This version of the form is not currently in use and is provided for reference only. Download this version of

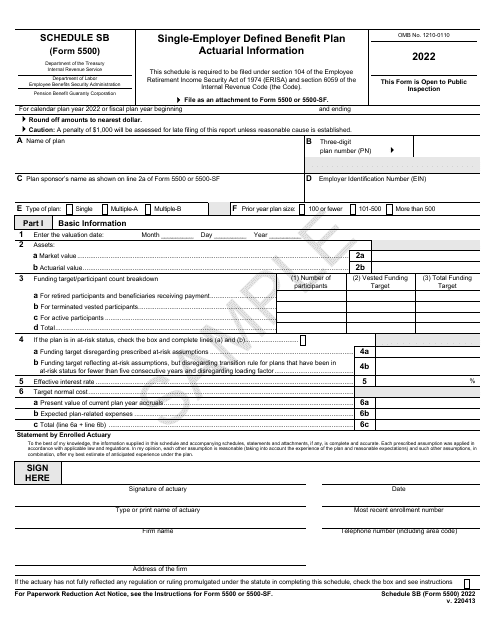

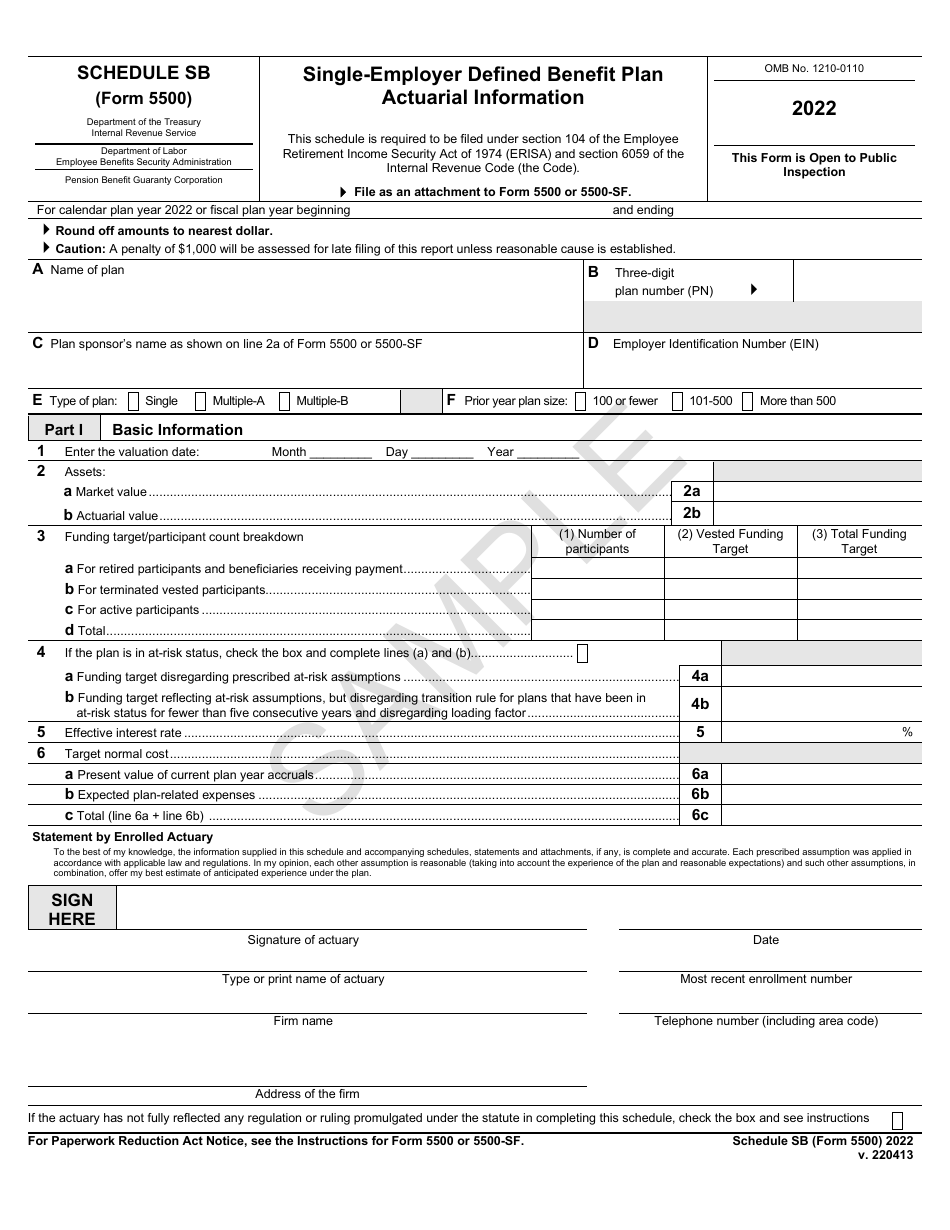

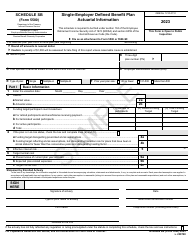

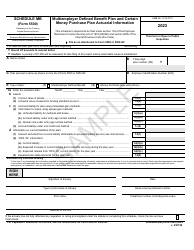

Form 5500 Schedule SB

for the current year.

Form 5500 Schedule SB Single-Employer Defined Benefit Plan Actuarial Information - Sample

What Is Form 5500 Schedule SB?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration on April 13, 2022 and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule SB?

A: Form 5500 Schedule SB is a form used to report actuarial information for single-employer defined benefit plans.

Q: What is a single-employer defined benefit plan?

A: A single-employer defined benefit plan is a retirement plan where the benefit amount is determined by a specified formula based on the employee's salary and years of service.

Q: Who needs to file Form 5500 Schedule SB?

A: Employers who sponsor single-employer defined benefit plans are required to file Form 5500 Schedule SB.

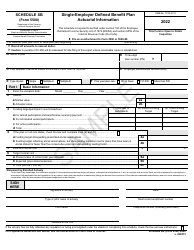

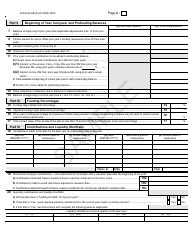

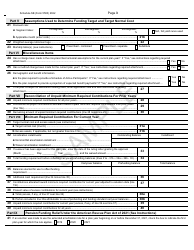

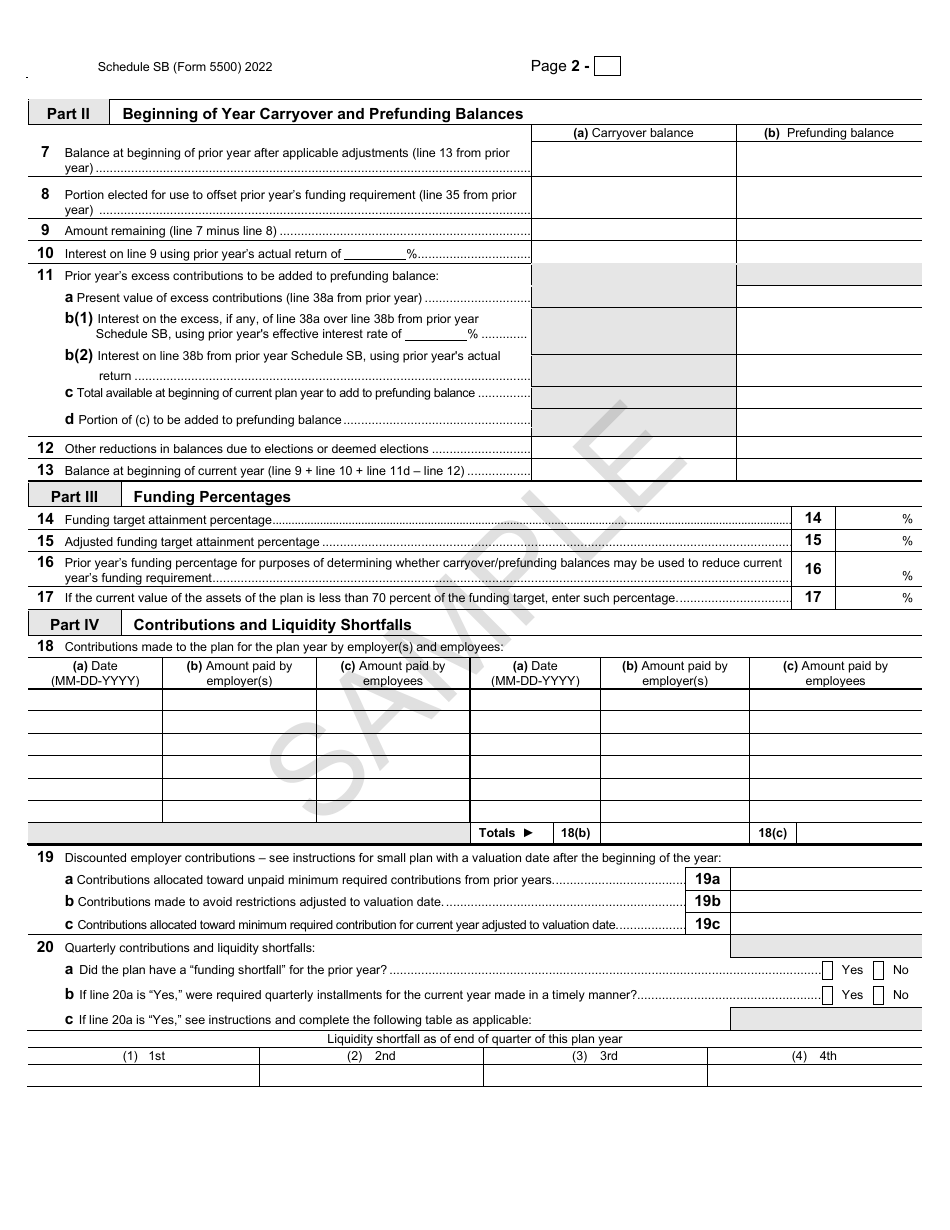

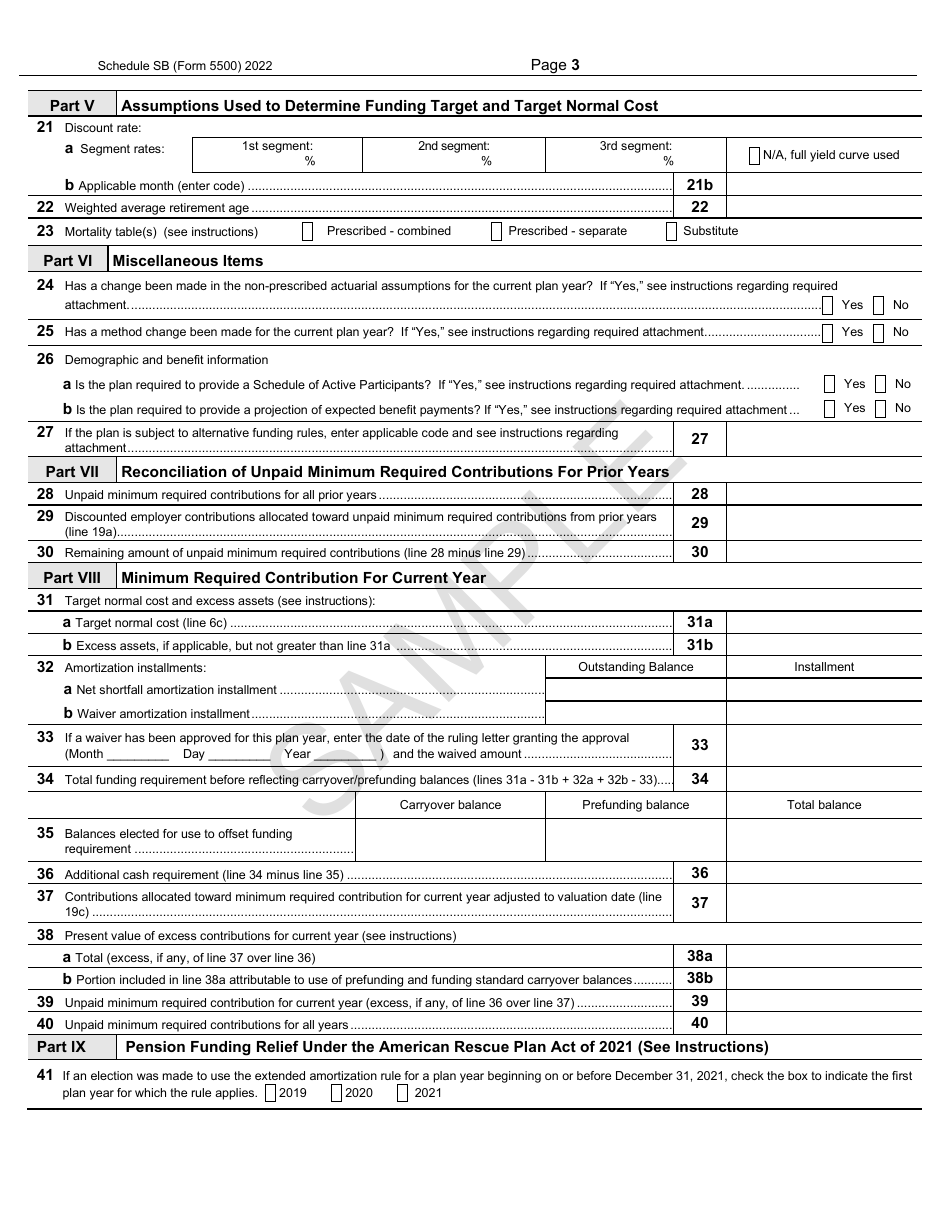

Q: What type of actuarial information is reported on Form 5500 Schedule SB?

A: Form 5500 Schedule SB reports information related to the funding and financial status of the defined benefit plan, including the plan's assets, liabilities, and actuarial assumptions.

Q: Is there a sample Form 5500 Schedule SB available?

A: Yes, there is a sample Form 5500 Schedule SB that can be used as a reference when preparing the form.

Form Details:

- Released on April 13, 2022;

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule SB by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.