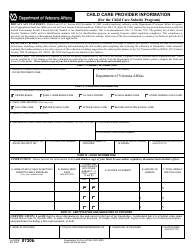

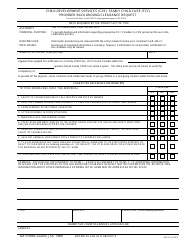

This version of the form is not currently in use and is provided for reference only. Download this version of

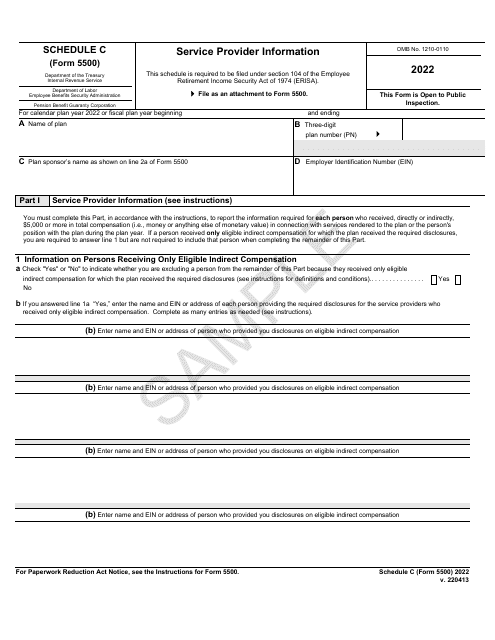

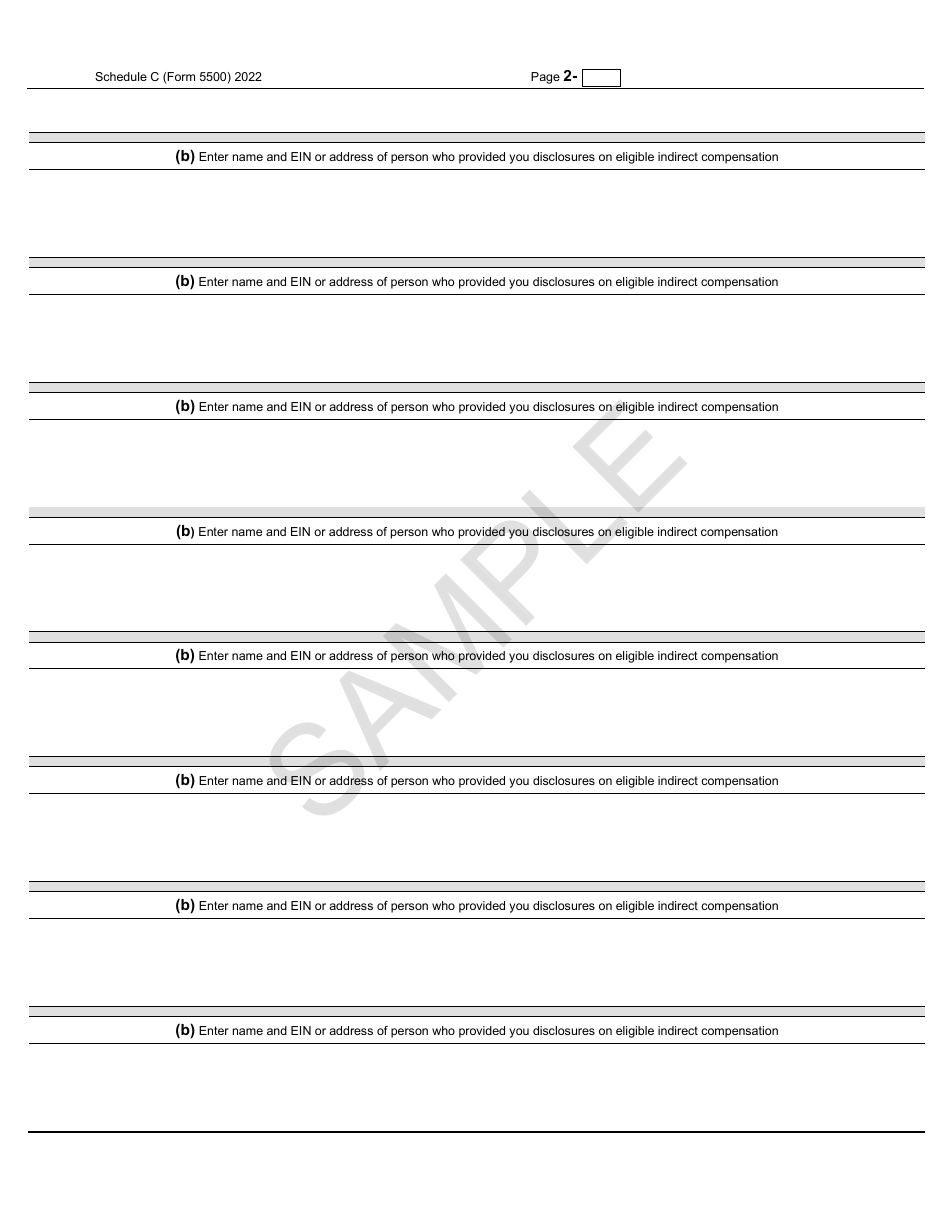

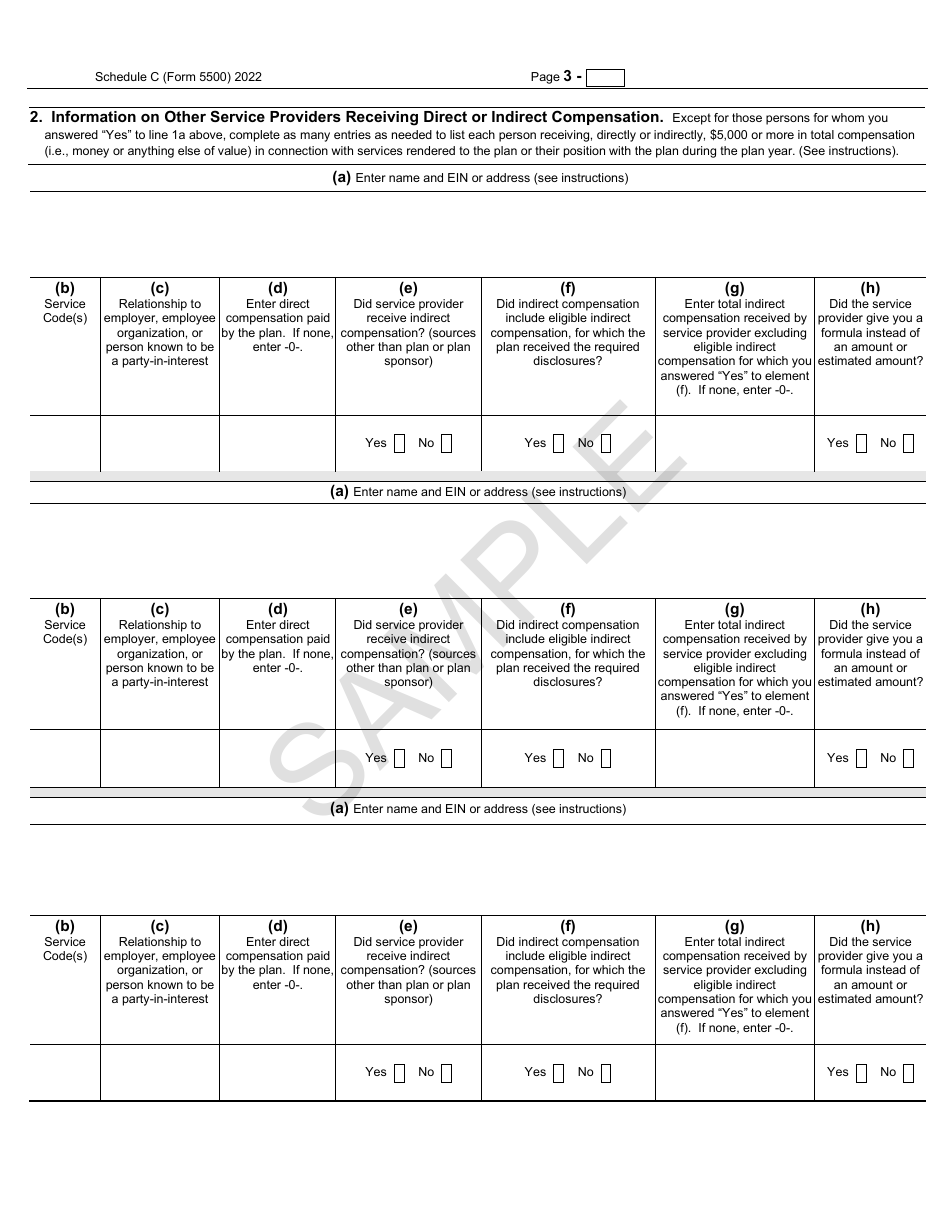

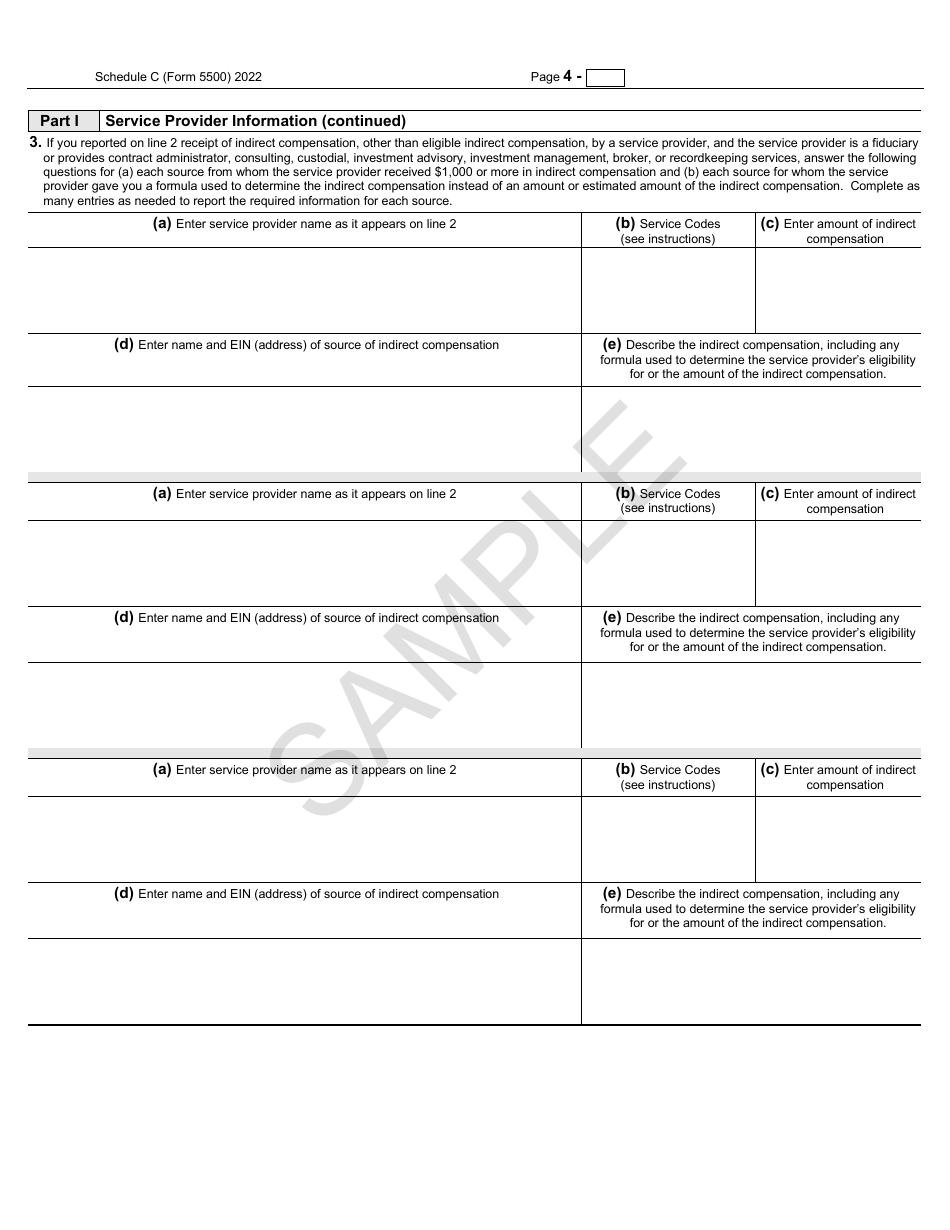

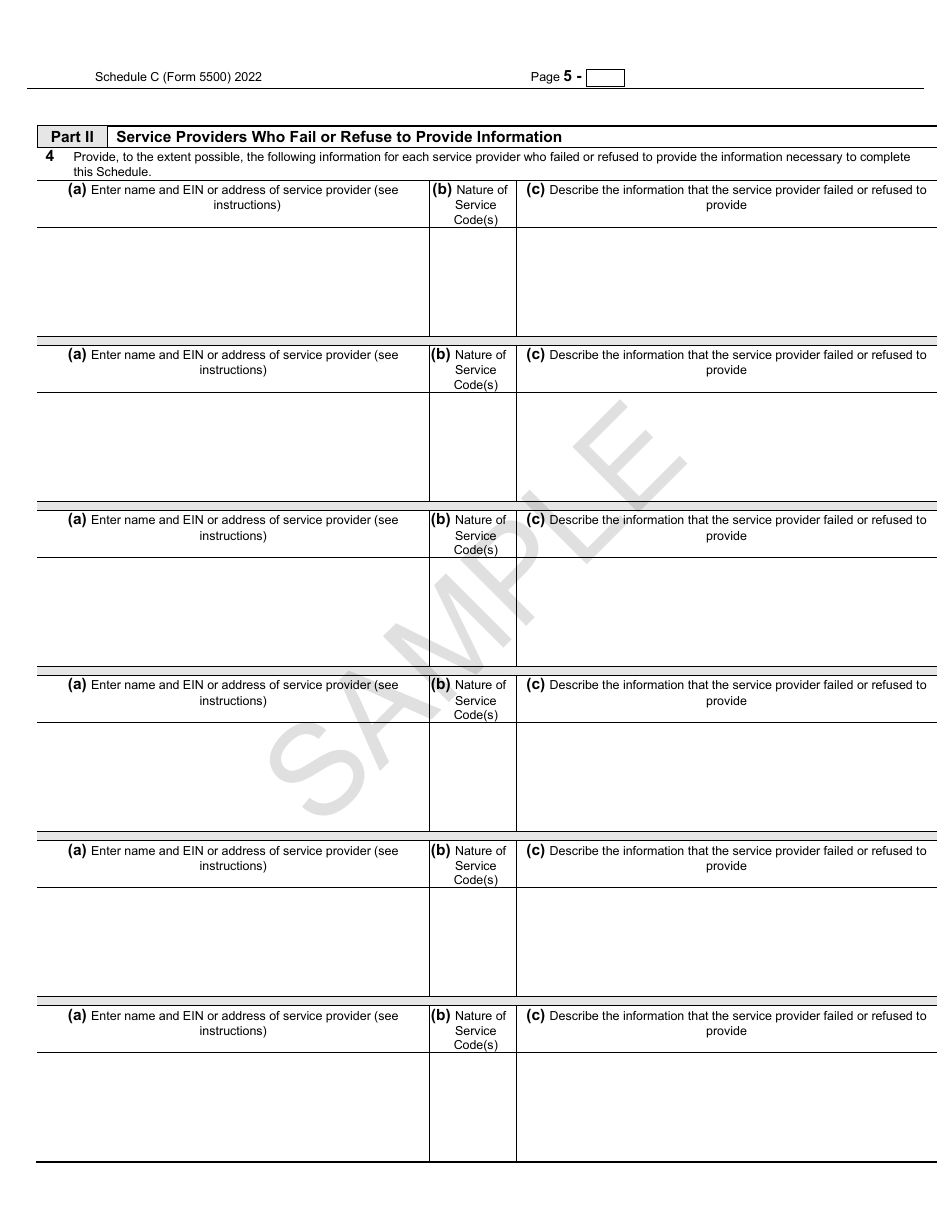

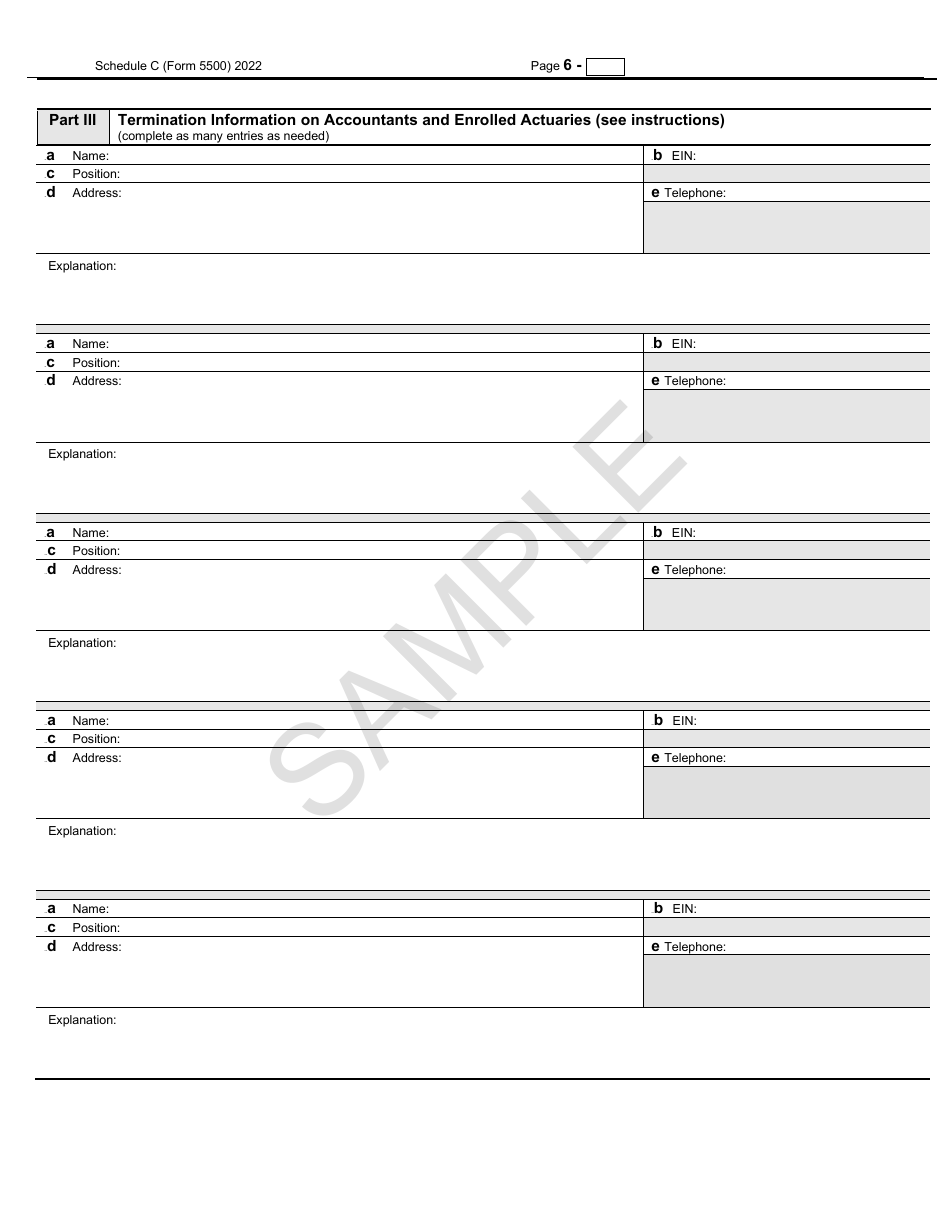

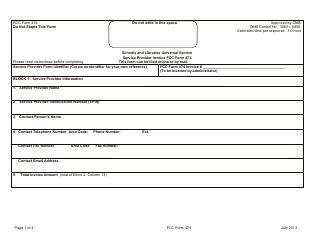

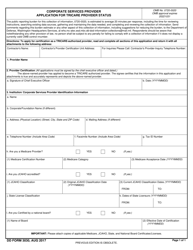

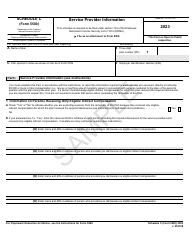

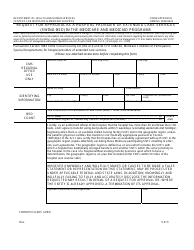

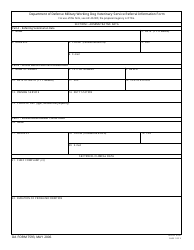

Form 5500 Schedule C

for the current year.

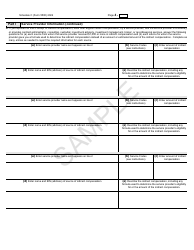

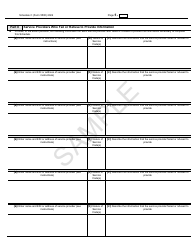

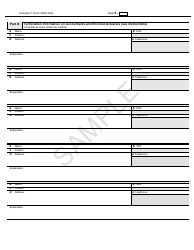

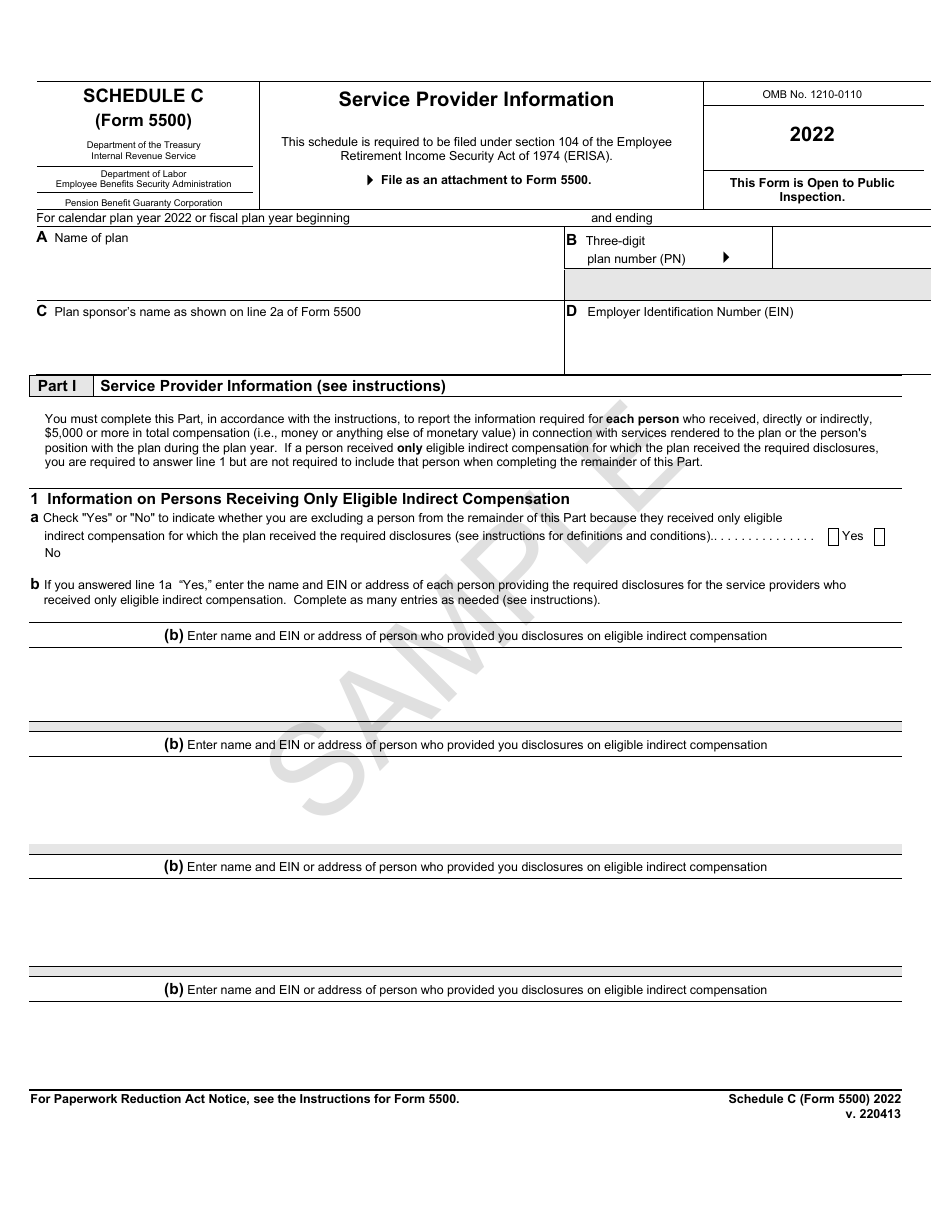

Form 5500 Schedule C Service Provider Information - Sample

What Is Form 5500 Schedule C?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration on April 13, 2022 and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule C?

A: Form 5500 Schedule C is a form used to report service provider information for employee benefit plans.

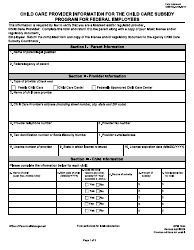

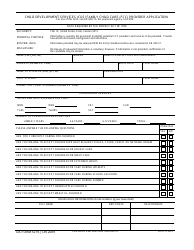

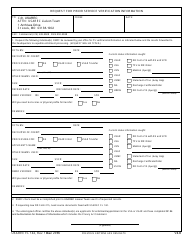

Q: What information is required in Form 5500 Schedule C?

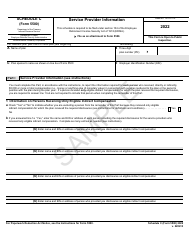

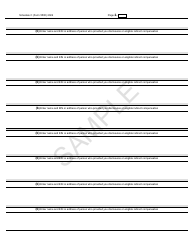

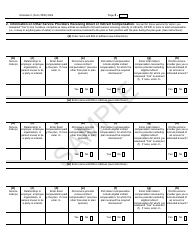

A: Form 5500 Schedule C requires information about the service providers, their compensation, and the services provided.

Q: Why is Form 5500 Schedule C important?

A: Form 5500 Schedule C helps ensure transparency and accountability in the management of employee benefit plans by collecting information about service providers and their compensation.

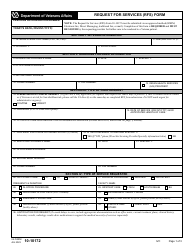

Q: Who is responsible for filing Form 5500 Schedule C?

A: The plan administrator or sponsor is responsible for filing Form 5500 Schedule C for employee benefit plans.

Form Details:

- Released on April 13, 2022;

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5500 Schedule C by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.