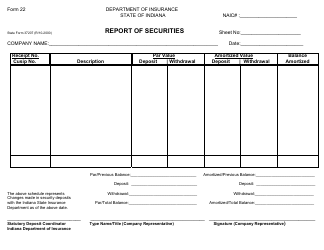

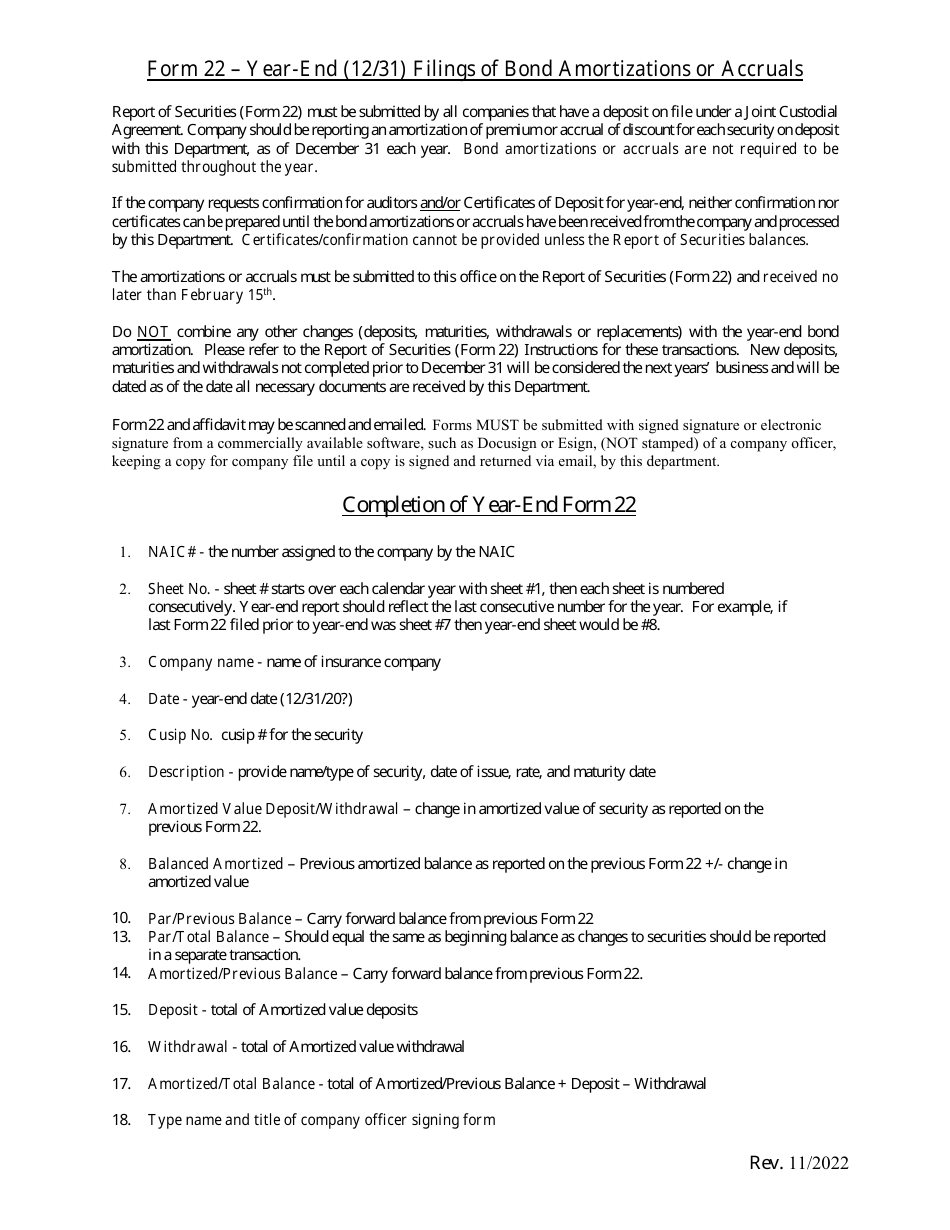

Form 22 (State Form 37207) Report of Securities - Indiana

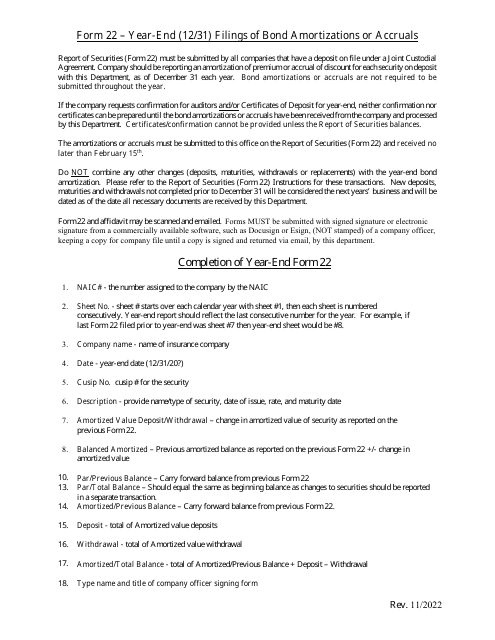

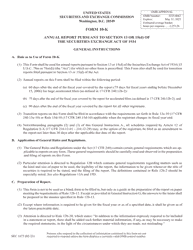

What Is Form 22 (State Form 37207)?

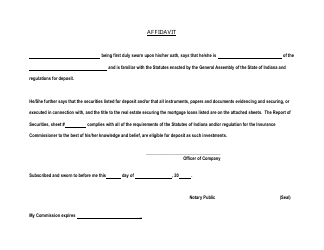

This is a legal form that was released by the Indiana Department of Insurance - a government authority operating within Indiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 22?

A: Form 22 is a report of securities for the state of Indiana.

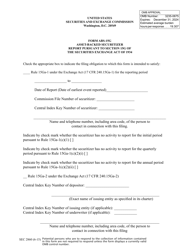

Q: Who needs to file Form 22?

A: Any entity or individual that sells or offers for sale securities in Indiana needs to file Form 22.

Q: Is Form 22 applicable to both residents and non-residents of Indiana?

A: Yes, both residents and non-residents of Indiana who sell securities in the state need to file Form 22.

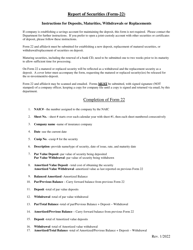

Q: What information is required on Form 22?

A: Form 22 requires information about the issuer of the securities, the offering details, financial information, and any exemptions claimed.

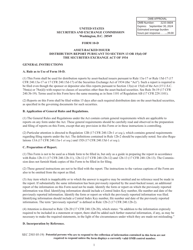

Q: When is Form 22 due?

A: Form 22 must be filed within 15 days of the first sale of securities in Indiana.

Q: Are there any filing fees for Form 22?

A: Yes, there are filing fees associated with Form 22. The fees vary depending on the total offering amount.

Q: Are there any penalties for late or non-filing of Form 22?

A: Yes, failure to timely file Form 22 or pay the required fees may result in penalties or enforcement actions by the Indiana Secretary of State.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Indiana Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 22 (State Form 37207) by clicking the link below or browse more documents and templates provided by the Indiana Department of Insurance.