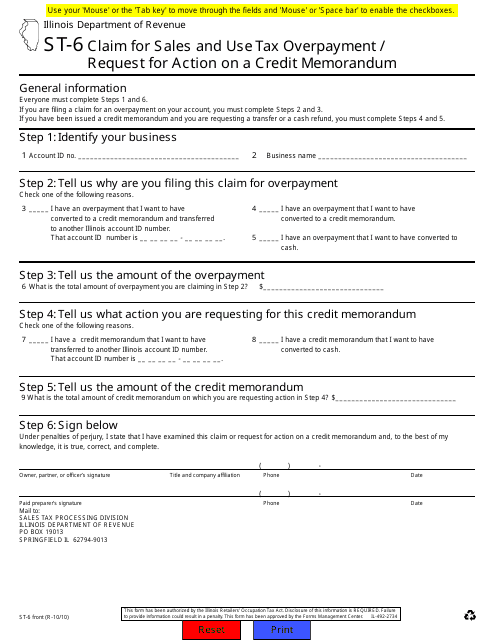

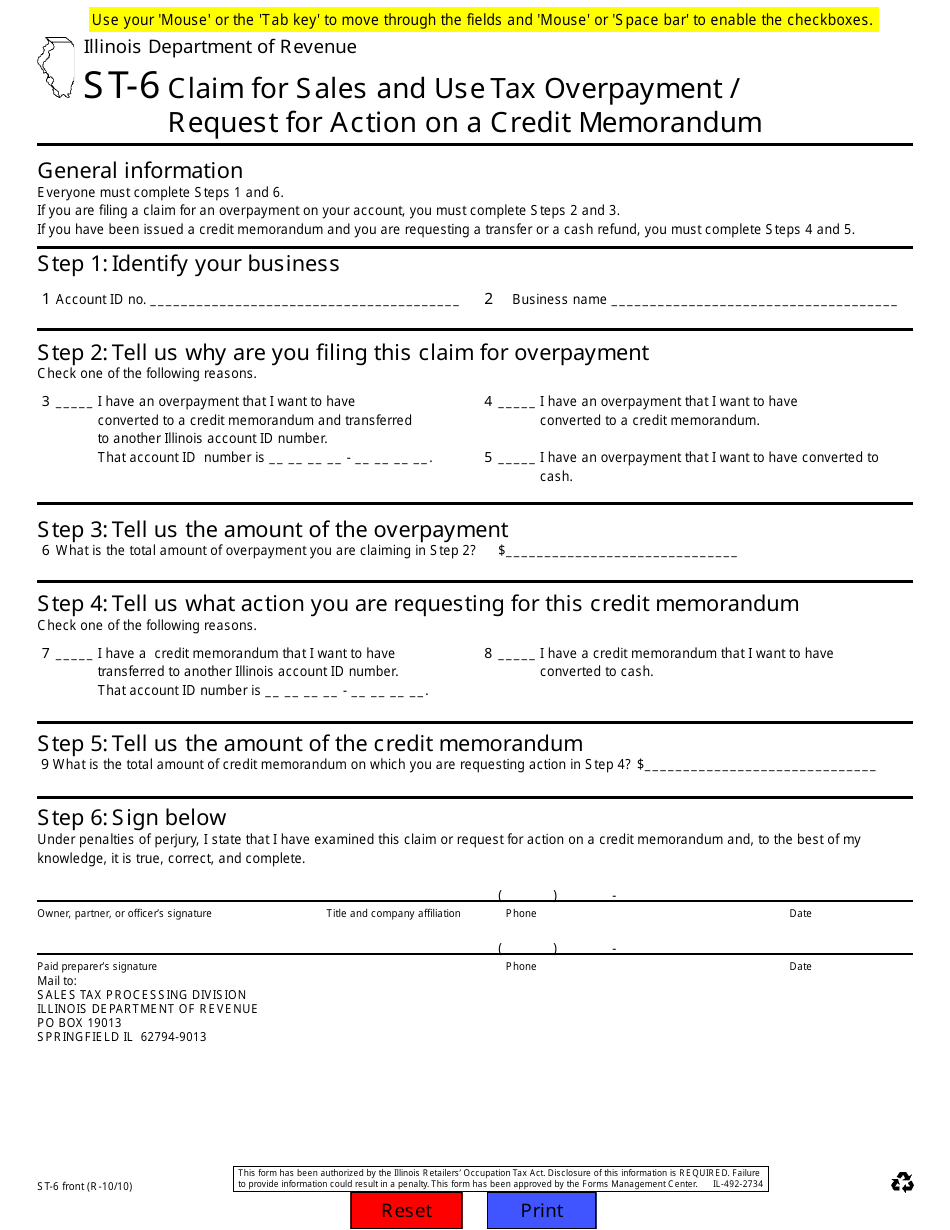

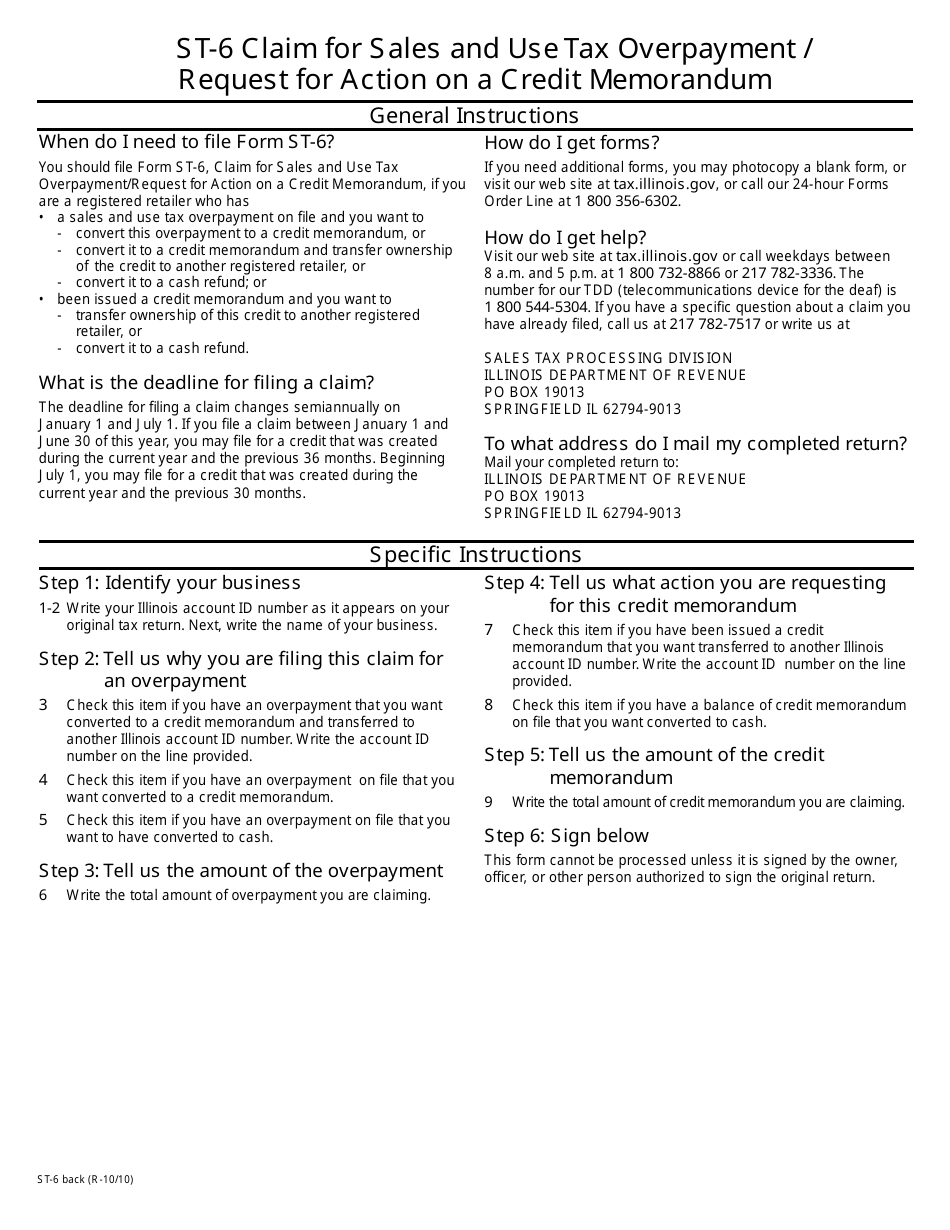

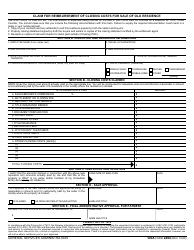

Form ST-6 Claim for Sales and Use Tax Overpayment / Request for Action on a Credit Memorandum - Illinois

What Is Form ST-6?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-6?

A: Form ST-6 is a claim form used in Illinois to request a refund for sales and use tax overpayment.

Q: What can I use Form ST-6 for?

A: You can use Form ST-6 to request a refund for sales and use tax overpayment or to request action on a credit memorandum.

Q: What information is required on Form ST-6?

A: Form ST-6 requires information such as the taxpayer's name, address, tax identification number, and details of the overpayment or credit memorandum.

Q: Is there a deadline to submit Form ST-6?

A: Yes, there is a deadline to submit Form ST-6. The form must be filed within 3 years from the date of payment or issuance of the credit memorandum.

Q: What happens after I submit Form ST-6?

A: After submitting Form ST-6, the Illinois Department of Revenue will review your claim and either issue a refund or take necessary action on the credit memorandum.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-6 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.