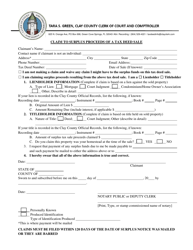

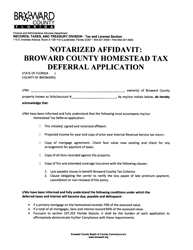

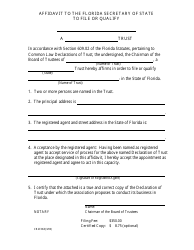

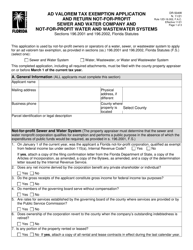

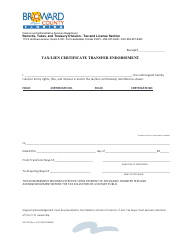

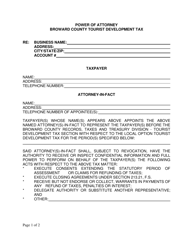

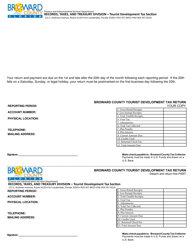

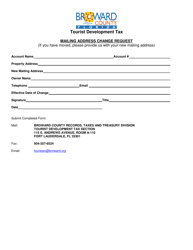

Affidavit to File for Tax Deed Surplus Funds (Pre - 10 / 1 / 2018) - Broward County, Florida

Affidavit to File for Surplus Funds (Pre - 10/1/2018) is a legal document that was released by the Records, Taxes & Treasury Division - Broward County, Florida - a government authority operating within Florida. The form may be used strictly within Broward County.

FAQ

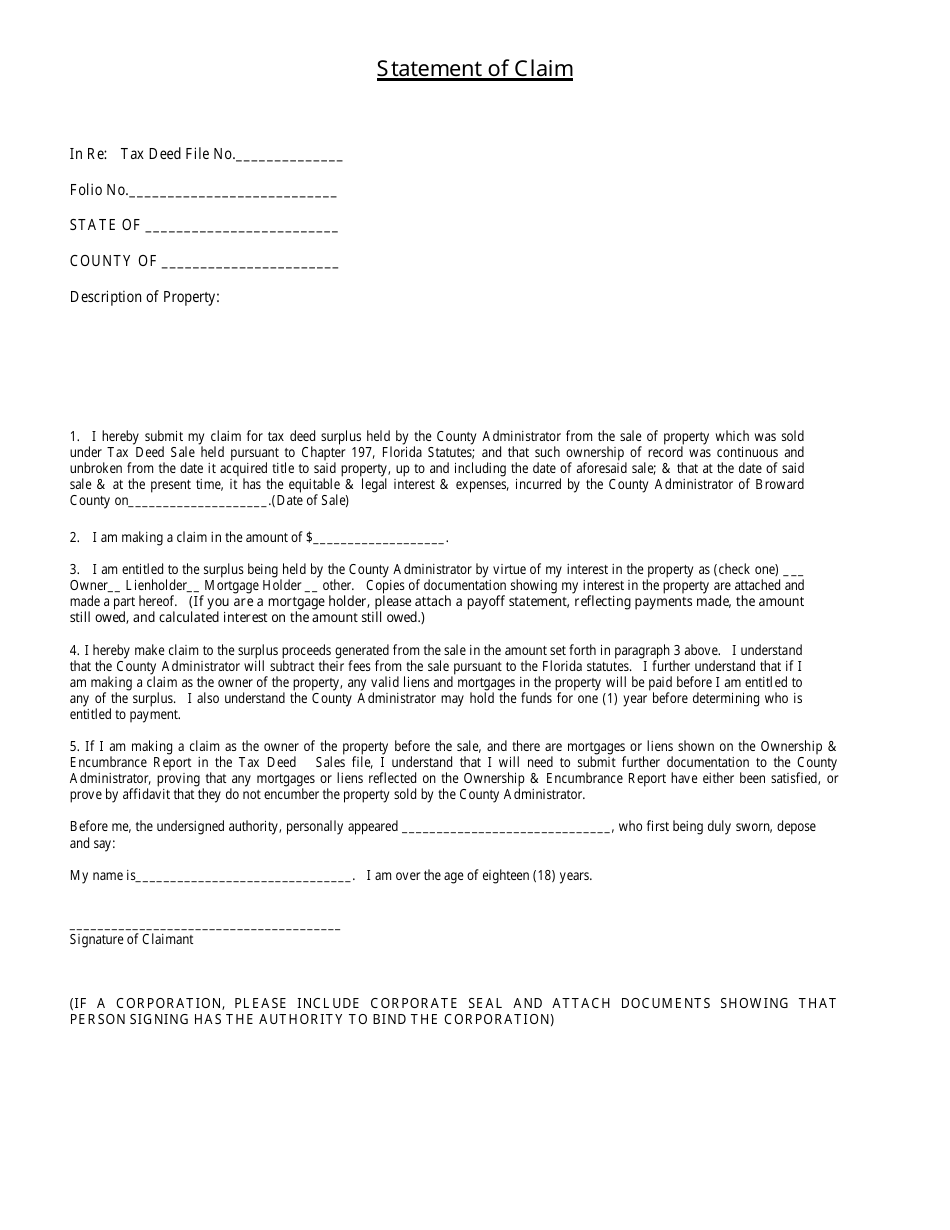

Q: What is an Affidavit to File for Tax Deed Surplus Funds?

A: An Affidavit to File for Tax Deed Surplus Funds is a legal document used to claim any excess funds from a tax foreclosure sale.

Q: What are tax deed surplus funds?

A: Tax deed surplus funds are any remaining funds from a tax foreclosure sale after the taxes and fees have been paid.

Q: Who can file an Affidavit to File for Tax Deed Surplus Funds?

A: The owner of the property at the time of the tax foreclosure sale or their legal representatives can file an Affidavit to File for Tax Deed Surplus Funds.

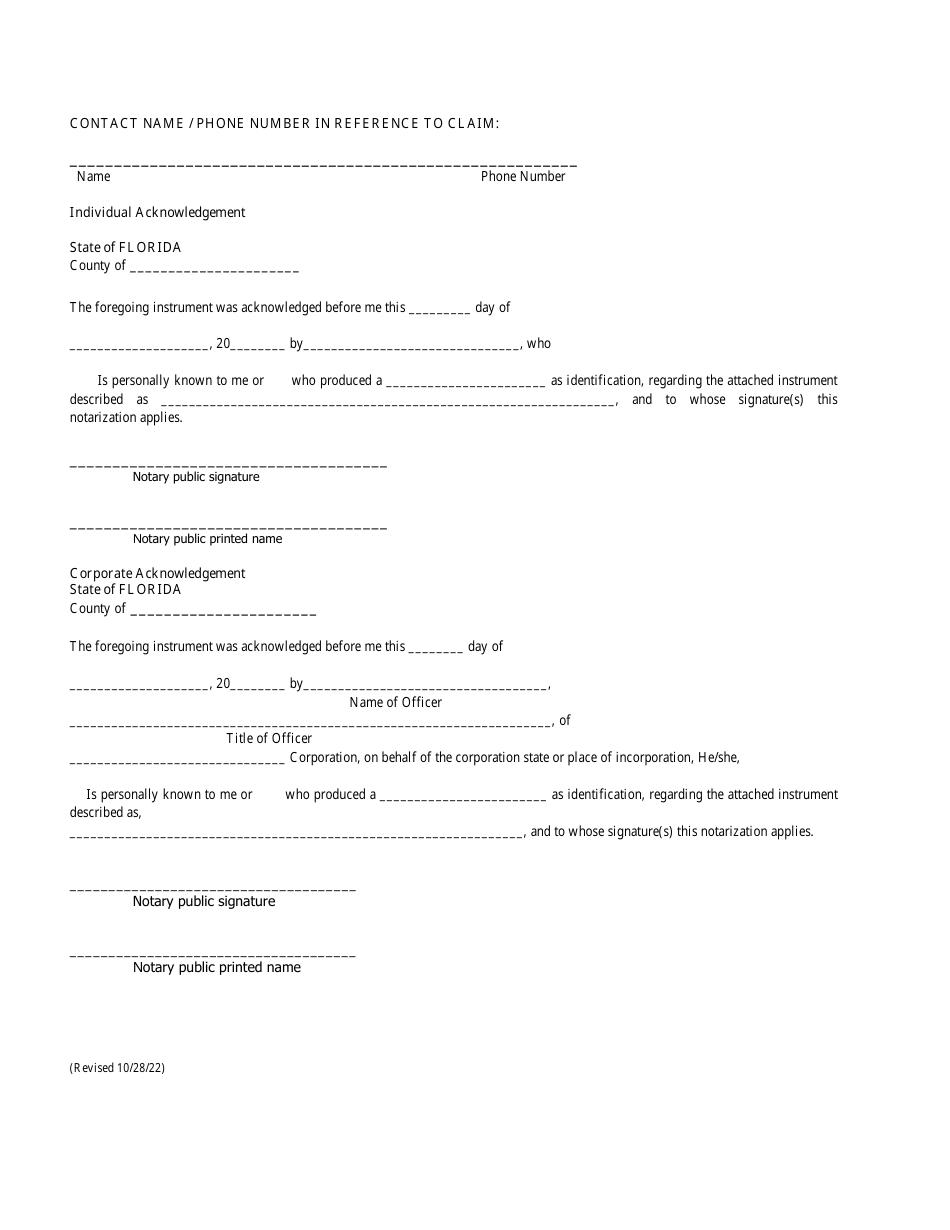

Q: How do I file an Affidavit to File for Tax Deed Surplus Funds in Broward County, Florida?

A: To file an Affidavit to File for Tax Deed Surplus Funds in Broward County, Florida, you must submit the completed affidavit along with supporting documents to the Broward County Clerk of Courts.

Q: What supporting documents are required to file an Affidavit to File for Tax Deed Surplus Funds?

A: The required supporting documents may include a copy of the deed, proof of ownership at the time of the tax foreclosure sale, and any other relevant documentation.

Q: How long does it take to receive the tax deed surplus funds?

A: The processing time for tax deed surplus funds may vary, but it typically takes several weeks to months to receive the funds.

Q: Can I file an Affidavit to File for Tax Deed Surplus Funds after October 1, 2018?

A: No, this particular affidavit is only applicable for tax deed surplus funds claims made before October 1, 2018 in Broward County, Florida.

Form Details:

- Released on November 4, 2022;

- The latest edition currently provided by the Records, Taxes & Treasury Division - Broward County, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Records, Taxes & Treasury Division - Broward County, Florida.