This version of the form is not currently in use and is provided for reference only. Download this version of

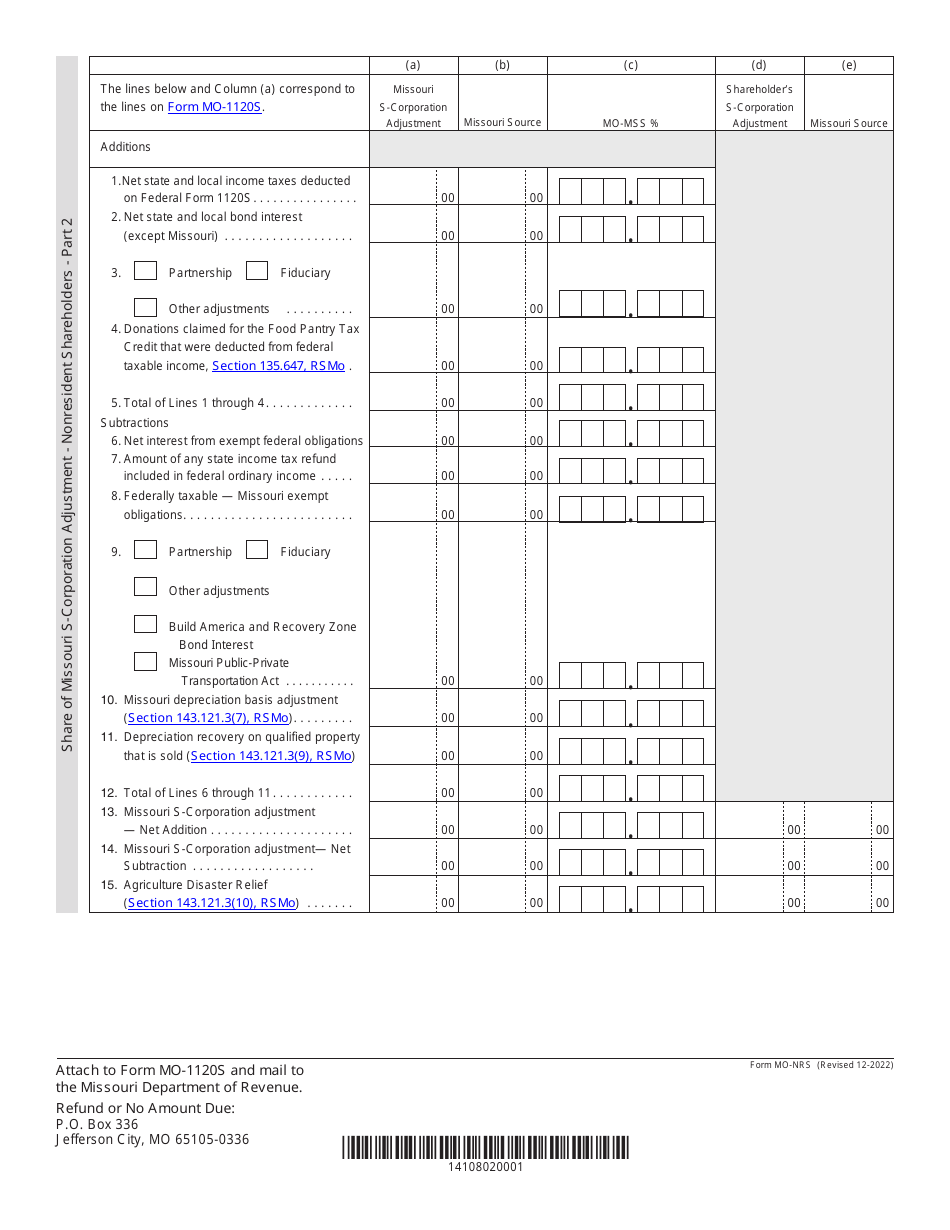

Form MO-NRS

for the current year.

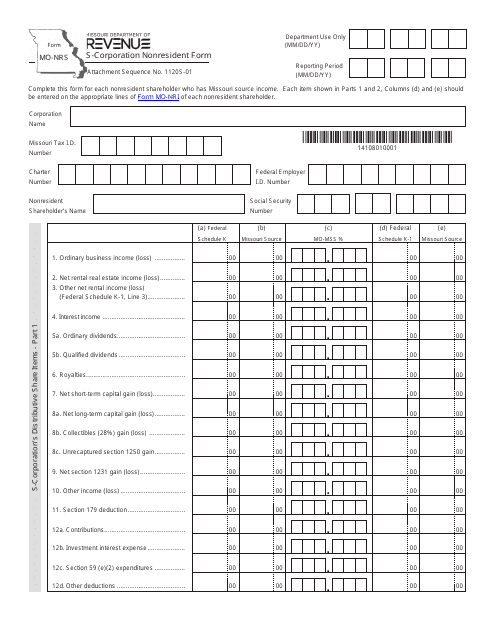

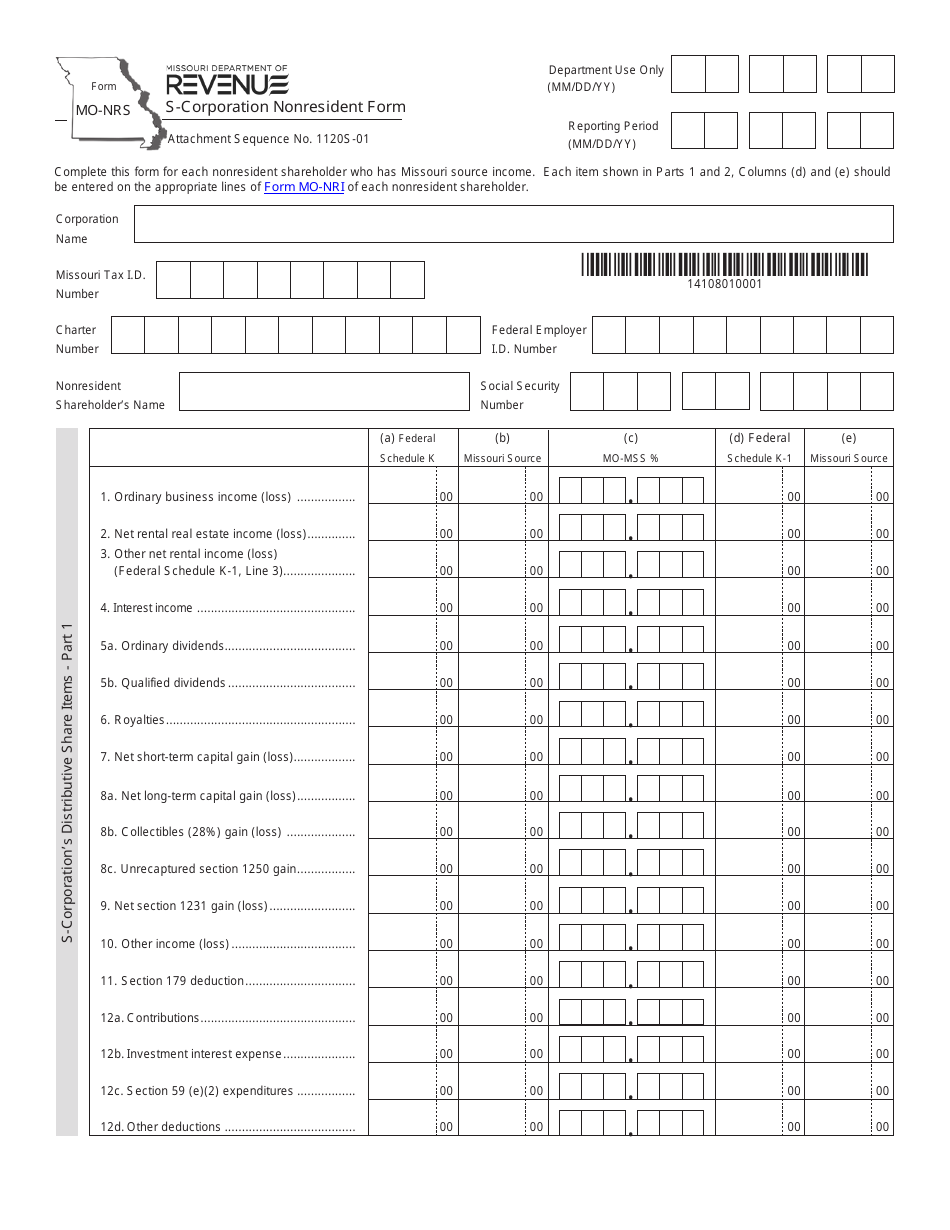

Form MO-NRS S-Corporation Nonresident Form - Missouri

What Is Form MO-NRS?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-NRS S-Corporation Nonresident Form?

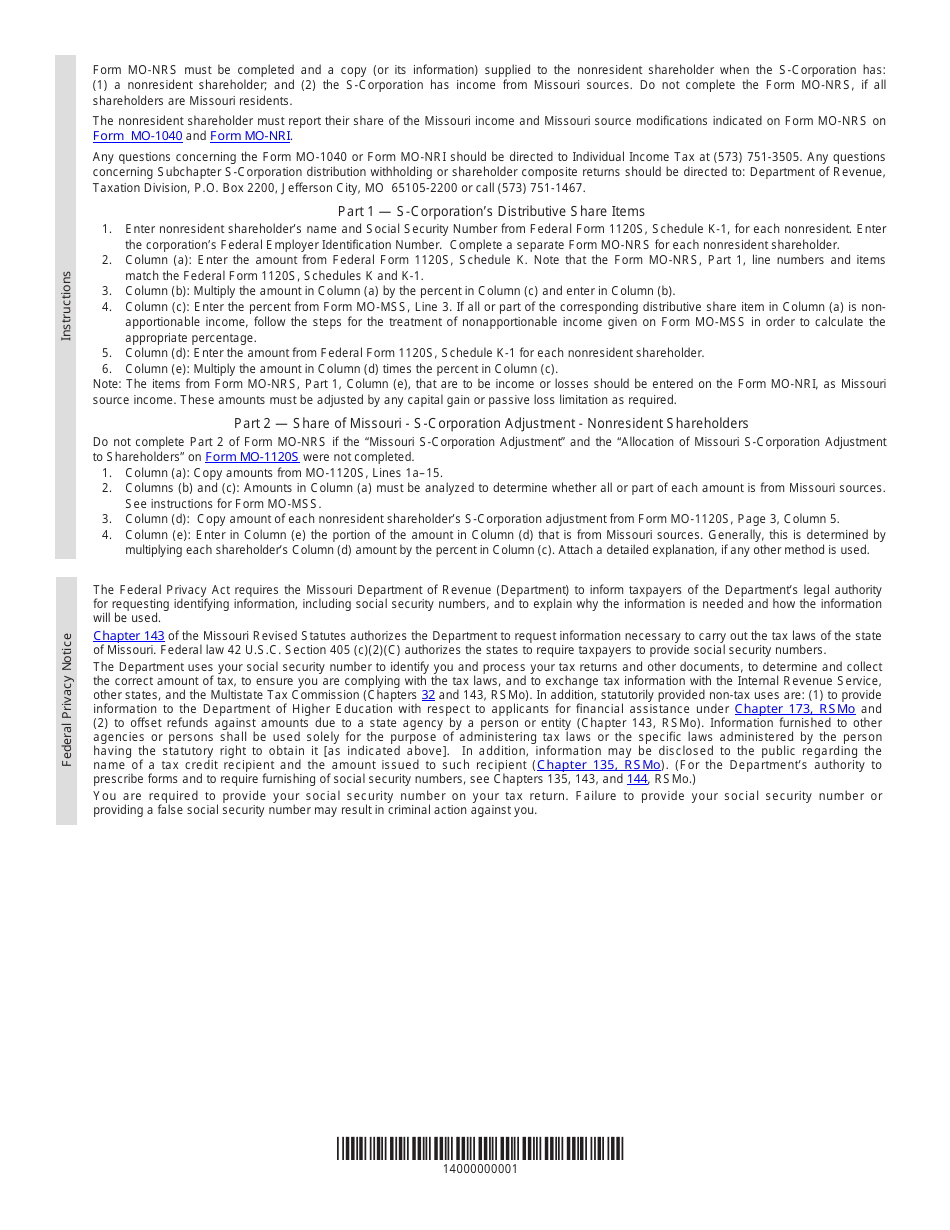

A: The MO-NRS S-Corporation Nonresident Form is a tax form for S-Corporations that have nonresident shareholders in Missouri.

Q: Who needs to file the MO-NRS S-Corporation Nonresident Form?

A: S-Corporations that have nonresident shareholders and conduct business in Missouri need to file the MO-NRS S-Corporation Nonresident Form.

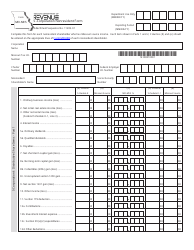

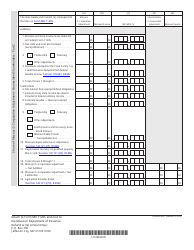

Q: What information is required on the MO-NRS S-Corporation Nonresident Form?

A: The MO-NRS S-Corporation Nonresident Form requires information about the S-Corporation, its nonresident shareholders, and their distributive share of income from Missouri sources.

Q: When is the deadline to file the MO-NRS S-Corporation Nonresident Form?

A: The MO-NRS S-Corporation Nonresident Form must be filed by the due date of the S-Corporation's Missouri income tax return.

Q: Are there any penalties for not filing the MO-NRS S-Corporation Nonresident Form?

A: Yes, there may be penalties for not filing the MO-NRS S-Corporation Nonresident Form, including late filing penalties and interest on unpaid tax amounts.

Q: Is the MO-NRS S-Corporation Nonresident Form the same as the regular S-Corporation tax form?

A: No, the MO-NRS S-Corporation Nonresident Form is a separate form specifically for S-Corporations with nonresident shareholders in Missouri.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-NRS by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.