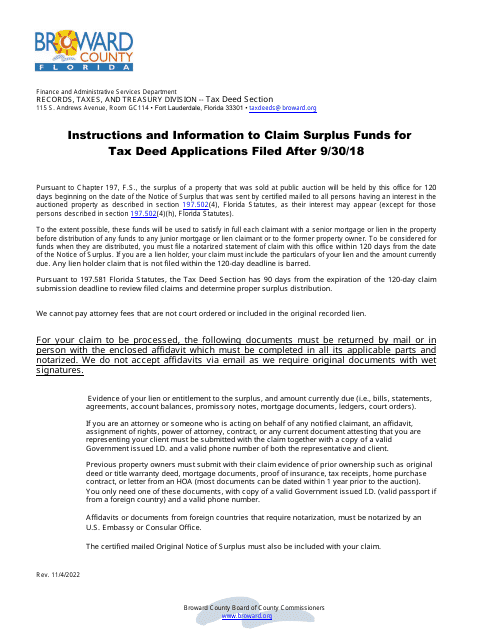

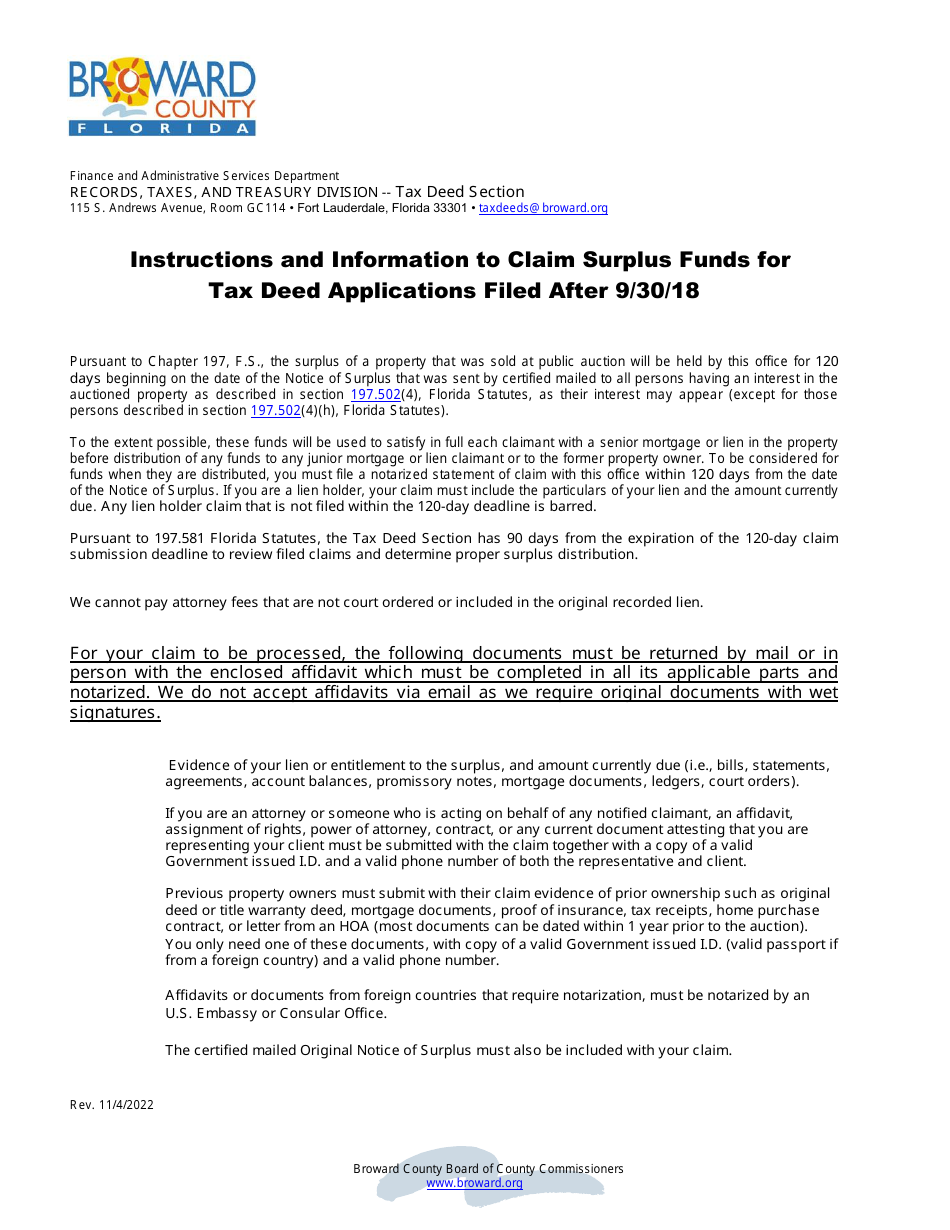

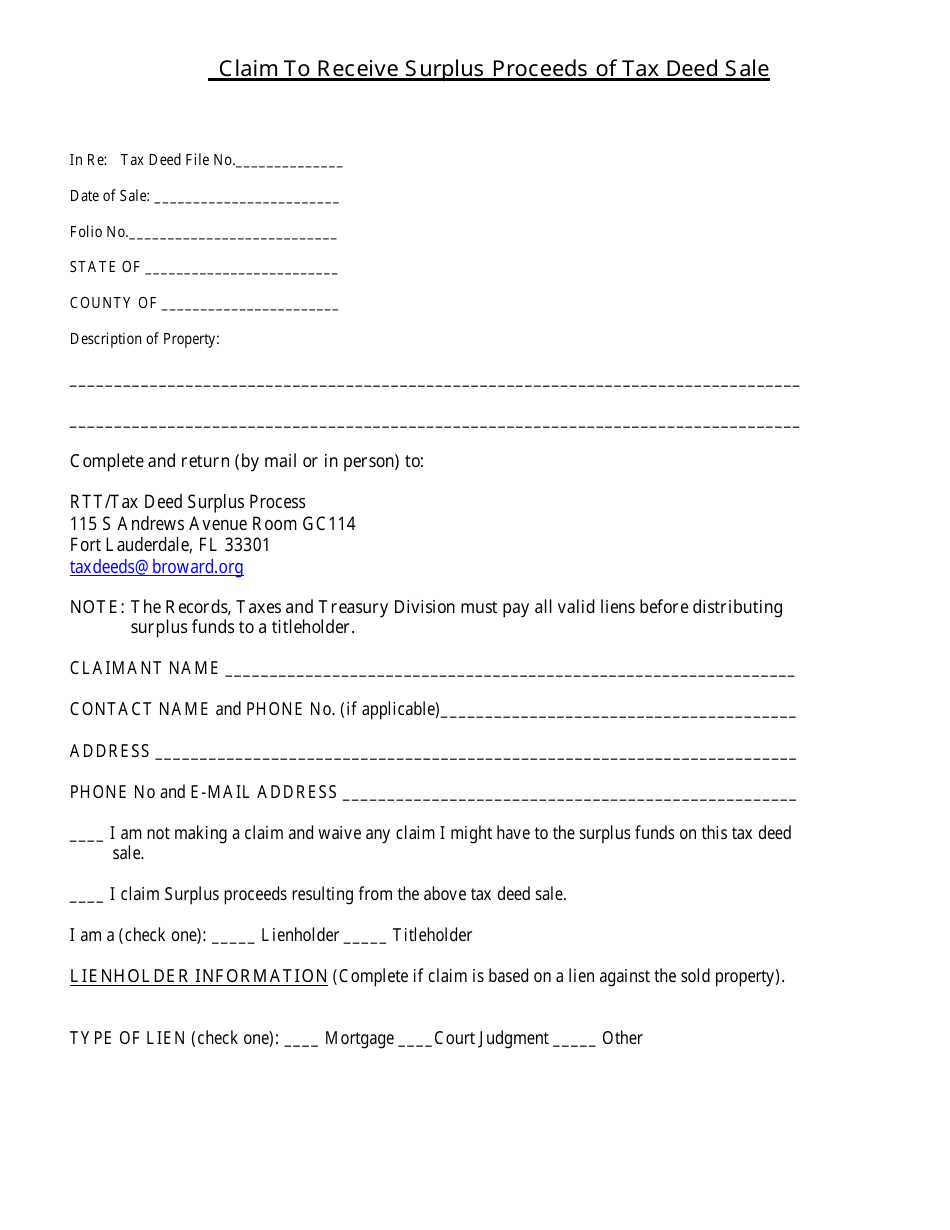

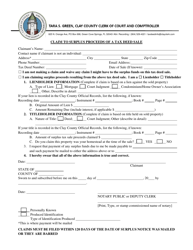

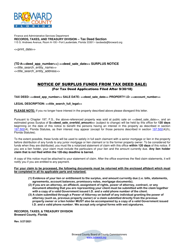

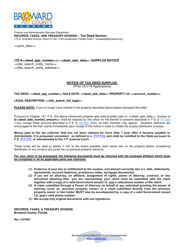

Claim to Receive Surplus Proceeds of Tax Deed Sale - Broward County, Florida

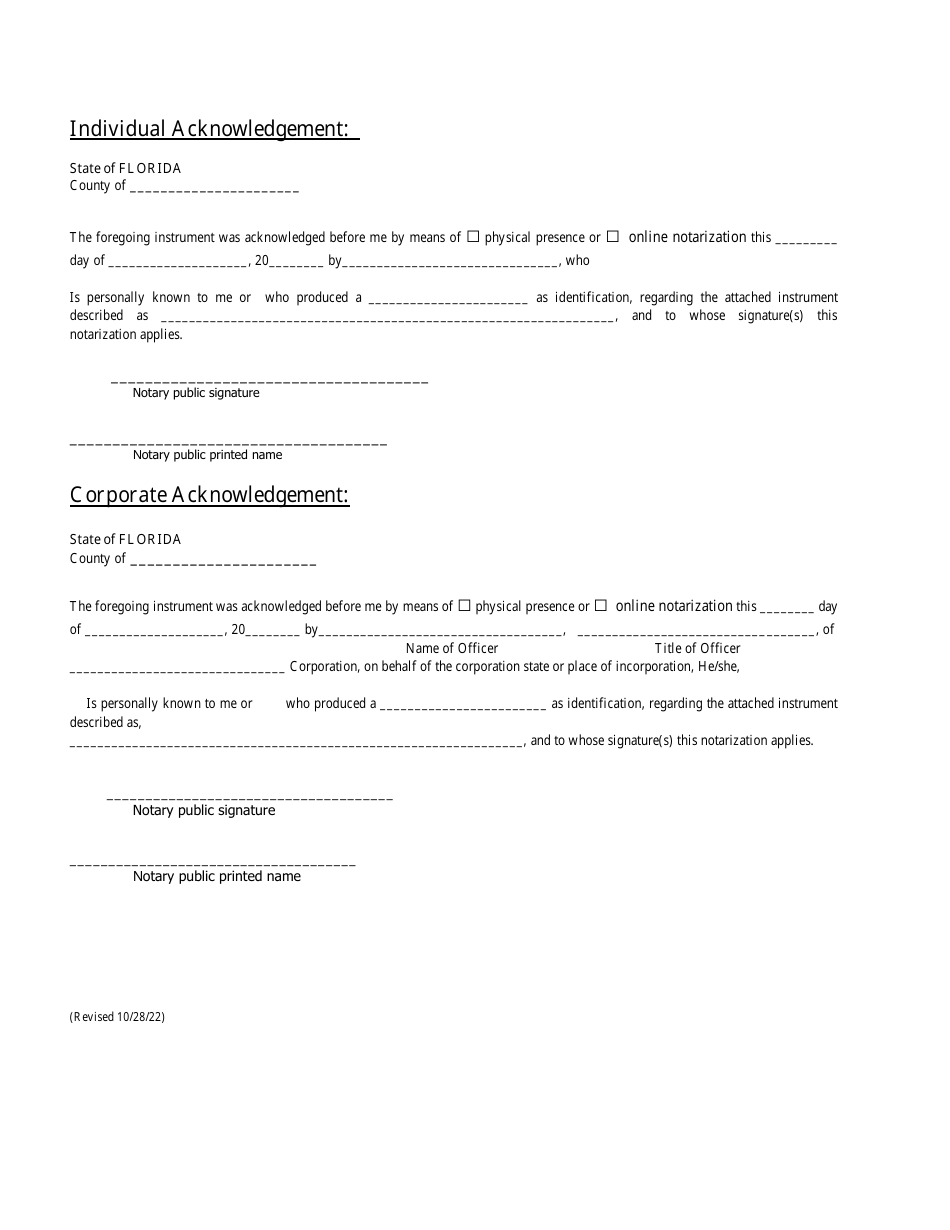

Claim to Receive Surplus Proceeds of Tax Deed Sale is a legal document that was released by the Records, Taxes & Treasury Division - Broward County, Florida - a government authority operating within Florida. The form may be used strictly within Broward County.

FAQ

Q: What is a surplus proceeds of tax deed sale?

A: Surplus proceeds of a tax deed sale refers to any money that remains after the sale of a property to pay off delinquent taxes and other obligations.

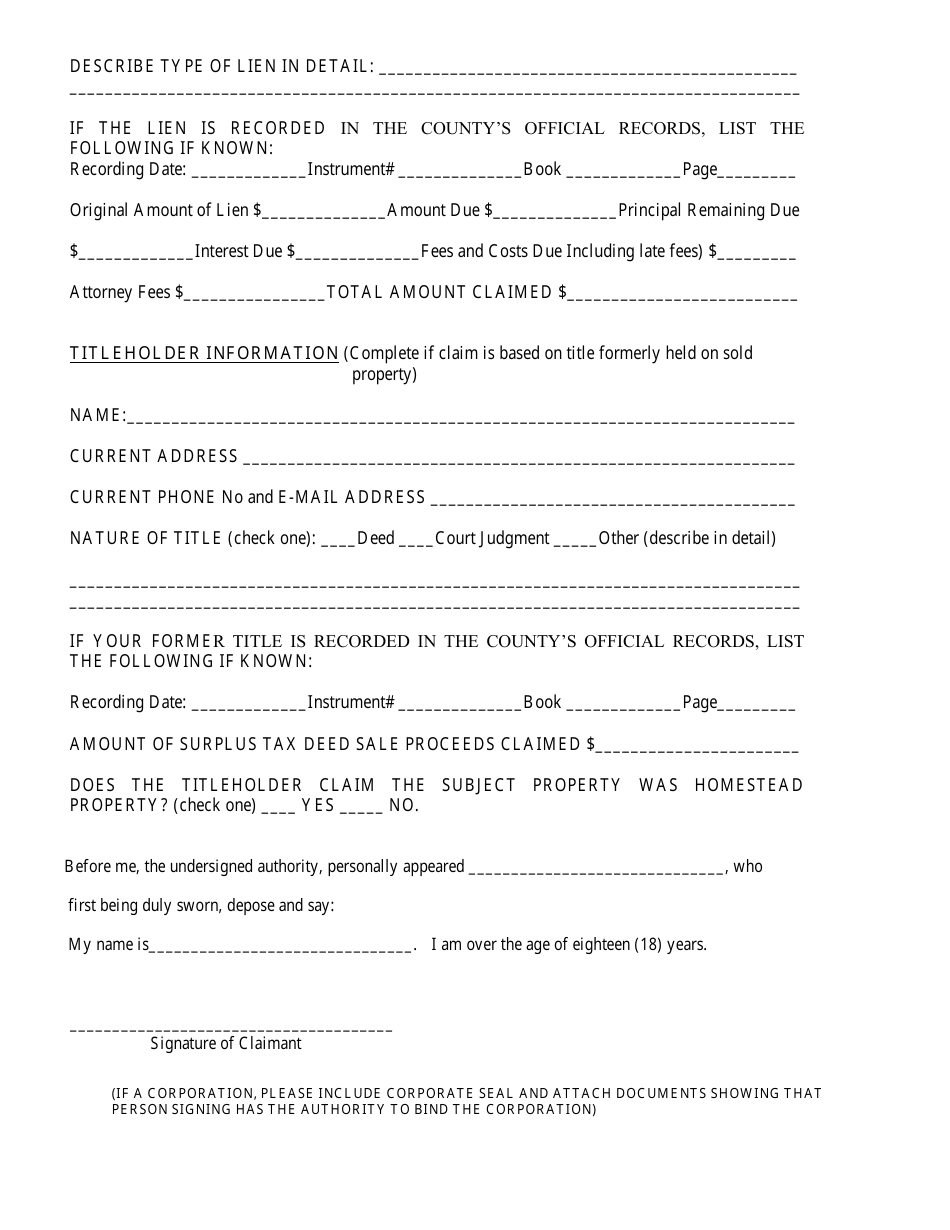

Q: How can I claim the surplus proceeds of a tax deed sale in Broward County, Florida?

A: To claim the surplus proceeds, you must file a claim with the Broward County Clerk of Courts and provide the required documentation.

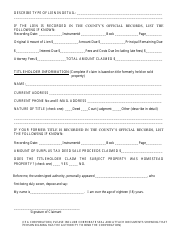

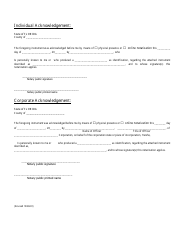

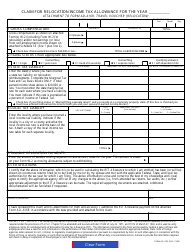

Q: What documentation is required to claim surplus proceeds of a tax deed sale in Broward County?

A: The documentation required may include an application, an affidavit, a copy of the tax deed sale certificate, and any other supporting documents as specified by the Clerk of Courts.

Q: Is there a deadline for filing a claim for surplus proceeds in Broward County?

A: Yes, there is a deadline for filing a claim, typically within 60 days from the date of the tax deed sale.

Q: What happens if I don't claim the surplus proceeds within the specified deadline?

A: If you fail to file a claim within the specified deadline, you may forfeit your right to the surplus proceeds, and the funds may be distributed to other parties according to state law.

Form Details:

- Released on November 4, 2022;

- The latest edition currently provided by the Records, Taxes & Treasury Division - Broward County, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Records, Taxes & Treasury Division - Broward County, Florida.