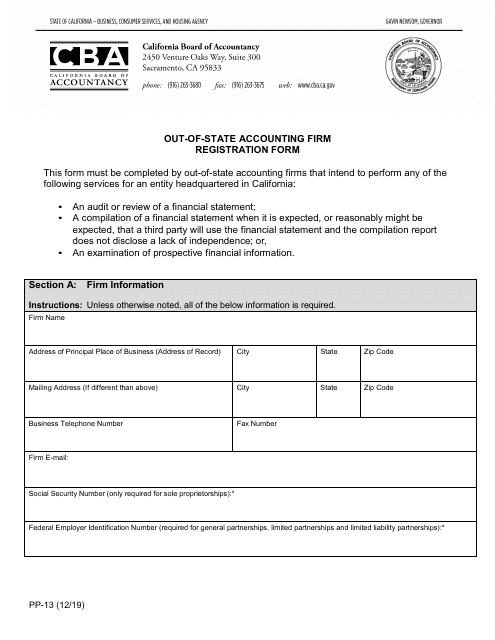

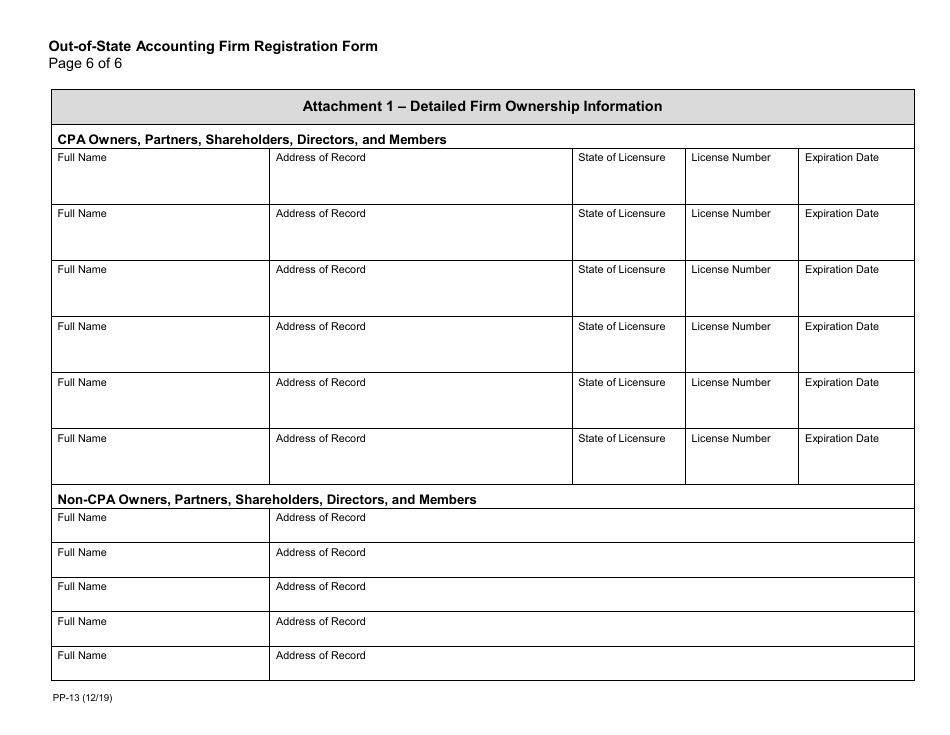

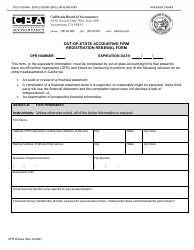

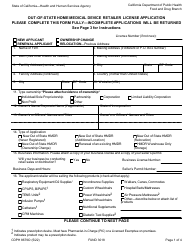

Form PP-13 Out-of-State Accounting Firm Registration Form - California

What Is Form PP-13?

This is a legal form that was released by the California Department of Consumer Affairs - Board of Accountancy - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PP-13?

A: Form PP-13 is the Out-of-State Accounting Firm Registration Form for California.

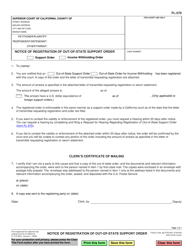

Q: Who needs to file Form PP-13?

A: Out-of-state accounting firms that want to provide services in California need to file Form PP-13.

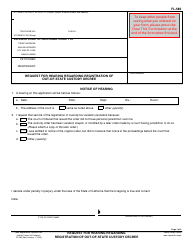

Q: What is the purpose of Form PP-13?

A: The purpose of Form PP-13 is to register an out-of-state accounting firm with the California Board of Accountancy.

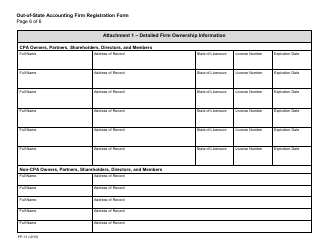

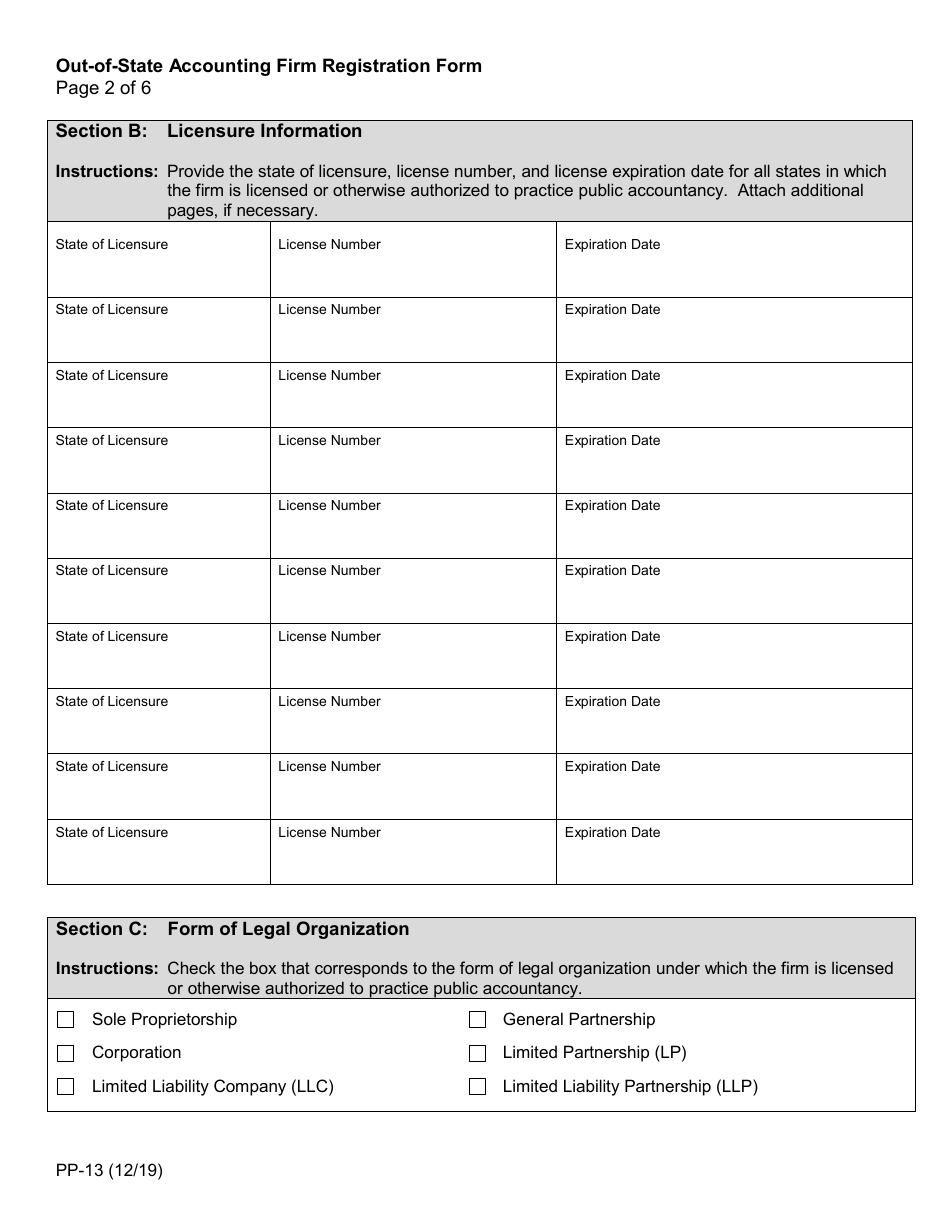

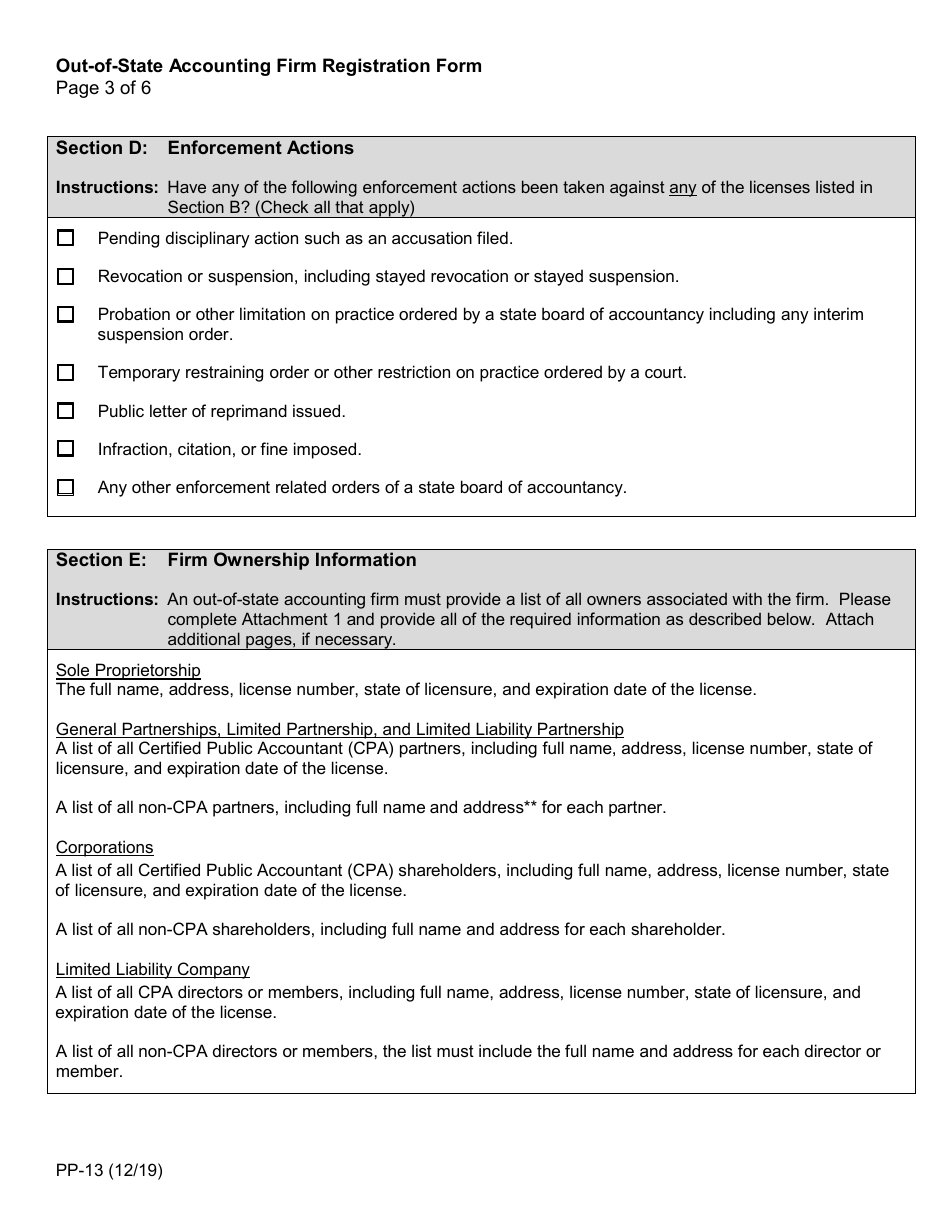

Q: What information is required on Form PP-13?

A: Form PP-13 requires information such as the name and address of the accounting firm, contact information, and details about the firm's license in its home state.

Q: What is the deadline for filing Form PP-13?

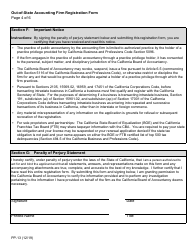

A: The deadline for filing Form PP-13 is 60 days prior to the start of providing services in California.

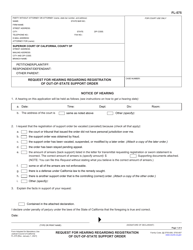

Q: Are there any penalties for not filing Form PP-13?

A: Yes, failure to file Form PP-13 can result in penalties and legal consequences.

Q: Can the information provided on Form PP-13 be updated or amended?

A: Yes, if there are any changes to the information provided on Form PP-13, it is important to notify the California Board of Accountancy and update the registration accordingly.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the California Department of Consumer Affairs - Board of Accountancy;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PP-13 by clicking the link below or browse more documents and templates provided by the California Department of Consumer Affairs - Board of Accountancy.