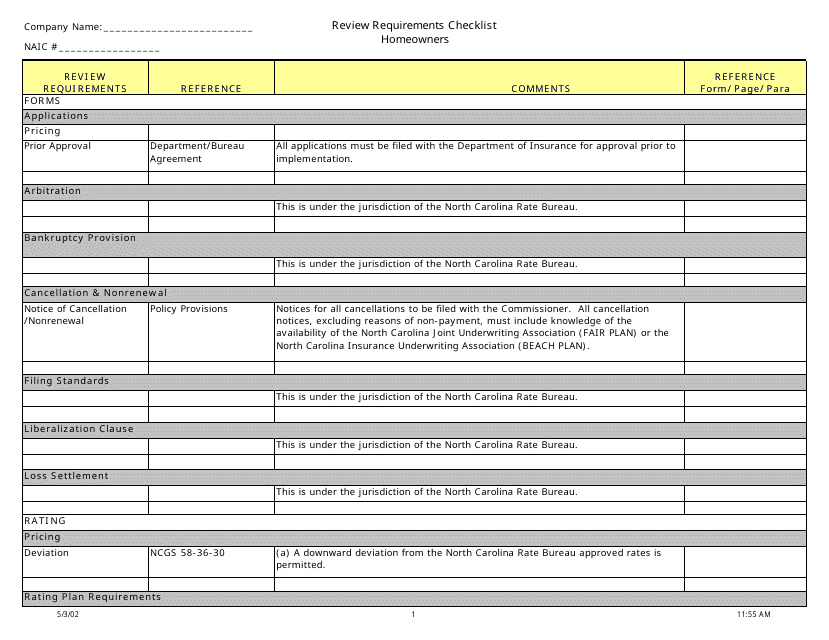

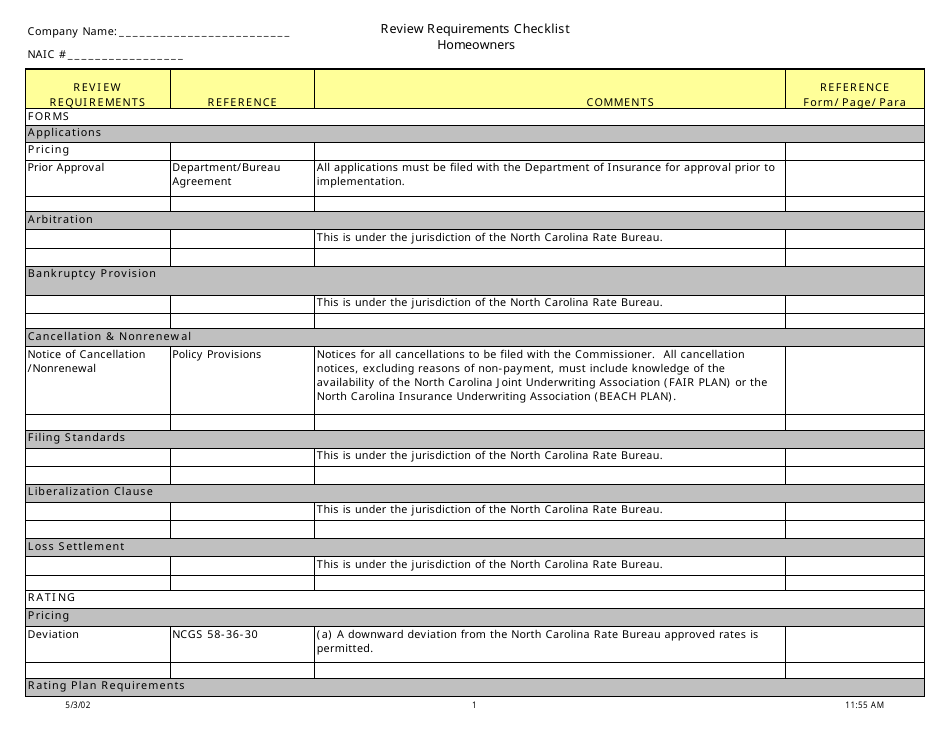

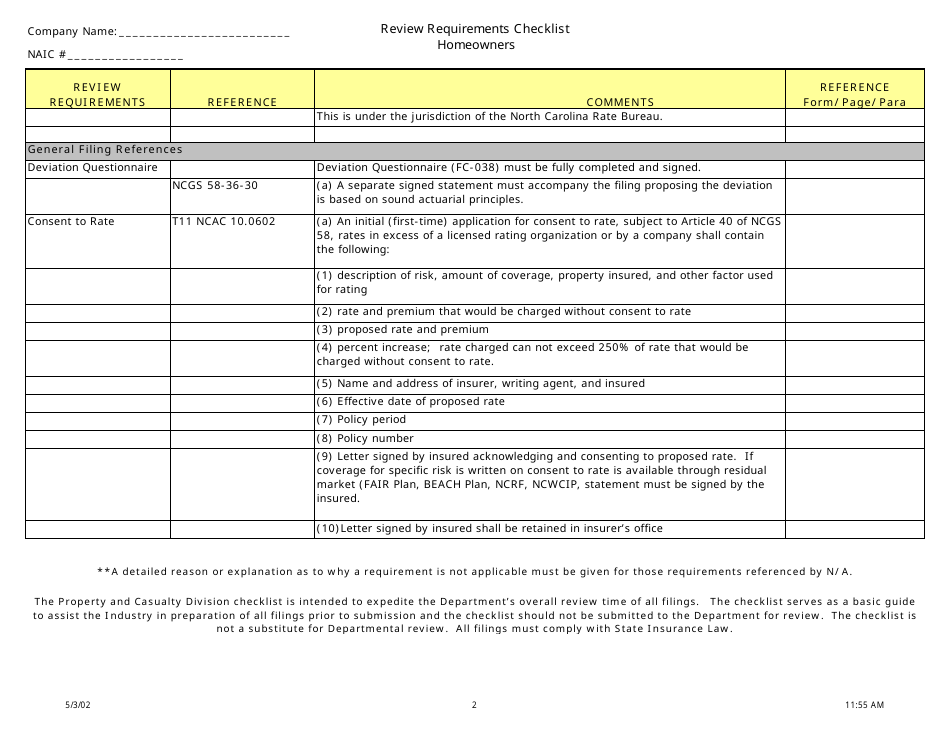

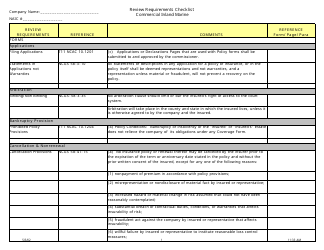

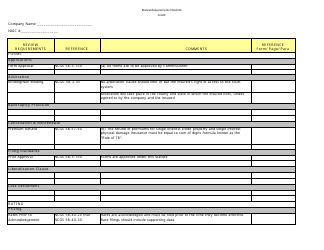

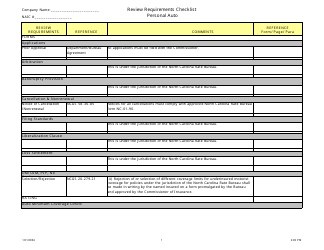

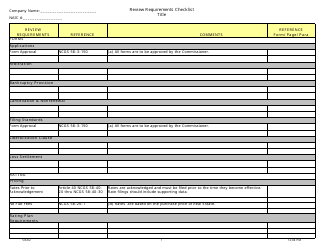

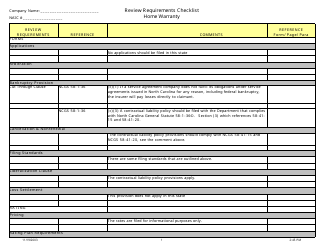

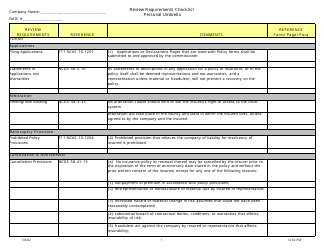

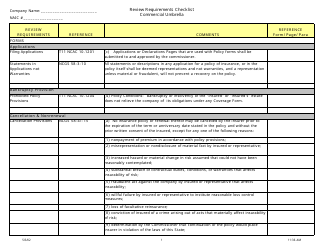

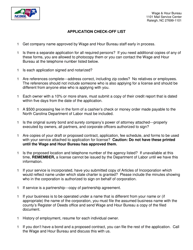

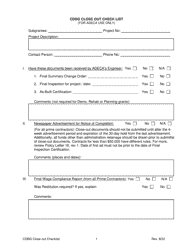

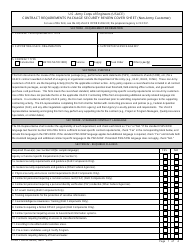

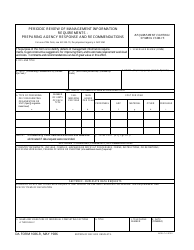

Review Requirements Checklist - Homeowners - North Carolina

Review Requirements Checklist - Homeowners is a legal document that was released by the North Carolina Department of Insurance - a government authority operating within North Carolina.

FAQ

Q: What are the insurance requirements for homeowners in North Carolina?

A: Homeowners in North Carolina are required to have insurance coverage for the dwelling, personal property, liability, and additional living expenses.

Q: Is flood insurance required for homeowners in North Carolina?

A: Flood insurance is not required for homeowners in North Carolina, but it is highly recommended, especially in flood-prone areas.

Q: Are there any specific coverage limits for homeowners insurance in North Carolina?

A: The coverage limits for homeowners insurance in North Carolina can vary depending on the insurer and policy, but it is important to ensure that your coverage is sufficient to protect your home and belongings.

Q: Does homeowners insurance in North Carolina cover damage from hurricanes?

A: Homeowners insurance in North Carolina typically covers damage from hurricanes, but it may have specific deductible and coverage requirements, especially for wind and hail damage.

Q: Are there any discounts available for homeowners insurance in North Carolina?

A: Many insurers offer discounts for homeowners insurance in North Carolina, such as multi-policy discounts, security system discounts, and discounts for having a claims-free history.

Q: What should homeowners do before filing an insurance claim in North Carolina?

A: Before filing an insurance claim, homeowners in North Carolina should document the damage with photos or videos, contact their insurance provider, and make temporary repairs to prevent further damage.

Q: How can homeowners protect their homes from wildfires in North Carolina?

A: Homeowners in North Carolina can protect their homes from wildfires by creating defensible space around their property, using fire-resistant materials for construction, and maintaining a safe distance from flammable vegetation.

Q: What is the North Carolina Insurance Underwriting Association (NCIUA)?

A: The North Carolina Insurance Underwriting Association (NCIUA) is a last-resort insurance provider that offers coverage to homeowners who are unable to obtain insurance in the private market due to high-risk factors.

Q: Can homeowners in North Carolina make changes to their insurance policy?

A: Yes, homeowners in North Carolina can make changes to their insurance policy by contacting their insurance provider and requesting the desired changes, such as adjusting coverage limits or adding additional coverage.

Q: What should homeowners do in case of a denied insurance claim in North Carolina?

A: If a homeowners insurance claim is denied in North Carolina, homeowners can review their policy, gather supporting documentation, and file an appeal or consult with a professional for assistance.

Form Details:

- Released on May 3, 2002;

- The latest edition currently provided by the North Carolina Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Insurance.