This version of the form is not currently in use and is provided for reference only. Download this version of

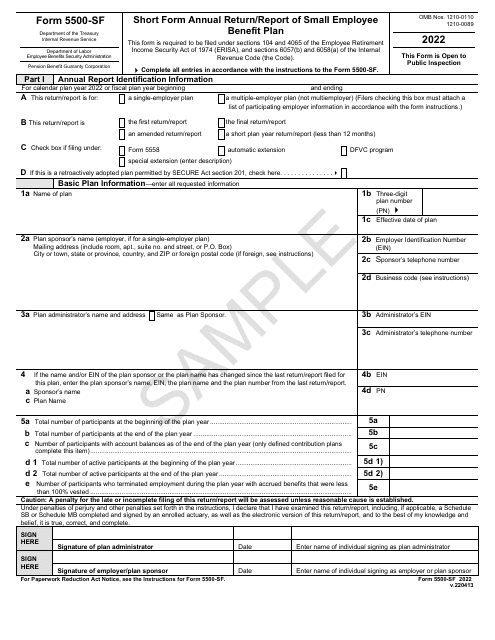

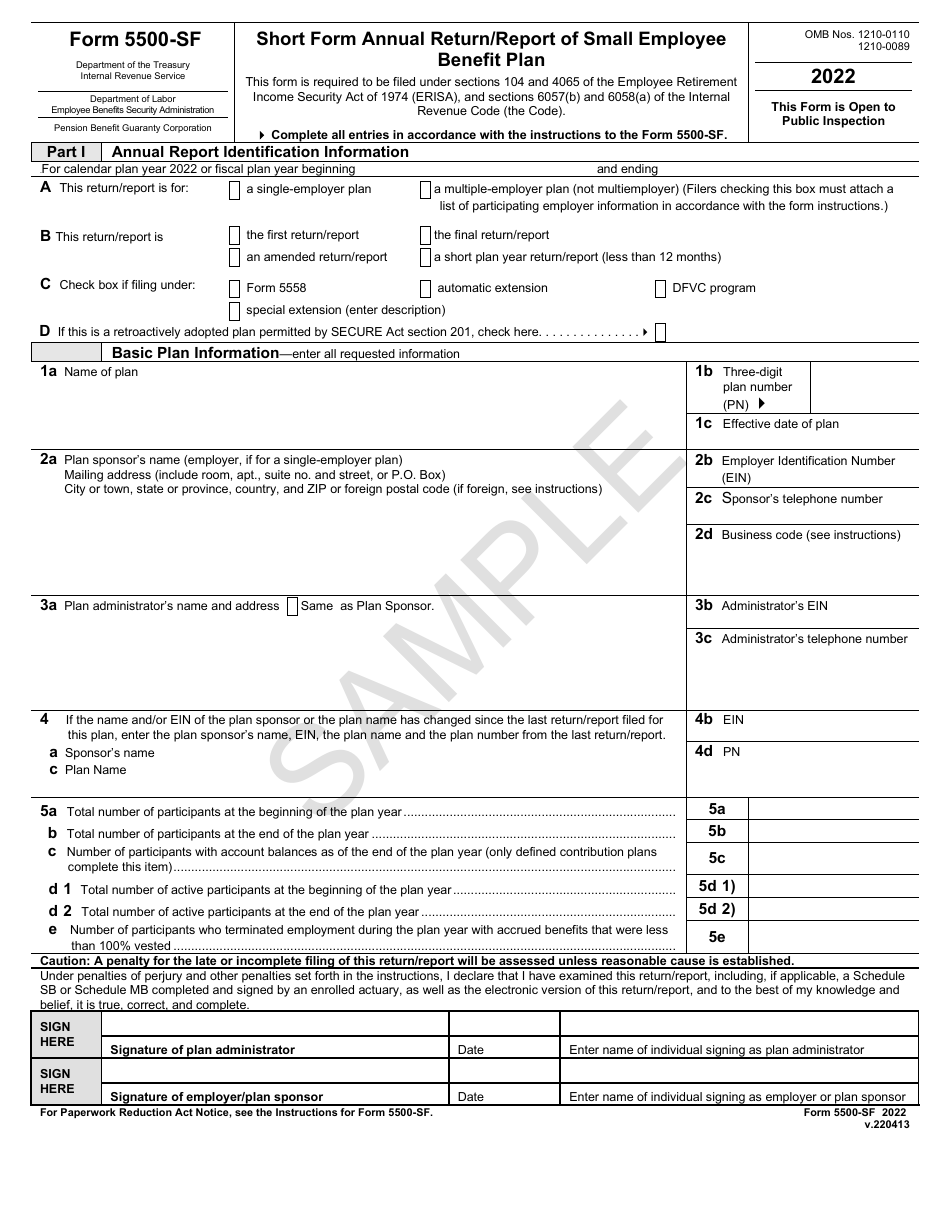

Form 5500-SF

for the current year.

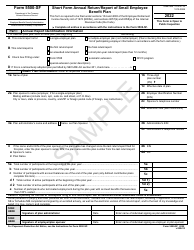

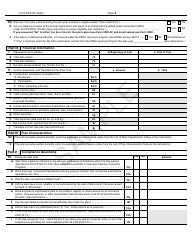

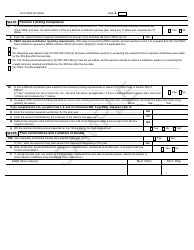

Form 5500-SF Short Form Annual Return / Report of Small Employee Benefit Plan - Sample

What Is Form 5500-SF?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration on April 13, 2022 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500-SF?

A: Form 5500-SF is a short form annual return/report of small employee benefit plans.

Q: Who needs to file Form 5500-SF?

A: Small employee benefit plans must file Form 5500-SF.

Q: What is considered a small employee benefit plan?

A: A small employee benefit plan is one that covers fewer than 100 participants at the beginning of the plan year.

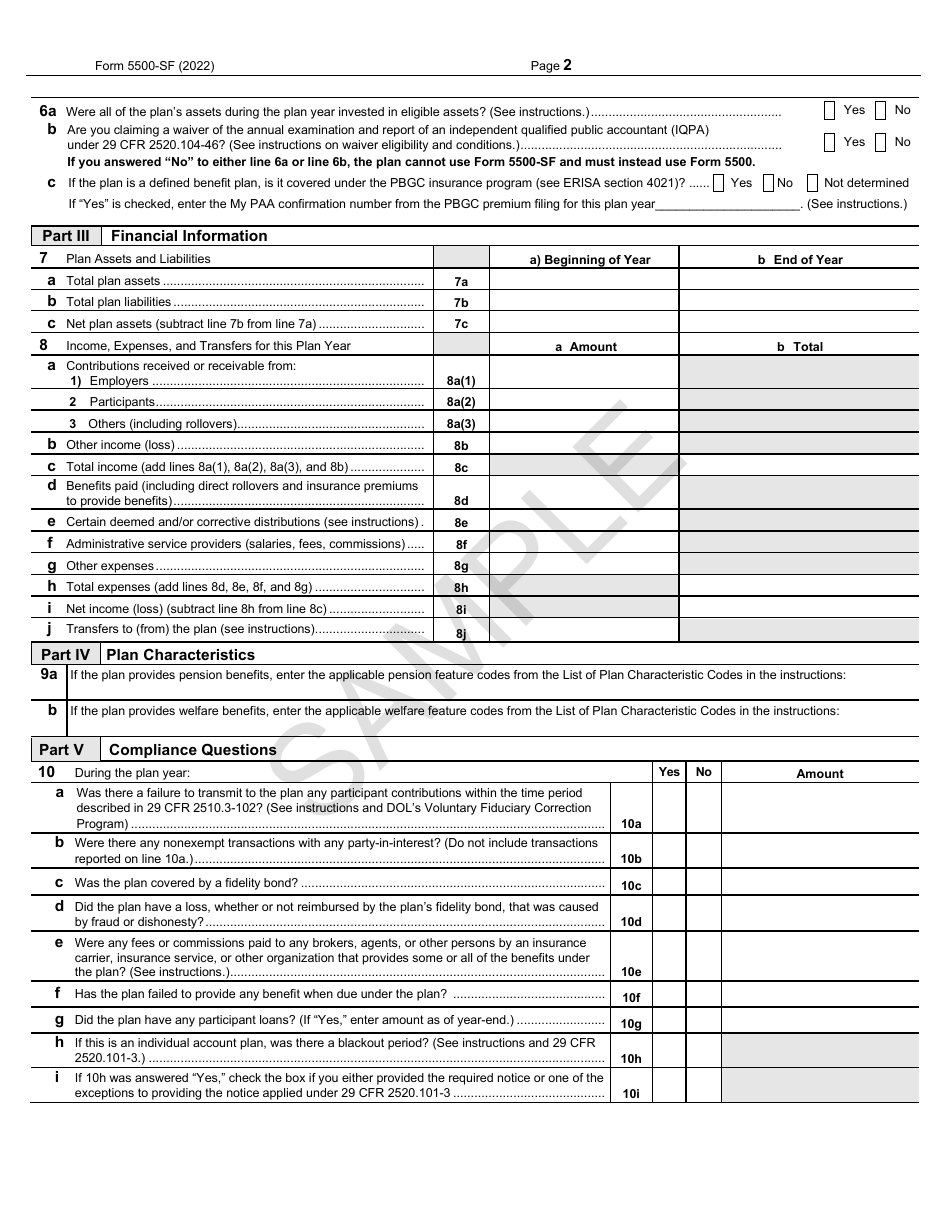

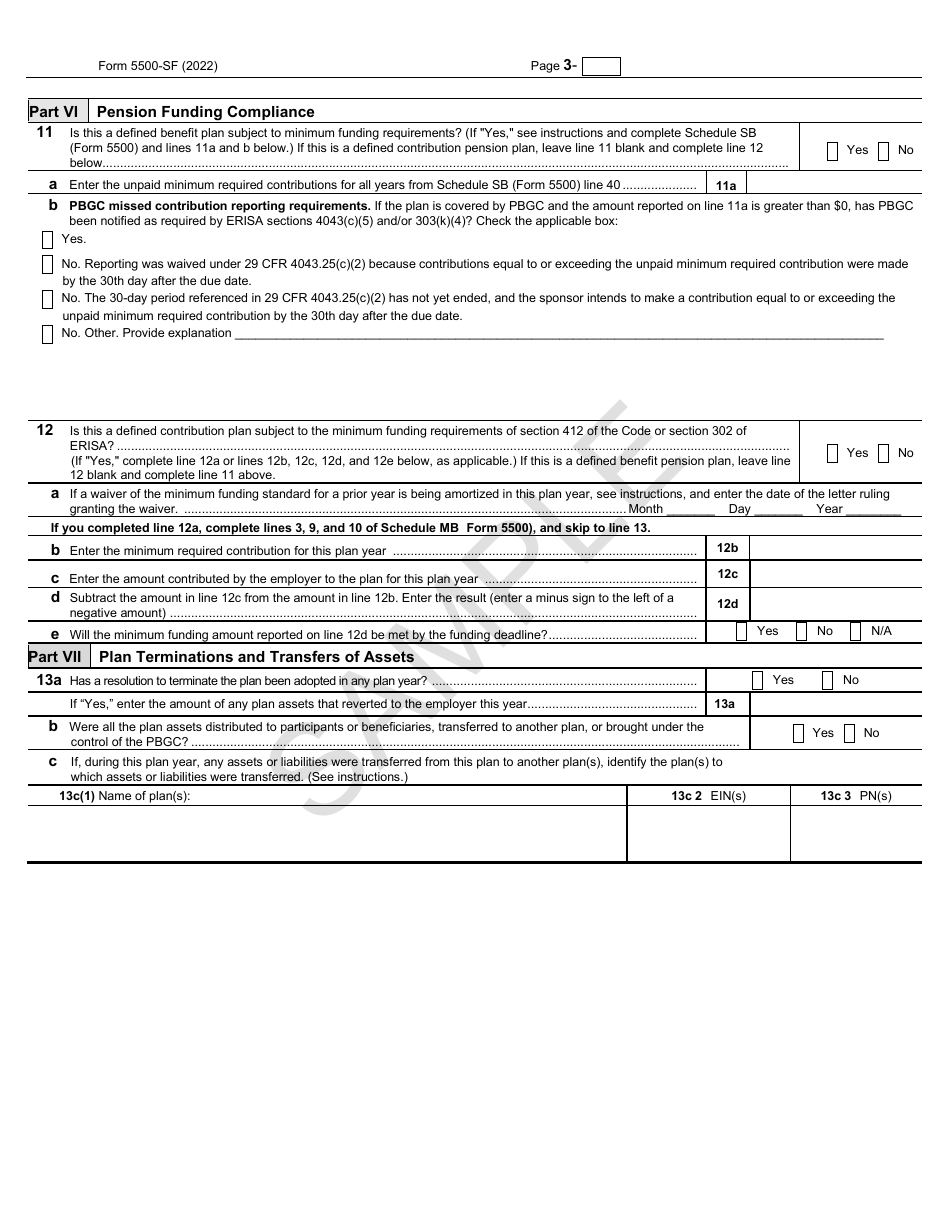

Q: What information is required on Form 5500-SF?

A: Form 5500-SF requires information on the plan's financial activity, administrative details, and participant data.

Q: When is Form 5500-SF due?

A: Form 5500-SF is due by the last day of the seventh month after the end of the plan year.

Q: Are there any penalties for not filing Form 5500-SF?

A: Yes, there are penalties for failing to file Form 5500-SF, including potential fines and loss of tax advantages for the plan.

Q: Can Form 5500-SF be filed electronically?

A: Yes, Form 5500-SF can be filed electronically using the Department of Labor's EFAST2 system.

Q: Do small employee benefit plans need to attach financial statements to Form 5500-SF?

A: Small employee benefit plans are generally not required to attach financial statements to Form 5500-SF.

Form Details:

- Released on April 13, 2022;

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5500-SF by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.