy to protect yourself from significant financial losses in the event of a lawsuit, especially if you have significant assets to protect.

Q: What does a personal umbrella policy cover?

A: A personal umbrella policy typically covers liability claims for bodily injury, property damage, and personal liability situations not covered by your other insurance policies.

Q: Who should consider getting a personal umbrella policy?

A: Anyone with assets to protect, such as home, car, investments, or savings, should consider getting a personal umbrella policy.

Q: What is the minimum coverage required for a personal umbrella policy in North Carolina?

A: There is no specific minimum coverage requirement for a personal umbrella policy in North Carolina. Coverage limits can vary based on individual needs and circumstances.

Q: Can I purchase a personal umbrella policy as a standalone policy?

A: No, a personal umbrella policy is typically purchased as an add-on to existing policies, such as home or auto insurance.

Q: How much does a personal umbrella policy cost?

A: The cost of a personal umbrella policy can vary depending on factors such as coverage limits, your insurance history, and personal circumstances. It is best to contact an insurance provider for a personalized quote.

Q: How do I apply for a personal umbrella policy?

A: To apply for a personal umbrella policy, contact an insurance provider or agent who offers this type of coverage. They will guide you through the application process.

Q: Are there any exclusions or limitations with a personal umbrella policy?

A: Yes, personal umbrella policies often have exclusions and limitations, such as not covering intentional acts, business-related activities, or certain high-risk activities. It's important to review the policy details and speak with an insurance professional to understand the specific exclusions and limitations.

Q: Can I cancel a personal umbrella policy if I no longer need it?

A: Yes, you can typically cancel a personal umbrella policy at any time. However, you may have to pay a fee or penalty depending on the terms of your policy.

Form Details:

- Released on May 3, 2002;

- The latest edition currently provided by the North Carolina Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Insurance.