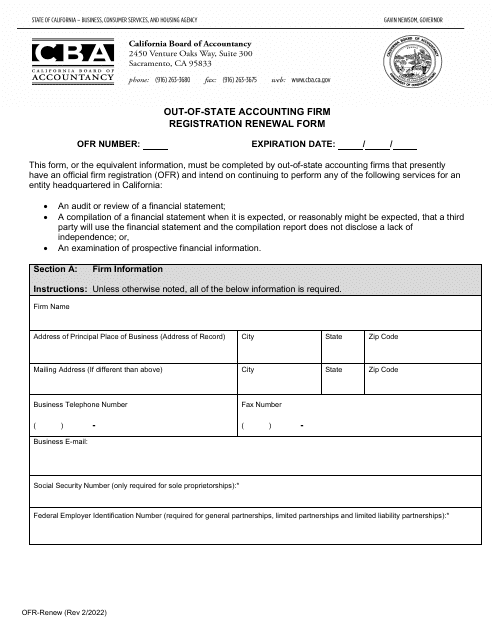

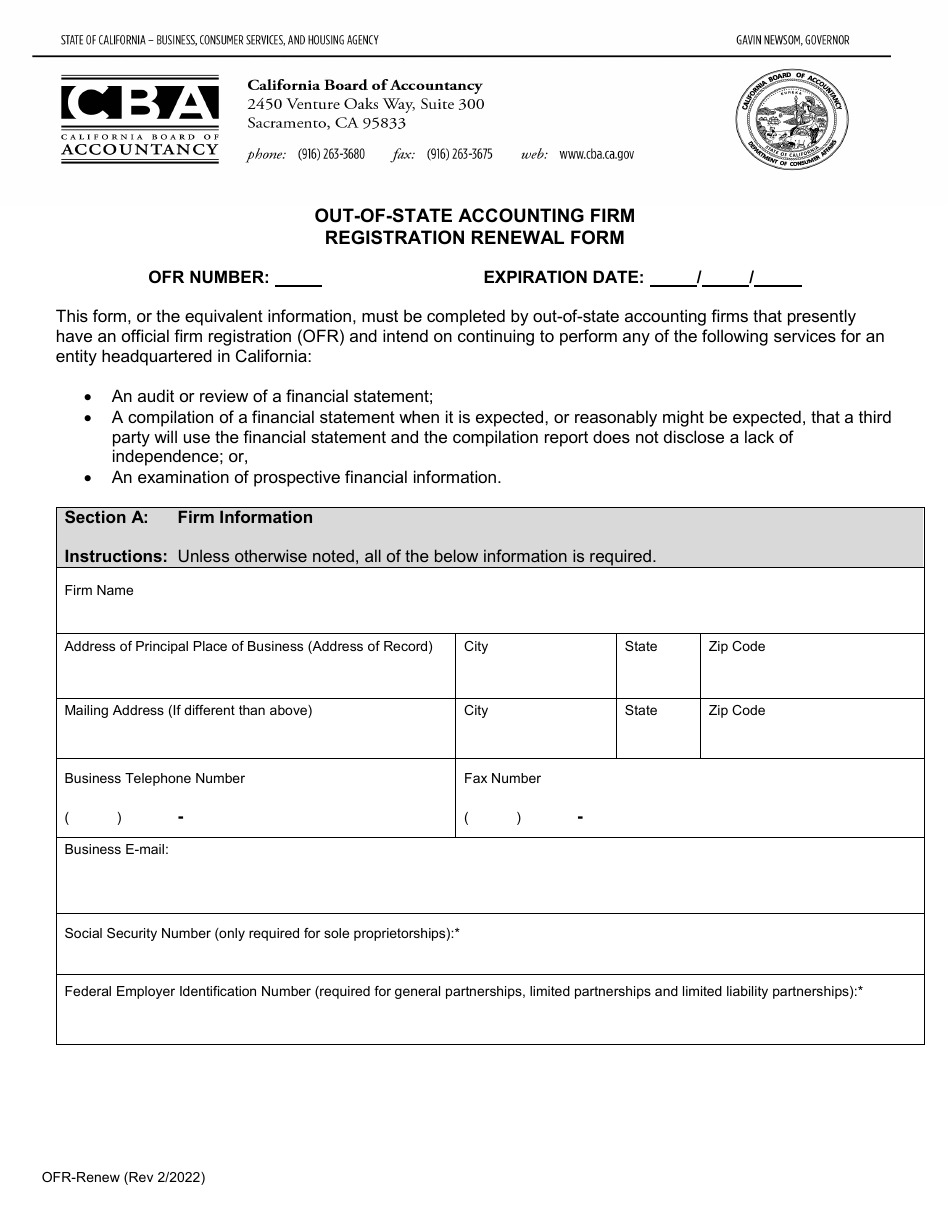

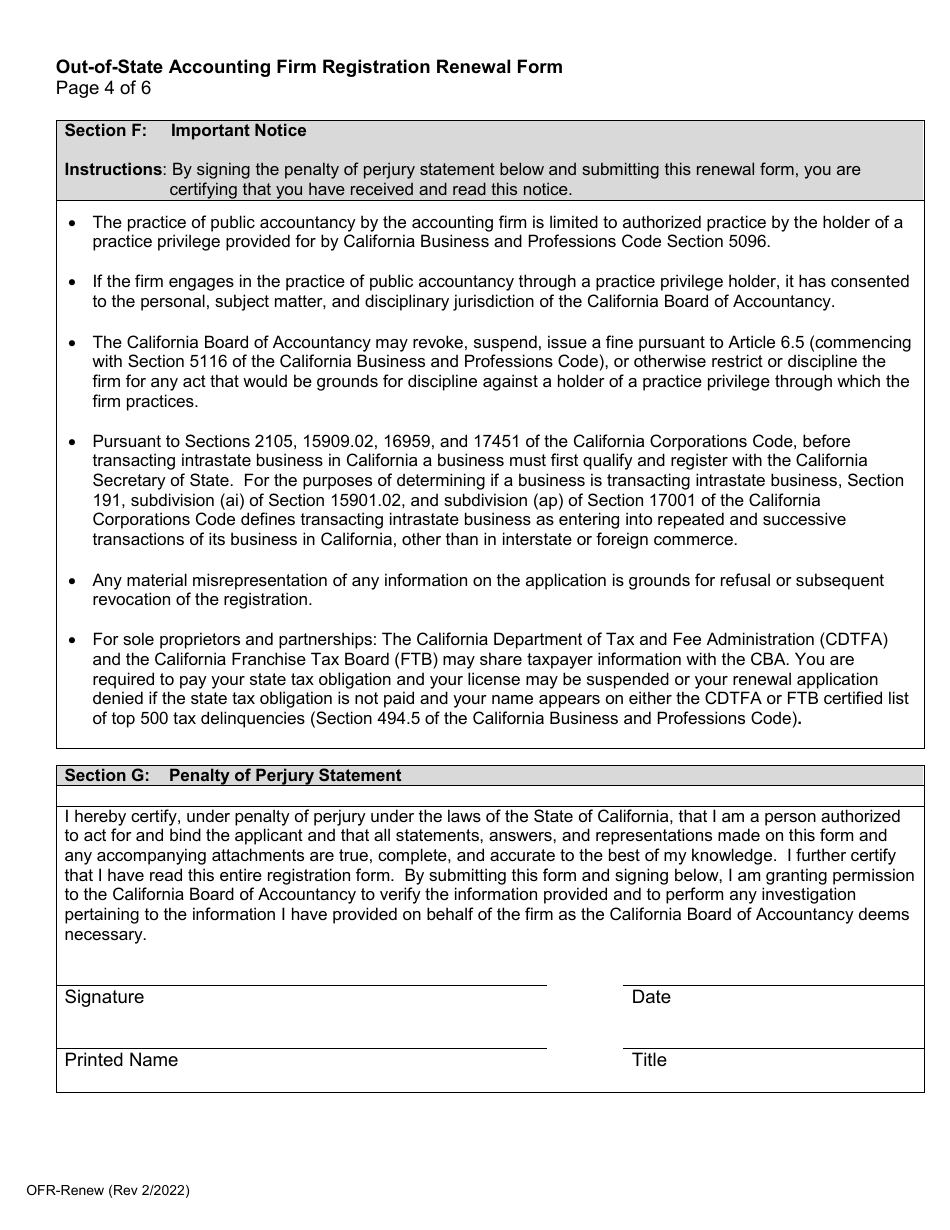

Form OFR-RENEW Out-of-State Accounting Firm Registration Renewal Form - California

What Is Form OFR-RENEW?

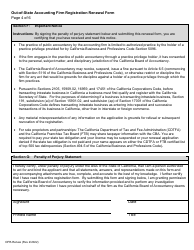

This is a legal form that was released by the California Department of Consumer Affairs - Board of Accountancy - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form OFR-RENEW?

A: Form OFR-RENEW is the Out-of-State Accounting Firm Registration Renewal Form.

Q: What is the purpose of Form OFR-RENEW?

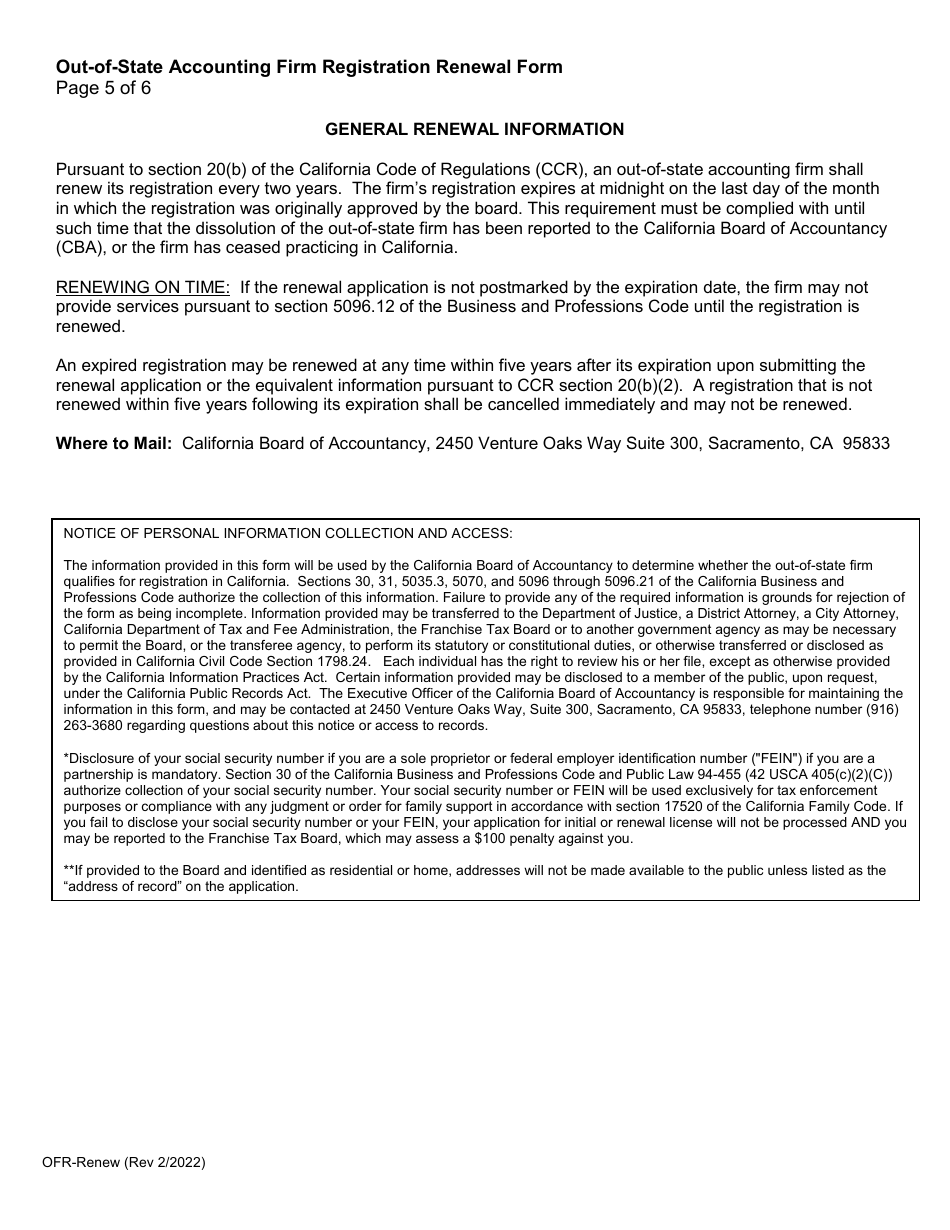

A: The purpose of Form OFR-RENEW is to renew the registration of an out-of-state accounting firm in California.

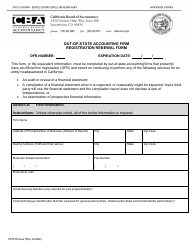

Q: Who needs to file Form OFR-RENEW?

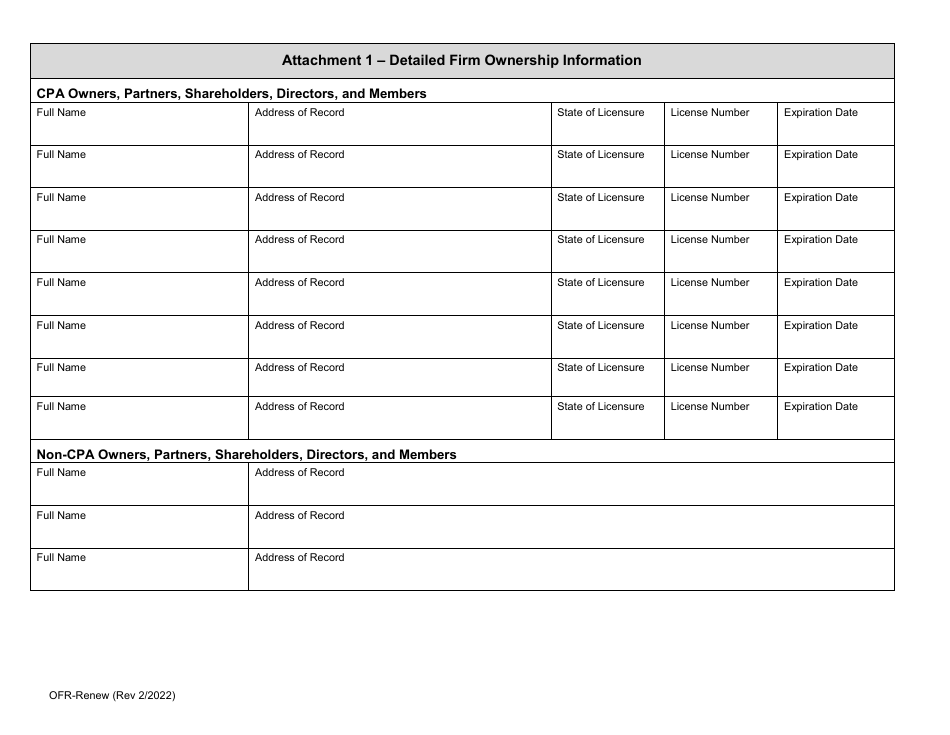

A: Out-of-state accounting firms that are registered in California need to file Form OFR-RENEW to renew their registration.

Q: When should Form OFR-RENEW be filed?

A: Form OFR-RENEW should be filed annually by out-of-state accounting firms to renew their registration.

Q: What happens if I don't file Form OFR-RENEW?

A: If you don't file Form OFR-RENEW, your out-of-state accounting firm may lose its registration in California.

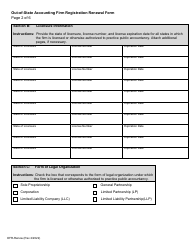

Q: Is Form OFR-RENEW only applicable to out-of-state accounting firms?

A: Yes, Form OFR-RENEW is specifically for out-of-state accounting firms that are registered in California.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the California Department of Consumer Affairs - Board of Accountancy;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OFR-RENEW by clicking the link below or browse more documents and templates provided by the California Department of Consumer Affairs - Board of Accountancy.