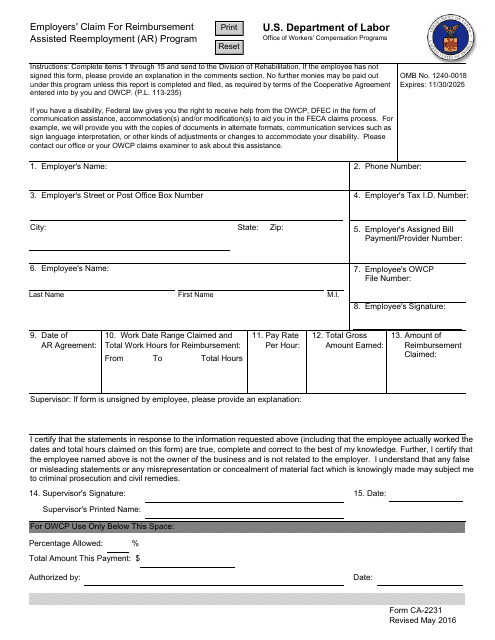

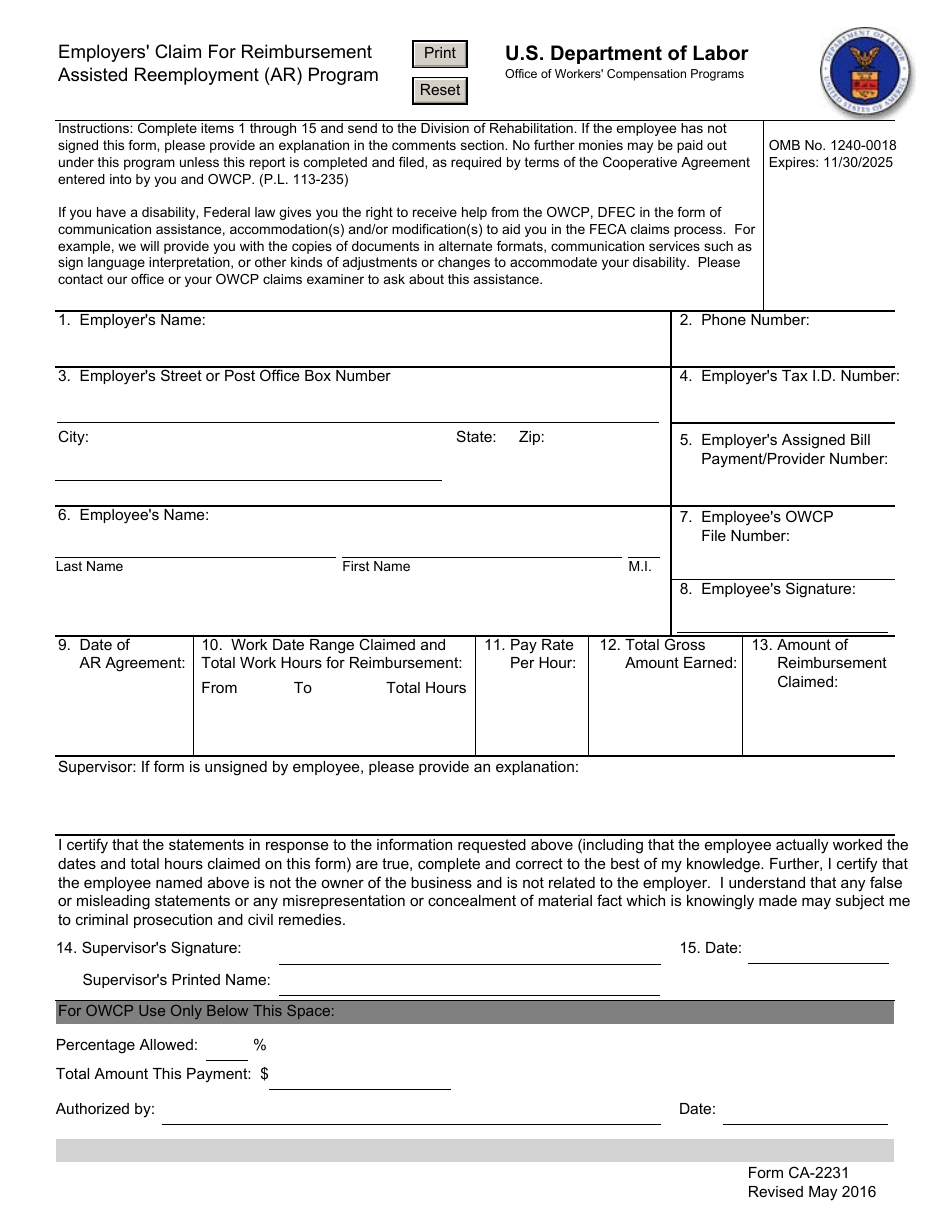

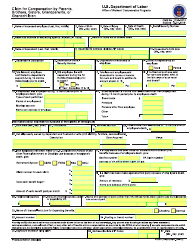

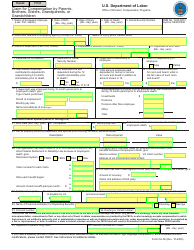

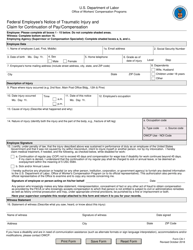

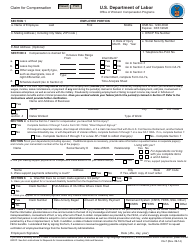

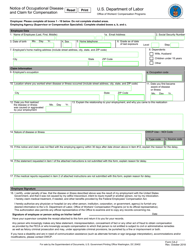

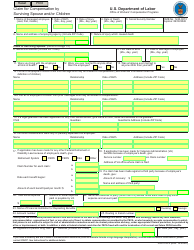

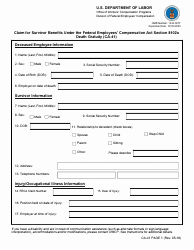

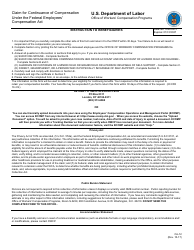

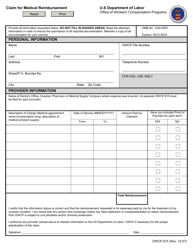

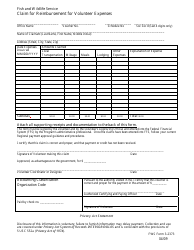

Form CA-2231 Employers' Claim for Reimbursement Assisted Reemployment (Ar) Program

What Is Form CA-2231?

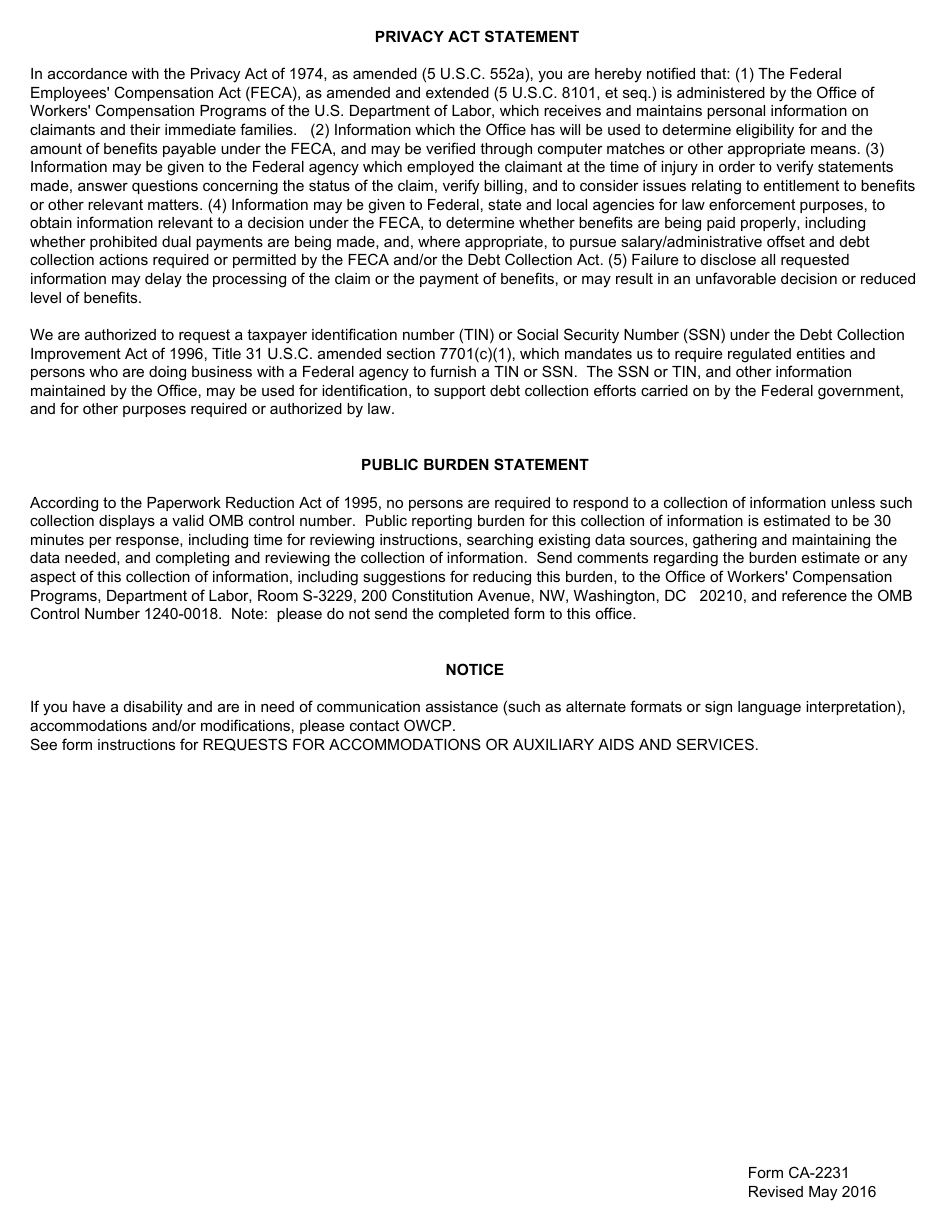

This is a legal form that was released by the U.S. Department of Labor - Office of Workers' Compensation Programs on May 1, 2016 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CA-2231?

A: Form CA-2231 is the Employers' Claim for Reimbursement for the Assisted Reemployment (AR) Program.

Q: What is the purpose of Form CA-2231?

A: The purpose of Form CA-2231 is for employers to claim reimbursement for expenses incurred through the Assisted Reemployment (AR) Program.

Q: What is the Assisted Reemployment (AR) Program?

A: The Assisted Reemployment (AR) Program is a program that provides assistance to unemployed individuals with finding new employment.

Q: Who can file Form CA-2231?

A: Employers who have incurred expenses through the Assisted Reemployment (AR) Program can file Form CA-2231.

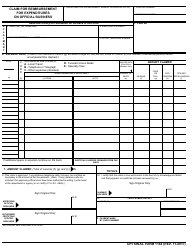

Q: What kind of expenses can be claimed on Form CA-2231?

A: Expenses related to activities such as job fairs, recruitment efforts, and job training can be claimed on Form CA-2231.

Q: Are there any deadlines for filing Form CA-2231?

A: Specific deadlines for filing Form CA-2231 may vary depending on the guidelines of the Assisted Reemployment (AR) Program. It is important to consult the instructions or contact the relevant government agency for the applicable deadlines.

Q: Do employers need to provide supporting documentation with Form CA-2231?

A: Yes, employers are generally required to provide supporting documentation with Form CA-2231 to substantiate their claimed expenses. This may include receipts, invoices, or other relevant records.

Q: What happens after filing Form CA-2231?

A: After filing Form CA-2231, the government agency responsible for the Assisted Reemployment (AR) Program will review the claim and determine if the reimbursement is approved.

Q: Is there an appeal process if the reimbursement claim is denied?

A: Specific appeal processes, if any, will depend on the guidelines of the Assisted Reemployment (AR) Program. Employers should consult the instructions or contact the relevant government agency for information on the appeal process.

Q: Can employers claim reimbursement for any other programs on Form CA-2231?

A: Form CA-2231 is specifically for claiming reimbursement for expenses incurred through the Assisted Reemployment (AR) Program. Other programs may have their own reimbursement processes and forms.

Form Details:

- Released on May 1, 2016;

- The latest available edition released by the U.S. Department of Labor - Office of Workers' Compensation Programs;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CA-2231 by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Office of Workers' Compensation Programs.