This version of the form is not currently in use and is provided for reference only. Download this version of

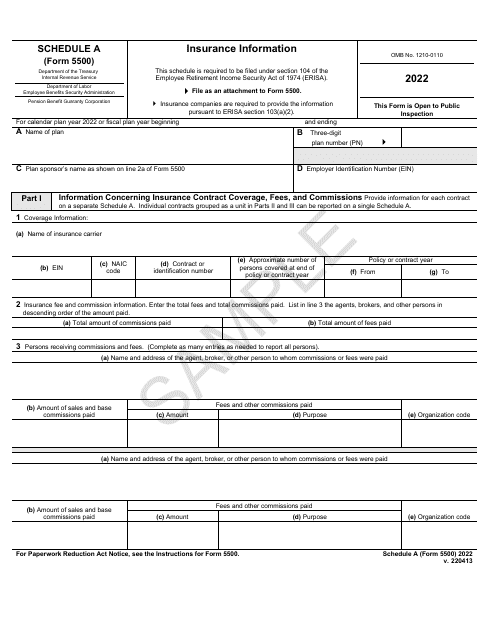

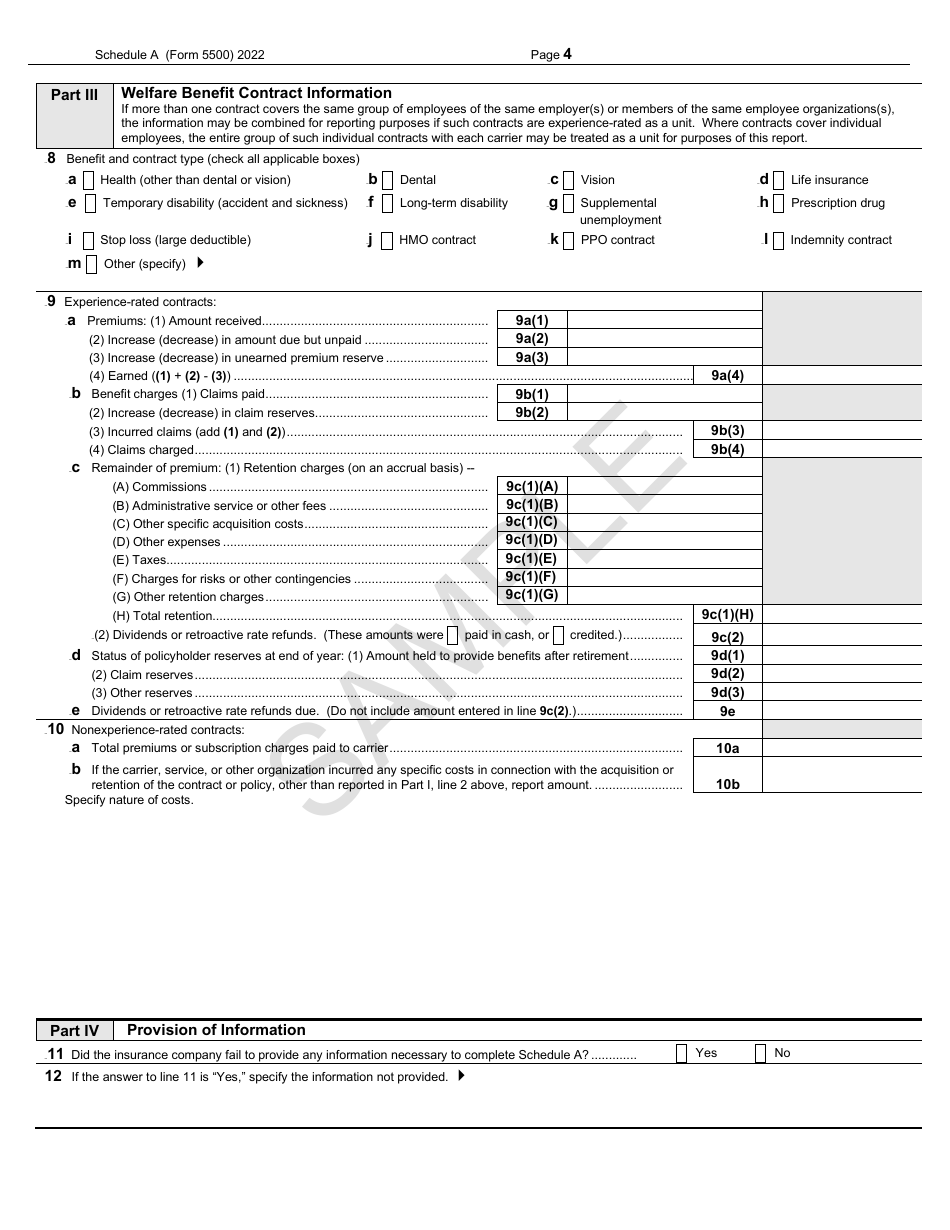

Form 5500 Schedule A

for the current year.

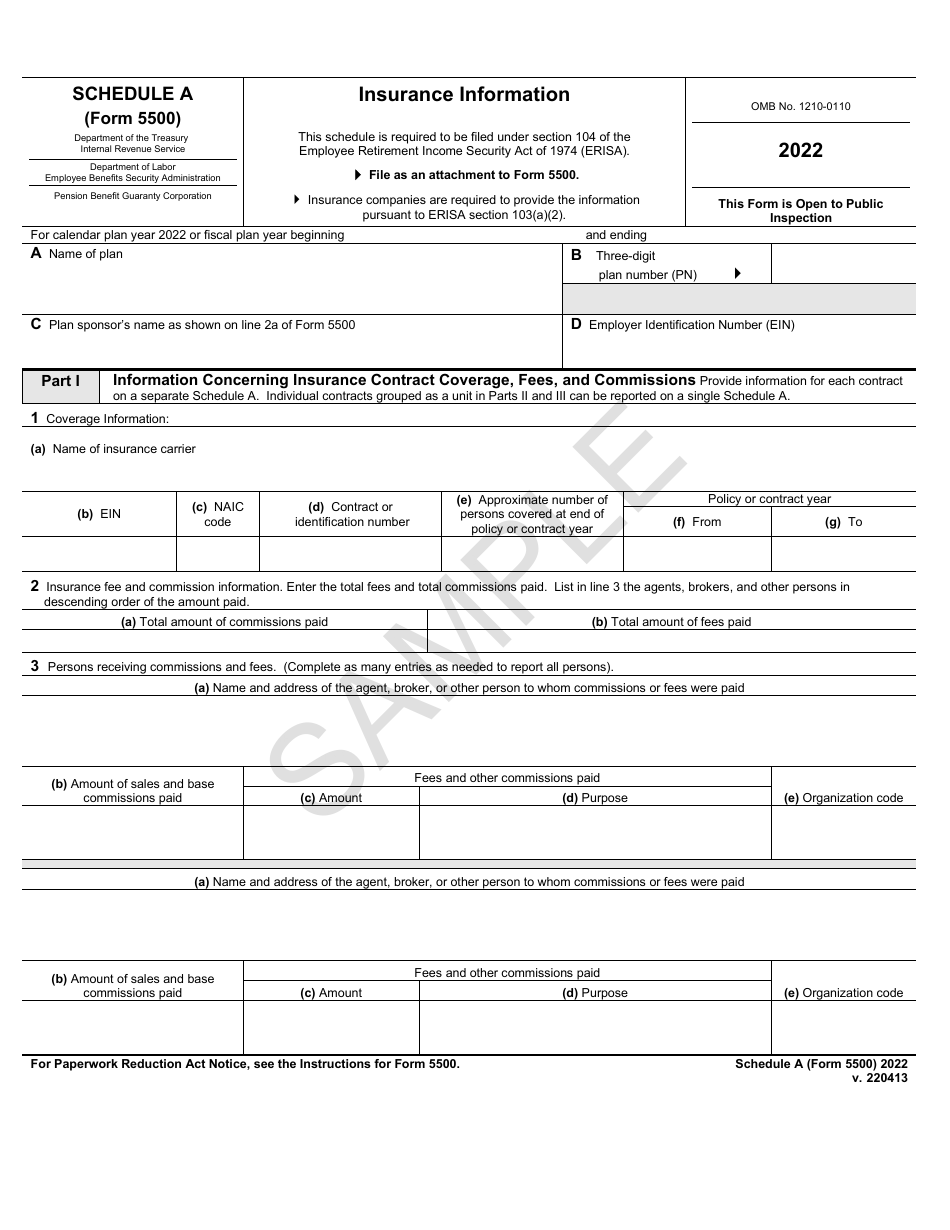

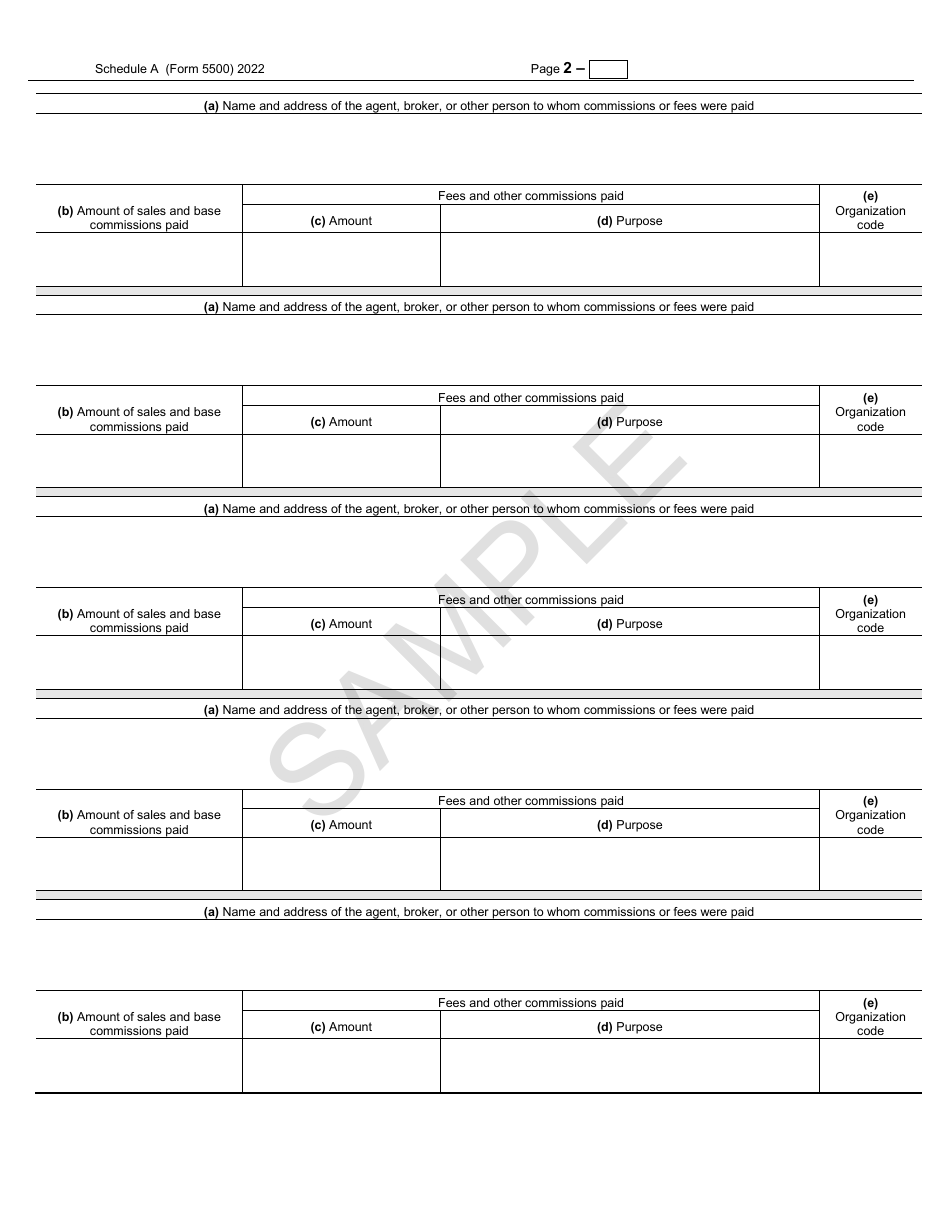

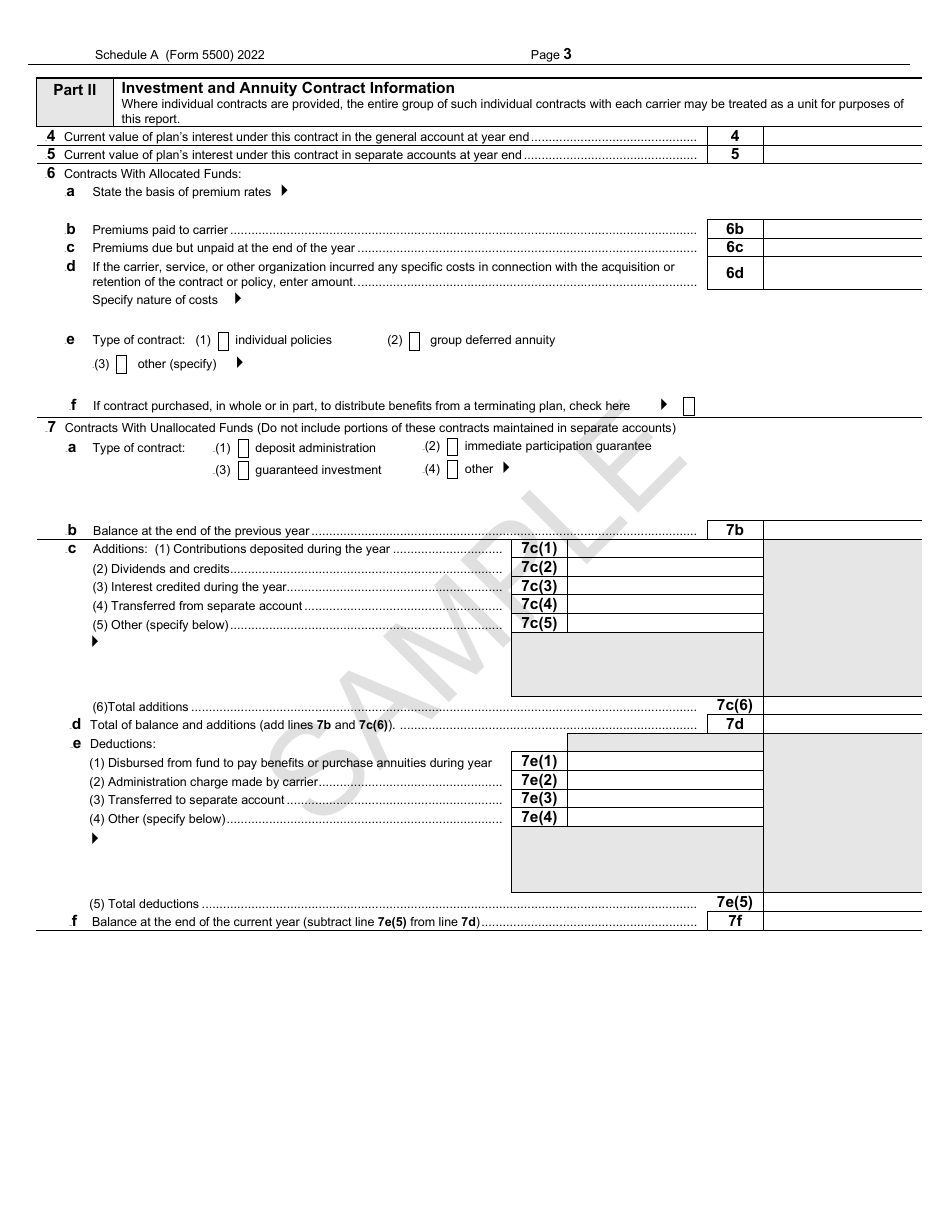

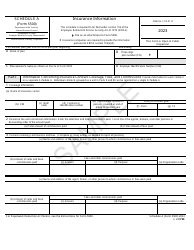

Form 5500 Schedule A Insurance Information - Sample

What Is Form 5500 Schedule A?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration on April 13, 2022 and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule A?

A: Form 5500 Schedule A is a document used to report insurance information for employee benefit plans.

Q: Who needs to file Form 5500 Schedule A?

A: Employers who sponsor employee benefit plans that provide insurance coverage need to file Form 5500 Schedule A.

Q: What information is required on Form 5500 Schedule A?

A: Form 5500 Schedule A requires information about the insurance carriers, premiums, and coverage details for the employee benefit plans.

Q: What is the purpose of filing Form 5500 Schedule A?

A: The purpose of filing Form 5500 Schedule A is to provide the government with information about the insurance coverage provided by employee benefit plans and ensure compliance with applicable laws.

Q: When is Form 5500 Schedule A due?

A: Form 5500 Schedule A is generally due by the last day of the seventh month after the plan year ends. However, there may be extensions available under certain circumstances.

Q: Are there any penalties for not filing Form 5500 Schedule A?

A: Yes, there can be penalties for not filing Form 5500 Schedule A or filing it late. The penalties can vary depending on the size of the plan and the duration of non-compliance.

Form Details:

- Released on April 13, 2022;

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule A by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.