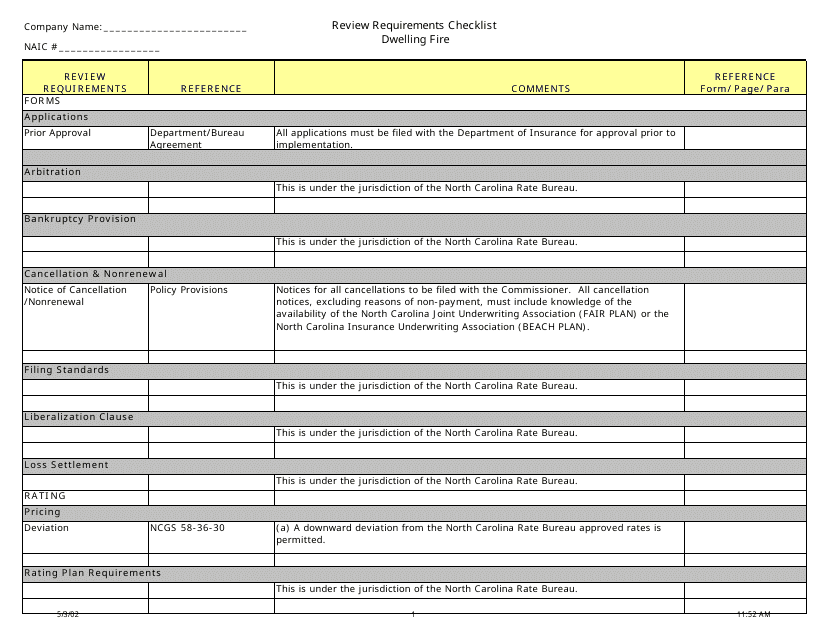

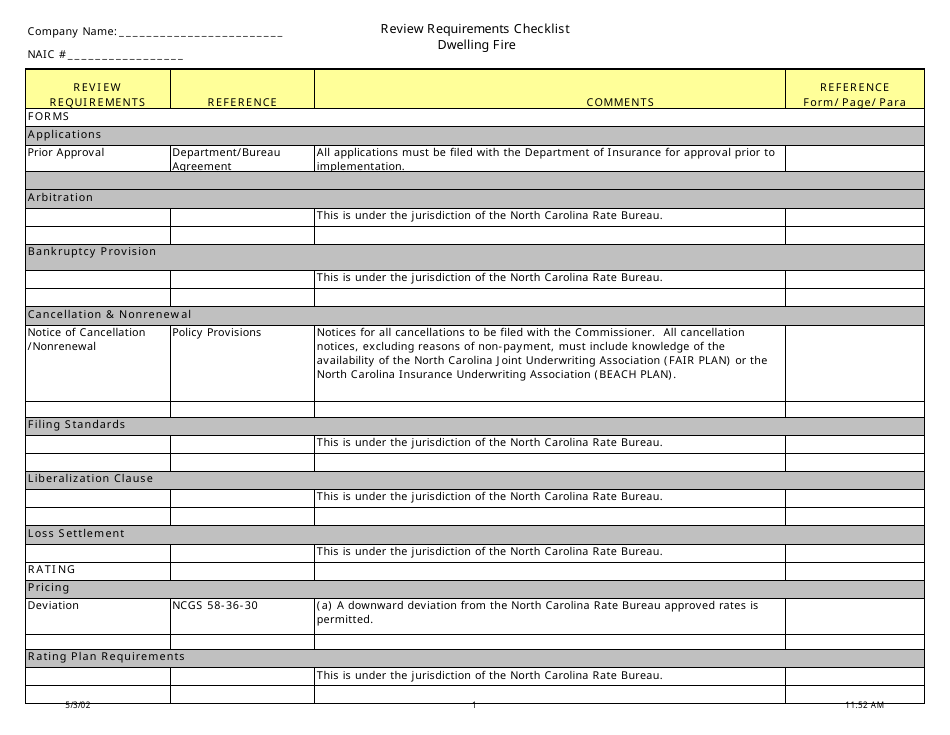

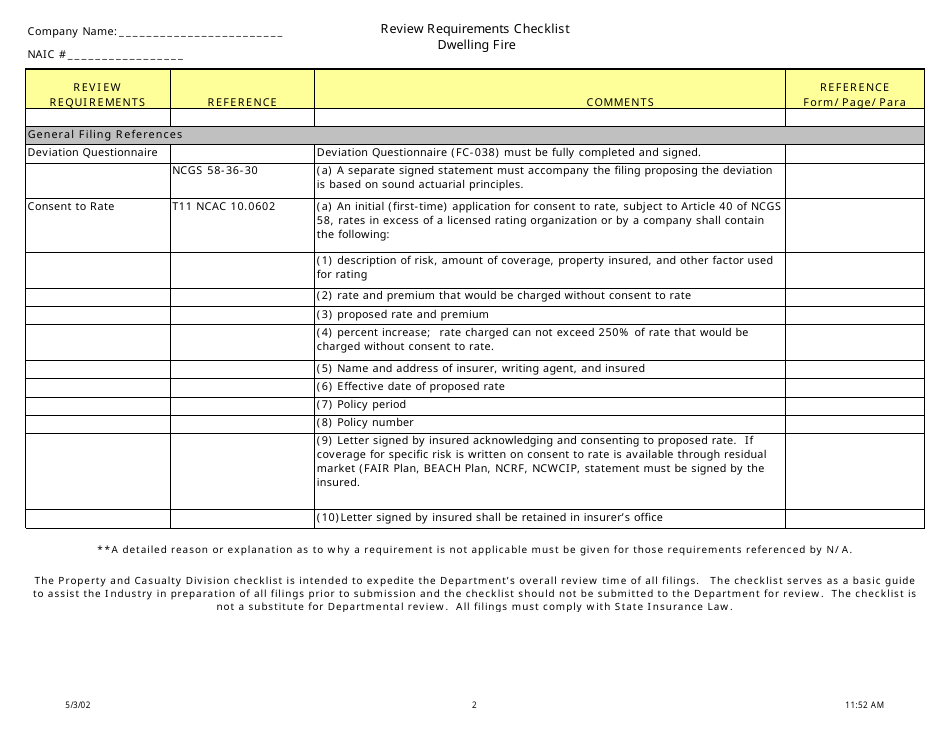

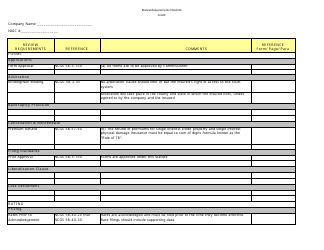

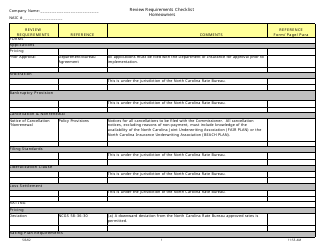

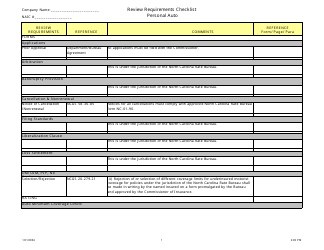

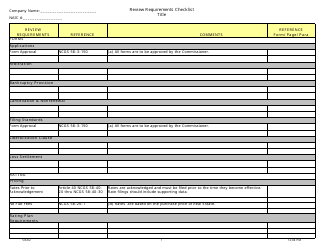

Review Requirements Checklist - Dwelling Fire - North Carolina

Review Requirements Checklist - Dwelling Fire is a legal document that was released by the North Carolina Department of Insurance - a government authority operating within North Carolina.

FAQ

Q: What is a dwelling fire policy?

A: A dwelling fire policy is an insurance policy that provides coverage for fire-related damage to a residential property.

Q: Who is eligible for a dwelling fire policy in North Carolina?

A: Homeowners and landlords who own residential properties in North Carolina are typically eligible for a dwelling fire policy.

Q: What does a dwelling fire policy in North Carolina cover?

A: A dwelling fire policy in North Carolina typically covers fire damage to the structure of a residential property and may also include coverage for other perils like lightning, windstorm, and smoke.

Q: What is not covered by a dwelling fire policy in North Carolina?

A: A dwelling fire policy in North Carolina usually does not cover personal belongings or liabilities of the property owner or landlord.

Q: How much coverage do I need for a dwelling fire policy in North Carolina?

A: The coverage amount for a dwelling fire policy in North Carolina should be sufficient to rebuild or repair the structure in case of a total or partial loss. It is recommended to consult with an insurance agent to determine the appropriate coverage amount.

Q: Are there any optional coverages available for a dwelling fire policy in North Carolina?

A: Yes, there may be optional coverages available for a dwelling fire policy in North Carolina, such as coverage for additional perils or protection for personal belongings.

Q: How can I purchase a dwelling fire policy in North Carolina?

A: You can purchase a dwelling fire policy in North Carolina through insurance companies or licensed insurance agents who offer this type of coverage.

Q: What factors can affect the cost of a dwelling fire policy in North Carolina?

A: The cost of a dwelling fire policy in North Carolina can be influenced by factors such as the location of the property, its construction materials, the desired coverage limits, and the insured's claims history.

Q: Is it required to have a dwelling fire policy in North Carolina?

A: A dwelling fire policy is generally not required by law in North Carolina, but it is highly recommended for homeowners and landlords to protect their investment and mitigate potential financial losses.

Q: Can I bundle a dwelling fire policy with other insurance policies in North Carolina?

A: Yes, some insurance companies in North Carolina may offer the option to bundle a dwelling fire policy with other insurance policies, such as homeowners insurance or landlord insurance, to potentially save on premiums.

Form Details:

- Released on May 3, 2002;

- The latest edition currently provided by the North Carolina Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Insurance.