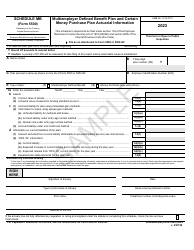

This version of the form is not currently in use and is provided for reference only. Download this version of

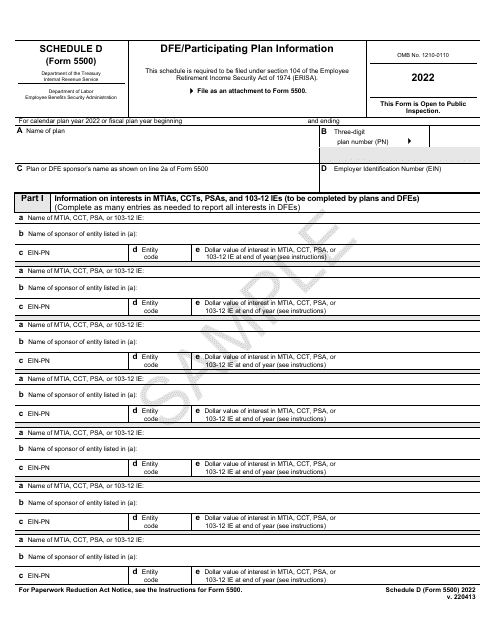

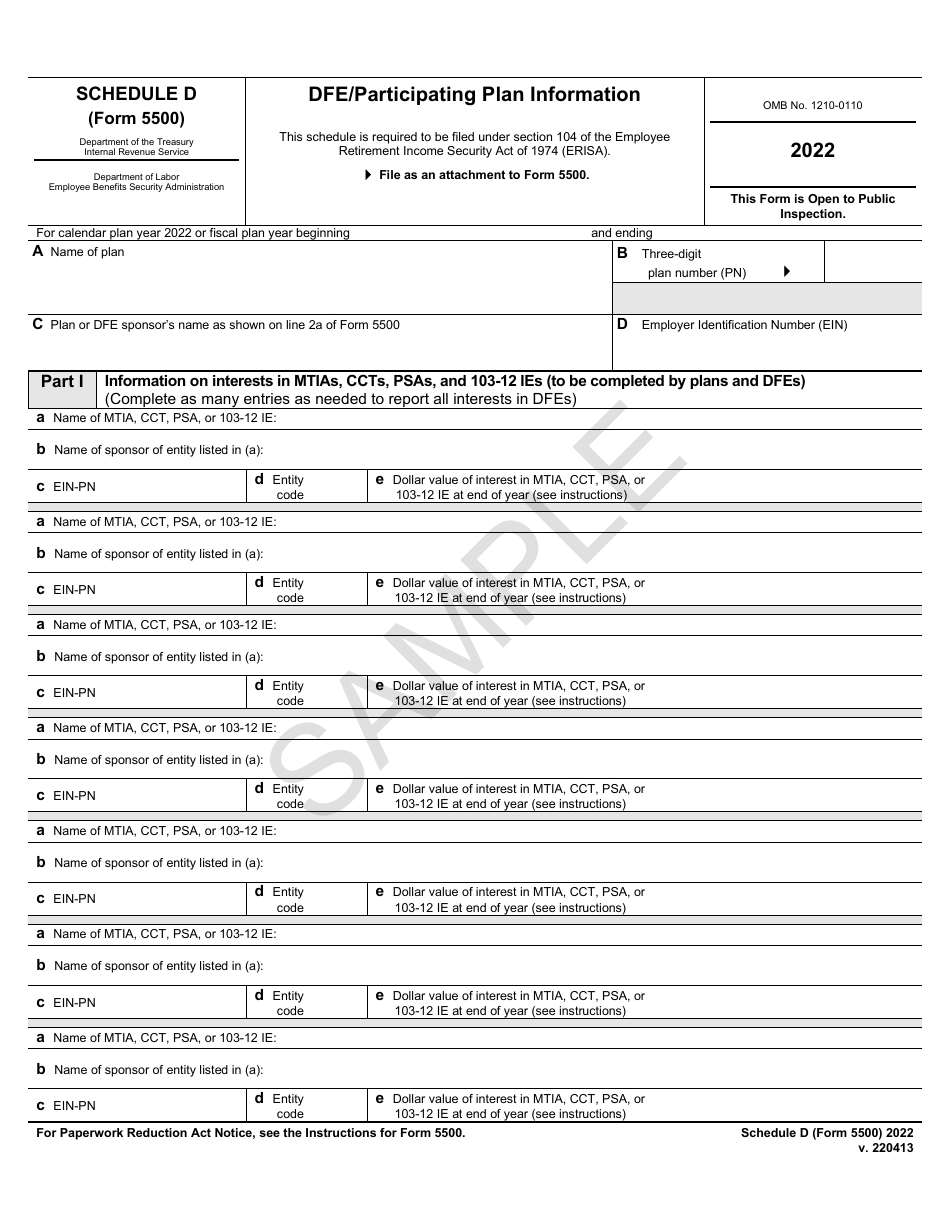

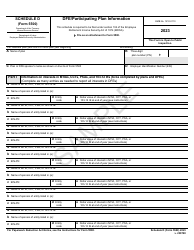

Form 5500 Schedule D

for the current year.

Form 5500 Schedule D Dfe / Participating Plan Information - Sample

What Is Form 5500 Schedule D?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration on April 13, 2022 and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule D?

A: Form 5500 Schedule D is a form used to report information about DFE (Direct Filing Entity) and participating plans.

Q: What does DFE stand for?

A: DFE stands for Direct Filing Entity.

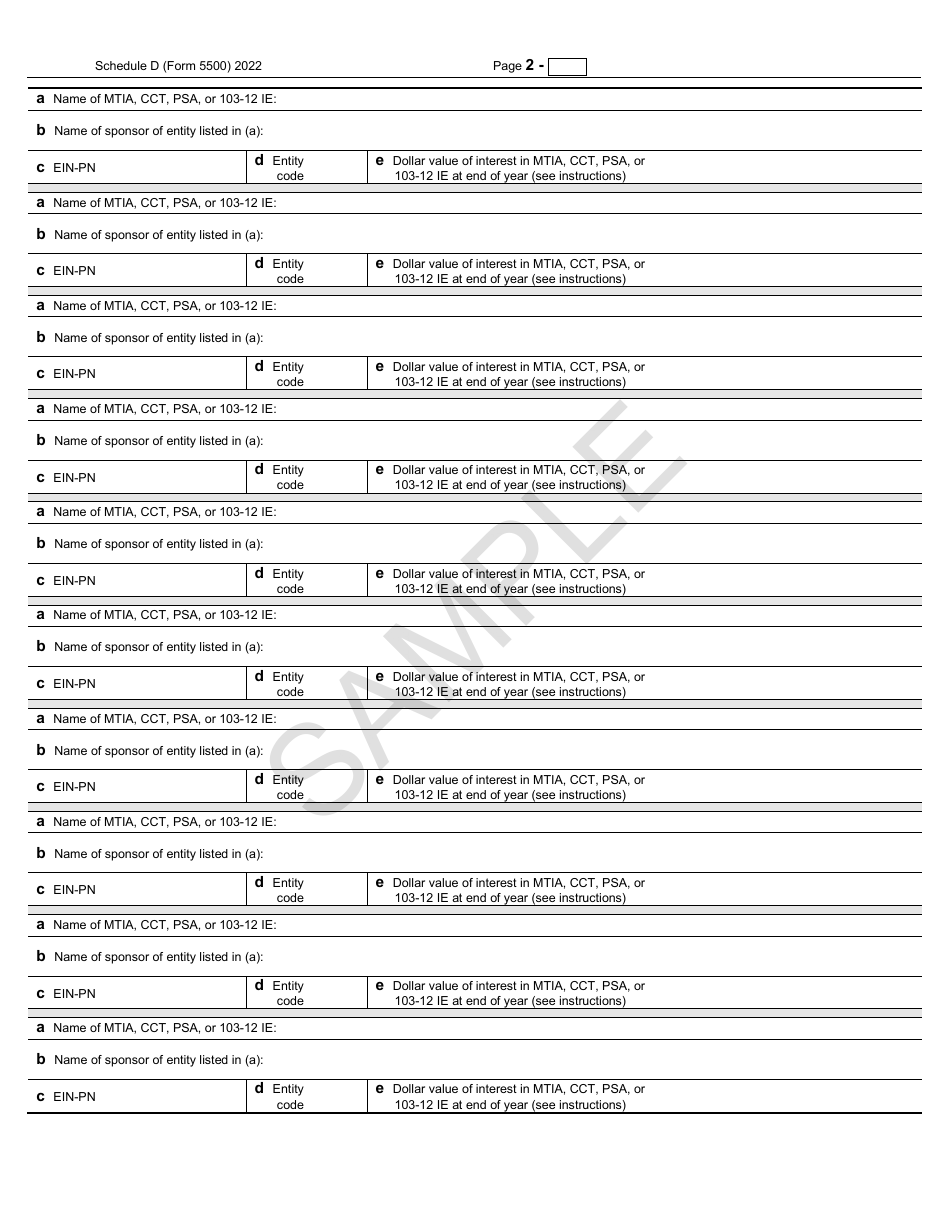

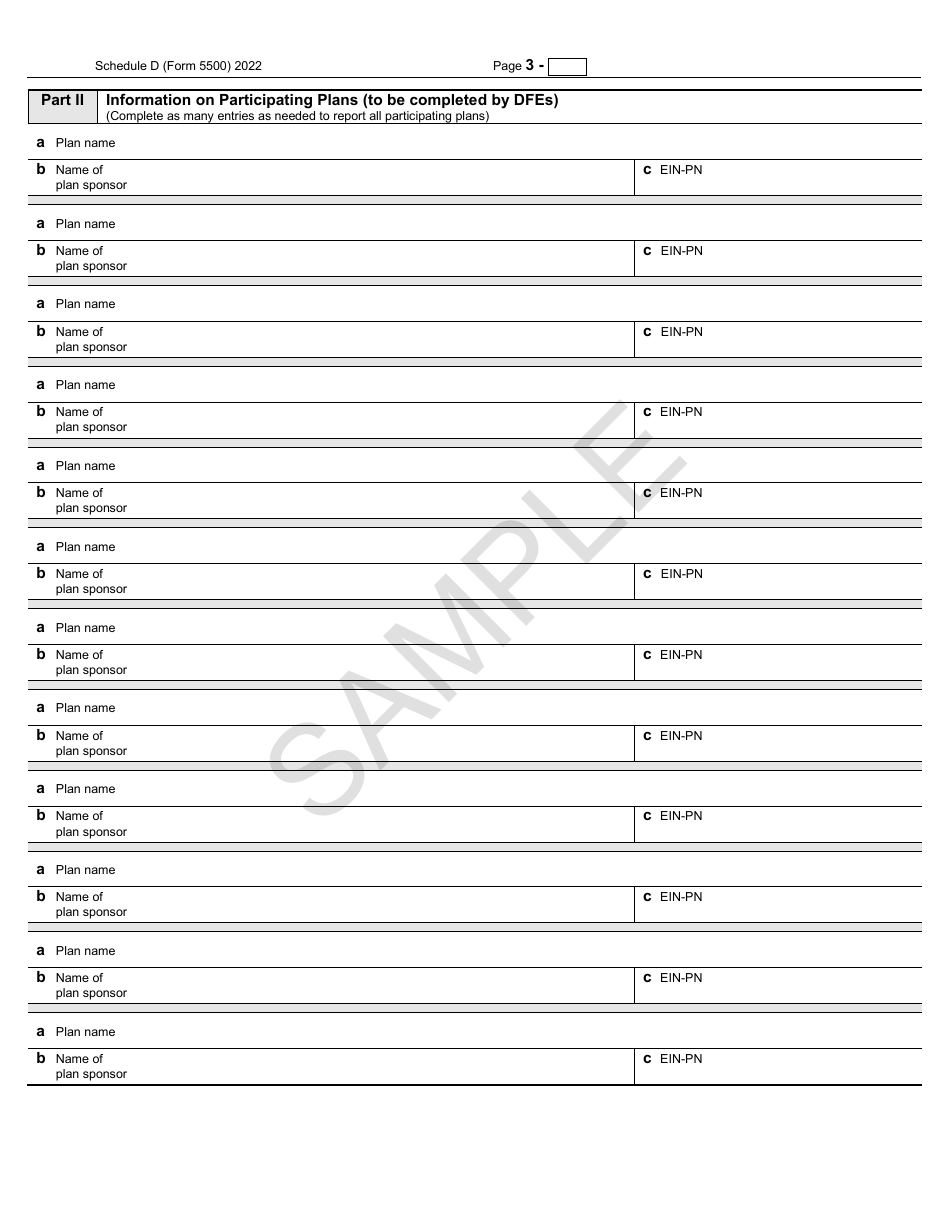

Q: What kind of information is reported on Form 5500 Schedule D?

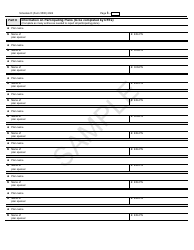

A: Form 5500 Schedule D reports information about the DFE and the participating plans, such as plan identifiers, trustees or custodians, investment information, and changes in service providers.

Q: Who needs to file Form 5500 Schedule D?

A: Form 5500 Schedule D needs to be filed by DFEs and participating plans that meet certain criteria, such as having more than 100 participants.

Q: Is Form 5500 Schedule D required for all retirement plans?

A: No, Form 5500 Schedule D is not required for all retirement plans. It is only required for DFEs and participating plans that meet certain criteria.

Form Details:

- Released on April 13, 2022;

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5500 Schedule D by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.