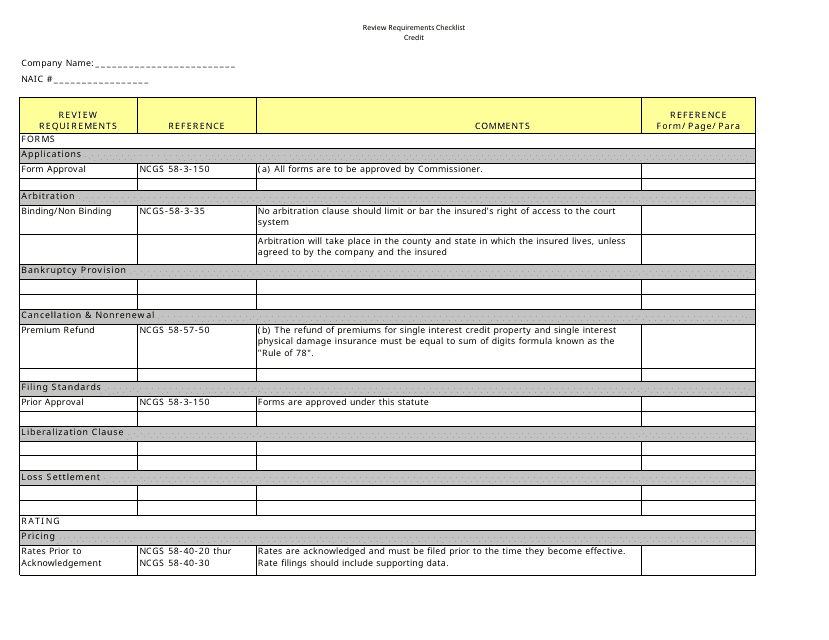

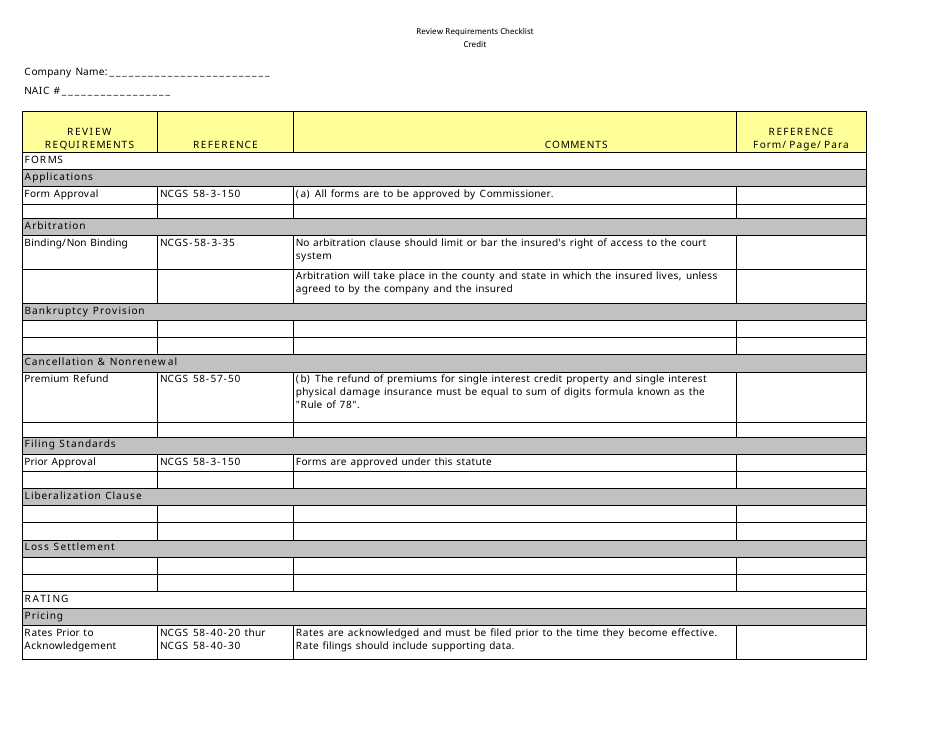

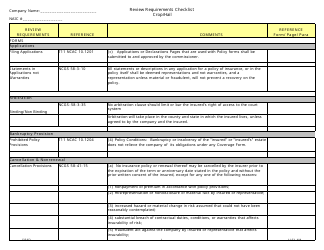

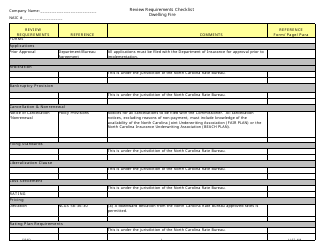

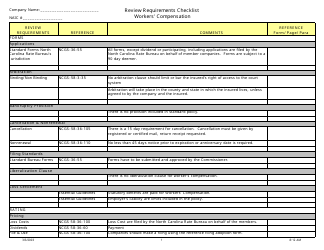

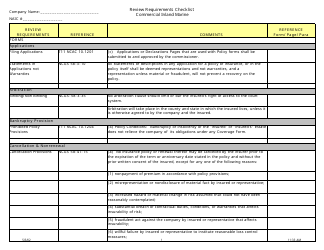

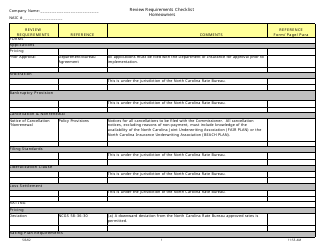

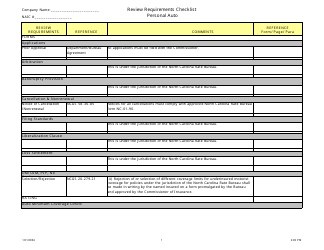

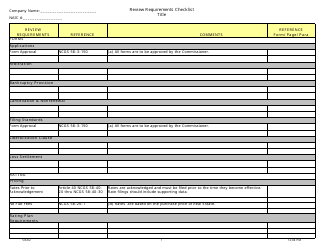

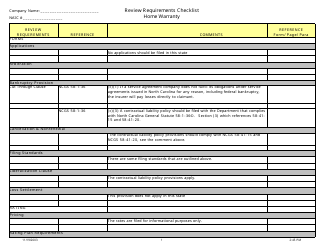

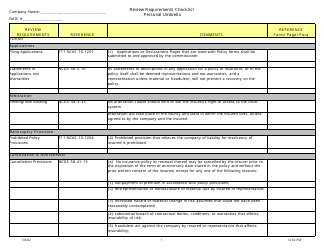

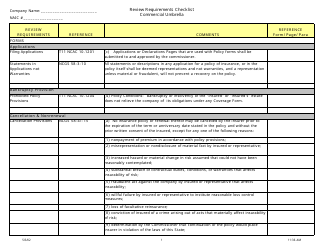

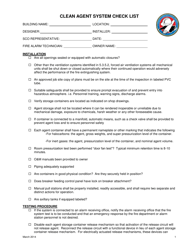

Review Requirements Checklist - Credit - North Carolina

Review Requirements Checklist - Credit is a legal document that was released by the North Carolina Department of Insurance - a government authority operating within North Carolina.

FAQ

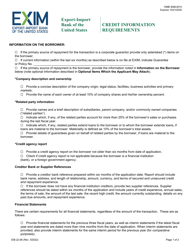

Q: What is the credit requirements checklist for North Carolina?

A: The credit requirements checklist for North Carolina is a list of criteria that individuals need to meet in order to obtain credit.

Q: What are the common credit requirements in North Carolina?

A: Some common credit requirements in North Carolina include having a good credit score, stable income, and a low debt-to-income ratio.

Q: What is considered a good credit score in North Carolina?

A: A good credit score in North Carolina is usually considered to be around 700 or above.

Q: Why is a stable income important for credit approval in North Carolina?

A: Having a stable income shows lenders that you have a consistent source of funds to repay your debts.

Q: What is a debt-to-income ratio and why is it important for credit approval in North Carolina?

A: A debt-to-income ratio is the percentage of your monthly income that goes towards paying debt. It is important for credit approval as lenders want to ensure that you have enough income to handle your debt obligations.

Q: Are there any specific credit requirements for certain types of loans in North Carolina?

A: Yes, certain types of loans may have additional credit requirements. For example, a mortgage loan may require a higher credit score and a lower debt-to-income ratio compared to a personal loan.

Q: What should I do if I don't meet the credit requirements in North Carolina?

A: If you don't meet the credit requirements, you can work on improving your credit score, reducing your debt, and increasing your income to increase your chances of approval.

Q: Are there any alternatives to traditional credit in North Carolina?

A: Yes, there are alternatives to traditional credit in North Carolina, such as secured credit cards or credit-builder loans, which can help individuals establish or rebuild their credit history.

Form Details:

- The latest edition currently provided by the North Carolina Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Insurance.