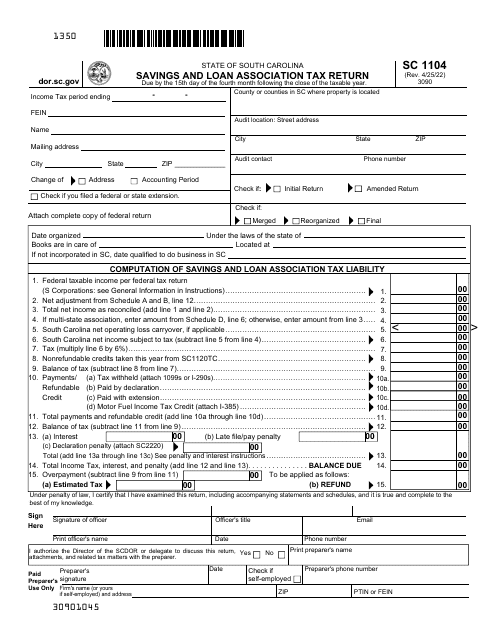

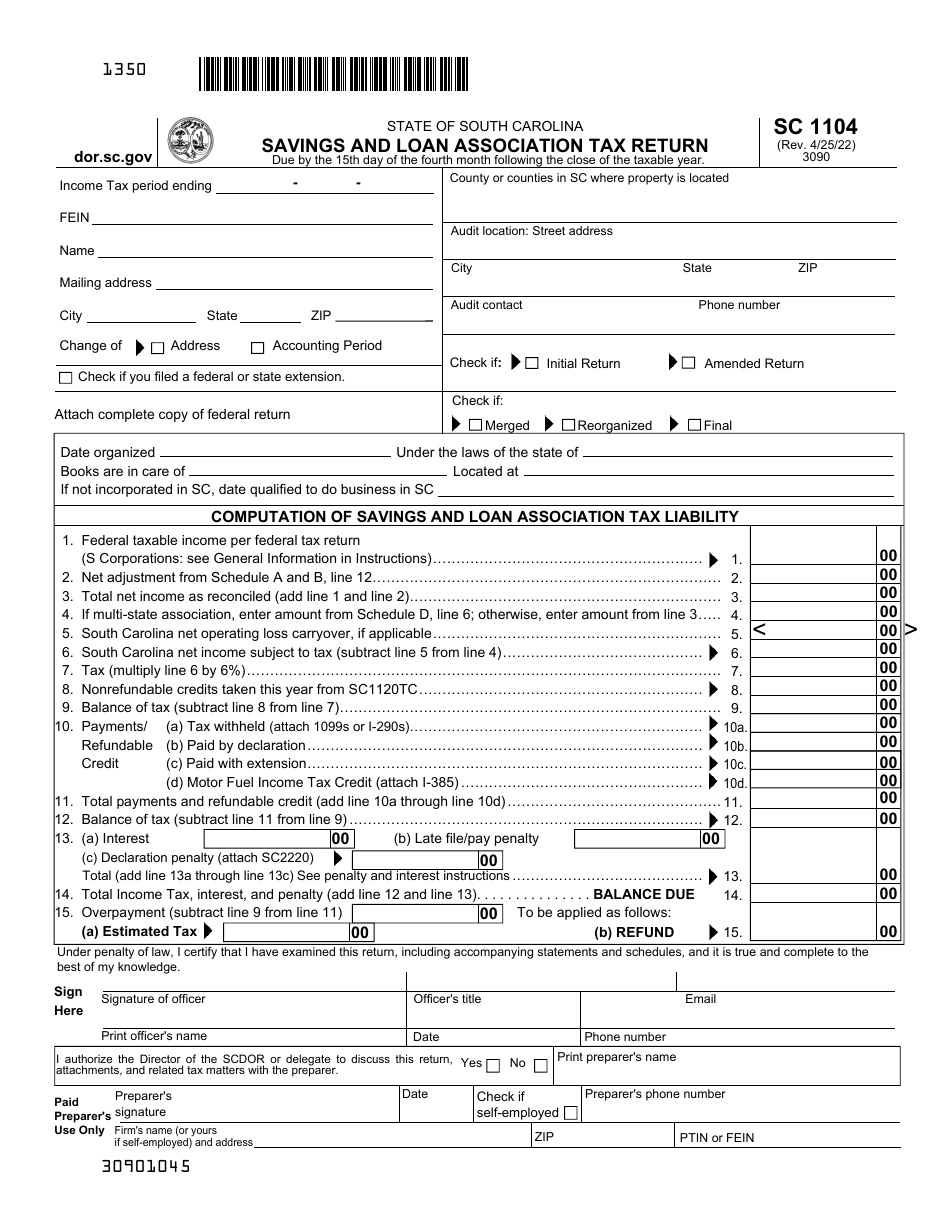

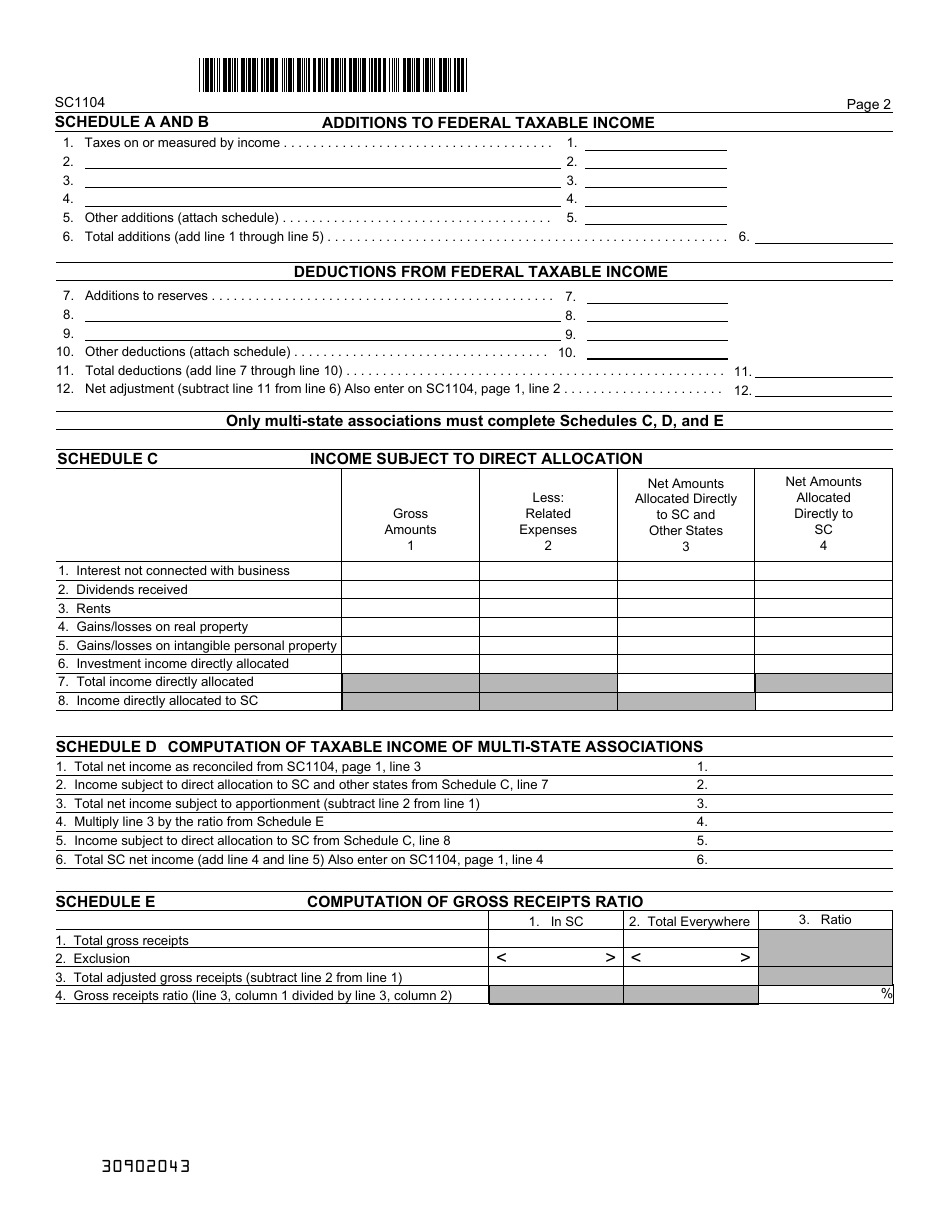

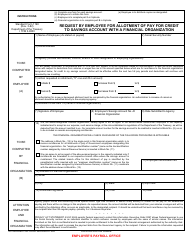

Form SC1104 Savings and Loan Association Tax Return - South Carolina

What Is Form SC1104?

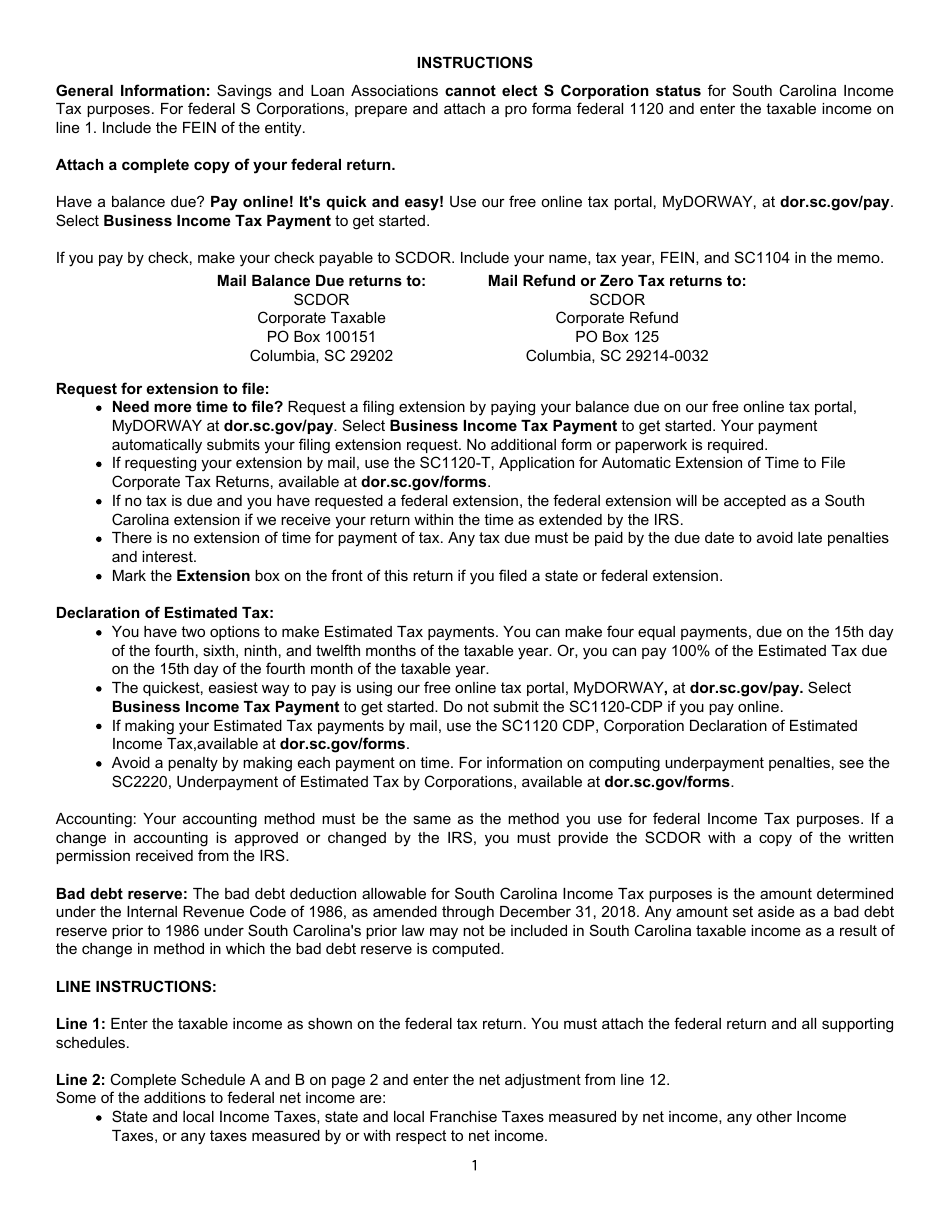

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SC1104?

A: Form SC1104 is the Savings and Loan Association Tax Return for South Carolina.

Q: Who needs to file Form SC1104?

A: Savings and Loan Associations in South Carolina need to file Form SC1104.

Q: What is the purpose of Form SC1104?

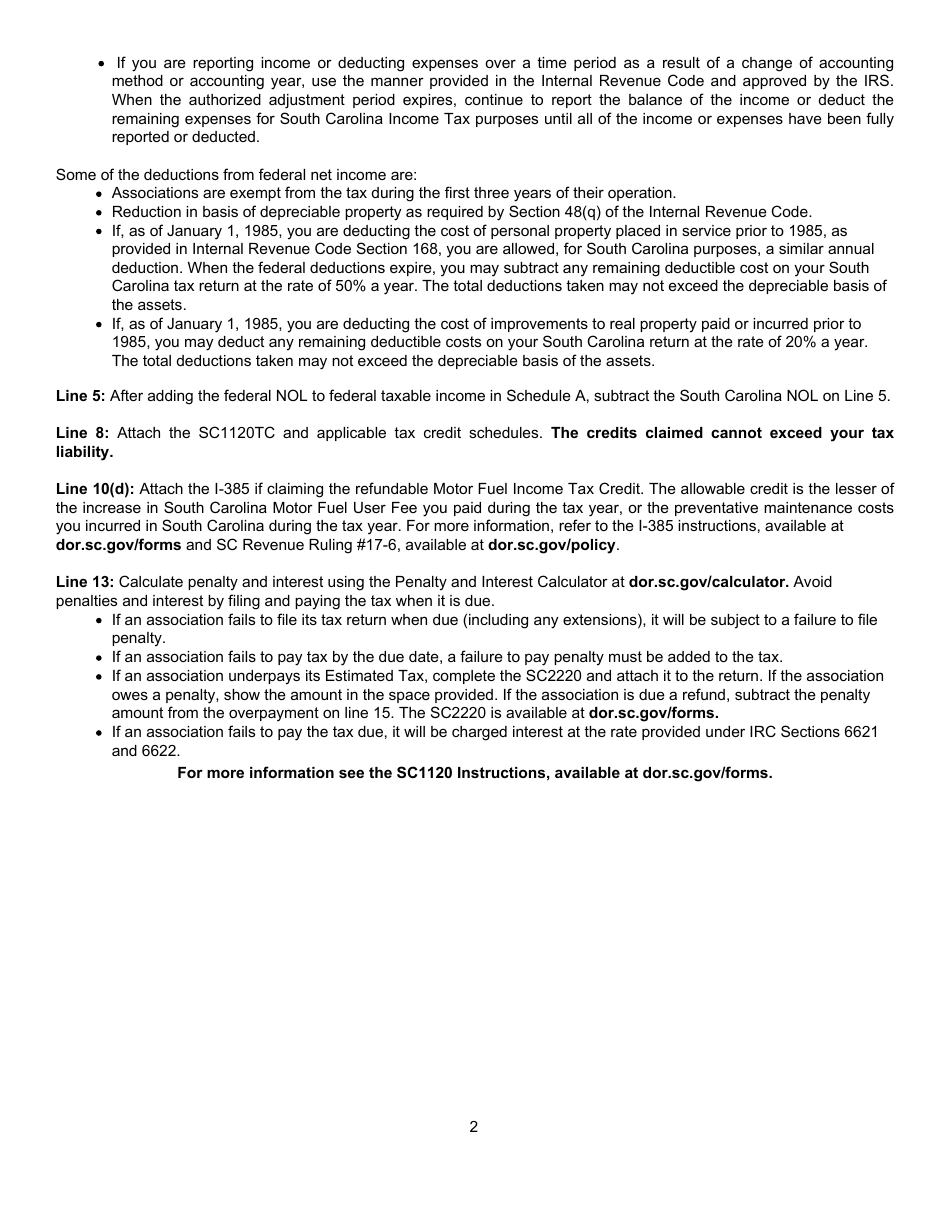

A: Form SC1104 is used to report and pay the state tax on income earned by Savings and Loan Associations in South Carolina.

Q: When is Form SC1104 due?

A: Form SC1104 is due on or before the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing of Form SC1104?

A: Yes, there are penalties for late filing of Form SC1104. It is important to file the form on time to avoid any penalties or interest charges.

Q: What supporting documents are required with Form SC1104?

A: The specific supporting documents required with Form SC1104 may vary. It is important to review the instructions provided with the form or consult with a tax professional.

Q: Is Form SC1104 the same as the federal tax return for Savings and Loan Associations?

A: No, Form SC1104 is specific to South Carolina and is separate from the federal tax return for Savings and Loan Associations.

Form Details:

- Released on April 25, 2022;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC1104 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.