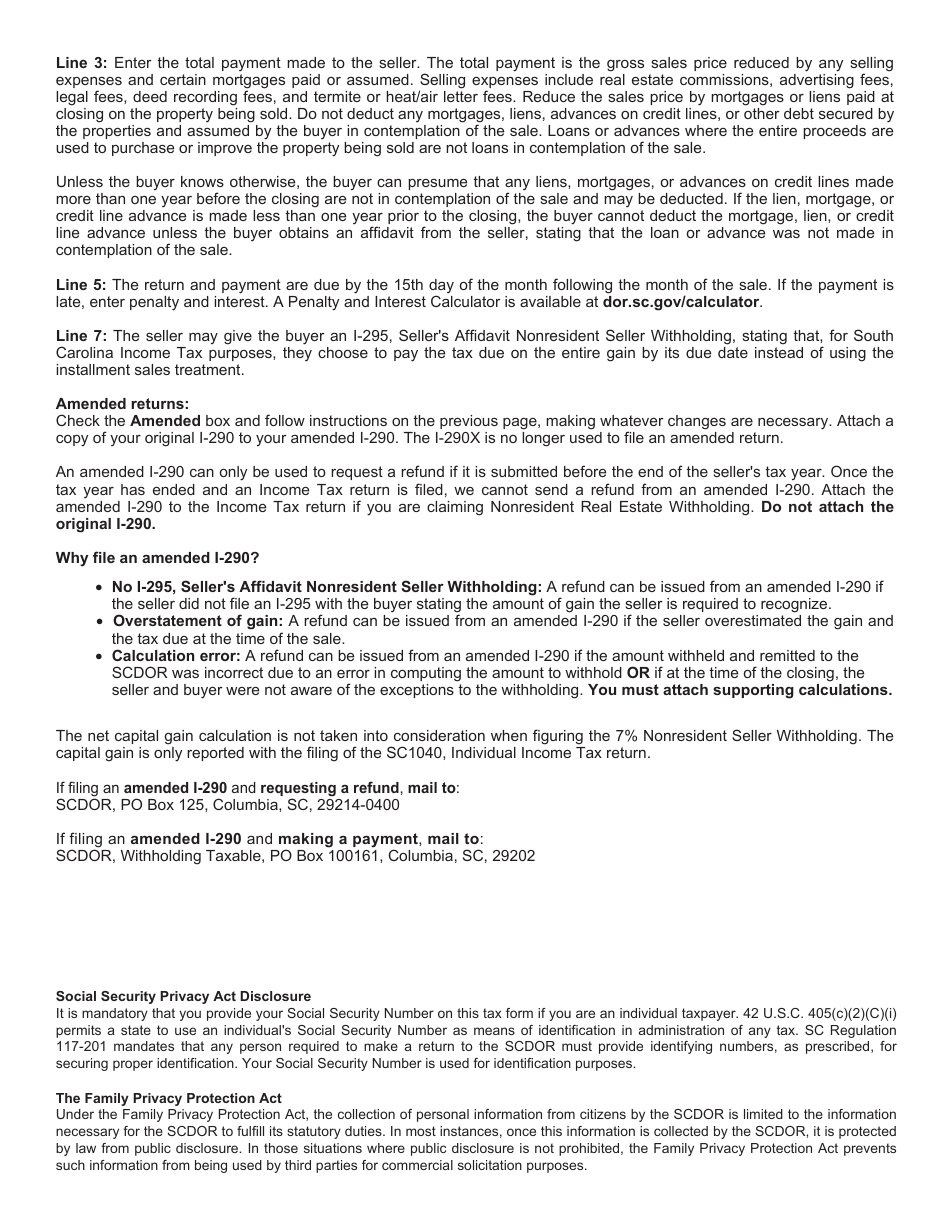

This version of the form is not currently in use and is provided for reference only. Download this version of

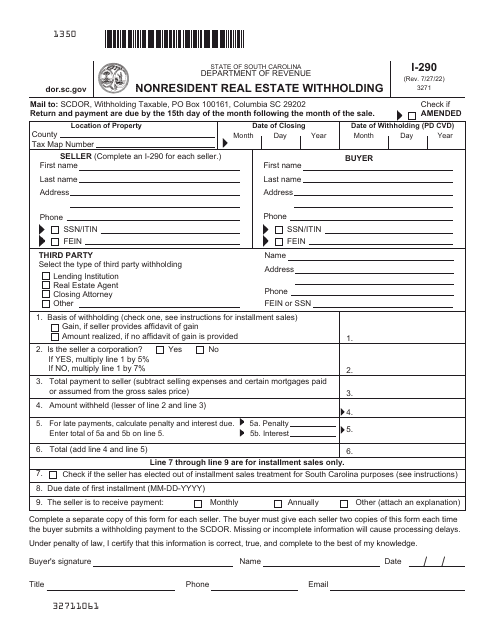

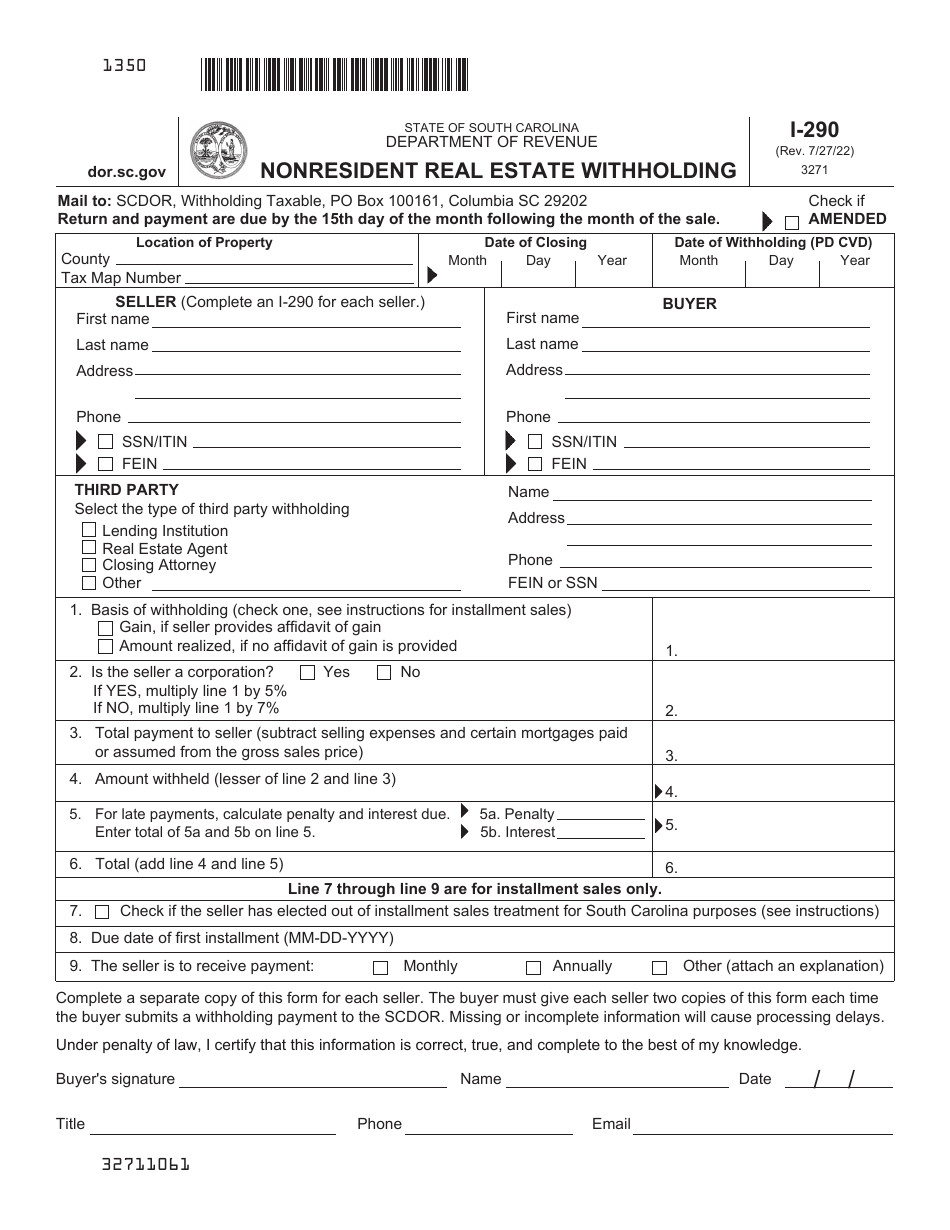

Form I-290

for the current year.

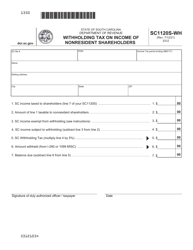

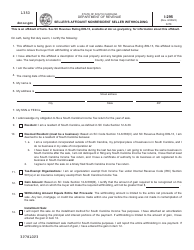

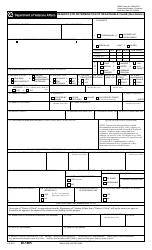

Form I-290 Nonresident Real Estate Withholding - South Carolina

What Is Form I-290?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

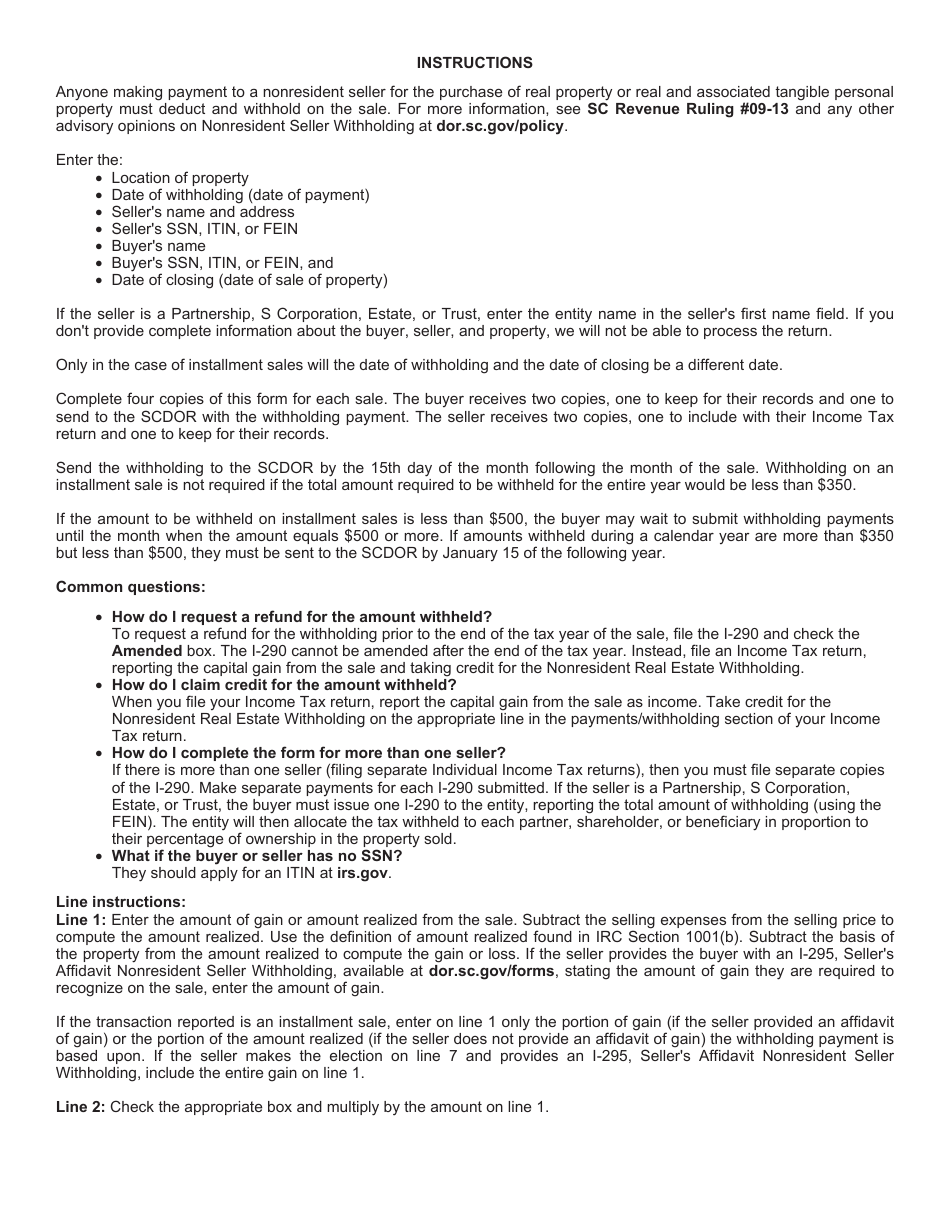

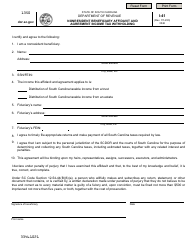

Q: What is Form I-290?

A: Form I-290 is a form used for nonresident real estate withholding.

Q: What is nonresident real estate withholding?

A: Nonresident real estate withholding is the process of withholding taxes on income from the sale of real estate by nonresidents.

Q: Why is nonresident real estate withholding required?

A: Nonresident real estate withholding is required to ensure that taxes are paid by nonresidents on their income from the sale of real estate.

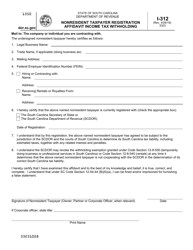

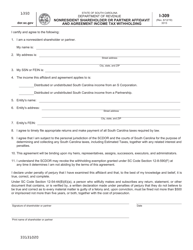

Q: Who needs to file Form I-290?

A: Anyone who is a nonresident and is selling real estate in South Carolina needs to file Form I-290.

Q: What happens if I don't file Form I-290?

A: If you don't file Form I-290, the buyer of the real estate may be required to withhold a percentage of the sales price and remit it to the South Carolina Department of Revenue.

Q: When should I file Form I-290?

A: Form I-290 should be filed no later than the day before the closing of the sale of the real estate.

Q: What documents do I need to include with Form I-290?

A: You will need to include a copy of the sales contract and a completed South Carolina Department of Revenue Form I-290.

Form Details:

- Released on July 27, 2022;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-290 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.