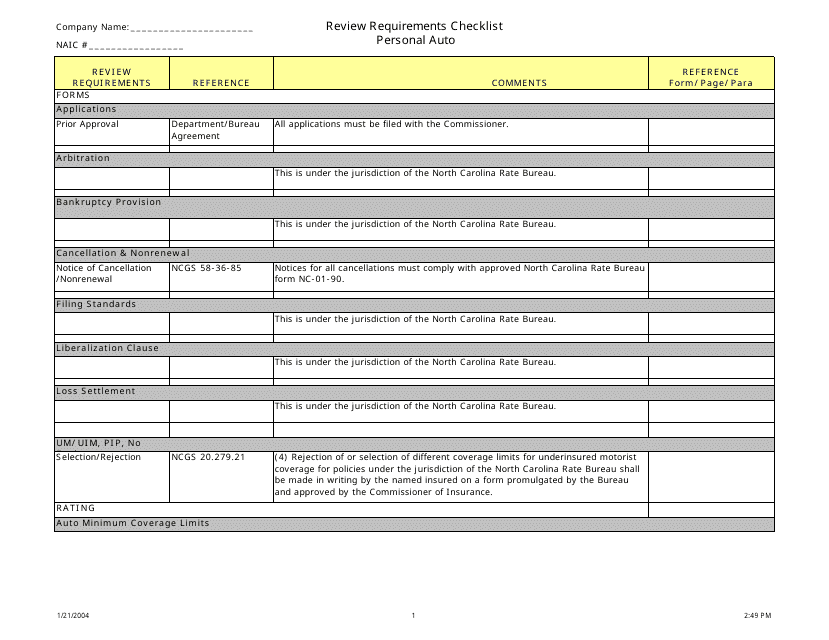

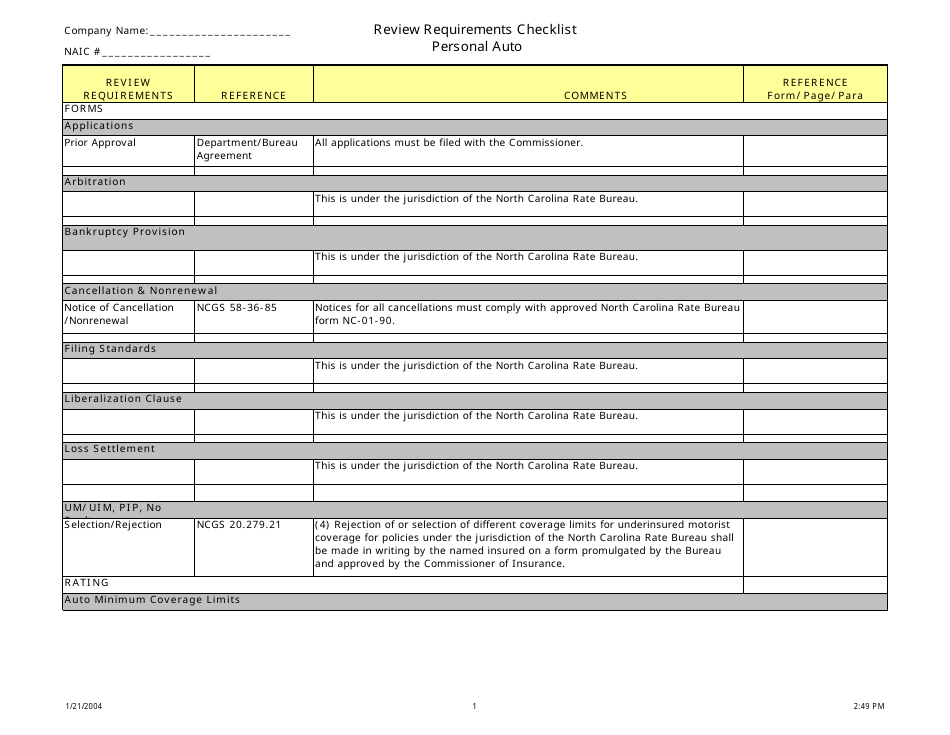

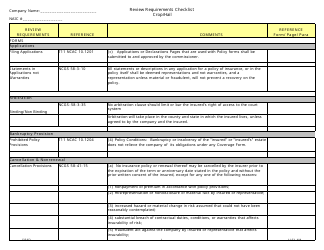

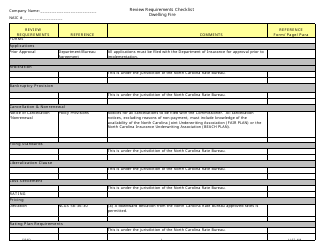

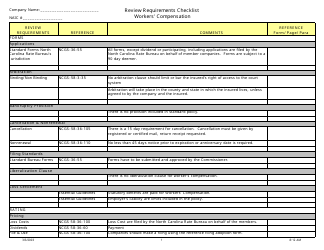

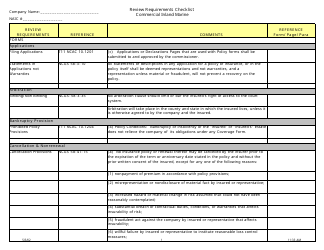

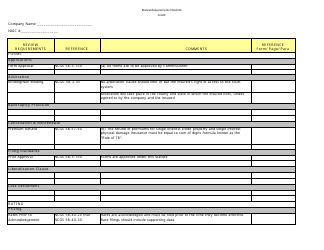

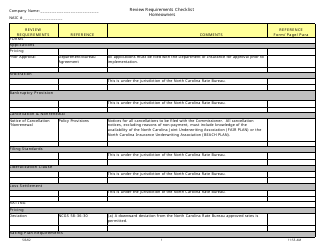

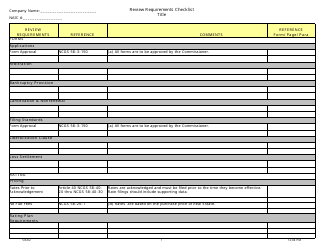

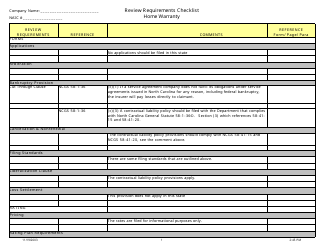

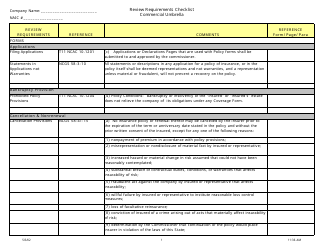

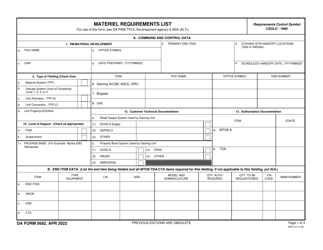

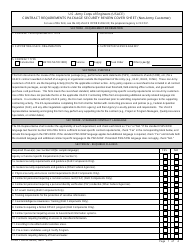

Review Requirements Checklist - Personal Auto - North Carolina

Review Requirements Checklist - Personal Auto is a legal document that was released by the North Carolina Department of Insurance - a government authority operating within North Carolina.

FAQ

Q: What documents are required for personal auto insurance in North Carolina?

A: In North Carolina, you typically need your driver's license, vehicle registration, and proof of insurance coverage to get personal auto insurance.

Q: Is personal auto insurance mandatory in North Carolina?

A: Yes, personal auto insurance is mandatory in North Carolina.

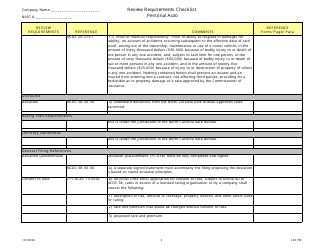

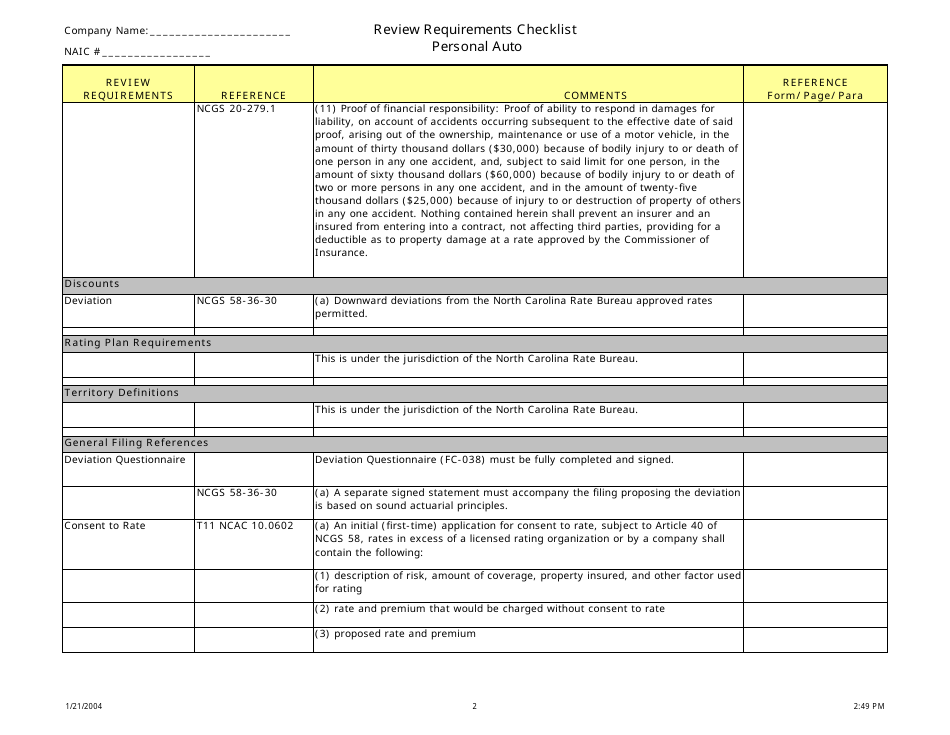

Q: What are the minimum liability limits for personal auto insurance in North Carolina?

A: The minimum liability limits for personal auto insurance in North Carolina are $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage.

Q: What is uninsured/underinsured motorist coverage?

A: Uninsured/underinsured motorist coverage provides protection if you are involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover your damages.

Q: Are there any discounts available for personal auto insurance in North Carolina?

A: Yes, there are various discounts available for personal auto insurance in North Carolina, such as safe driver discounts, multi-policy discounts, and good student discounts.

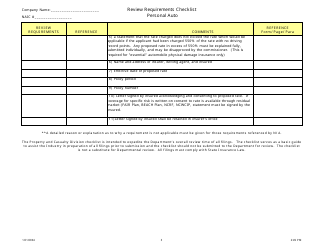

Q: Can I choose my own deductibles for personal auto insurance in North Carolina?

A: Yes, you can typically choose your own deductibles for personal auto insurance in North Carolina.

Q: What happens if I drive without personal auto insurance in North Carolina?

A: Driving without personal auto insurance in North Carolina is illegal and can result in penalties such as fines, license suspension, and even vehicle impoundment.

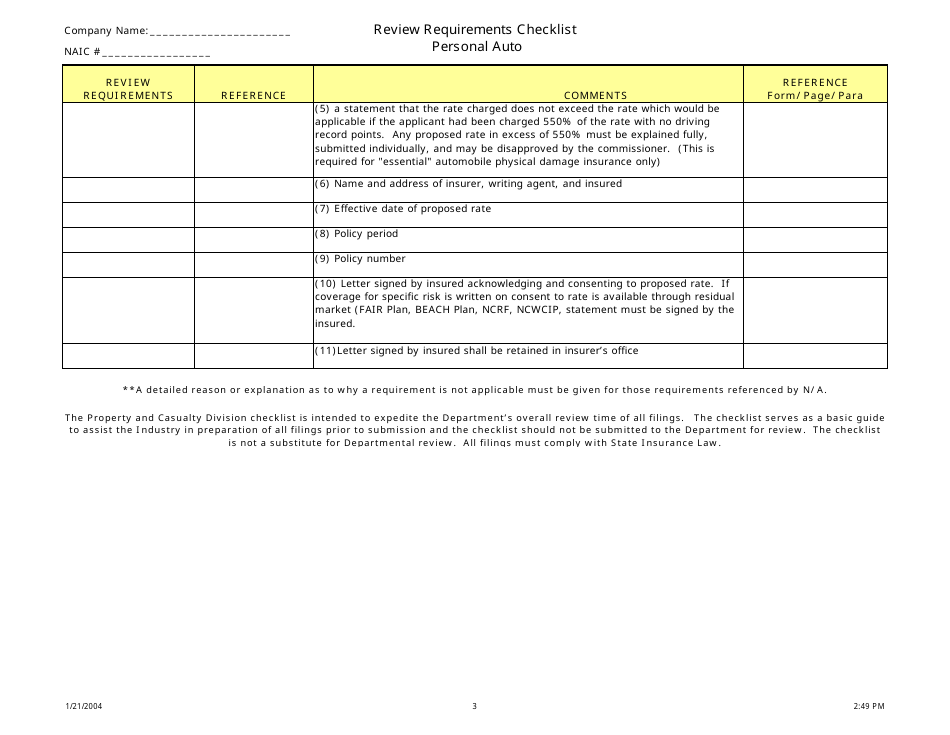

Form Details:

- Released on January 21, 2004;

- The latest edition currently provided by the North Carolina Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Insurance.