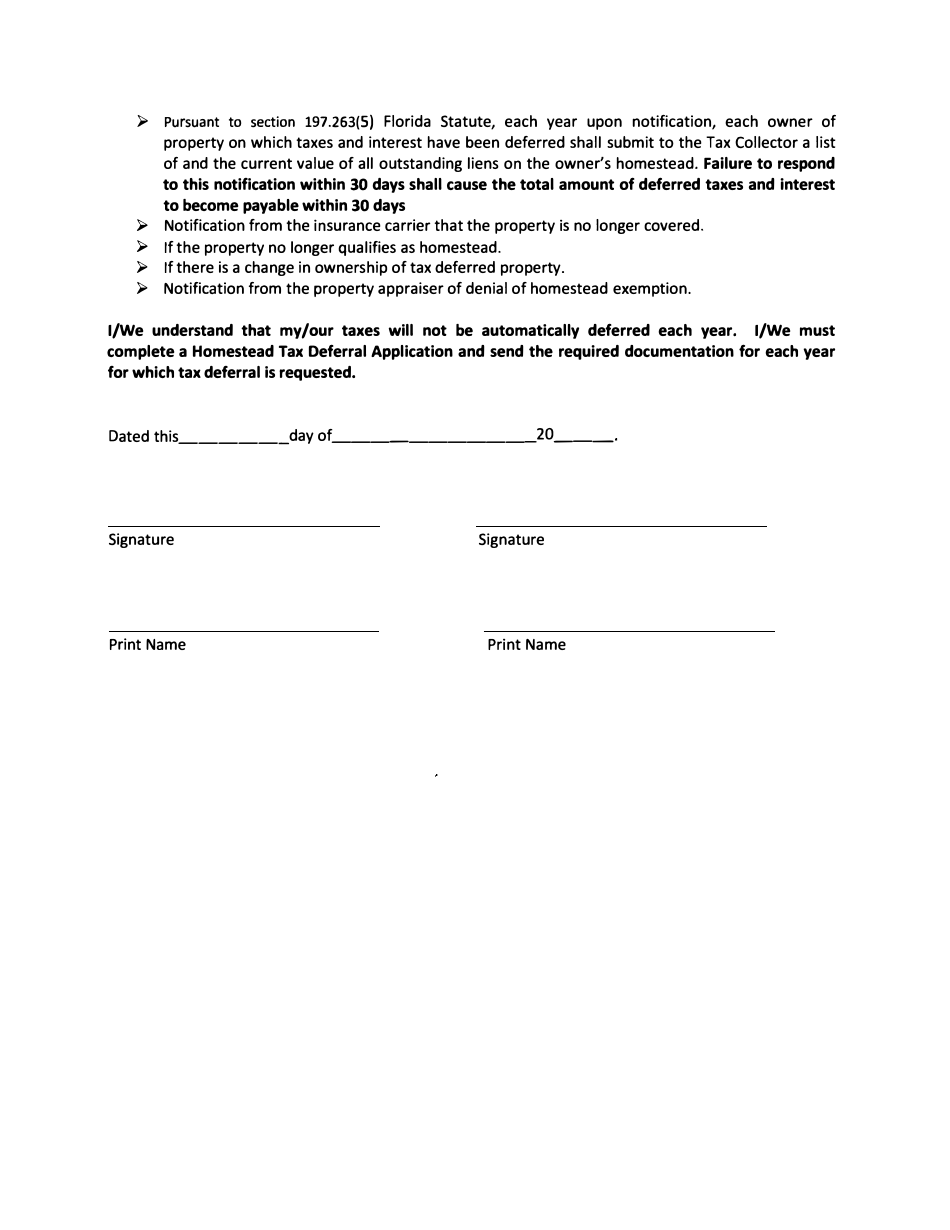

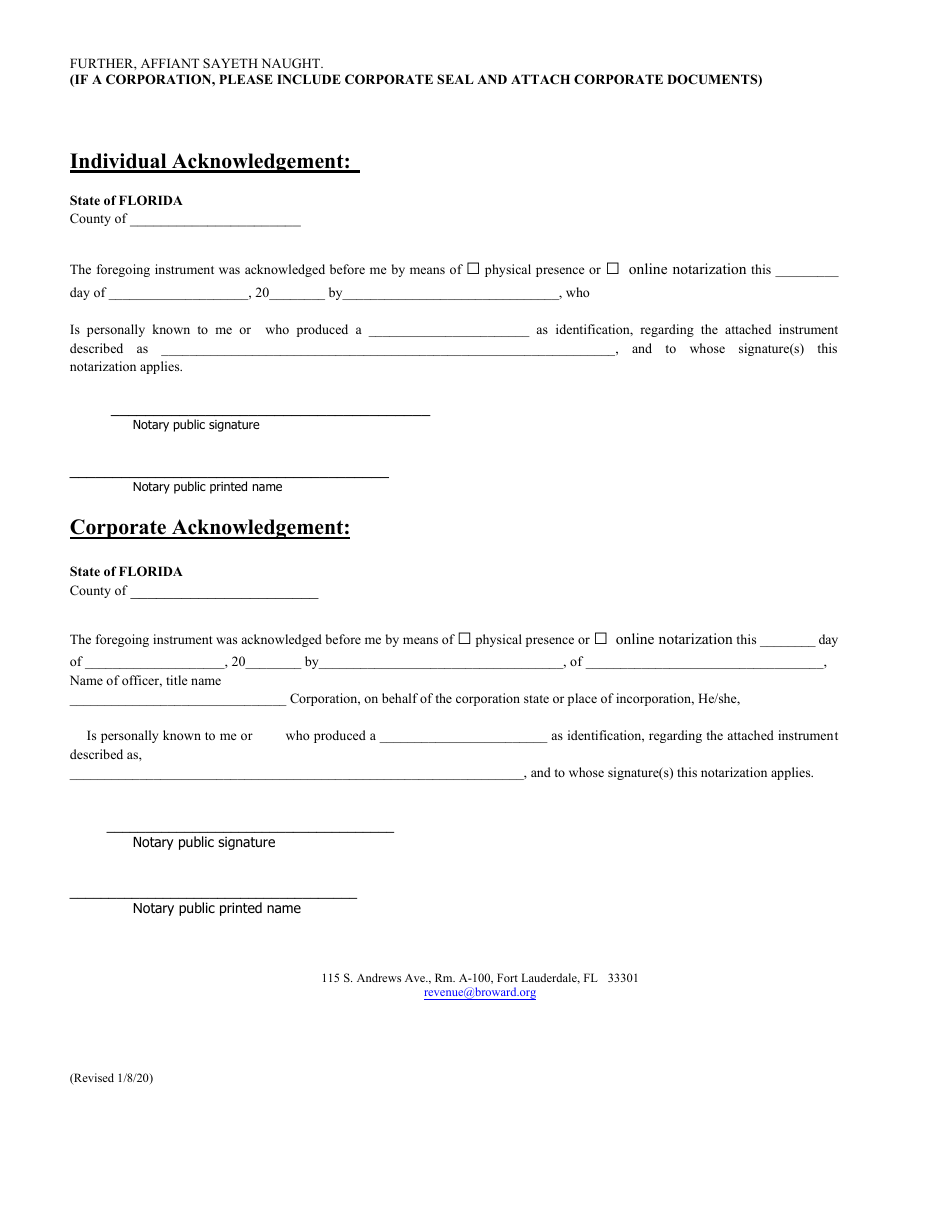

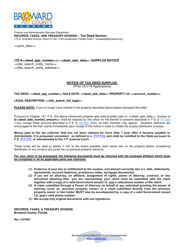

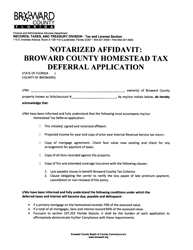

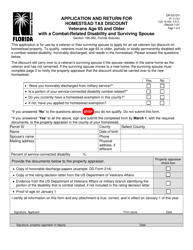

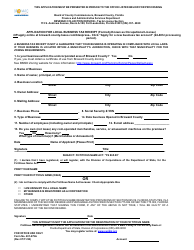

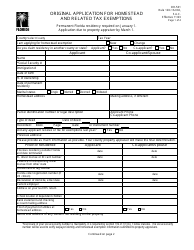

Affidavit for Homestead Tax Deferral Application - Broward County, Florida

Affidavit for Homestead Tax Deferral Application is a legal document that was released by the Records, Taxes & Treasury Division - Broward County, Florida - a government authority operating within Florida. The form may be used strictly within Broward County.

FAQ

Q: What is an Affidavit for Homestead Tax Deferral Application?

A: An Affidavit for Homestead Tax Deferral Application is a document used in Broward County, Florida to apply for tax deferral on a homestead property.

Q: What is a homestead property?

A: A homestead property is a primary residence that is occupied by the owner and qualifies for certain tax benefits.

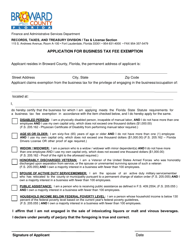

Q: Who can apply for a Homestead Tax Deferral Application in Broward County, Florida?

A: Property owners who are at least 65 years old, disabled, or qualifying low-income seniors can apply for a Homestead Tax Deferral Application in Broward County, Florida.

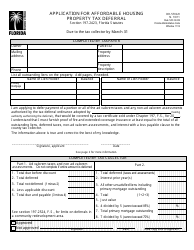

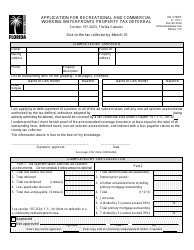

Q: What is the purpose of the Homestead Tax Deferral Application?

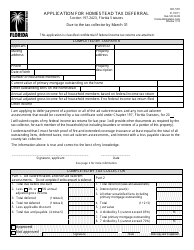

A: The purpose of the Homestead Tax Deferral Application is to provide eligible property owners with the option to defer payment of their property taxes until a later date.

Q: How does the Homestead Tax Deferral Application work?

A: If approved, the taxes on the homestead property are deferred, and a lien is placed on the property. The deferred taxes, plus interest, must be paid when the property is sold, transferred, or when the owner passes away.

Q: Are there any eligibility requirements for the Homestead Tax Deferral Application?

A: Yes, there are eligibility requirements which include being at least 65 years old, disabled, or a qualifying low-income senior. Additionally, the property must be the owner's primary residence and meet certain value limitations.

Q: Is there a deadline to submit the Homestead Tax Deferral Application in Broward County, Florida?

A: Yes, the Homestead Tax Deferral Application must be submitted by March 1st of the tax year for which deferral is being requested.

Q: What are the benefits of the Homestead Tax Deferral Application?

A: The benefits of the Homestead Tax Deferral Application include the ability to defer payment of property taxes, which can help eligible property owners who may be experiencing financial hardship.

Q: Is the Homestead Tax Deferral Application available in other counties in Florida?

A: The availability of the Homestead Tax Deferral Application may vary by county in Florida. It is recommended to check with the property appraiser's office in your county for more information.

Form Details:

- Released on January 8, 2020;

- The latest edition currently provided by the Records, Taxes & Treasury Division - Broward County, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Records, Taxes & Treasury Division - Broward County, Florida.