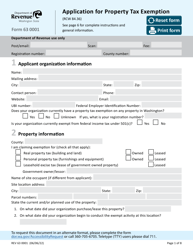

Form REV64 0118 Application for Extension of Property Tax Exemption as Property Used for Nonprofit Low-Income Homeownership Development - Washington

What Is Form REV64 0118?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

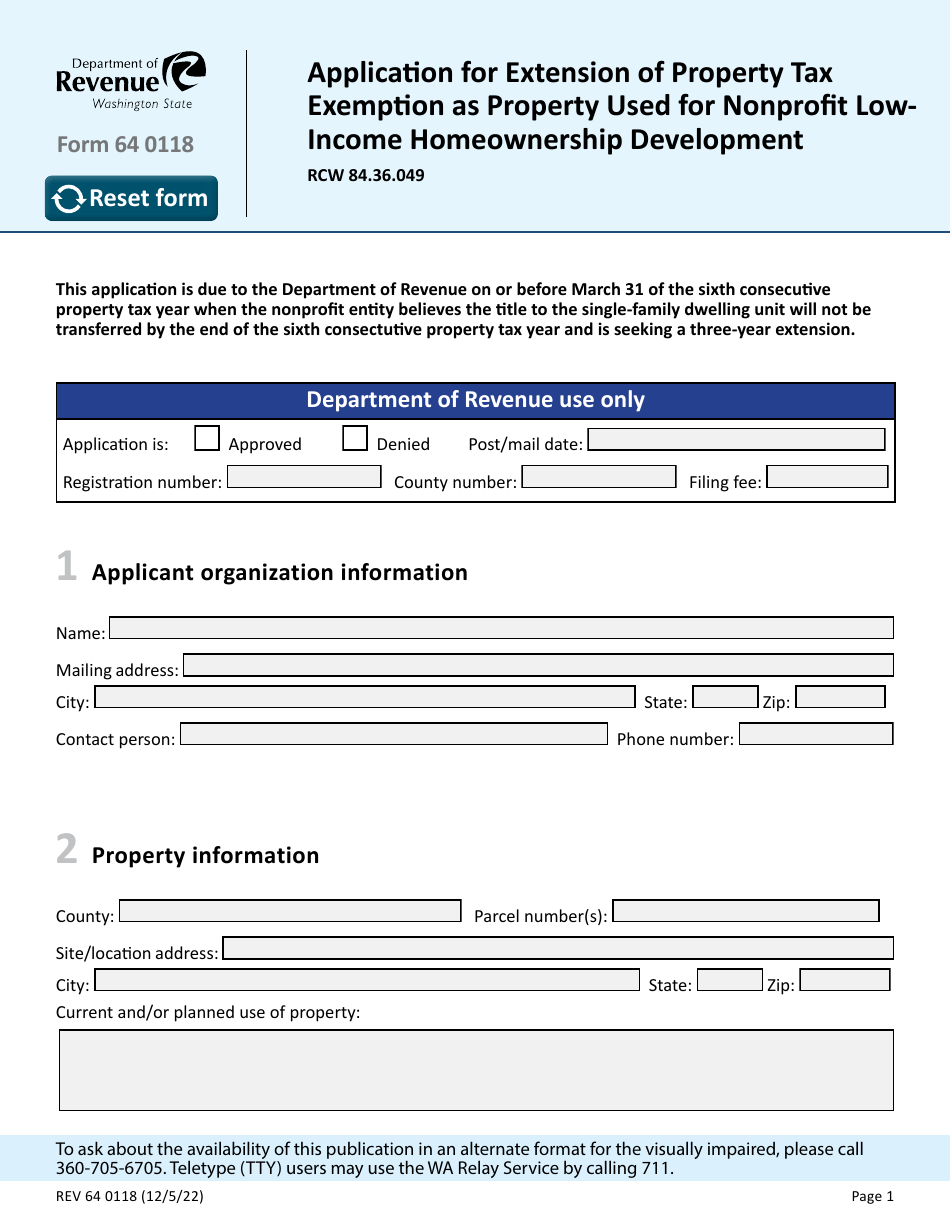

Q: What is Form REV64 0118?

A: Form REV64 0118 is an application for extension of property tax exemption as property used for nonprofit low-income homeownership development in Washington.

Q: Who can use Form REV64 0118?

A: Nonprofit organizations in Washington that develop low-income homeownership properties can use Form REV64 0118 to apply for an extension of property tax exemption.

Q: What is the purpose of this form?

A: The purpose of Form REV64 0118 is to request an extension of property tax exemption for properties used in nonprofit low-income homeownership development.

Q: When should Form REV64 0118 be filed?

A: Form REV64 0118 should be filed before the expiration of the existing property tax exemption.

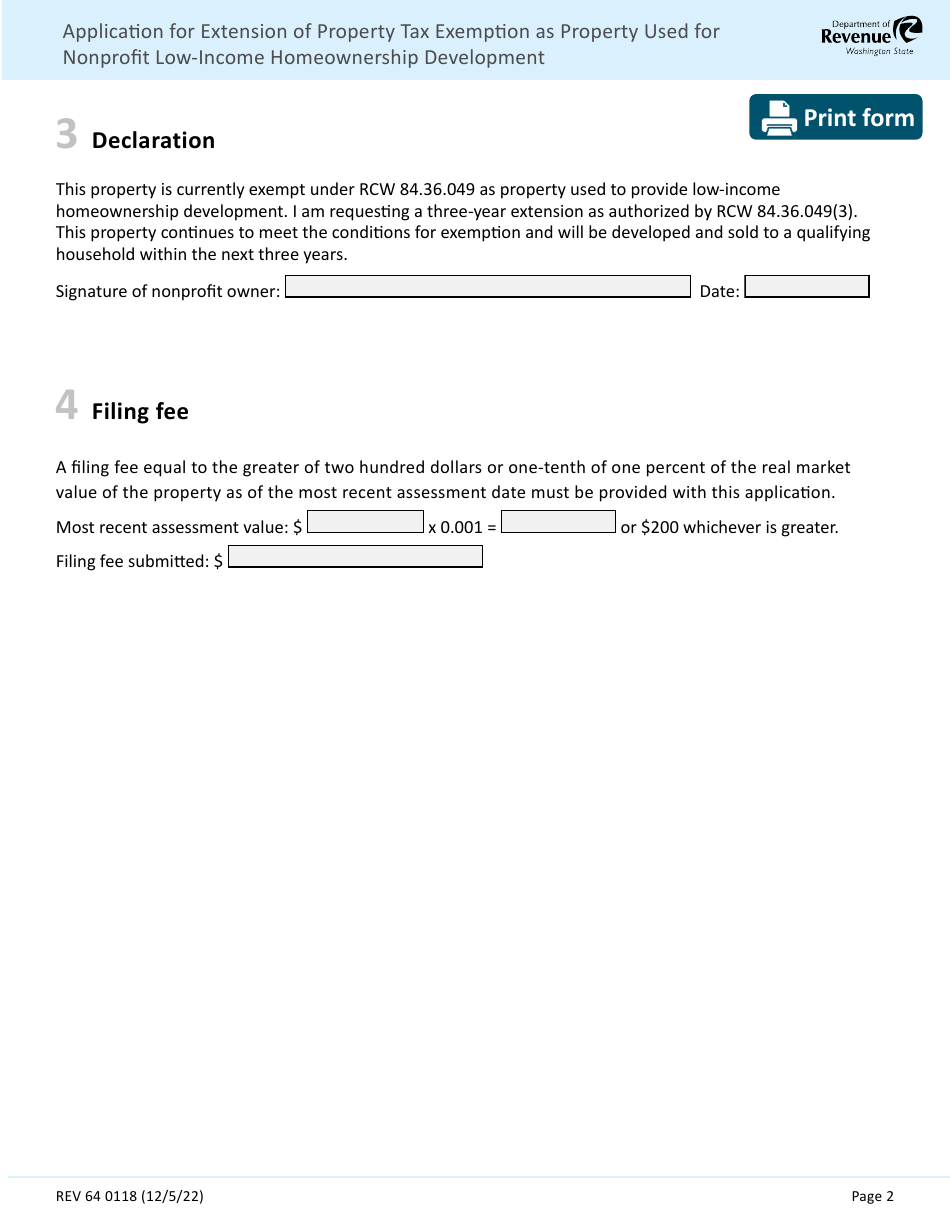

Q: Is there a fee for filing Form REV64 0118?

A: No, there is no fee for filing Form REV64 0118.

Q: What documents should be included with Form REV64 0118?

A: The application should include supporting documents, such as a project summary, financial statements, and proof of nonprofit status.

Q: How long does it take to process Form REV64 0118?

A: The processing time for Form REV64 0118 may vary, but the department strives to process applications within 90 days.

Q: Can the property tax exemption be extended indefinitely?

A: No, the property tax exemption can be extended for a maximum of 10 years.

Form Details:

- Released on December 5, 2022;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV64 0118 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.