This version of the form is not currently in use and is provided for reference only. Download this version of

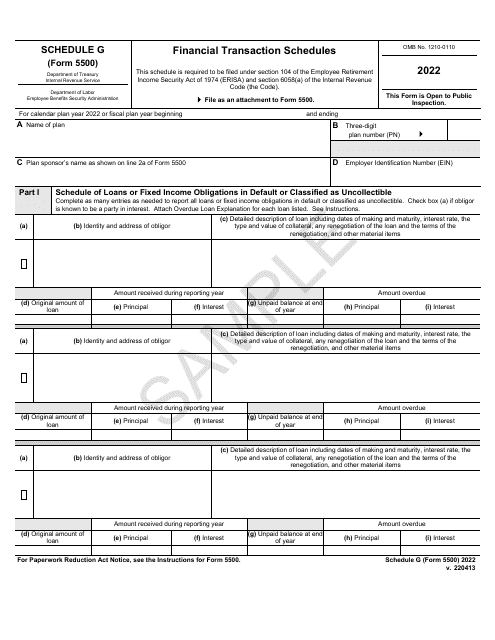

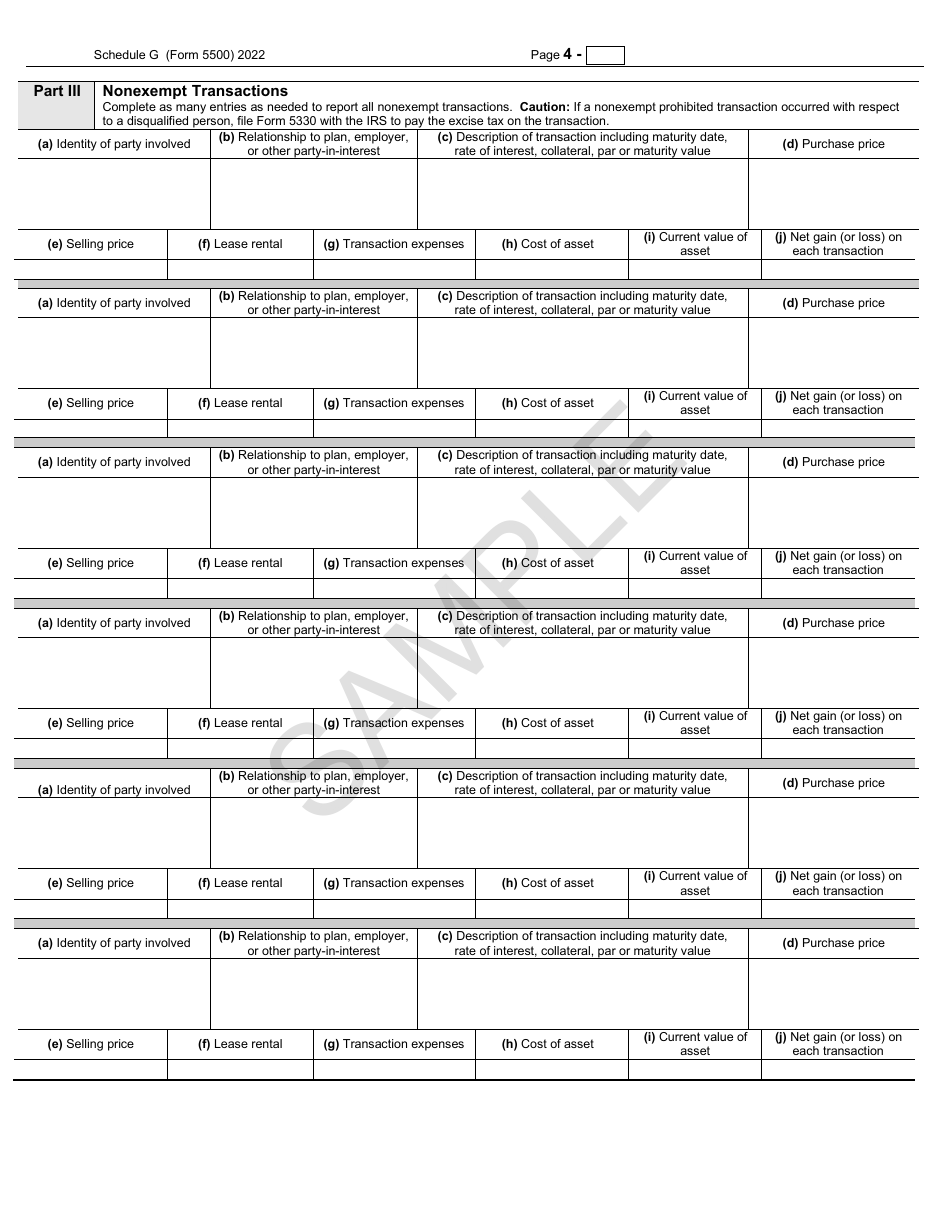

Form 5500 Schedule G

for the current year.

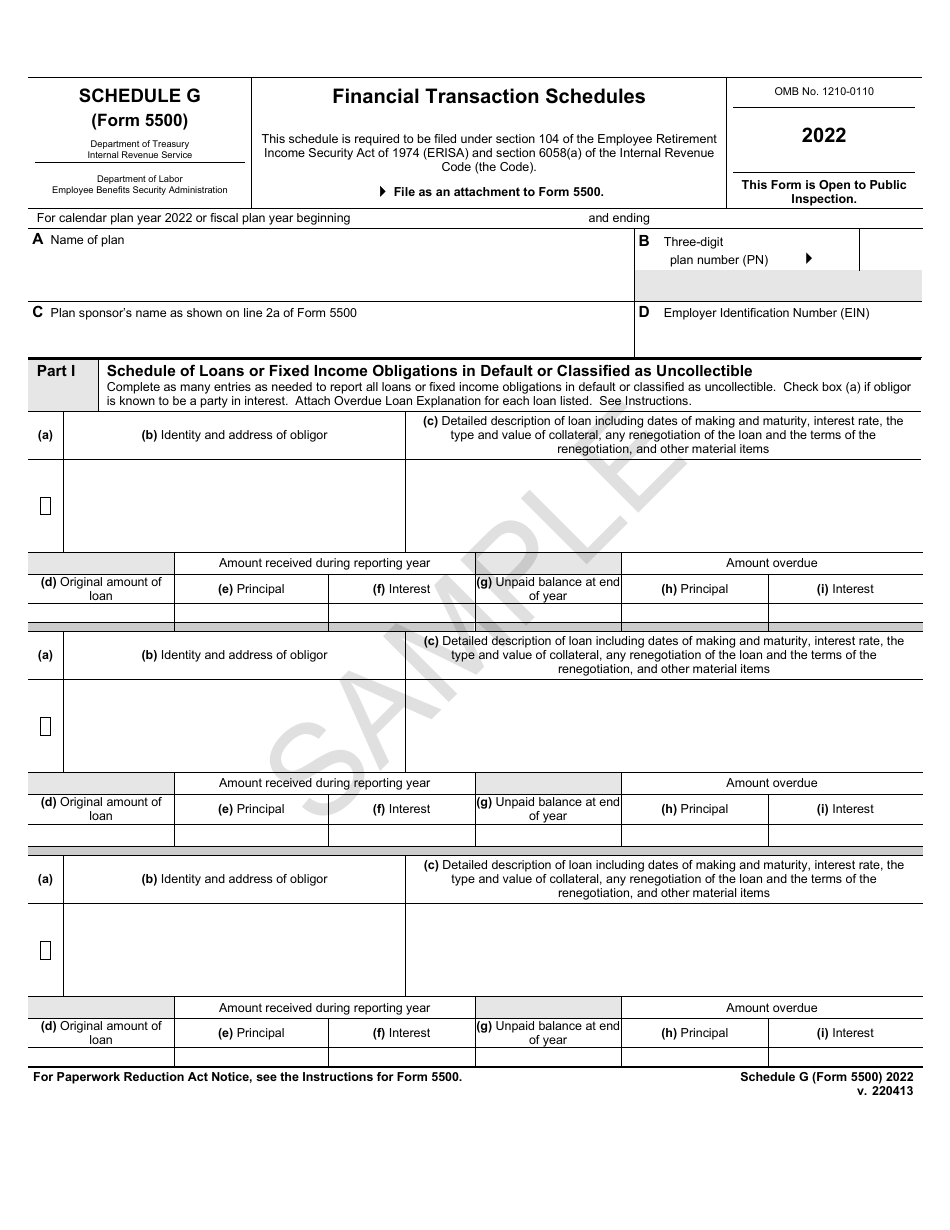

Form 5500 Schedule G Financial Transaction Schedules - Sample

What Is Form 5500 Schedule G?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration on April 13, 2022 and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule G?

A: Form 5500 Schedule G is a financial transaction schedule that provides detailed information about certain financial transactions related to employee benefit plans.

Q: Who needs to file Form 5500 Schedule G?

A: Employers or plan administrators of employee benefit plans that meet certain criteria are required to file Form 5500 Schedule G.

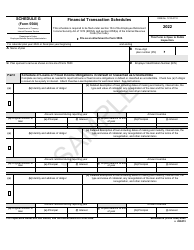

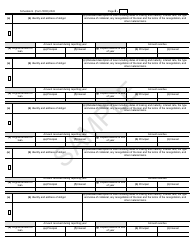

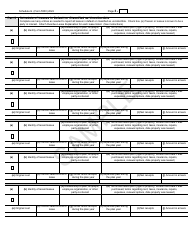

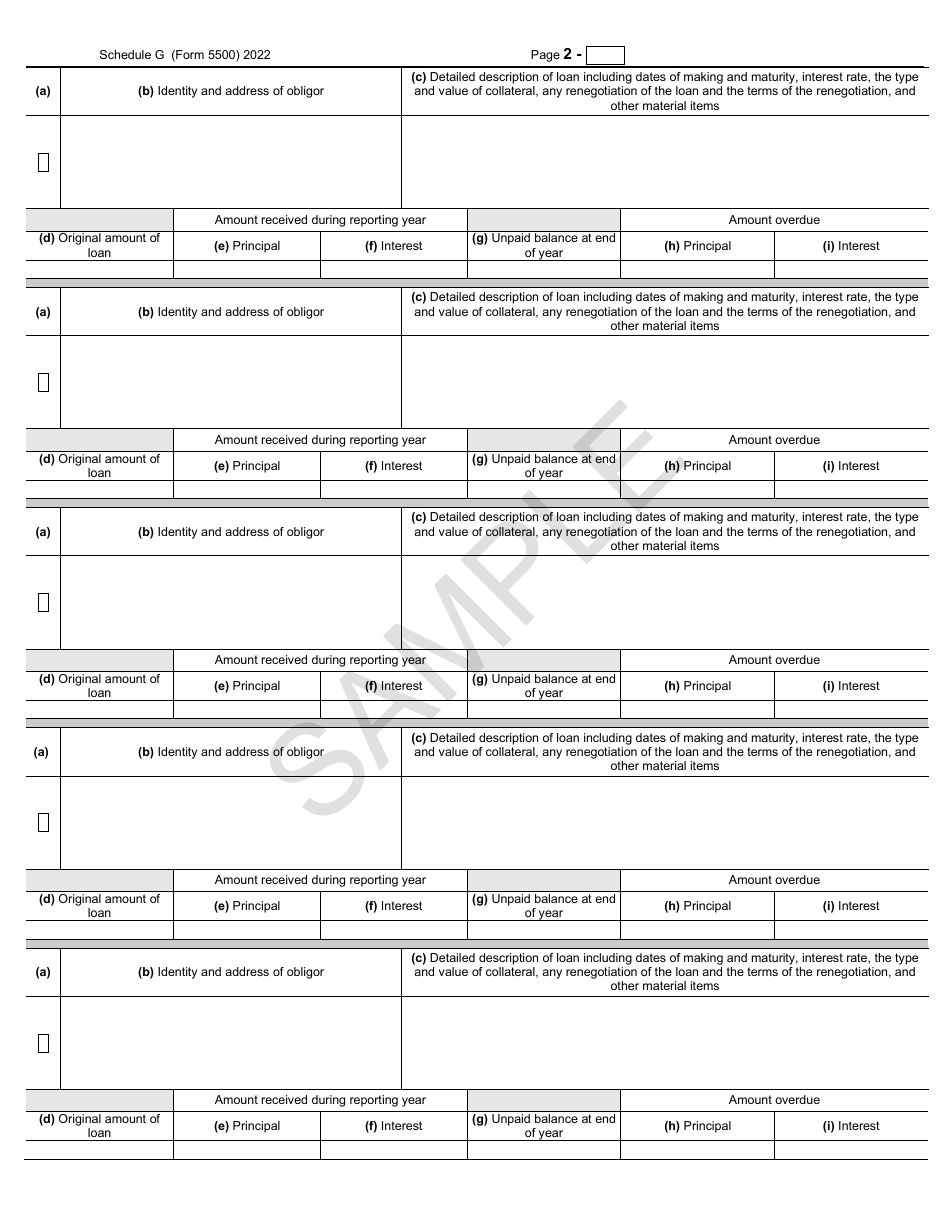

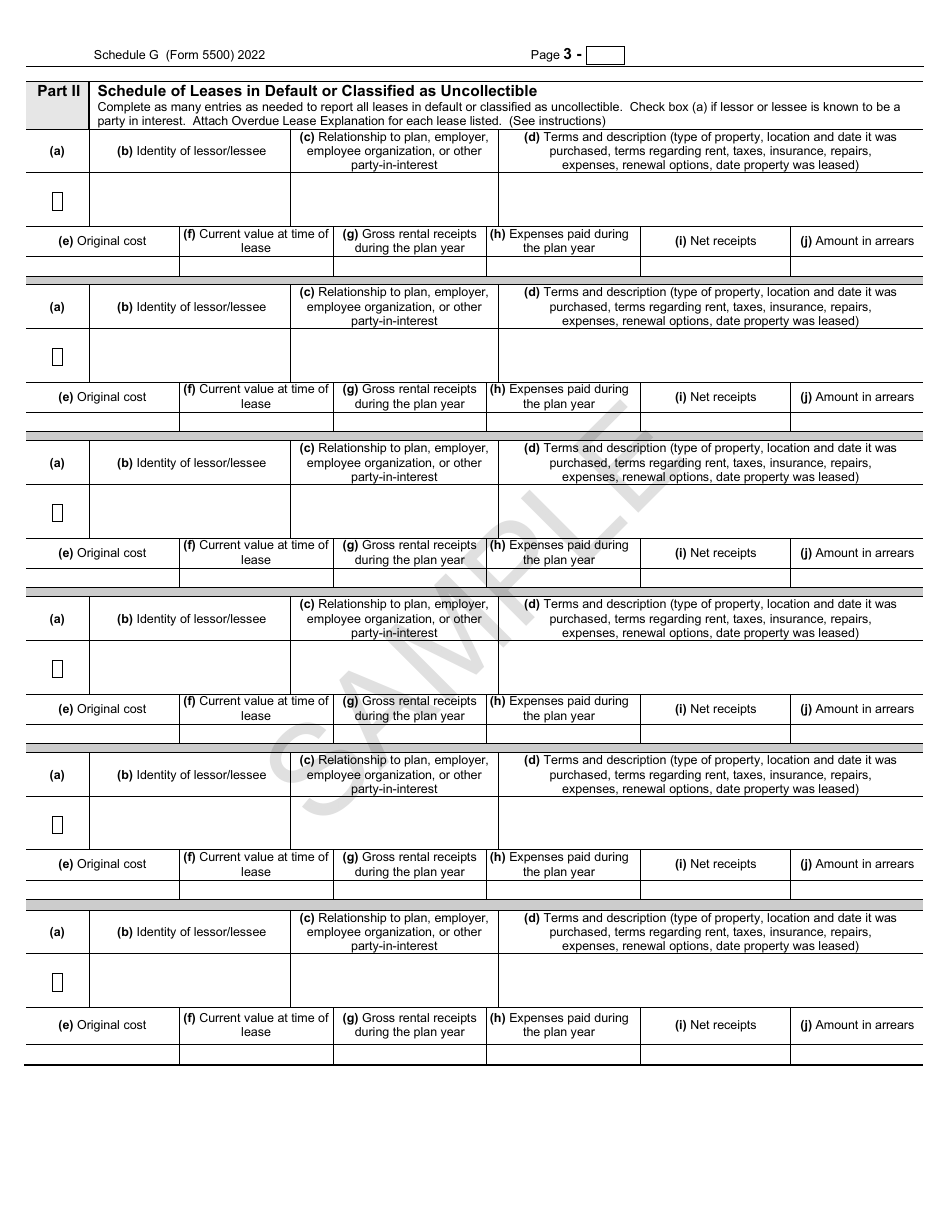

Q: What information is included in Form 5500 Schedule G?

A: Form 5500 Schedule G includes information about certain transactions, such as loans, leases, investments, and other financial activities related to employee benefit plans.

Q: How often is Form 5500 Schedule G filed?

A: Form 5500 Schedule G is generally filed annually along with Form 5500, the Annual Return/Report of Employee Benefit Plan.

Q: Is Form 5500 Schedule G available to the public?

A: Yes, Form 5500 Schedule G is part of the public disclosure materials for employee benefit plans and is available for public inspection.

Form Details:

- Released on April 13, 2022;

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule G by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.