This version of the form is not currently in use and is provided for reference only. Download this version of

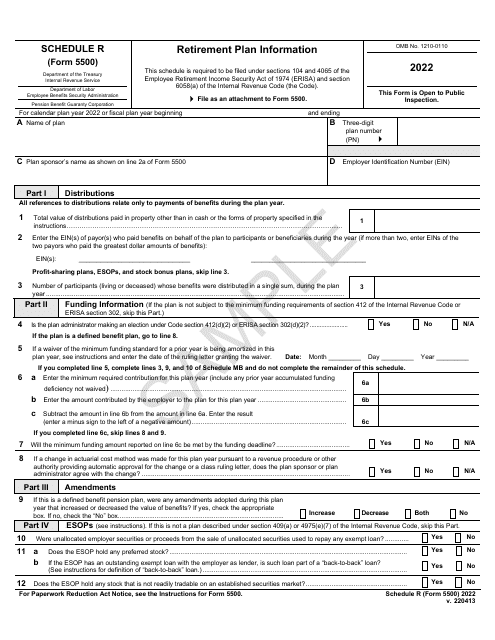

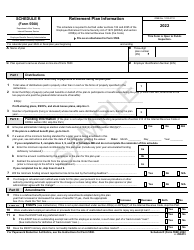

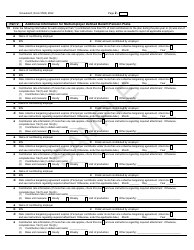

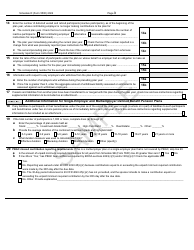

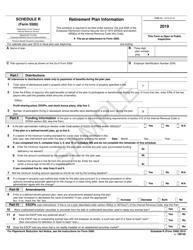

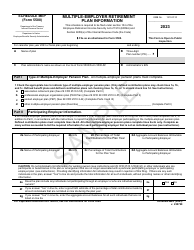

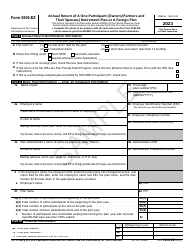

Form 5500 Schedule R

for the current year.

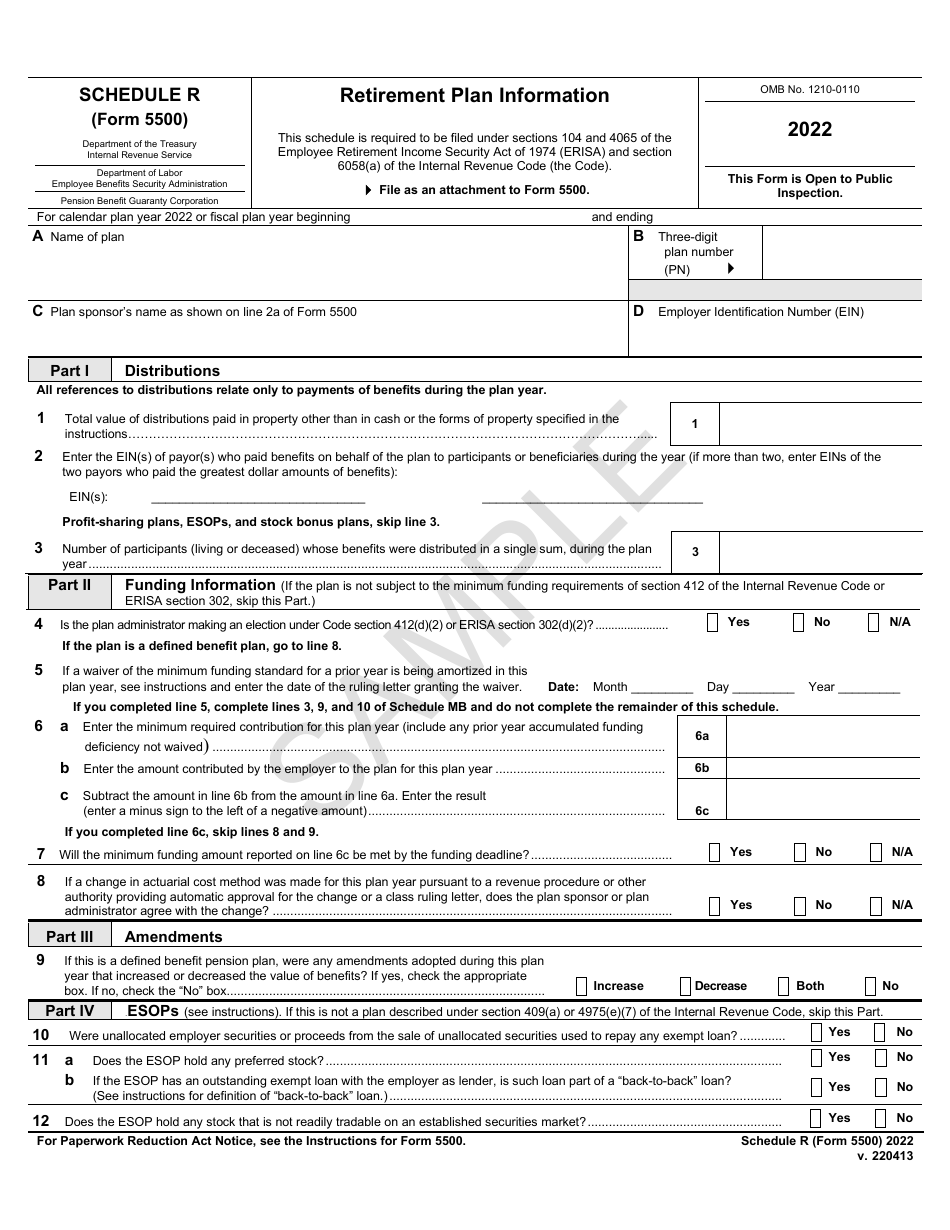

Form 5500 Schedule R Retirement Plan Information - Sample

What Is Form 5500 Schedule R?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration on April 13, 2022 and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule R?

A: Form 5500 Schedule R is a document used to report retirement plan information.

Q: Who needs to file Form 5500 Schedule R?

A: Employers who sponsor retirement plans are required to file Form 5500 Schedule R.

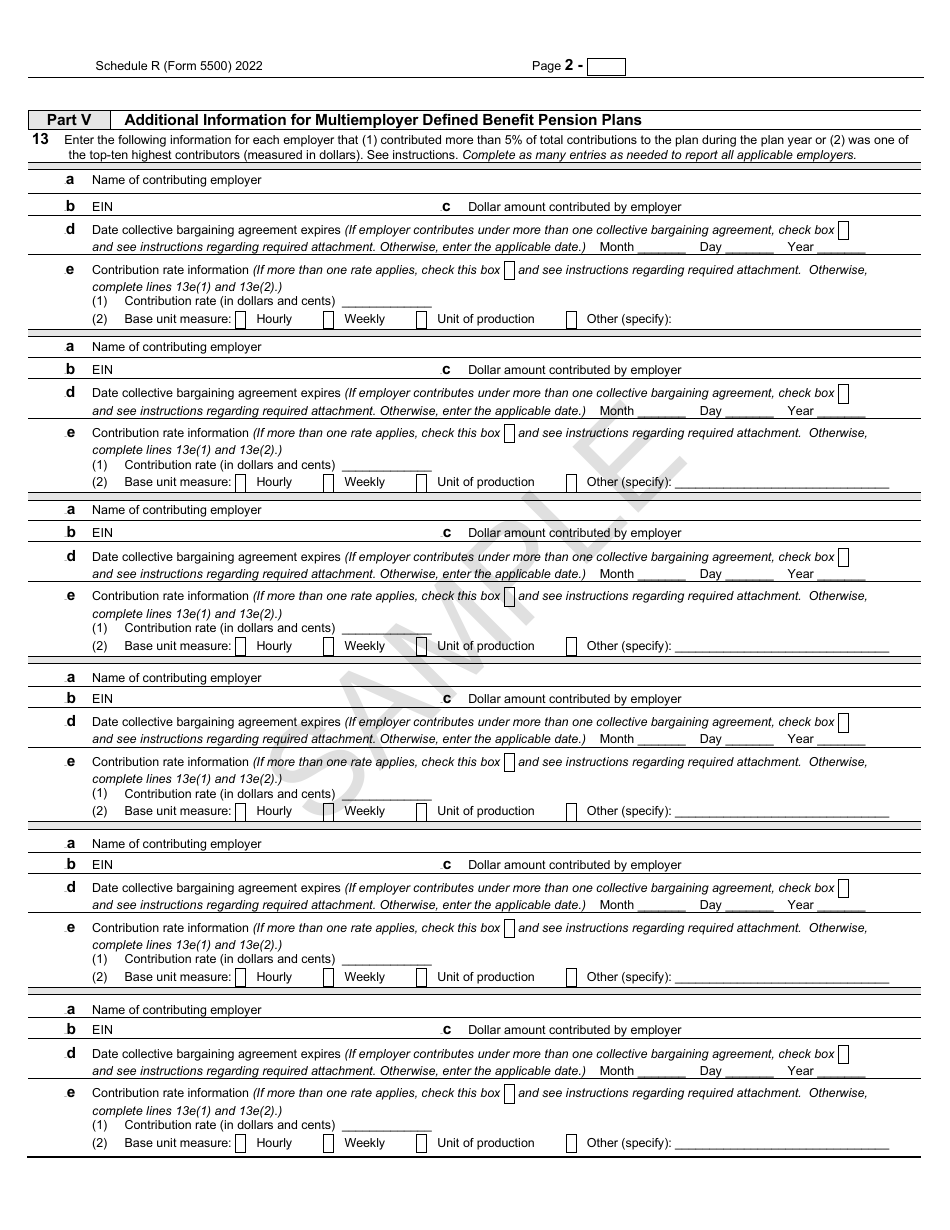

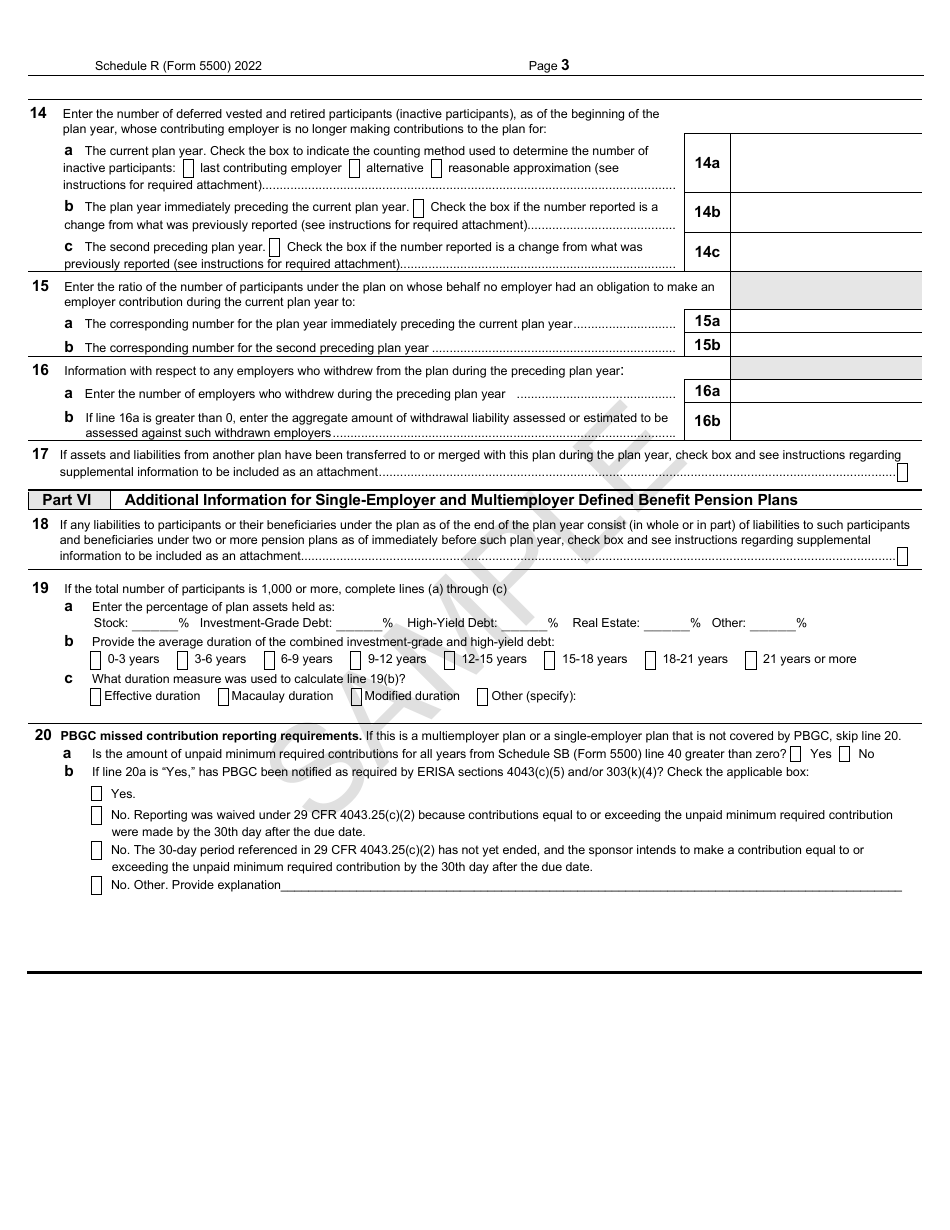

Q: What information is included in Form 5500 Schedule R?

A: Form 5500 Schedule R includes details about the retirement plan, such as the number of participants, contributions, and distributions.

Q: Do I need to attach any other forms with Form 5500 Schedule R?

A: Yes, you may need to attach other forms depending on the type of retirement plan you have.

Q: What is the purpose of Form 5500 Schedule R?

A: The purpose of Form 5500 Schedule R is to provide information to the government and participants about the financial condition of a retirement plan.

Q: When is the deadline for filing Form 5500 Schedule R?

A: Form 5500 Schedule R must generally be filed by the last day of the seventh month after the plan year ends.

Form Details:

- Released on April 13, 2022;

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule R by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.