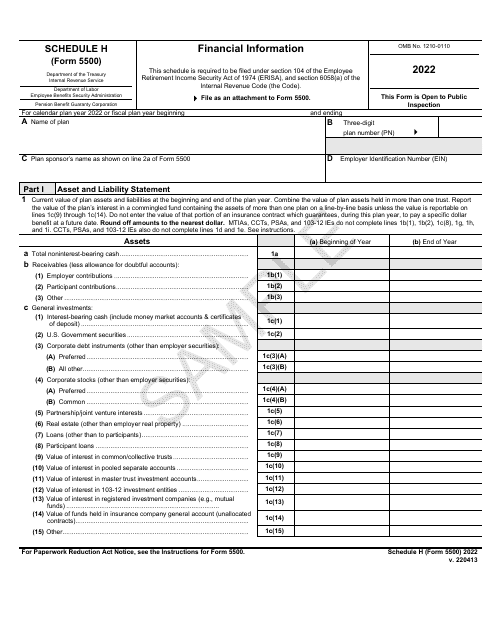

This version of the form is not currently in use and is provided for reference only. Download this version of

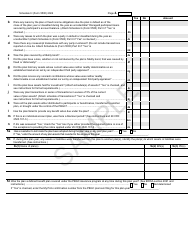

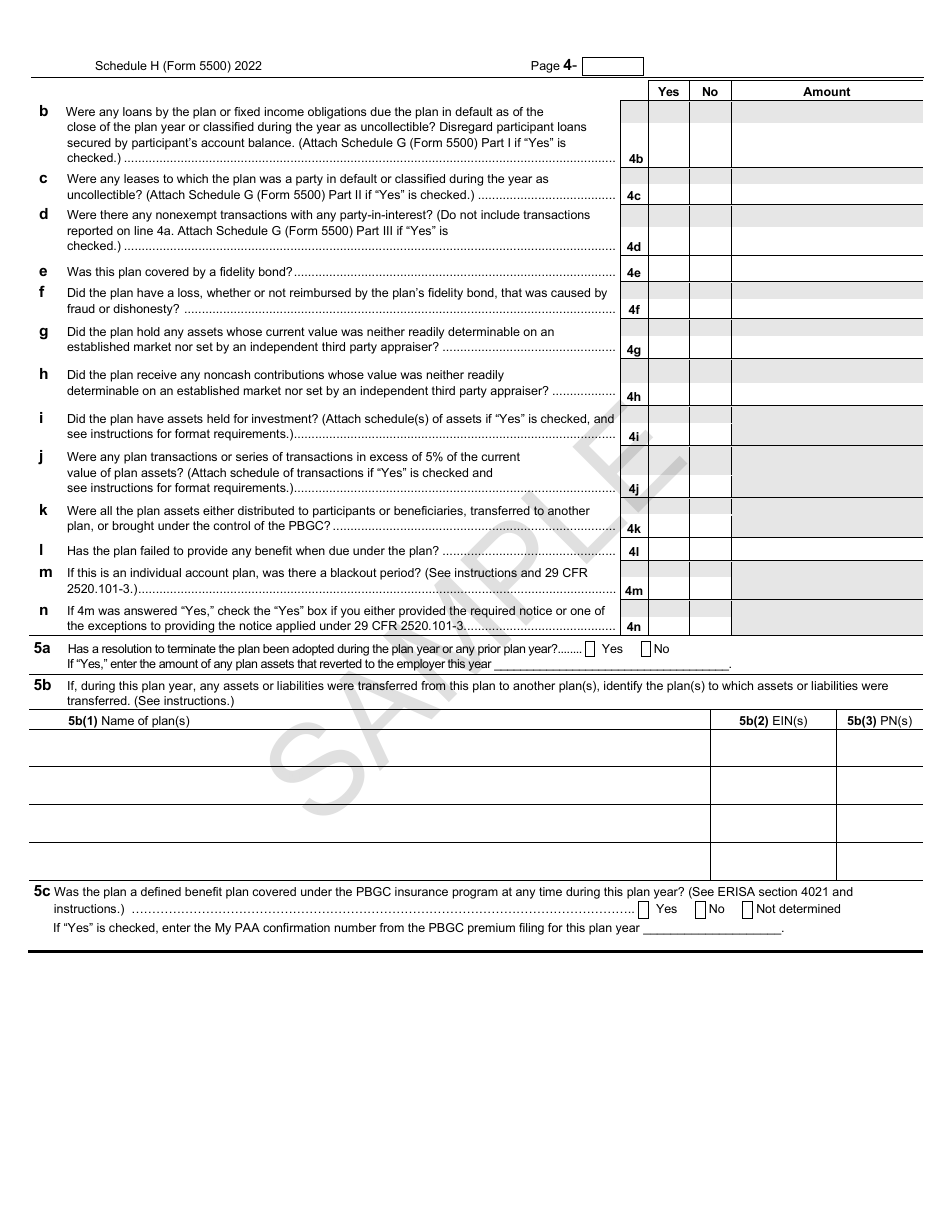

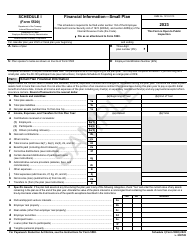

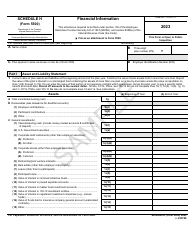

Form 5500 Schedule H

for the current year.

Form 5500 Schedule H Financial Information - Sample

What Is Form 5500 Schedule H?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration on April 13, 2022 and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule H?

A: Form 5500 Schedule H is a document used to report financial information for employee benefit plans.

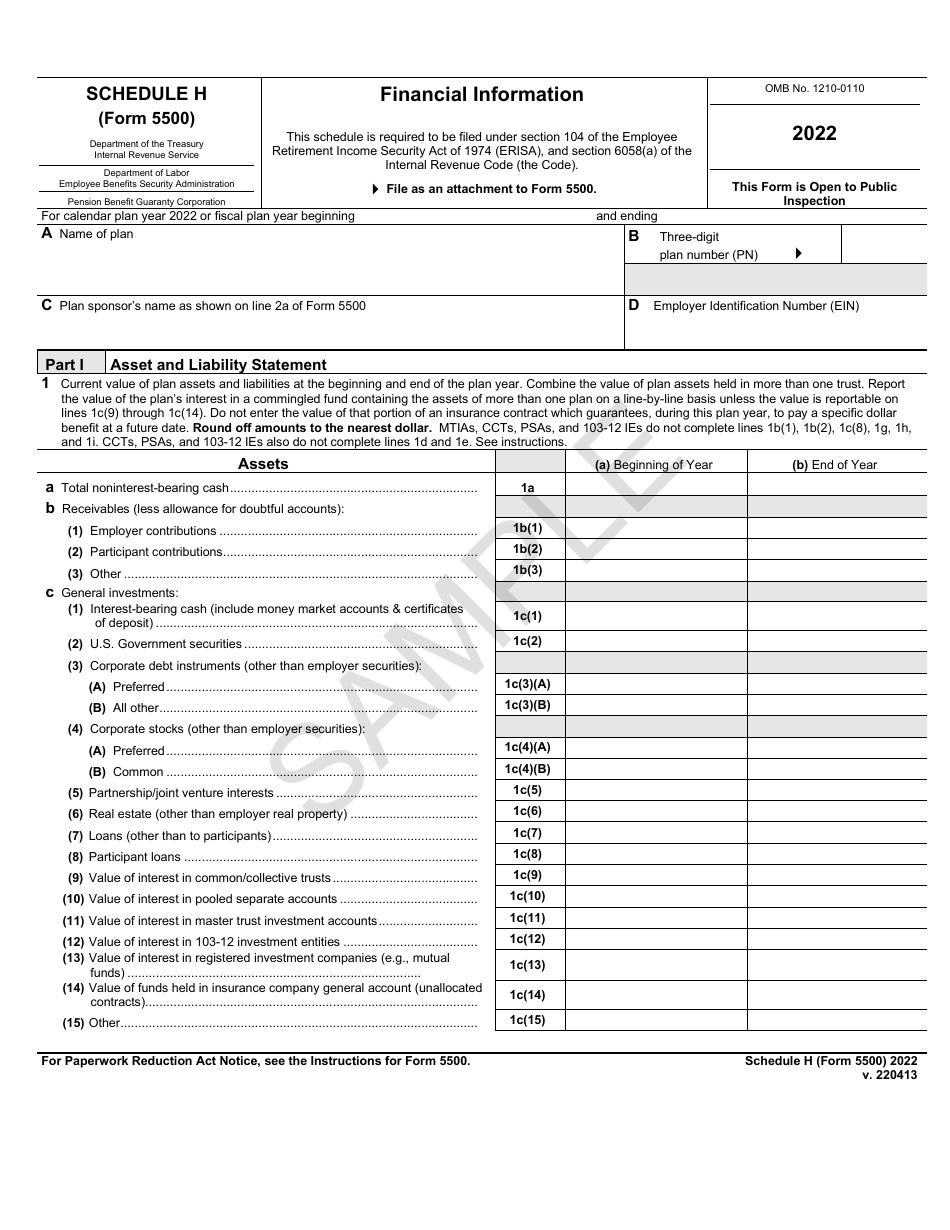

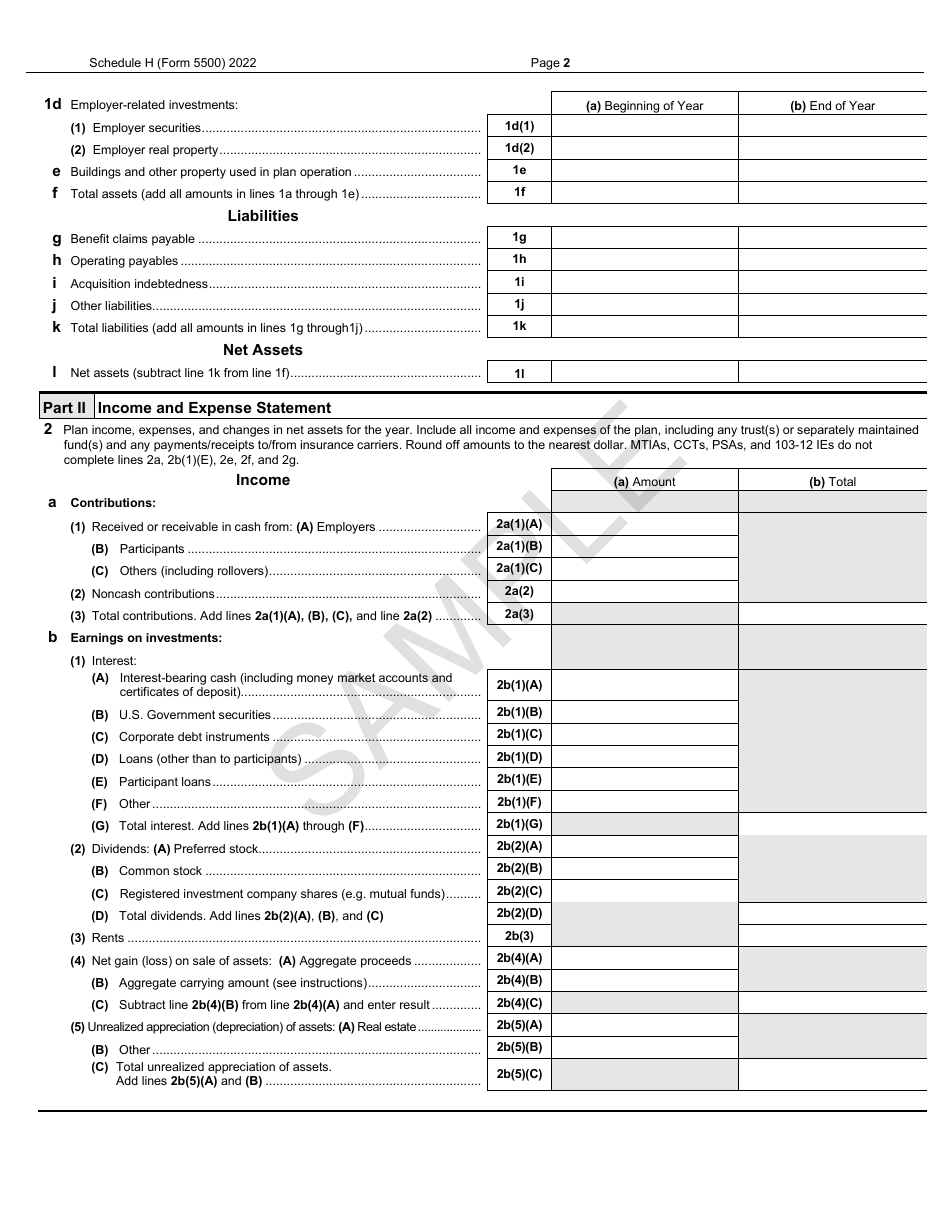

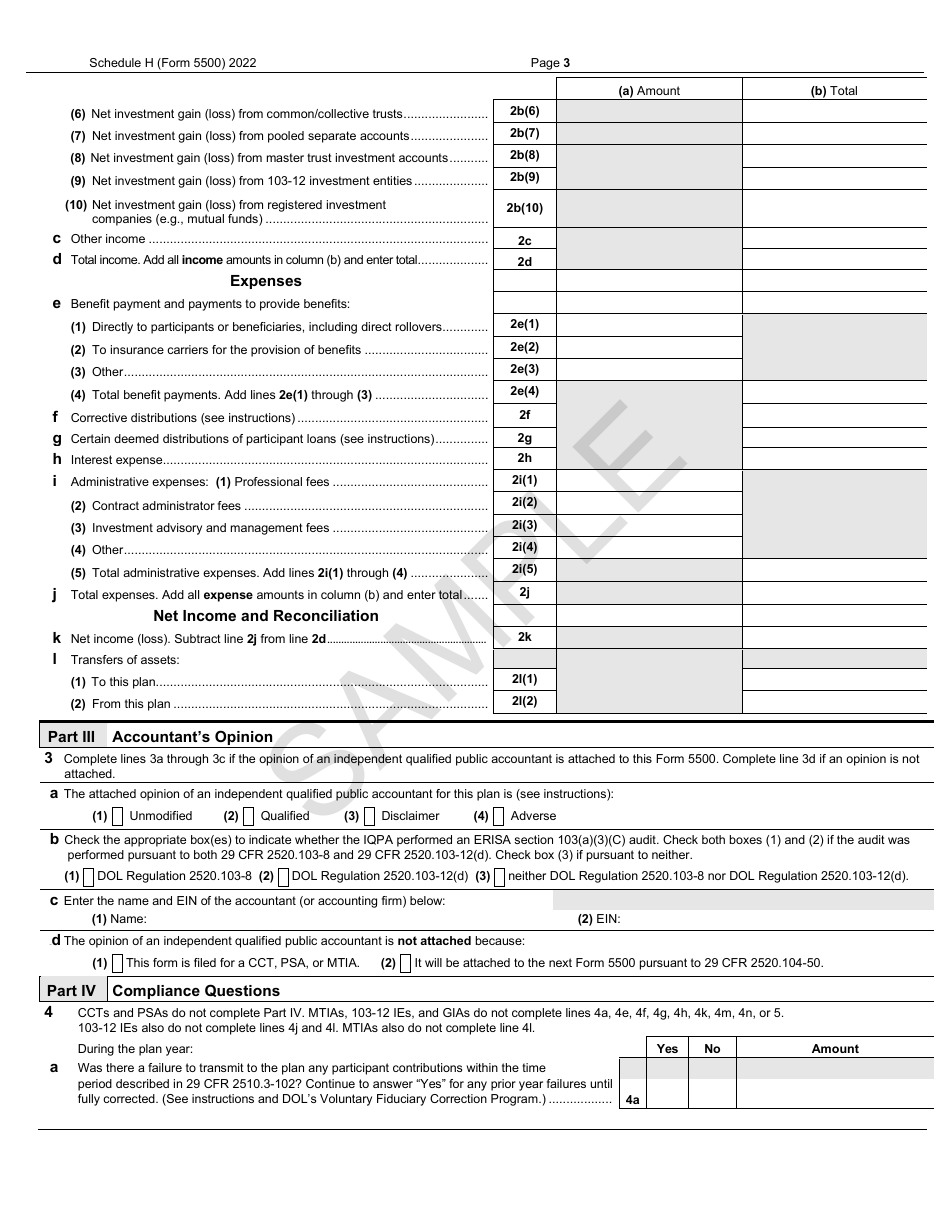

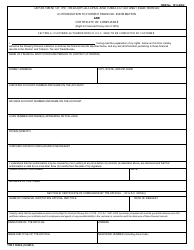

Q: What kind of financial information is included in Form 5500 Schedule H?

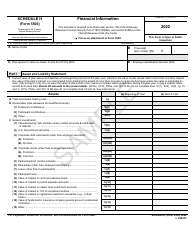

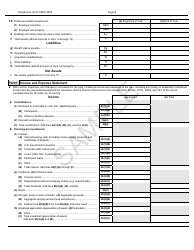

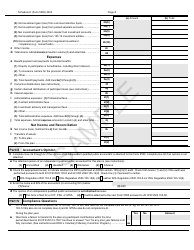

A: Form 5500 Schedule H includes information about the plan's assets, liabilities, income, and expenses.

Q: Who is required to file Form 5500 Schedule H?

A: Employers who sponsor employee benefit plans, such as retirement plans or health insurance plans, are required to file Form 5500 Schedule H.

Q: Are there any filing deadlines for Form 5500 Schedule H?

A: Yes, Form 5500 Schedule H must be filed annually, and the filing deadline is the last day of the seventh month after the end of the plan year.

Q: Is there a penalty for not filing Form 5500 Schedule H?

A: Yes, there are penalties for late or non-filing of Form 5500 Schedule H, which can vary depending on the size of the plan and the length of the delay.

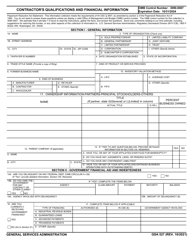

Form Details:

- Released on April 13, 2022;

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule H by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.