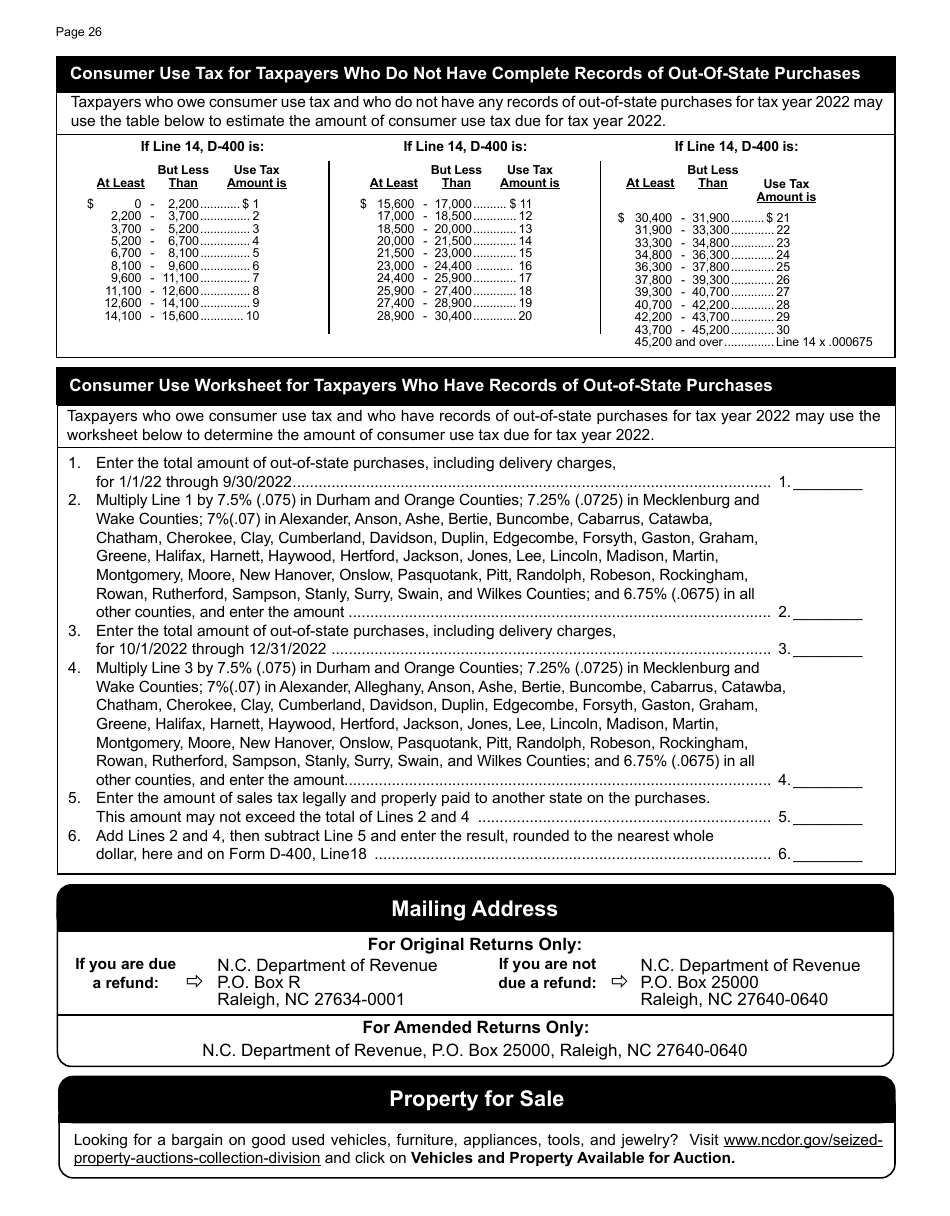

Instructions for Form D-400, D-400TC Schedule A, AM, PN, PN-1, S - North Carolina

This document contains official instructions for Schedule A , Schedule AM , Schedule PN , Schedule PN-1 , and Schedule S for Form D-400 , and Form D-400TC . . These documents are released and collected by the North Carolina Department of Revenue. An up-to-date fillable Form D-400 Schedule A is available for download through this link. The latest available Form D-400 Schedule PN can be downloaded through this link. Form D-400 Schedule PN-1 can be found here. The newest Form D-400 Schedule S can be downloaded here.

FAQ

Q: What is Form D-400?

A: Form D-400 is the individual income tax return form for residents of North Carolina.

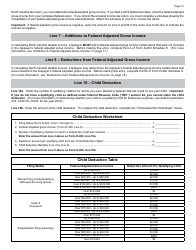

Q: What is Form D-400TC Schedule A?

A: Form D-400TC Schedule A is used to calculate deductions and credits for North Carolina taxpayers.

Q: What are the other schedules related to Form D-400?

A: The other schedules related to Form D-400 are AM, PN, PN-1, and S.

Q: What is Form D-400TC Schedule AM used for?

A: Form D-400TC Schedule AM is used to report additions and subtractions to income for North Carolina taxpayers.

Q: What is Form D-400TC Schedule PN used for?

A: Form D-400TC Schedule PN is used to report partnerships and S corporations income for North Carolina taxpayers.

Q: What is Form D-400TC Schedule PN-1 used for?

A: Form D-400TC Schedule PN-1 is used to report nonresident or part-year resident income for North Carolina taxpayers.

Q: What is Form D-400TC Schedule S used for?

A: Form D-400TC Schedule S is used to calculate the tax payable by a shareholder of an S corporation in North Carolina.

Instruction Details:

- This 28-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.