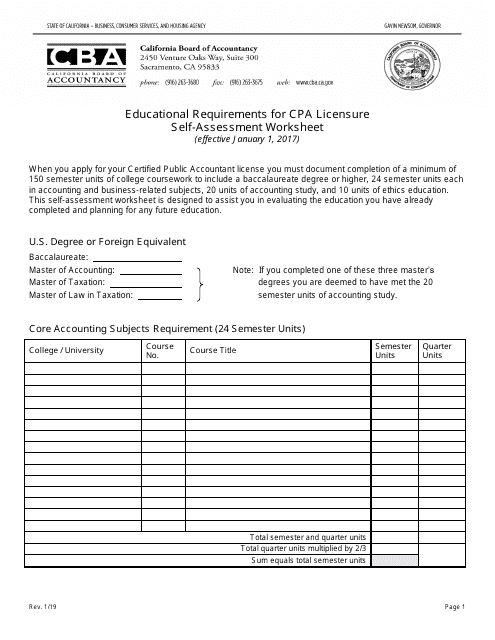

Educational Requirements for CPA Licensure Self-assessment Worksheet - California

Educational Requirements for CPA Licensure Self-assessment Worksheet is a legal document that was released by the California Department of Consumer Affairs - Board of Accountancy - a government authority operating within California.

FAQ

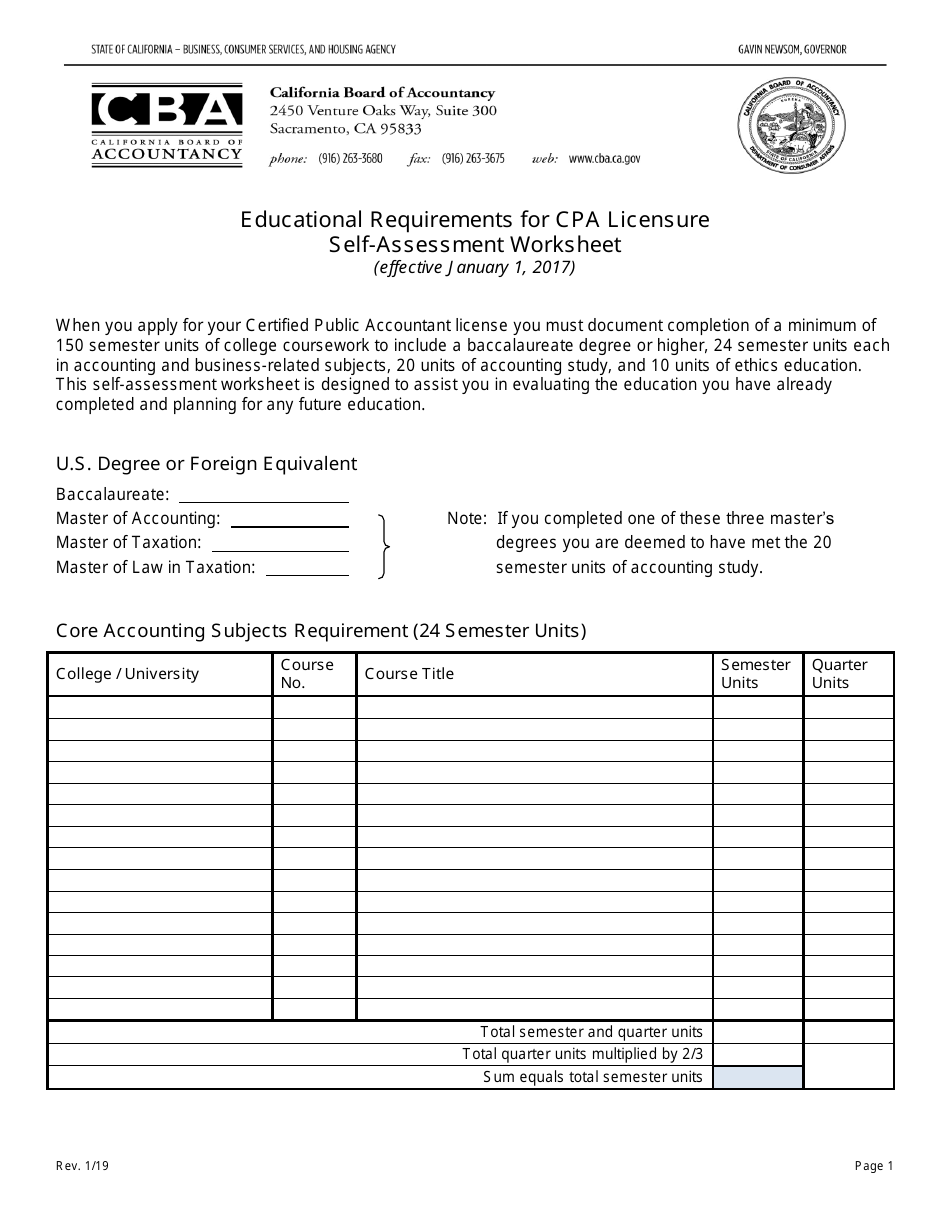

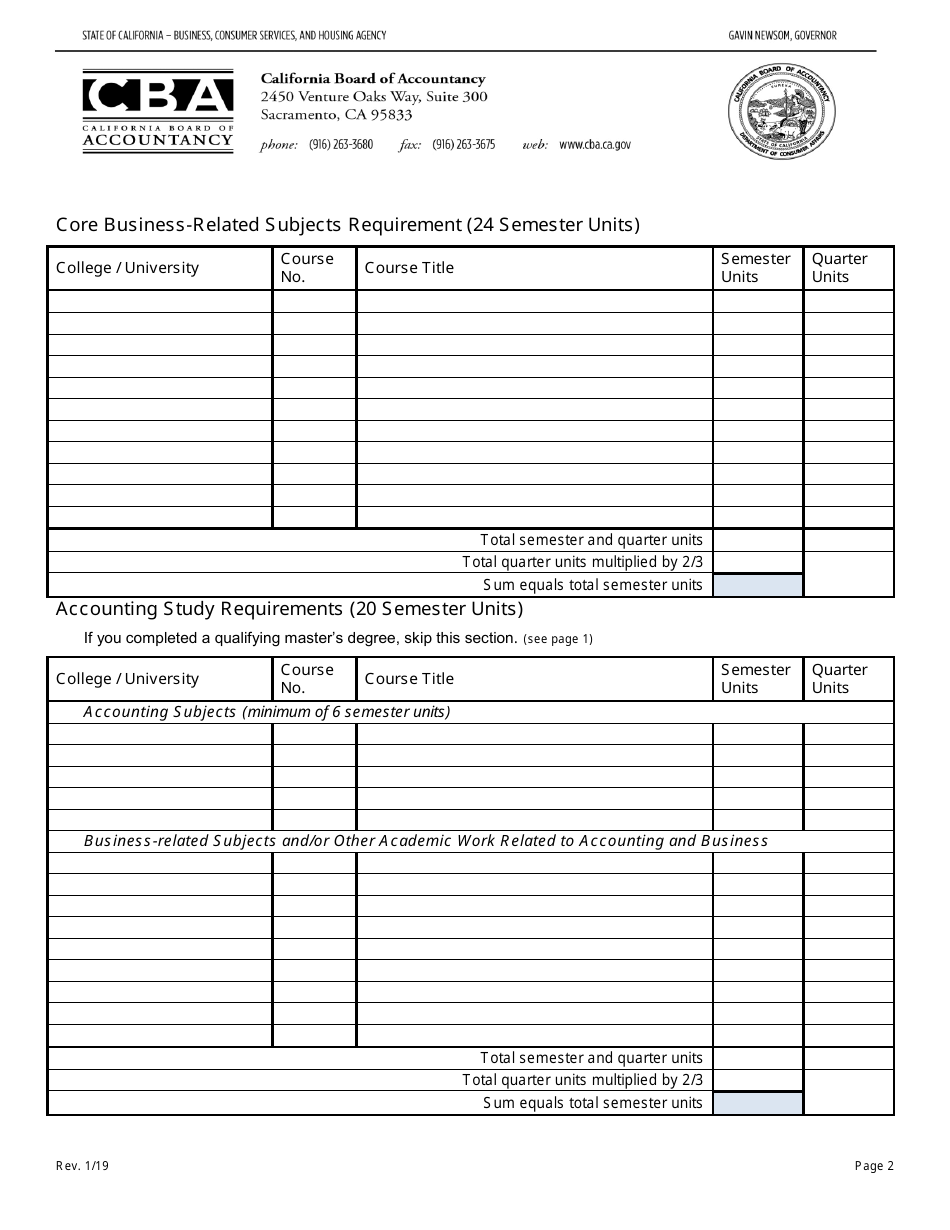

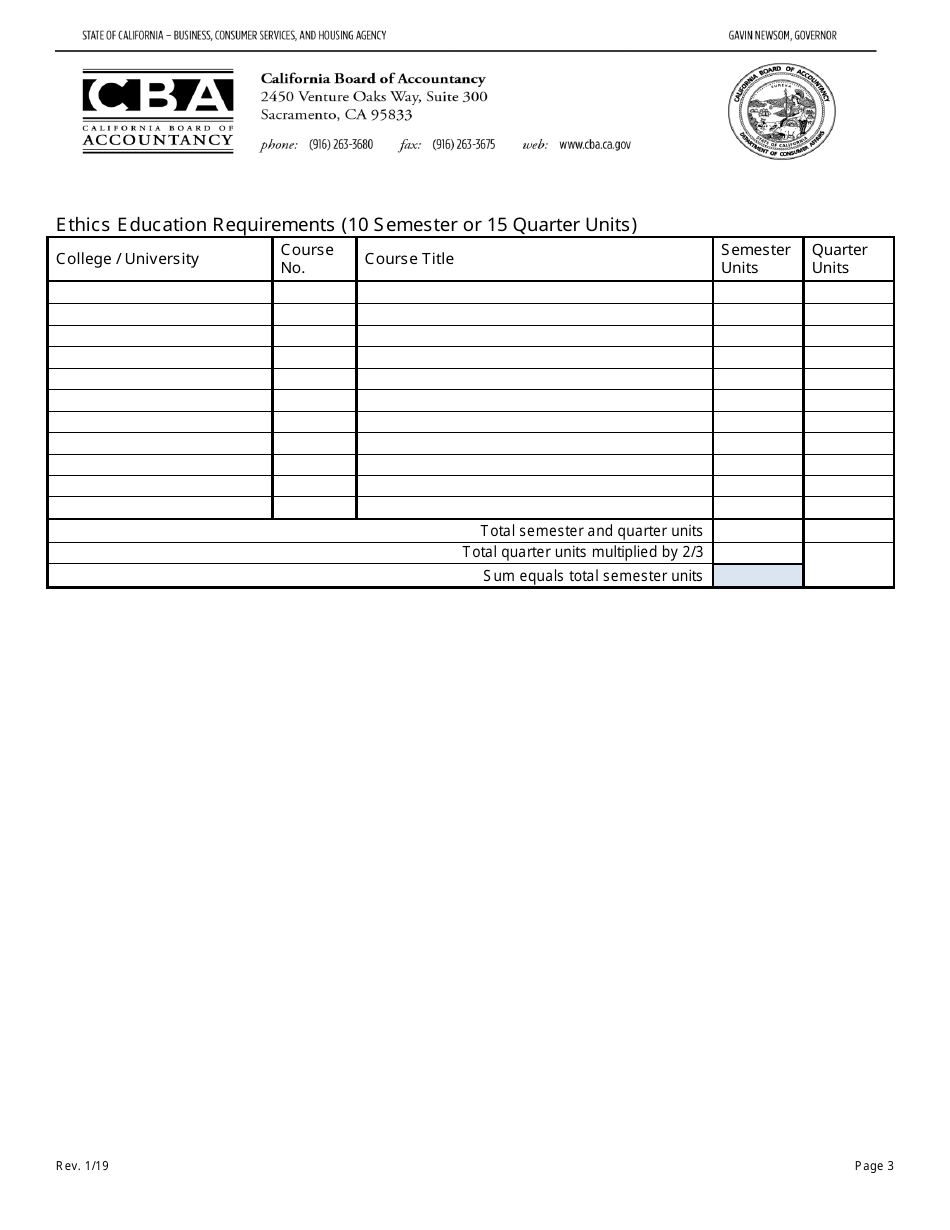

Q: What are the educational requirements for CPA licensure in California?

A: In California, you need to complete 150 semester units of college education, including specific accounting and business courses.

Q: How many semester units of college education are required for CPA licensure in California?

A: You need to complete 150 semester units of college education.

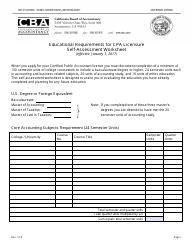

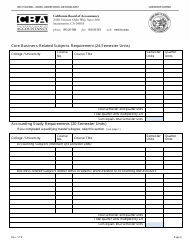

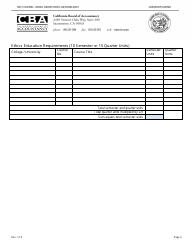

Q: What courses are required for CPA licensure in California?

A: You need to complete specific accounting and business courses.

Q: Is a bachelor's degree required for CPA licensure in California?

A: Yes, you need to have at least a bachelor's degree.

Q: Does the 150 semester units include general education courses?

A: Yes, the 150 semester units include both general education and specific accounting/business courses.

Q: Can I meet the educational requirements through a combination of undergraduate and graduate courses?

A: Yes, you can meet the educational requirements through a combination of undergraduate and graduate courses.

Q: Are there any additional requirements for CPA licensure in California?

A: Yes, in addition to the educational requirements, you need to pass the Uniform CPA Exam and fulfill experience requirements.

Form Details:

- Released on January 1, 2019;

- The latest edition currently provided by the California Department of Consumer Affairs - Board of Accountancy;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Consumer Affairs - Board of Accountancy.