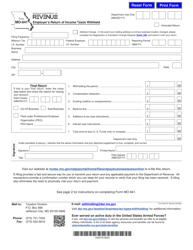

This version of the form is not currently in use and is provided for reference only. Download this version of

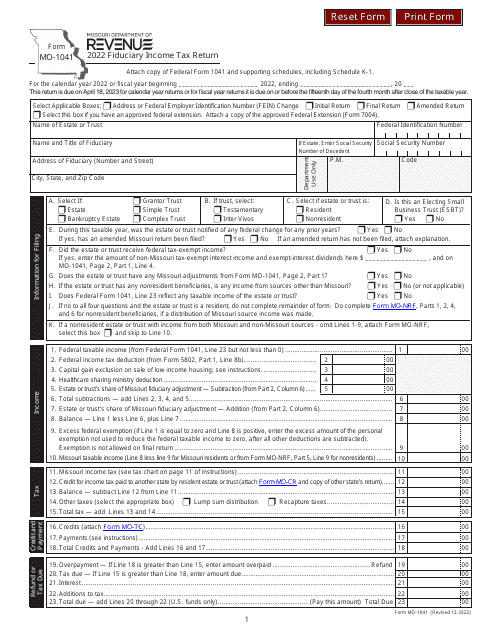

Form MO-1041

for the current year.

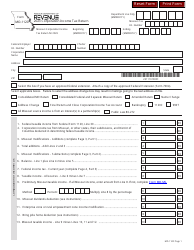

Form MO-1041 Fiduciary Income Tax Return - Missouri

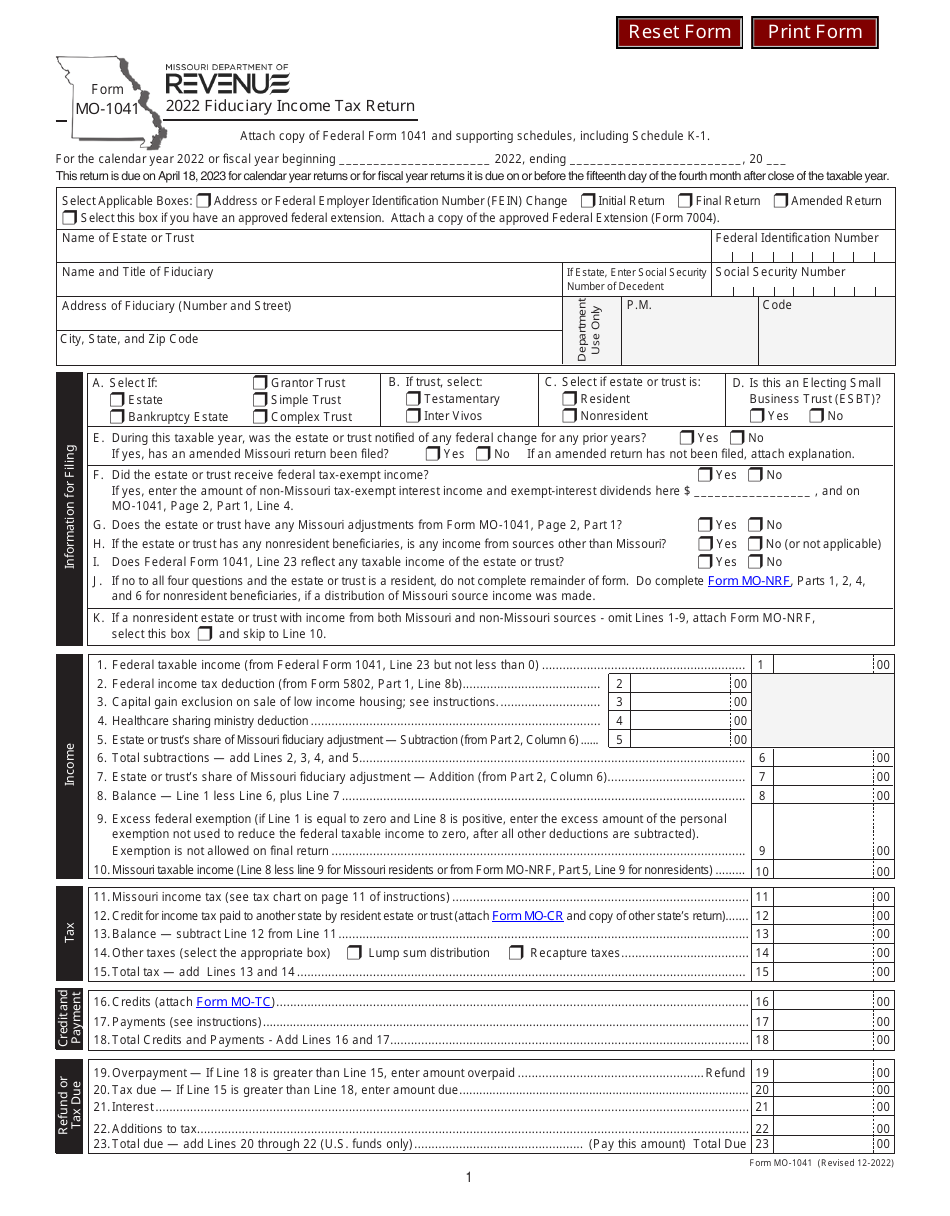

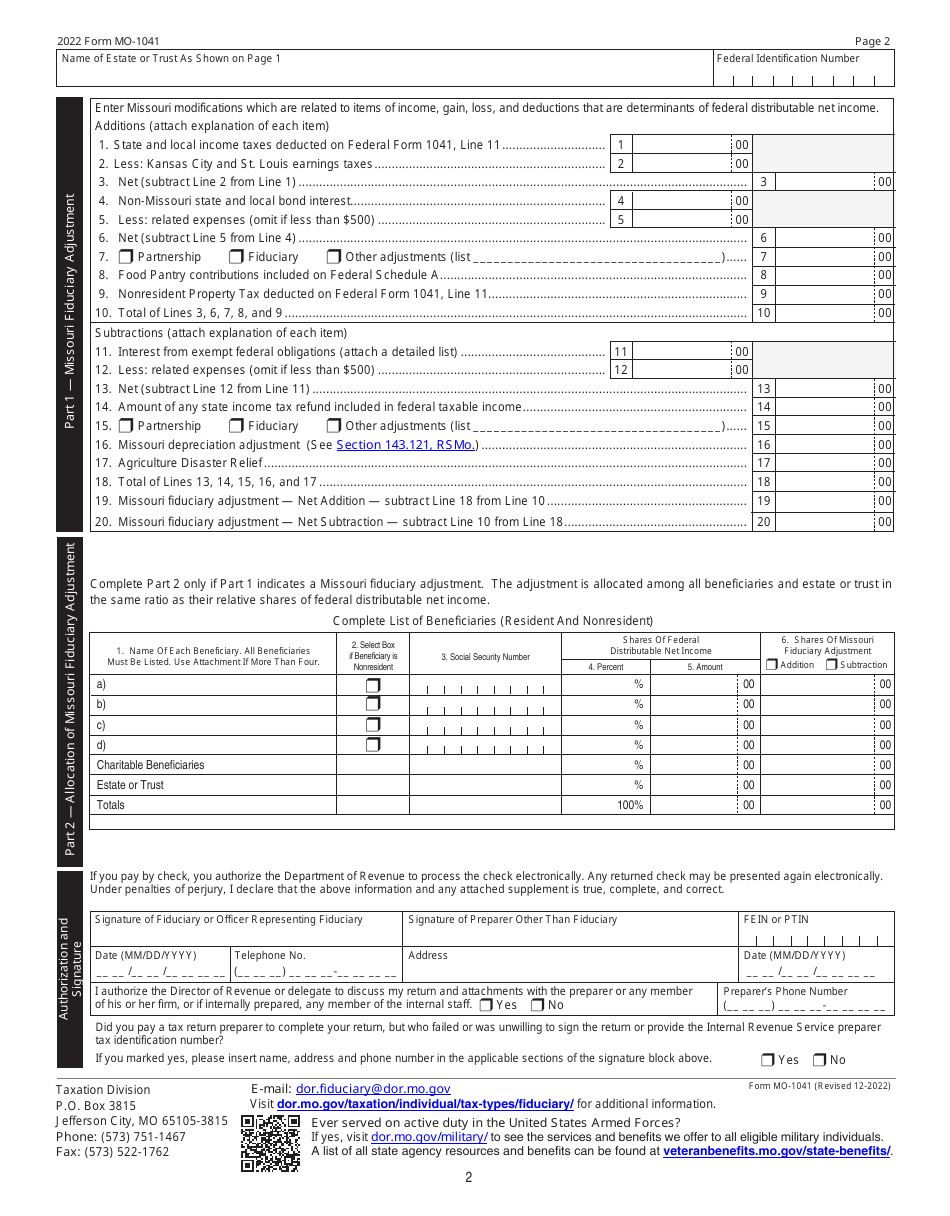

What Is Form MO-1041?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-1041?

A: Form MO-1041 is the Fiduciary Income Tax Return used in Missouri.

Q: Who needs to file Form MO-1041?

A: Anyone who is acting as a fiduciary, such as an executor or trustee, and has received income that needs to be reported for a Missouri estate or trust, is required to file Form MO-1041.

Q: What income should be reported on Form MO-1041?

A: All income received by the estate or trust, including interest, dividends, rents, and capital gains, should be reported on Form MO-1041.

Q: When is Form MO-1041 due?

A: Form MO-1041 is generally due on or before April 15th of the following year.

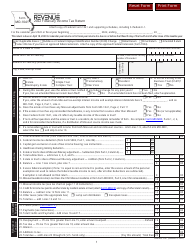

Q: Are there any extensions available for filing Form MO-1041?

A: Yes, extensions of up to 6 months are available. However, any tax owed must still be paid by the original due date to avoid penalties and interest.

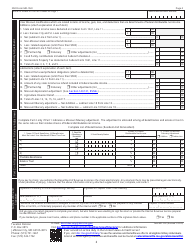

Q: Is Form MO-1041 the only form that needs to be filed for a Missouri estate or trust?

A: No, in addition to Form MO-1041, Form MO-1041V may need to be filed if there is a balance due, and Schedule K-1 may need to be given to beneficiaries to report their share of the income.

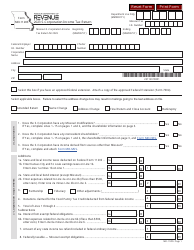

Q: Can Form MO-1041 be e-filed?

A: Yes, Form MO-1041 can be e-filed using approved software.

Q: Are there any special considerations for non-resident fiduciaries?

A: Yes, non-resident fiduciaries must file Form MO-1041NR instead of Form MO-1041.

Q: Is there a minimum income threshold for filing Form MO-1041?

A: Yes, if the estate or trust had less than $600 in gross income for the year, Form MO-1041 may not need to be filed.

Q: What happens if I don't file Form MO-1041 when required?

A: If you are required to file Form MO-1041 and fail to do so, you may be subject to penalties and interest on any unpaid taxes.

Q: Can I claim deductions and credits on Form MO-1041?

A: Yes, just like with individual income tax returns, you can claim deductions and credits on Form MO-1041 to reduce the tax liability for the estate or trust.

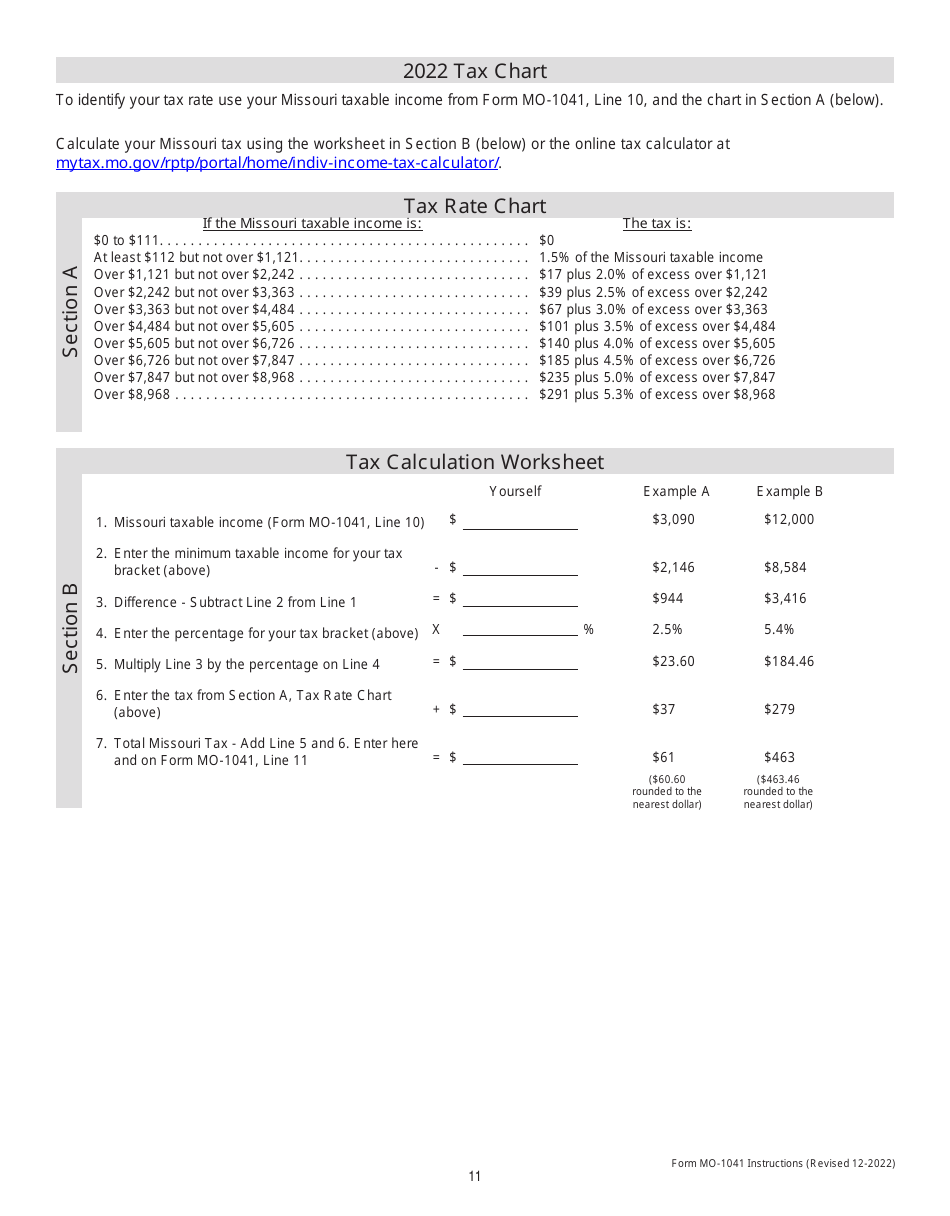

Q: Is there a separate tax rate for estates and trusts in Missouri?

A: No, estates and trusts are subject to the same tax rates as individuals in Missouri.

Q: What supporting documents should be kept for Form MO-1041?

A: You should keep records of all income, expenses, deductions, and credits claimed on Form MO-1041, as well as any other supporting documents required by the Missouri Department of Revenue.

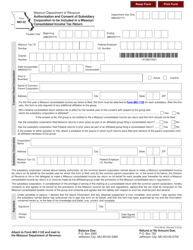

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1041 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.