Guidelines for Substitute & Reproduced Tax Forms - North Dakota

Guidelines for Substitute & Reproduced Tax Forms is a legal document that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota.

FAQ

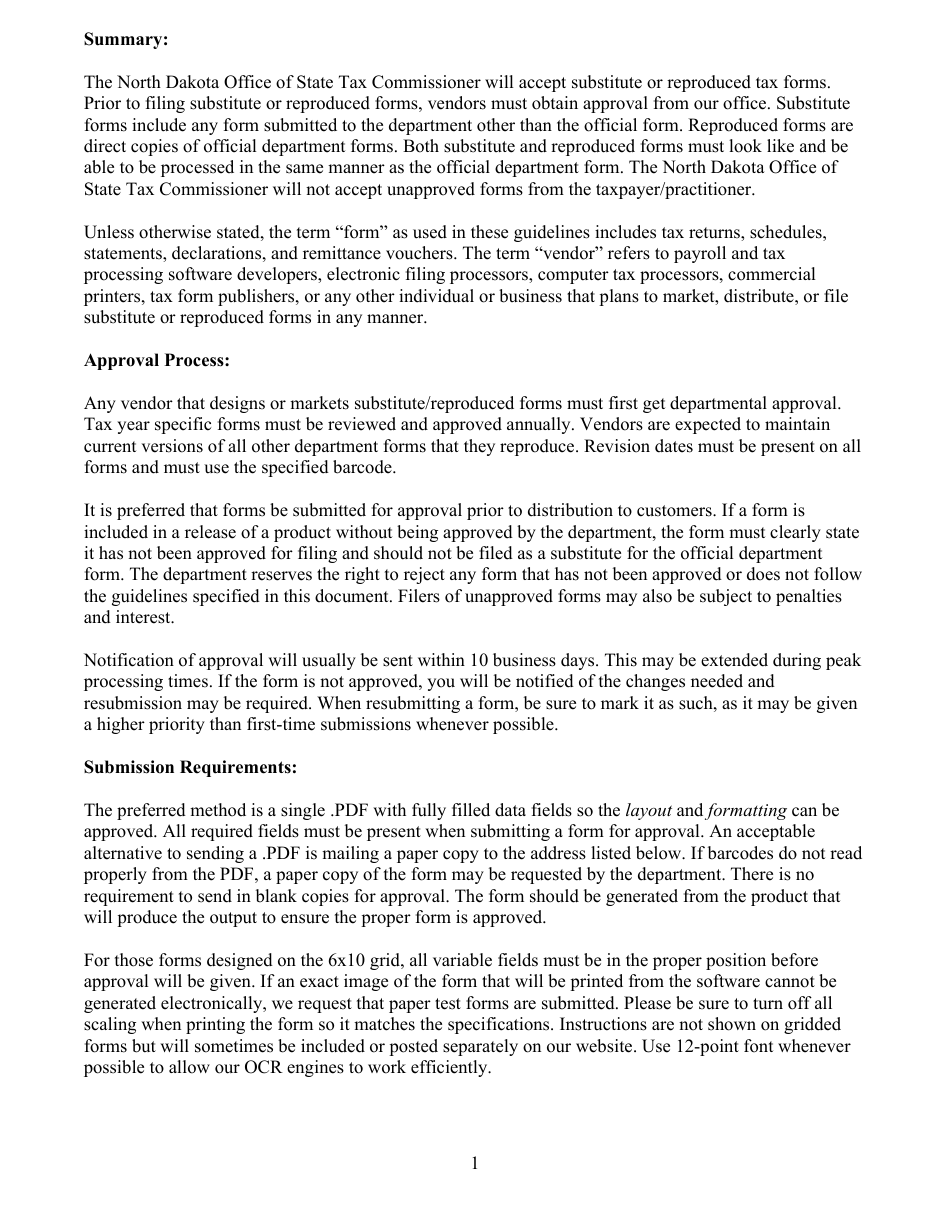

Q: What are substitute tax forms?

A: Substitute tax forms are replicas of the official tax forms provided by the tax authority.

Q: Why would substitute tax forms be used?

A: Substitute tax forms may be used when the official forms are unavailable or if there is a need for additional copies.

Q: Are substitute tax forms accepted by the tax authority?

A: Yes, substitute tax forms are generally accepted by the tax authority as long as they meet the specified requirements.

Q: What should I do if I receive a substitute tax form?

A: You should review the substitute tax form for accuracy and report any discrepancies to the issuer.

Q: Can I use a reproduced tax form?

A: In some cases, reproduced tax forms may be accepted by the tax authority, but it is advisable to check with the specific tax authority for their requirements.

Q: What should I do if I have questions about substitute or reproduced tax forms?

A: You should contact the tax authority or seek professional advice to clarify any doubts or concerns.

Form Details:

- Released on October 1, 2022;

- The latest edition currently provided by the North Dakota Office of State Tax Commissioner;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.