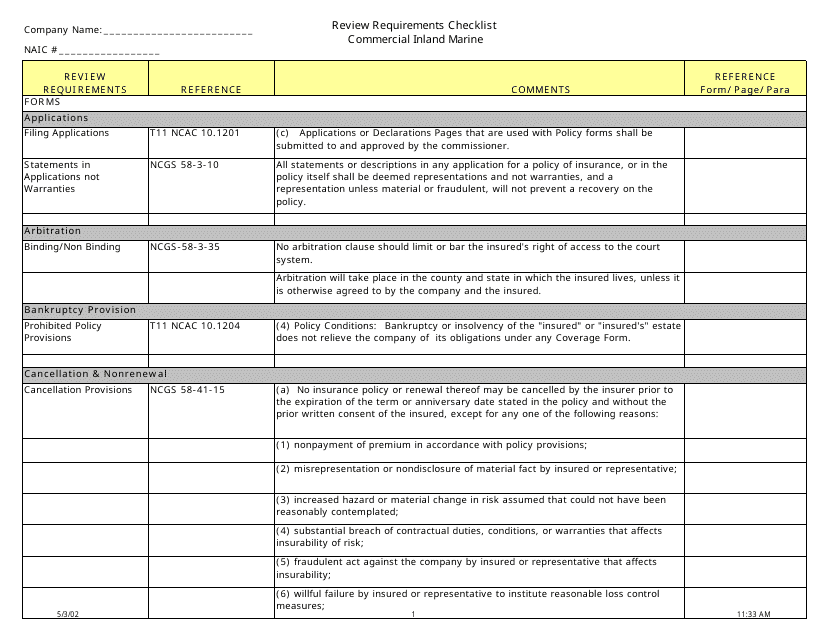

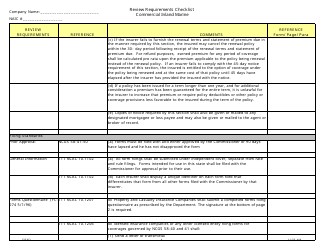

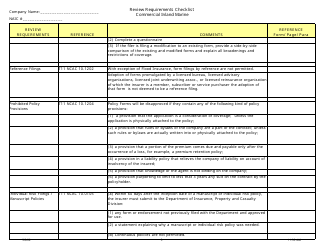

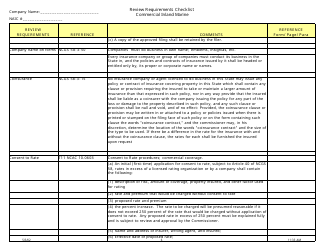

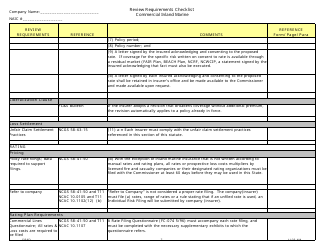

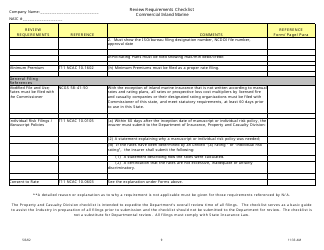

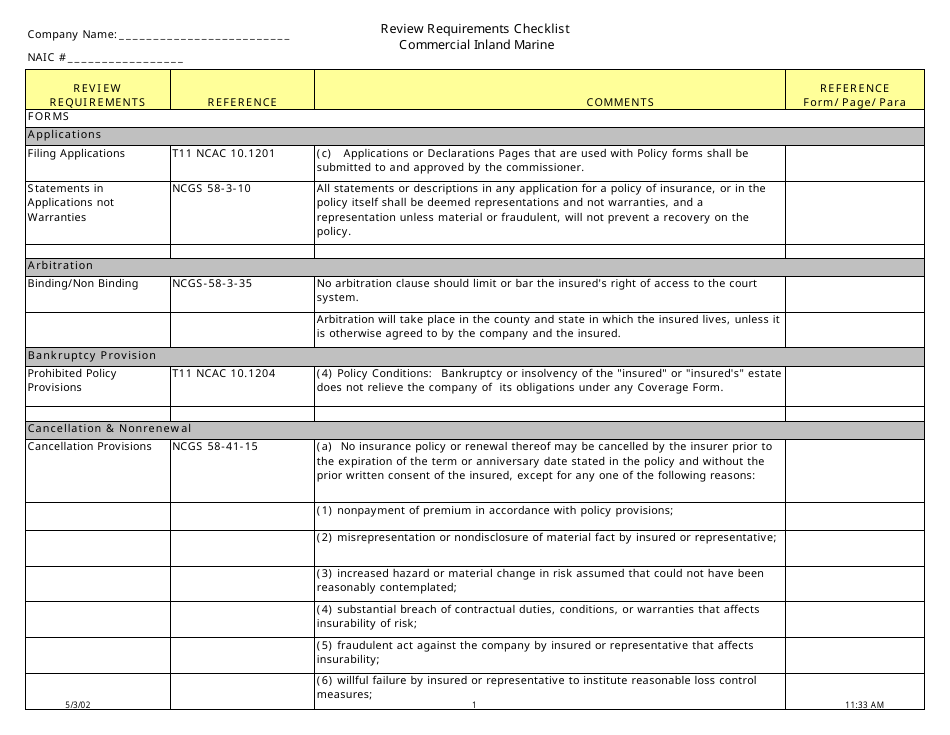

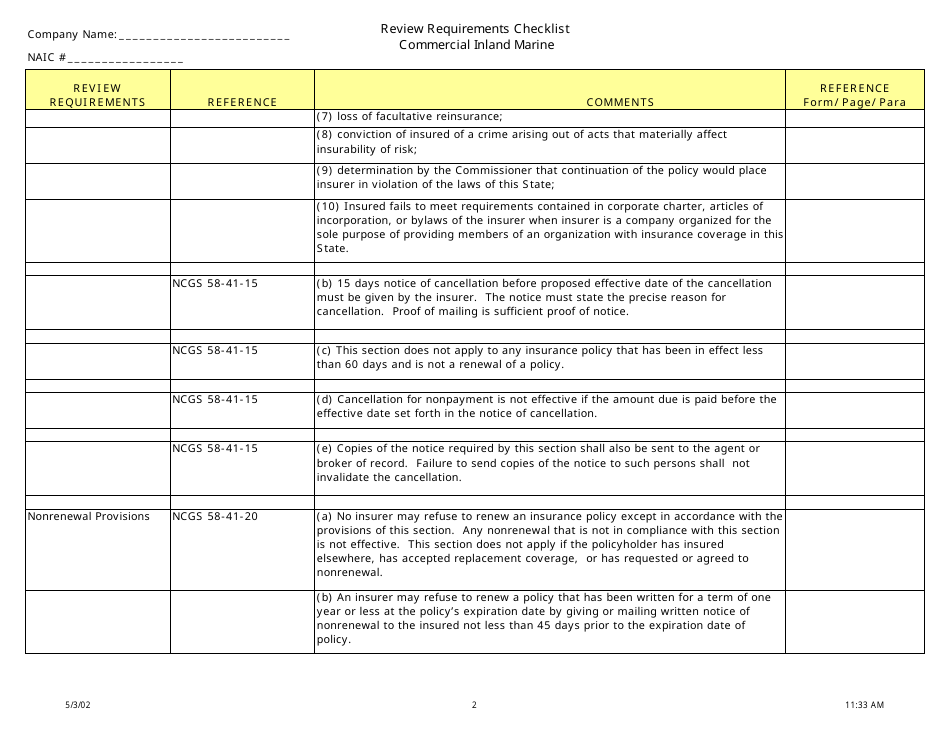

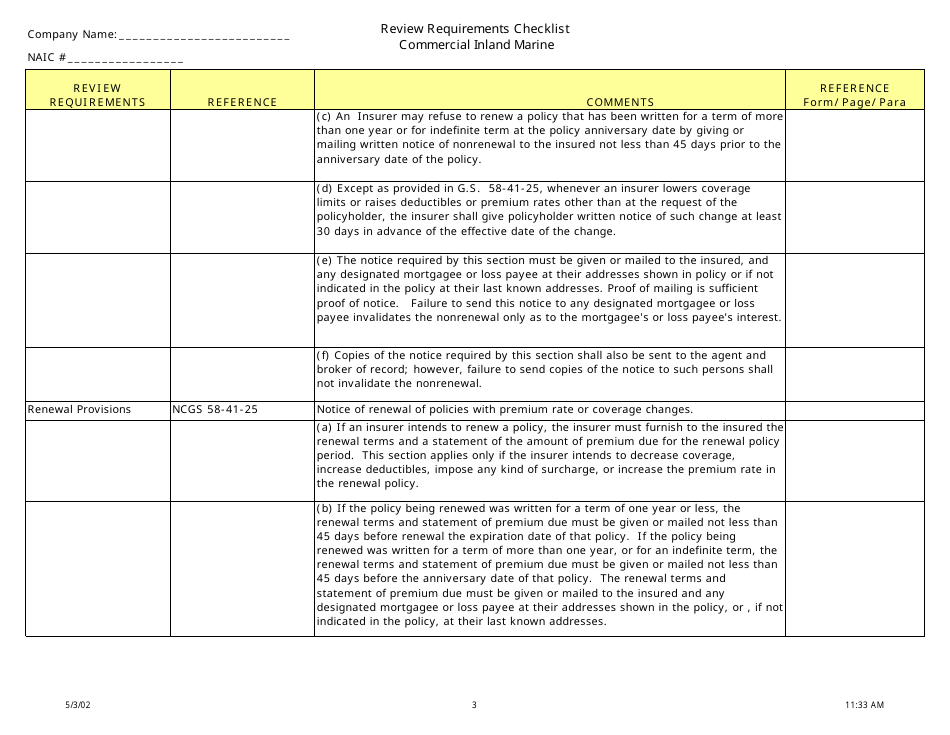

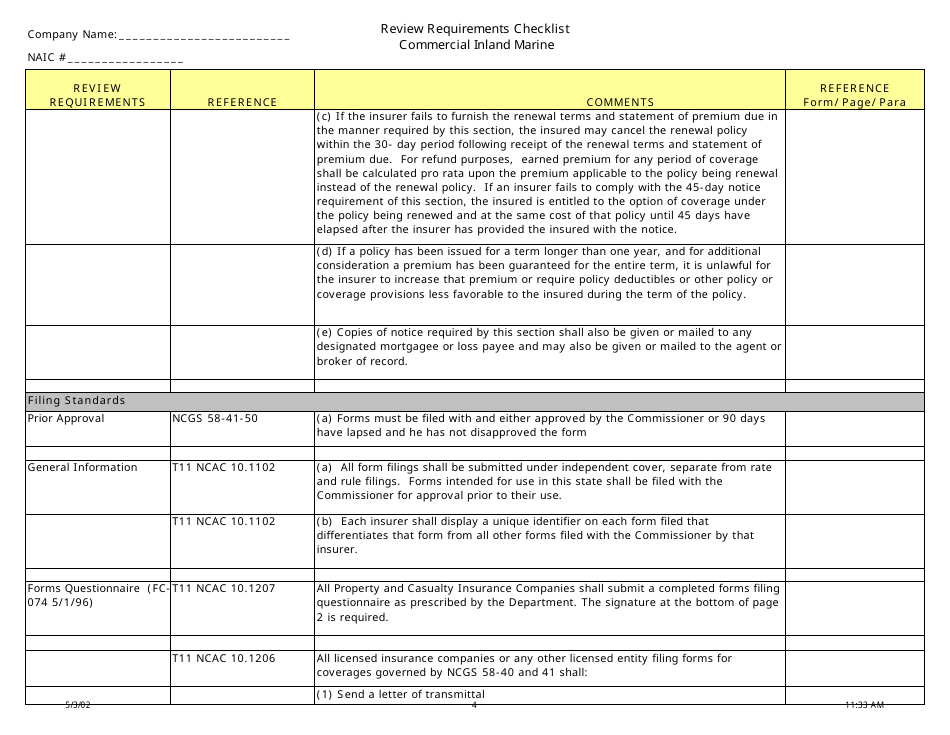

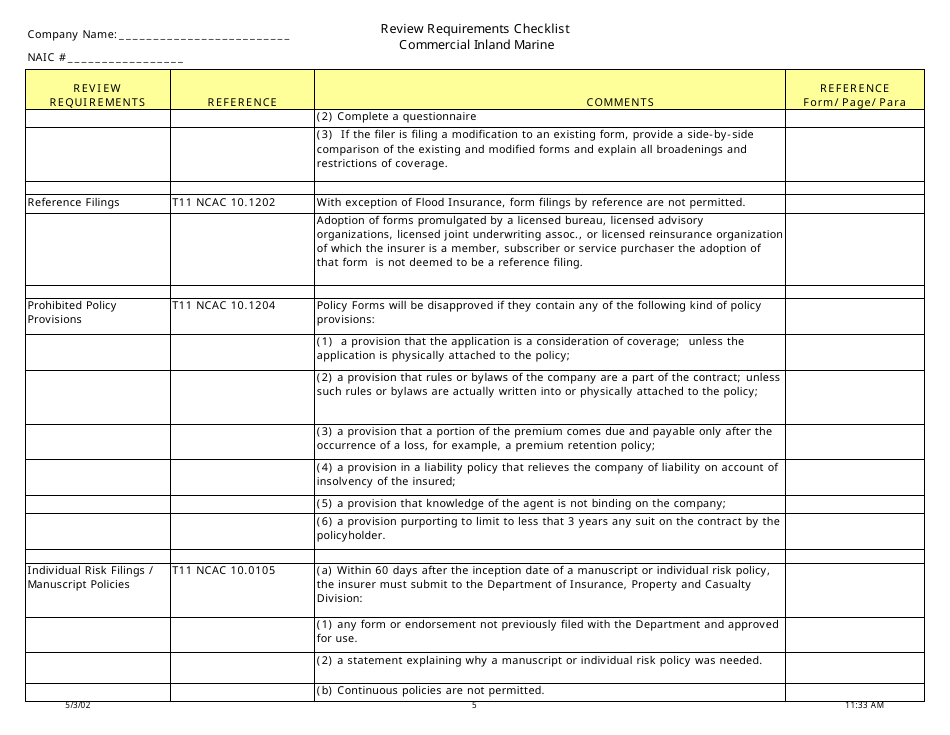

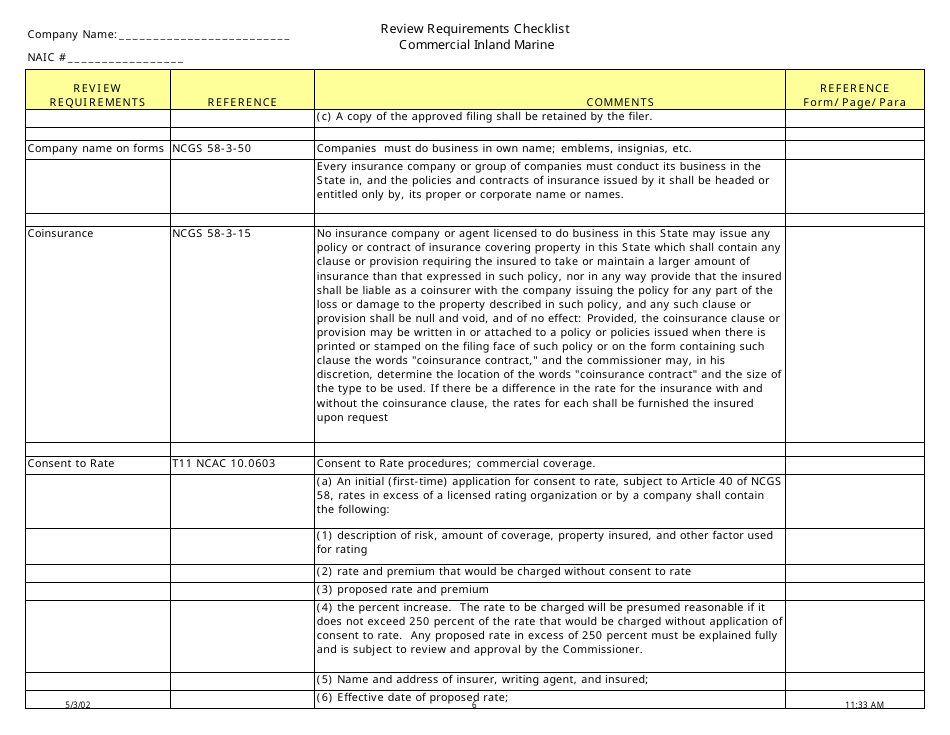

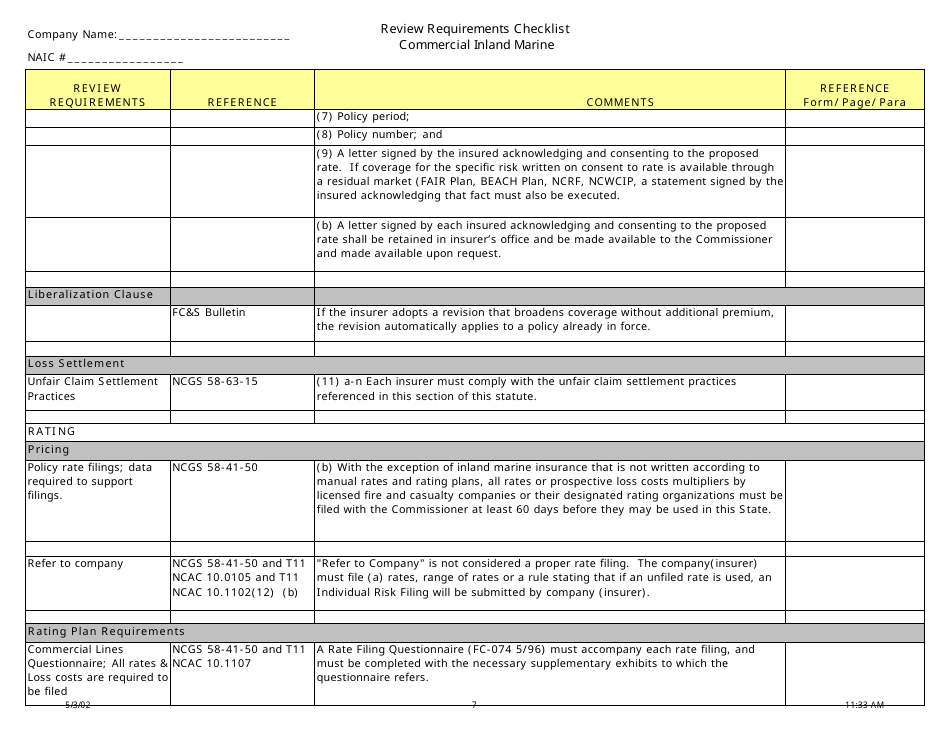

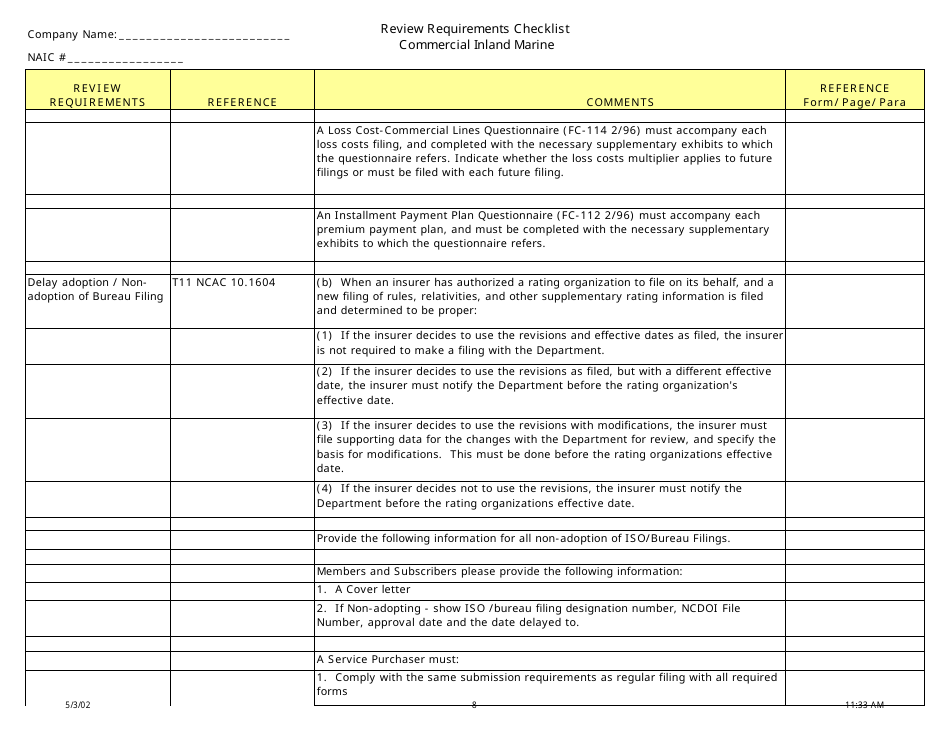

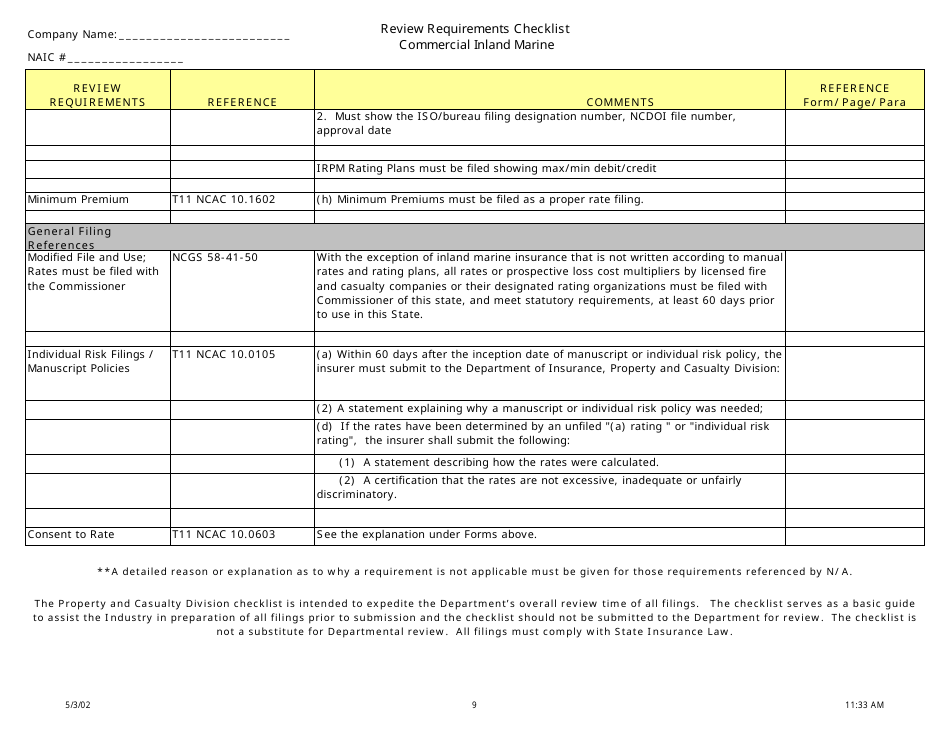

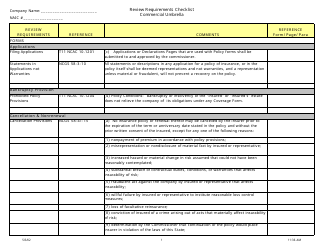

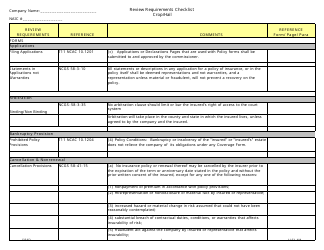

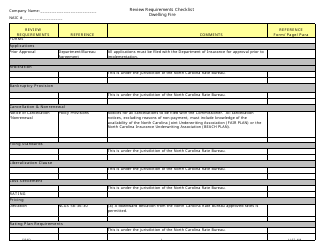

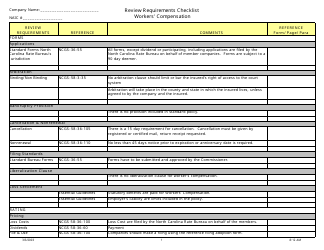

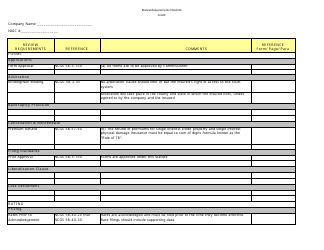

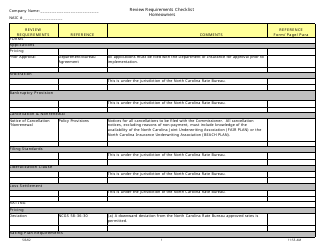

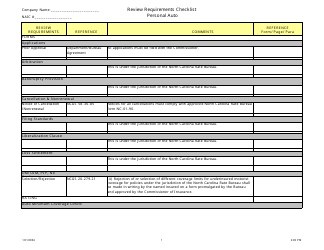

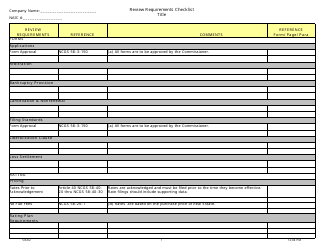

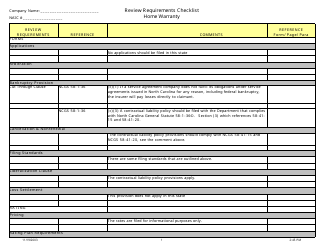

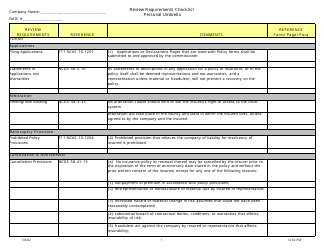

Review Requirements Checklist - Commercial Inland Marine - North Carolina

Review Requirements Checklist - Commercial Inland Marine is a legal document that was released by the North Carolina Department of Insurance - a government authority operating within North Carolina.

FAQ

Q: What is a commercial inland marine policy?

A: A commercial inland marine policy is an insurance policy that covers property or equipment that is mobile or not permanently attached to a fixed location.

Q: What does a commercial inland marine policy in North Carolina cover?

A: A commercial inland marine policy in North Carolina typically covers items such as tools, equipment, and other property that is used for business purposes and may be transported from one location to another.

Q: Do I need a commercial inland marine policy if I already have property insurance?

A: Yes, a commercial inland marine policy is often necessary, as standard property insurance typically does not provide coverage for property that is mobile or not permanently attached to a fixed location.

Q: Who needs a commercial inland marine policy in North Carolina?

A: Businesses that own or regularly transport valuable equipment or property, such as contractors, manufacturers, and transportation companies, may benefit from having a commercial inland marine policy.

Q: What types of coverage options are available for commercial inland marine policies?

A: Some common coverage options for commercial inland marine policies include contractor's equipment coverage, installation floater coverage, and transportation coverage.

Q: How much does a commercial inland marine policy in North Carolina cost?

A: The cost of a commercial inland marine policy can vary depending on factors such as the value of the insured property, the type of coverage selected, and the insurance provider.

Q: How can I purchase a commercial inland marine policy in North Carolina?

A: You can purchase a commercial inland marine policy in North Carolina by contacting an insurance agent or broker who specializes in commercial insurance.

Q: Can I add additional coverage to my commercial inland marine policy?

A: Yes, additional coverage options may be available for specific needs, such as coverage for leased equipment or coverage for property being transported internationally.

Q: What should I consider when selecting a commercial inland marine policy in North Carolina?

A: When selecting a commercial inland marine policy, it's important to consider factors such as the coverage limits, deductibles, and any exclusions or limitations of coverage.

Q: Are there any specific regulations or requirements for commercial inland marine policies in North Carolina?

A: It's important to consult with an insurance professional in North Carolina to understand any specific regulations or requirements that may apply to commercial inland marine policies in the state.

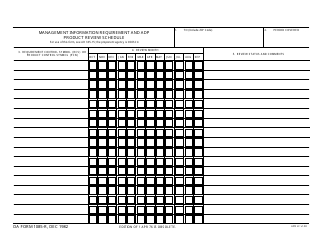

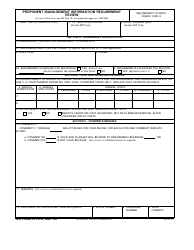

Form Details:

- Released on May 3, 2002;

- The latest edition currently provided by the North Carolina Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Insurance.